- Bitcoin MVRV ratio suggested potential market shifts, with a crucial support level to watch at 1.75.

- Retail and whale activity showed mixed signals, with active addresses rising but large transactions slightly declining.

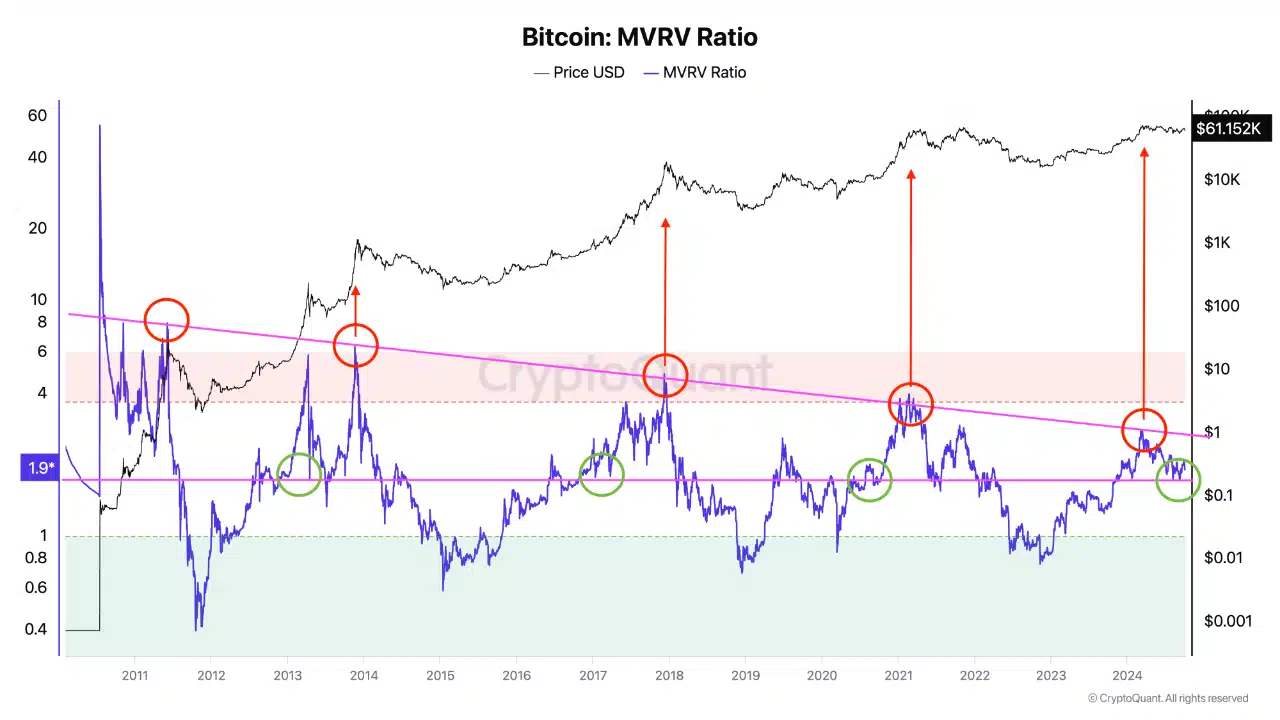

As a seasoned researcher who has navigated through several crypto market cycles, I find myself intrigued by the recent developments in Bitcoin’s market trends. The MVRV ratio, historically a reliable indicator of major shifts, suggests that we might be on the verge of a significant move for BTC, with a crucial support level at 1.75 to watch out for. If this trend breaks and reverses, it could potentially reach a range between 4 and 6, which has traditionally signaled a market peak in prior cycles.

As a crypto investor, I’ve been thrilled lately as Bitcoin [BTC] has soared past the $66,000 mark, igniting excitement among us investors and financial analysts. This brief rally has many of us believing that October could be a bullish month, a trend we’re calling “Uptober.

Nevertheless, the rise in price didn’t last long, as Bitcoin experienced a substantial drop following that period.

For the past seven days, the primary cryptocurrency has been on a slide, dropping by about 6.6%. Currently, it’s trading below $62,000, and there’s been a minor drop of 0.4% over the past day.

Amid this fluctuation, a CryptoQuant analyst known has shed light on a critical trend occurring in the background. According to the analyst, this emerging pattern could potentially have notable implications for Bitcoin’s future market behavior.

MVRV ratio suggests a major move for BTC

As a researcher, my attention often turns towards Bitcoin’s Market Value to Realized Value (MVRV) ratio. This crucial metric helps me gauge if Bitcoin is currently experiencing overvaluation or undervaluation. Essentially, it does this by comparing the current market value of all coins to the price at which they were last actively traded or ‘realized’.

