- Bitcoin’s historical post-halving cycles suggested a potential top between June and October 2025, with projections nearing $200K.

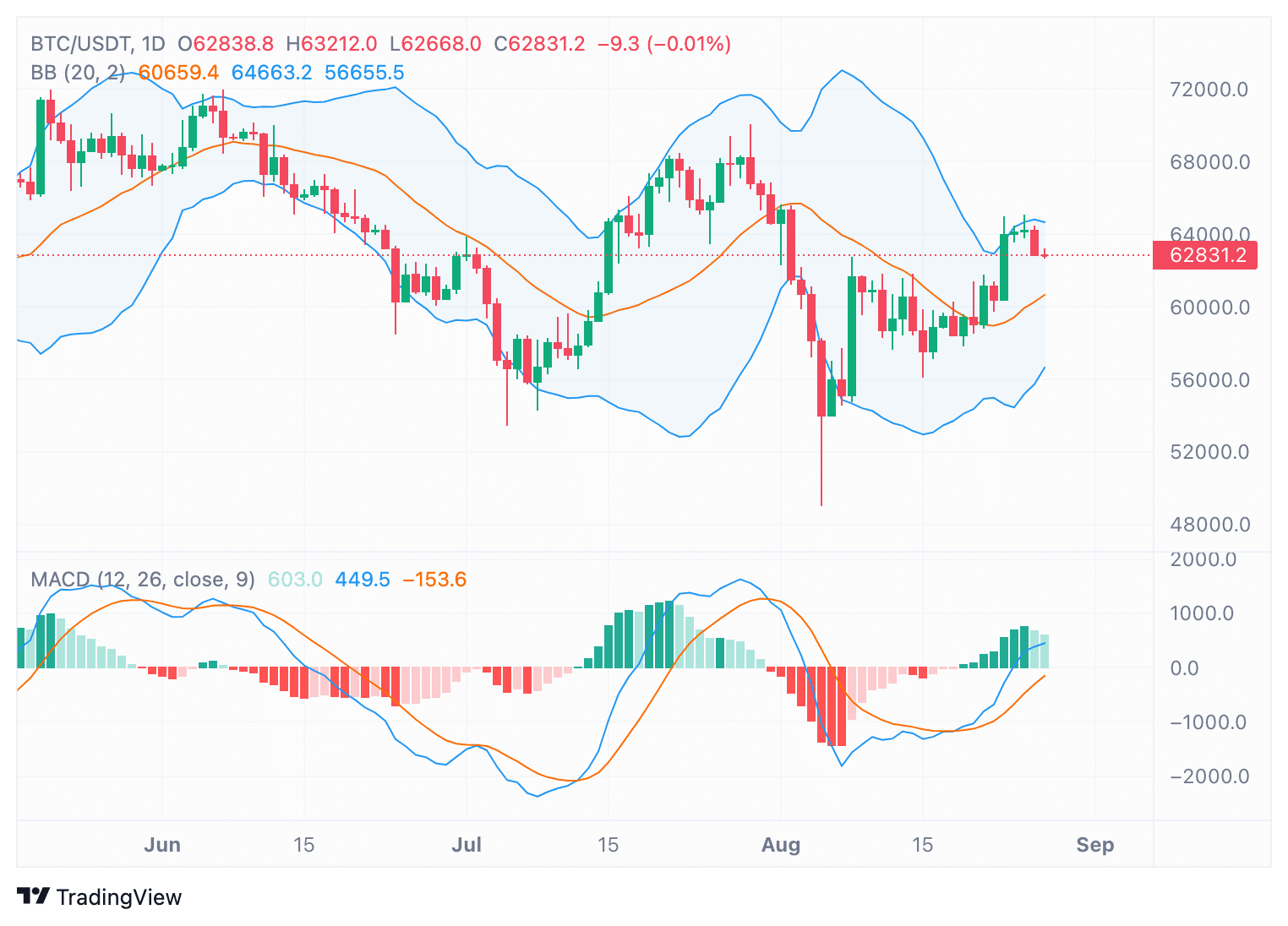

- Technical indicators like MACD and Bollinger Bands showed bullish signs, but traders should remain cautious of potential reversals.

As a seasoned analyst with over two decades of experience navigating the turbulent waters of global financial markets, I find myself intrigued by the current state of Bitcoin and its potential trajectory.

On Monday, Bitcoin (BTC) surpassed $64,000 for closure, following a series of gains fueled by positive indications from the United States Federal Reserve over the past week.

Investors showed optimism following the comments made by Federal Reserve Chair Jerome Powell, where he affirmed his intention to lower interest rates in September.

This bolstered sentiment in both traditional markets and the crypto space.

In the past day, Bitcoin saw a minor decrease of 1.40%, but it managed to regain some ground lost in the preceding weeks due to the recent surge.

Regardless, Bitcoin experienced an increase of 3.15% during the previous week, boasting a market capitalization estimated to be around $1.23 trillion according to Coingecko.

Historical post-halving patterns

Bitcoin market observers and experts have kept a close eye on Bitcoin’s price fluctuations since the latest halving occurred.

In the past, Bitcoin’s price has tended to reach its peak several months following each halving event.

To illustrate, following the halving in 2013, Bitcoin experienced a dramatic rise of more than 9,500%. This peak was reached approximately 406 days later. In comparison, after the halving in 2017, Bitcoin increased by around 4,100% and peaked 511 days afterwards.

