- Exploring the potential Bitcoin price impact by recently rising political tensions.

- A look at similarities between now and 2022 and assessing differences that may lead to a different outcome.

As a seasoned researcher with over two decades of market analysis under my belt, I’ve witnessed numerous events that have shaped the financial landscape. The current geopolitical tensions in the Middle East are undeniably concerning, but how might they impact Bitcoin?

Over the years, the fluctuations in Bitcoin’s (BTC) value have been affected by numerous factors, including economic conditions and geopolitical events. Given the current tensions in the Middle East, one might wonder if these geopolitical developments could potentially influence the price of Bitcoin.

As I delve into the implications of Bitcoin, let me make one thing clear from my perspective as a researcher. Violence, particularly physical conflict, hinders human advancement, and I deeply empathize with those who are adversely impacted.

The threat of major geopolitical conflicts has widespread impact, especially on the markets.

Investors often show a greater hesitation to put their money into Bitcoin as well as other high-risk investment areas when conflicts arise, preferring instead to hold back on their investments.

In February 2022, as the Russia-Ukraine conflict began, Bitcoin and other cryptocurrencies saw substantial withdrawals due to the shift in investment strategy towards caution.

Will Bitcoin end up in a similar situation this time?

Over the past five days, Bitcoin has seen a substantial decrease in value, dropping from approximately $66,000 to around $60,450 at the current moment.

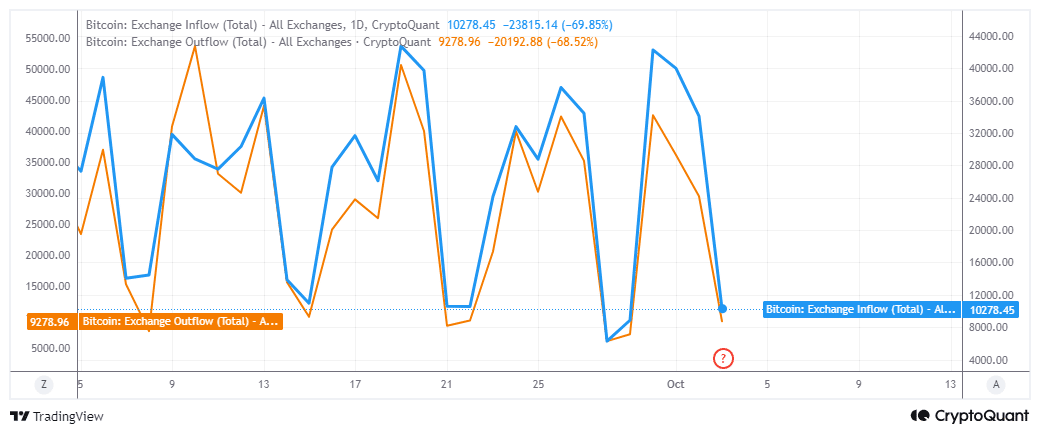

In the past day, bitcoins flowing into exchanges amounted to 10,278 BTC, whereas bitcoins leaving exchanges were fewer, totaling 9,278 BTC.

If more Bitcoin is coming in from exchanges than going out, it could suggest a potential drop in Bitcoin’s price, possibly falling below $60,000 by the weekend, provided the selling pressure persists.

It’s important to mention that there has been a gradual decrease in both incoming and outgoing activities over the past three days.

It wasn’t entirely certain if the uncertain global political climate influenced the market’s attitude as we’ve seen it so far, since the current selling activity this week might also stem from investors cashing out after Bitcoin’s surge in September.

Although the escalating tensions could potentially sway public opinion about Bitcoin, it’s worth noting that the current scenario exhibits some unique characteristics.

BTC’s sell pressure in early 2022 had multiple factors hammering down on the cryptocurrency.

At approximately the same period, markets were experiencing a significant outflow of funds due to governments increasing interest rates, thereby causing liquidity to drain at an accelerated pace.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This time around, global liquidity may significantly increase due to interest rate reductions. To put it another way, the circumstances are markedly distinct from what we’ve seen before.

In the end, political conflicts might affect things temporarily, but their influence could weaken significantly due to shifts in financial fluidity conditions.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-10-03 19:35