Historically, the MVRM (Moving Average Variance Ratio) has proven valuable for spotting substantial market peaks and troughs within Bitcoin’s halving periods.

According to the analyst’s explanation, the MVRV ratio has been decreasing steadily, and a significant support point has been marked at approximately 1.75.

Right now, the MVRM (Market Value to Realized Value) ratio is at approximately 1.9. This prompts an essential inquiry: if the MVRM ratio were to breach its historical downtrend and change course, could it potentially increase within a range between 4 and 6?

Historically, such a wide range in Bitcoin’s value has often signaled a market peak in past cycles. The analyst emphasizes the significance of the MVRV metric, as it helps to measure the market mood and predict future price fluctuations.

Other metrics show mixed trends

Considering the possible changes in market trends, it’s a good idea to investigate other signals that may shed light on where Bitcoin might be heading next.

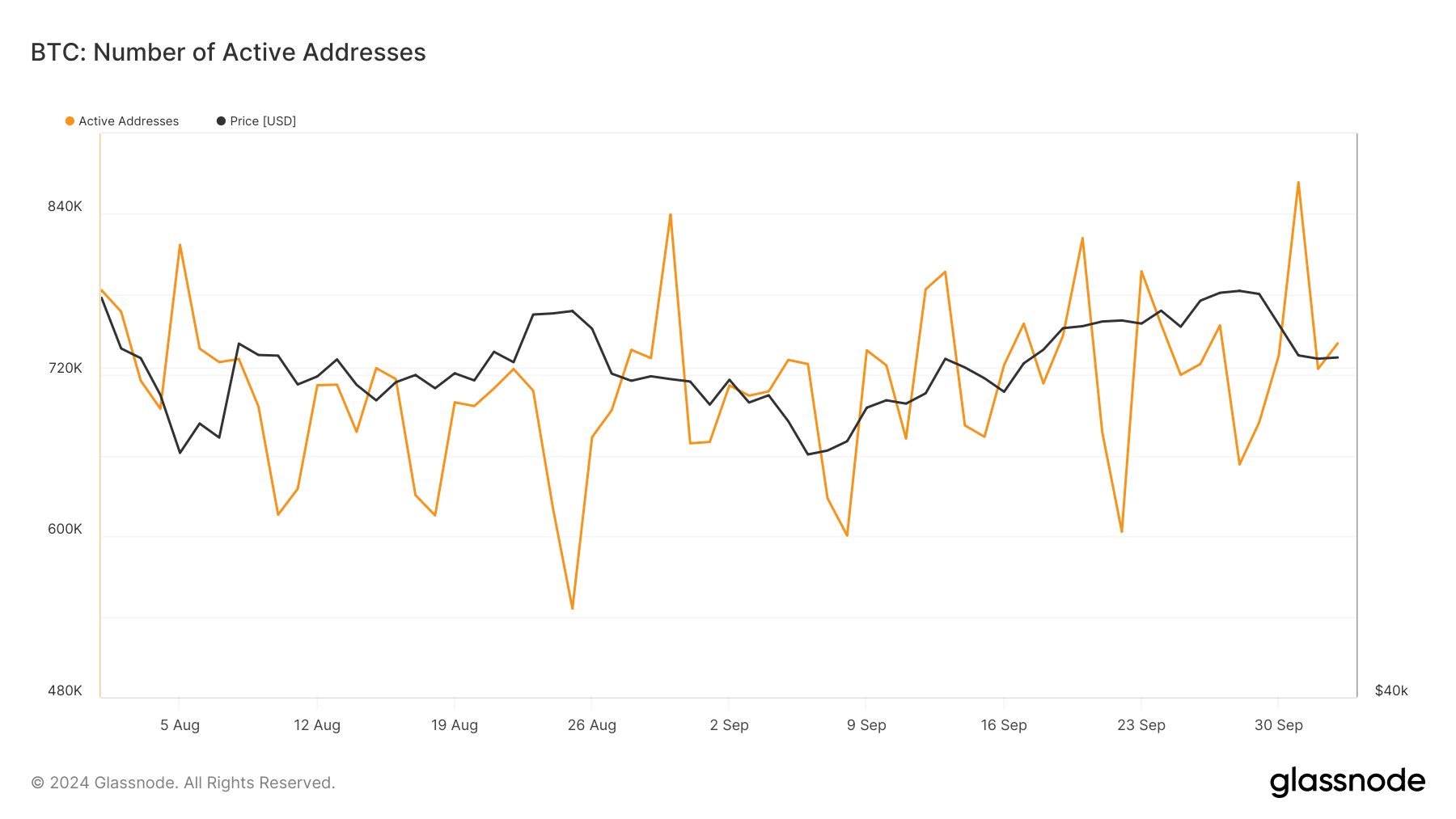

For instance, one key metric to watch is Retail Investor Activity, which is often reflected in the number of active addresses. According to data from Glassnode, this metric has been on a steady rise month-over-month.