In 2021, Bitcoin rose by 636% before topping out 546 days after the halving.

Based on insights from crypto trader Mags, it’s possible that this cycle might mirror a previous one, potentially reaching its highest point somewhere between June 2025 and October 2025.

Based on past trends, it’s suggested that the peak value for Bitcoin might occur within a timeframe of approximately 400 to 550 days from the current date.

Regardless of a more modest increase, like a 300% surge, the cryptocurrency might reach around $200,000 during this timeframe.

Bullish momentum ahead?

Technical indicators suggest that Bitcoin may continue its upward trend in the near term.

The Bollinger Bands revealed that Bitcoin’s price moved towards the upper band, indicating potential overbought conditions around the $63,000 level.

In simpler terms, the Moving Average Convergence Divergence (MACD) has just signaled a potential increase in the market trend, as the MACD line is currently ascending above its signal line.

This suggested that upward momentum could continue, as confirmed by the histogram turning green.

Keep in mind that while there’s currently a positive trend, it’s essential to remain vigilant since a potential reversal could occur if the current bullish energy starts to wane over the next few days.

Market sentiment remains optimistic

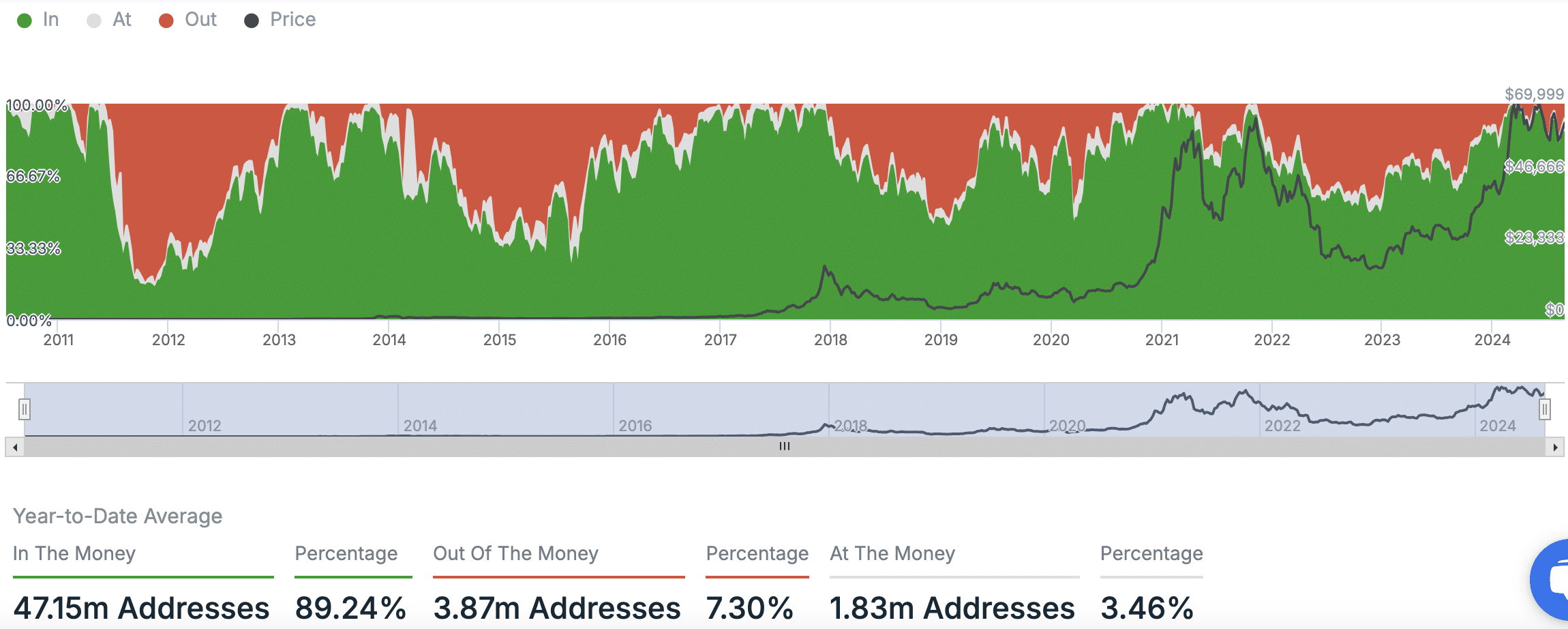

The overall feeling towards Bitcoin seemed generally optimistic, bolstered by both on-chain statistics and trade indications.

At the given point in time, I observed that approximately 89.24% of Bitcoin wallets, or put another way, a vast majority of Bitcoin holders, found themselves in a profitable position, as their acquisition cost was lower than the current market price.

Approximately 7.30% of Bitcoin addresses hold bitcoins that are currently worth less than what was initially paid for them, indicating a predominantly positive investment situation for most Bitcoin investors.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As a cryptocurrency investor, I’m observing a predominantly optimistic market trend. Three strong positive signals are indicating a bullish momentum, while four indicators are maintaining a neutral stance at the moment. This suggests that we might be on the brink of some exciting growth in the crypto space!

In the Futures market, there was a sense of holding back, indicating that although traders were hopeful, they chose to exercise caution, waiting for more information or events before making decisive moves.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-08-28 07:04