-

AGIX, GRT, and APE, face potential crashes due to Bitcoin’s bearish chart patterns.

Major altcoins like Ethereum, BNB, and Solana have dropped significantly as well.

As a crypto investor with some experience under my belt, I can’t help but feel a sense of unease as I observe the recent downturn in the cryptocurrency markets. The bearish chart patterns of Bitcoin, coupled with the significant declines in major altcoins like Ethereum, BNB, and Solana, have me on edge.

I’ve noticed a noteworthy decline in the cryptocurrency market lately. Major digital currencies like Bitcoin [BTC] have faced challenges in holding their ground.

According to Kyledoops’ analysis in a recent “Crypto Banter” video, Bitcoin has been struggling to surpass significant resistance points.

Over the past week, there’s been a clear downtrend for this asset. It has experienced a significant decrease of more than 10%, causing Bitcoin to dip and reach a monthly low around $58,000.

Predictions of a 30% crash

As a crypto investor, I’ve noticed that it’s not just Bitcoin taking a hit – the entire altcoin market is experiencing a significant downturn as well.

As a researcher studying the cryptocurrency market, I’ve observed a significant decrease in the total market capitalization of altcoins within the past week. A high of over $1 trillion was reached just previously, but now stands at $952 billion.

In the unstable market conditions identified by Kyledoops, certain alternative cryptocurrencies face the risk of additional price declines.

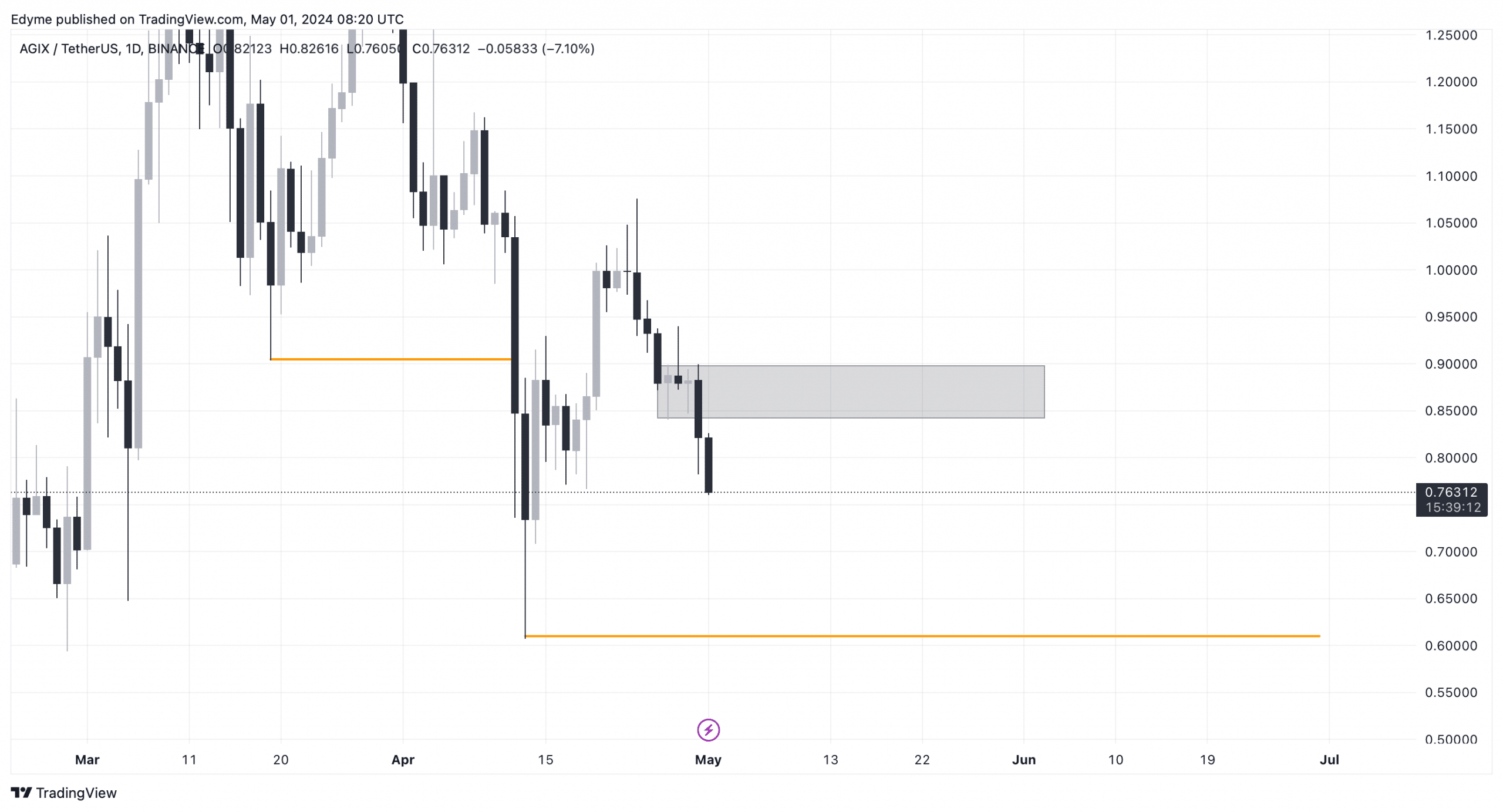

The value of SingularityNET’s AGIX token has decreased by 24% in the last week, and an additional 10% drop was observed within the past day.

As a technical analyst, I have observed that the chart patterns of AGIX, similar to those of The Graph (GRT) and Apecoin (APE), indicate a potential decrease of around 30%.

Tokens associated with artificial intelligence and gaming are particularly vulnerable.

