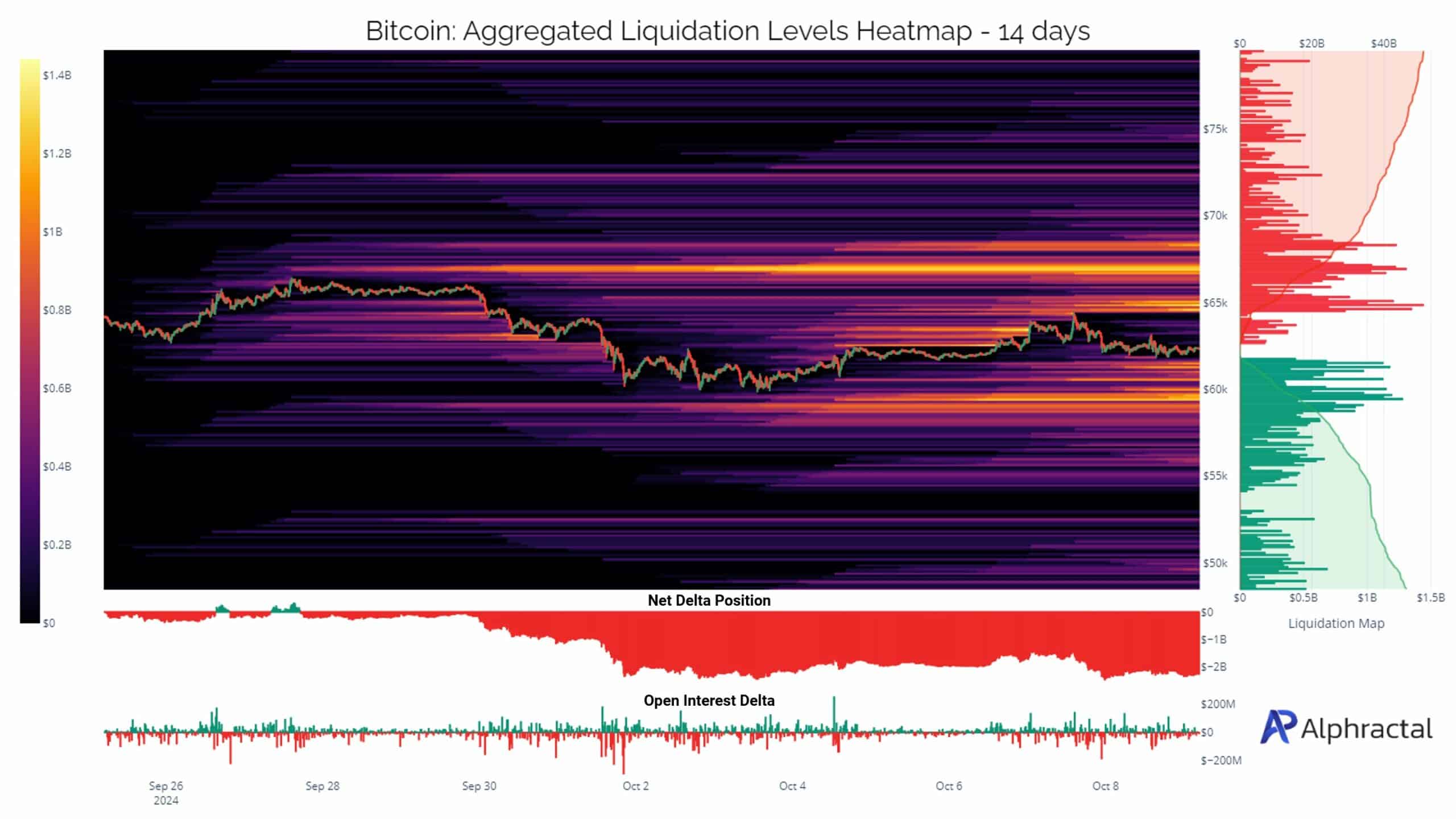

- The highest liquidation level for Bitcoin was at $67K.

