- Bitcoin has an HTF bullish outlook, but the current retracement could go deeper.

- The ETF inflows temporarily buoyed bullish spirits.

As a researcher with extensive experience in cryptocurrency markets, I’ve closely monitored Bitcoin’s [BTC] price action and trends. While the higher timeframe outlook remains bullish, the current retracement could go deeper than expected.

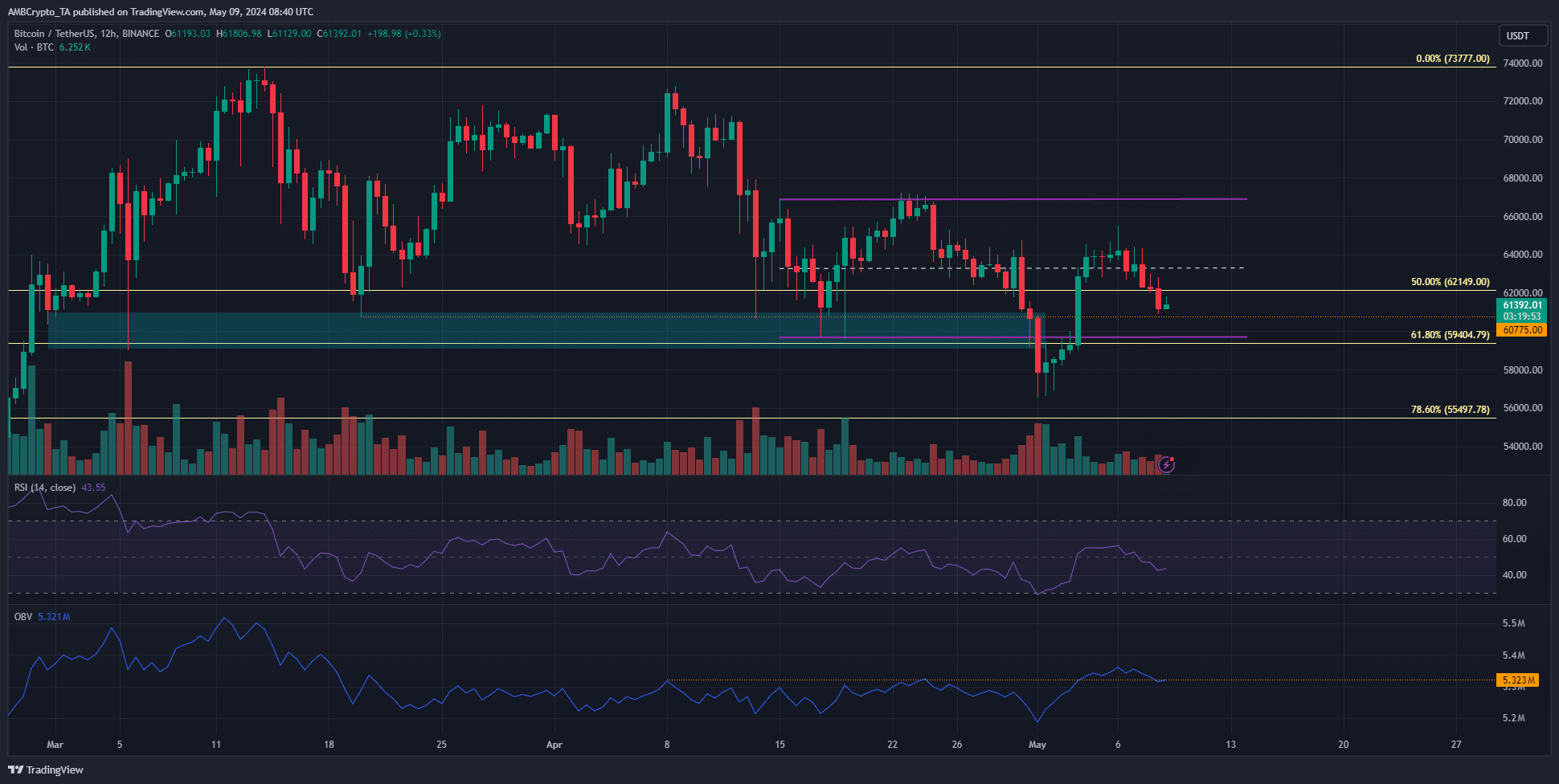

Bitcoin’s price took a turn for the worse on the smaller timeframes following its rapid rise to $65,500 earlier in the week on May 6th.

On May 7th, the selling force overpowered the $63,300 support level, causing it to shift into a resistance level.

As a researcher studying the Bitcoin market, I’ve noticed reports suggesting a decrease in its accumulation rate. This potential trend might lead to even more depreciation if there’s insufficient demand to counteract it. However, it’s important to note that despite some promising inflows on Monday, the overall sentiment towards Bitcoin remains bearish.

The $62.1k level falters as the downtrend gathers strength

Previously, Bitcoin (BTC) fluctuated between specific price levels with its lowest point being at $59,700. On May 1st, the market dynamics surpassed this threshold, leading to a revisit of the $65,000 region as a potential resistance barrier.

This meant that the market structure was bearish.