Following a peak of approximately 832,000 active Bitcoin addresses in August, there was a minor dip to around 822,000 in September. However, since then, the number of active addresses has been on an upward trend, now exceeding 863,000.

The increasing popularity indicates a rekindled enthusiasm and participation from retailers in the Bitcoin trading sector, despite the fluctuating prices it has recently experienced.

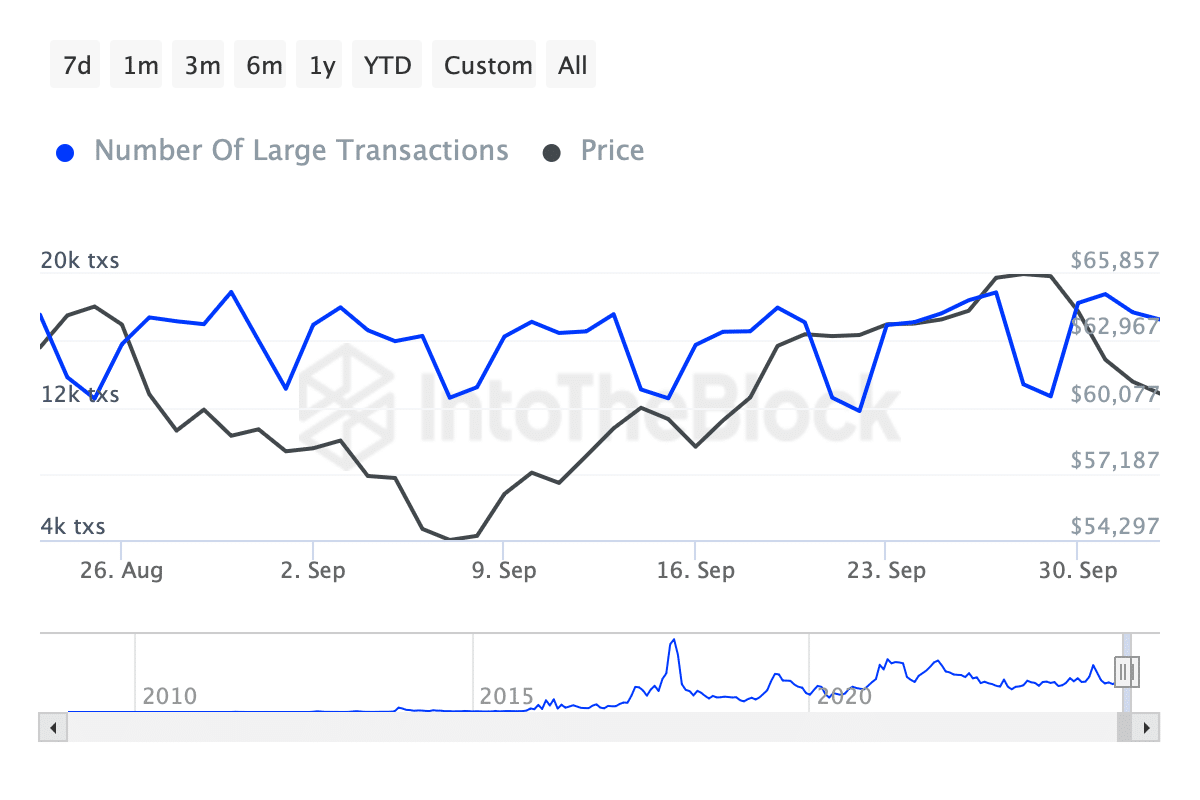

As an analyst, I recognize that retail interest is just one piece of the puzzle; deciphering the actions of significant investors, often referred to as “whales,” holds equal importance. A valuable clue in this investigation is the frequency of transactions surpassing $100,000, which we can monitor using data from IntoTheBlock.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The number of transactions significantly rose during the period from August to September, going up from fewer than 14,000 to more than 18,000.

Following that spike, the number of whale transactions has been steadily reducing, now hovering at approximately 17,700.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- The Battle Royale That Started It All Has Never Been More Profitable

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

2024-10-04 17:44