The analysis of AGIX‘s daily chart reveals a significant change in trend towards bearishness following the altcoin’s breakdown of key support levels.

Lately, there’s been a doji candlestick that appeared, indicating neutral price action. However, a subsequent candle closed significantly below this level, accompanied by an engulfing bearish candlestick. This pattern may suggest the possibility of continued price drops.

Regarding Fetch AI (FET), the “Crypto Banter” analysis team forecasts a possible 15% decrease. This prediction appears reasonable since Fetch AI’s price chart bears a striking resemblance to that of AGIX, which has already indicated more downward trends.

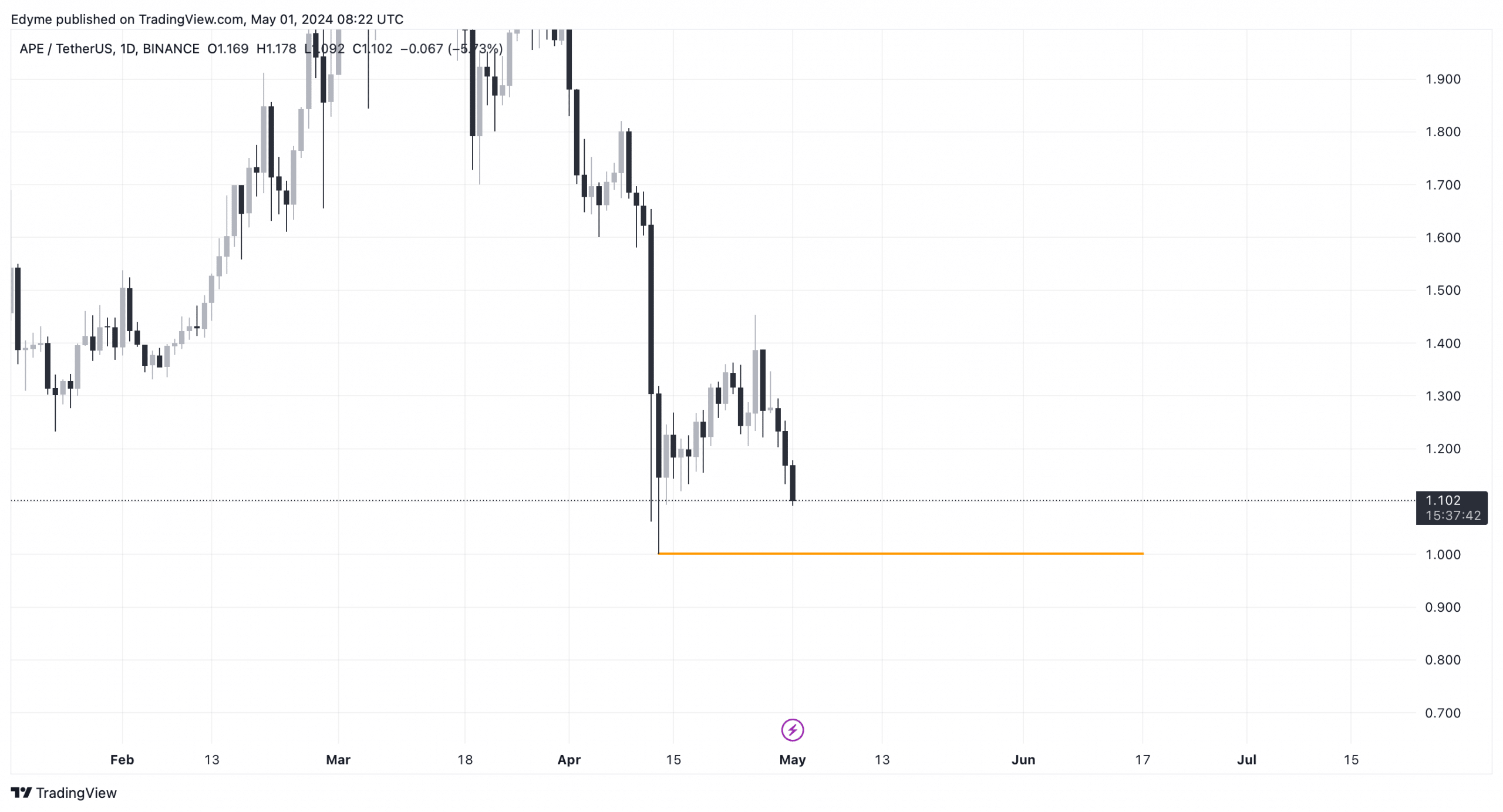

As a researcher studying the market trends of Advanced Micro Devices Inc. (AMD) stocks, I would note that Alternative Phrase for Equity (APE), AMD’s tracking stock, could experience a significant decline in value. Specifically, it might dip down to approximately $1, which represents a potential 20% decrease or even setting new record lows.

As an analyst, I’ve identified a significant swing low in the daily chart of this asset around the $1 mark. This level has historically been associated with reduced liquidity, making it a critical point to monitor before considering any potential reversal in the trend.

Just like AXS, there’s a strong likelihood that it will experience a potential decrease of approximately 47%, adding to the pessimistic perspective.

Bitcoin: Far-reaching effects

In the midst of the current cryptocurrency market projections, Ethereum [ETH], Binance Coin [BNB], and Solana [SOL] have each experienced decreases of around 8.8%, 8.8%, and 10.9% respectively over the past 24 hours.

A recent examination by AMBCrypto identified some key features in Solana’s technical setup based on its 3-day chart. Notably, there appears to be a descending triangle formation, with a significant support line situated around the price point of $128.

If the market mood worsens and sentiments towards Solana deteriorate more, there’s a potential for the price to fall below the $130 support level.

Read More

2024-05-01 13:43