As a researcher studying financial markets, I’ve noticed that the Relative Strength Index (RSI) on the daily chart has dipped below the neutral 50 threshold, suggesting bearish momentum. On the other hand, On Balance Volume (OBV) surged above a previous resistance level and is currently holding it at the current market price.

It seemed quite possible that Bitcoin’s price might dip as low as $55k or even fall lower within the next few weeks.

Over the last two months, there has been significant demand to sell, putting considerable downward pressure on prices. The lack of buying interest in this period could potentially lead to further price decreases.

Why Bitcoin can not bullishly reverse instantly

As a researcher observing the market trends, I’ve noticed a bearish inclination based on the technical analysis. Following a robust price movement, it is essential for markets to take a pause and gather strength before continuing their trajectory.

As a crypto investor, I’ve noticed that when Bitcoin (BTC) dips below the support level of $59,700, it sends a clear signal that the consolidation period we were hoping for might not be imminent. Instead, the downtrend seems to be gaining momentum once again.

Read Bitcoin’s [BTC] Price Prediction 2024-25

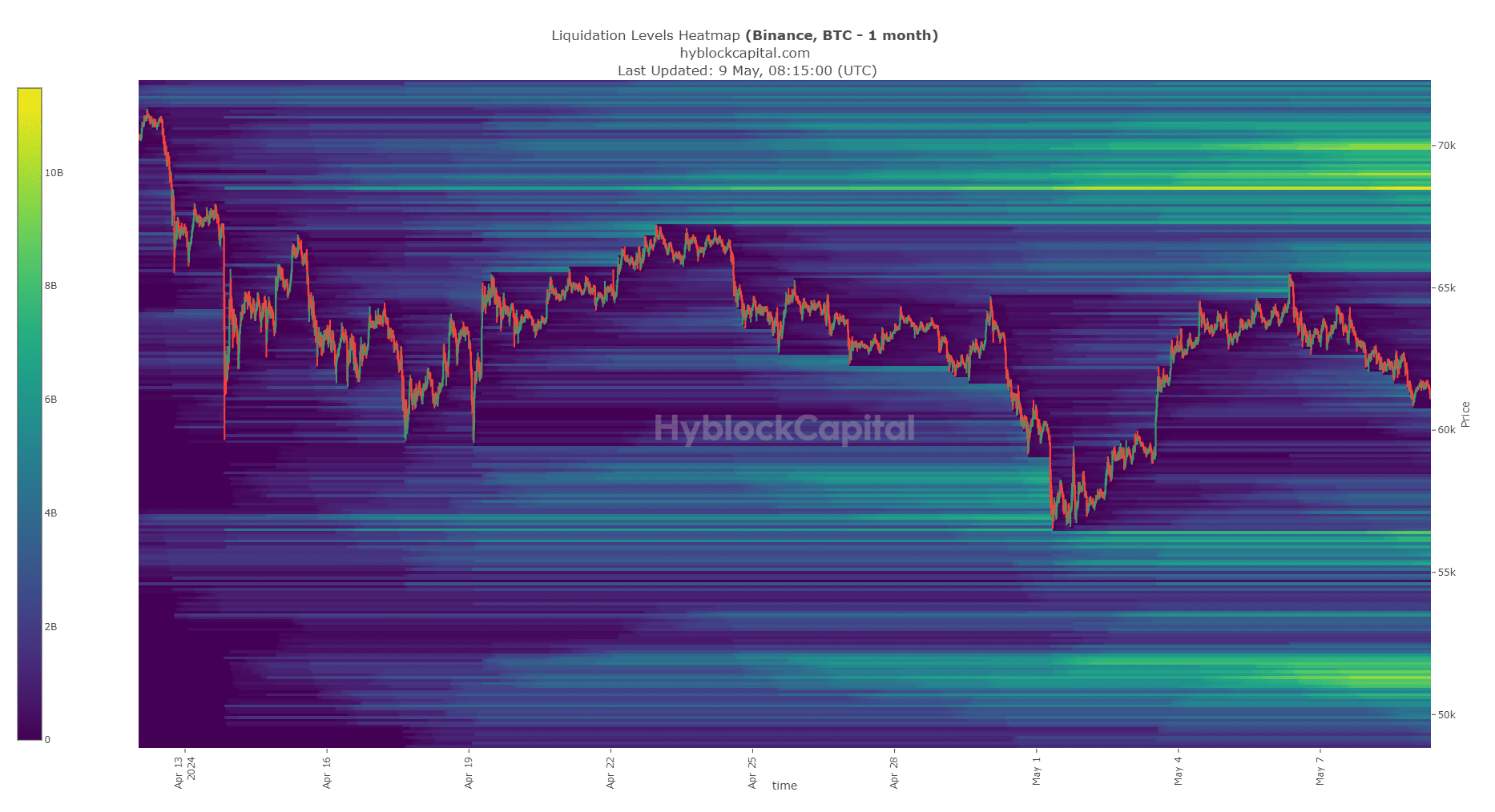

As a bitcoin market analyst, I’ve identified two significant levels where liquidity pockets reside at $56,000 and $51,500. These areas may act as the next magnetic zones for the price of Bitcoin. Moving northward, the $68,500 to $70,000 region previously showed potential for a bearish reversal.

Given the technical factors, a move southward appeared more likely.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-05-09 16:07