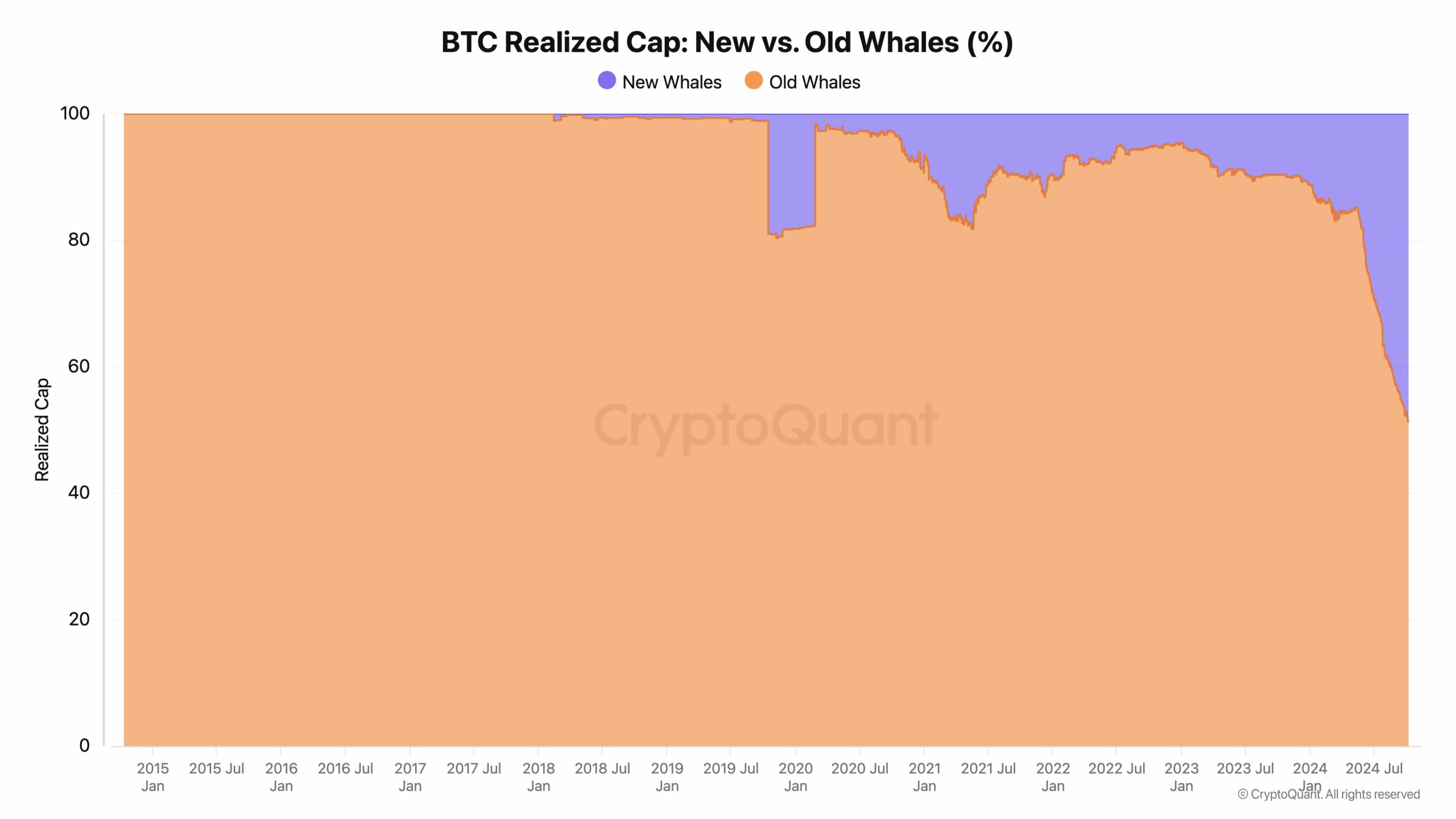

- There was a generational shift among these large investors of Bitcoin.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous market cycles and trends that have shaped my understanding of the dynamics at play. The current state of Bitcoin is particularly intriguing, given the high liquidation levels at $67K and the generational shift among large investors.

There’s a lot of interest among the crypto community in identifying crucial price points for Bitcoin (BTC), particularly when market conditions are turbulent and volatile.

At the moment, there’s a sense that Bitcoin might experience substantial shifts because of high withdrawal thresholds. These could potentially force traders to make clear-cut decisions.

Over the past week, there’s been a significant build-up of buy orders (long positions) for Bitcoin on major trading platforms, resulting in substantial potential selling areas or “liquidation zones”.

In simpler terms, the crucial Bitcoin price point right now is around $60,000. However, if we widen our focus to a two-week period, the $67,000 area appears as the potential zone with the highest volume of liquidations.

It seems likely that the price of Bitcoin might be drawn to this region in the future, since it often congregates around zones with high liquidity due to long-term trends.

Bitcoins have demonstrated durability by holding its ground above the crucial bull market support level for yet another week, according to technical analysis.

This level hasn’t been surpassed in three successive weekly closings since May, yet optimism remains that buyers might drive the price upwards from this point. Given the current market compression, such a development would be significant.

In simpler terms, Bitcoin’s performance, when looked at alongside stocks, seems quite strong. This makes the predicted price of $67K seem more and more achievable.

BTC whales and active addresses

Another factor to consider is the shifting landscape of Bitcoin whales. There is currently a generational shift among these large investors.

Approximately $108 billion has been recently allocated by new investors into Bitcoin, whereas the initial investment of $113 billion is currently held by older investors since it was first introduced.

The ratio between these groups is narrowing, with new whales slowly gaining influence.

This transition indicates that fresh funds might be flowing into the market, potentially causing Bitcoin’s price to increase gradually, despite the fact that the market remains volatile and unforeseeable.

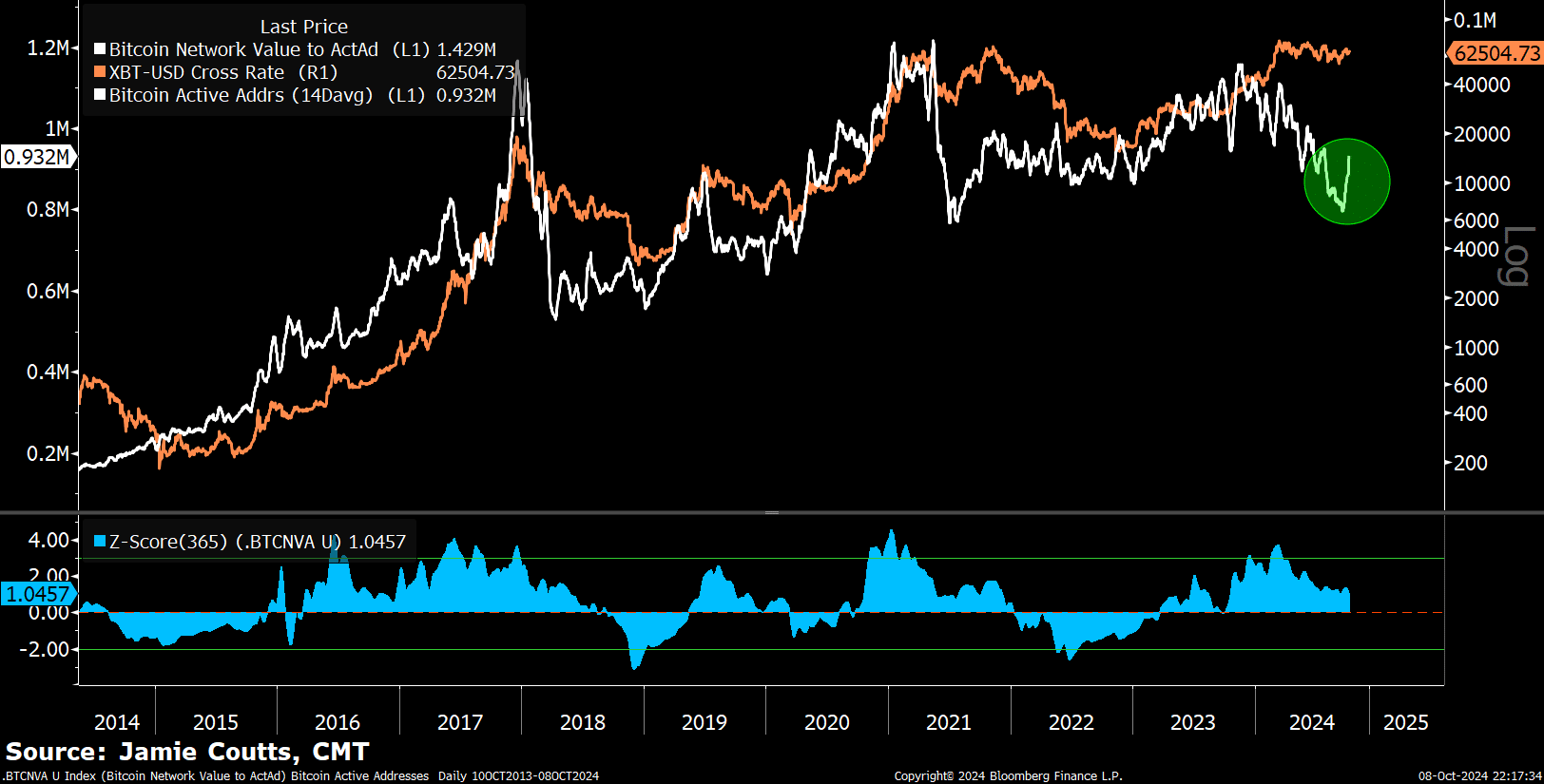

Looking at the on-chain data, there’s been a revival in the number of active Bitcoin addresses following an 11-month decline.

Despite a decrease in its predictive ability over the last four years, this metric still serves as a substantial marker for network activity.

The reduced correlation between active addresses and price is likely due to several factors.

Here we see the emergence of Exchange Traded Funds (ETFs) influencing prices significantly, an uptick in transactions on secondary layers such as the Lightning Network, and shifts in on-chain actions due to advancements like Ordinals and Non-Fungible Tokens (NFTs).

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As Bitcoin may reach new record highs during this phase, an uptick in daily transactions on the main network would serve as evidence of the network’s increasing worth and significance.

In its role as a worldwide financial network, Bitcoin is showing natural expansion across various key indicators, suggesting that under favorable circumstances, it might approach or even surpass the $67K threshold in the near future.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-10 05:12