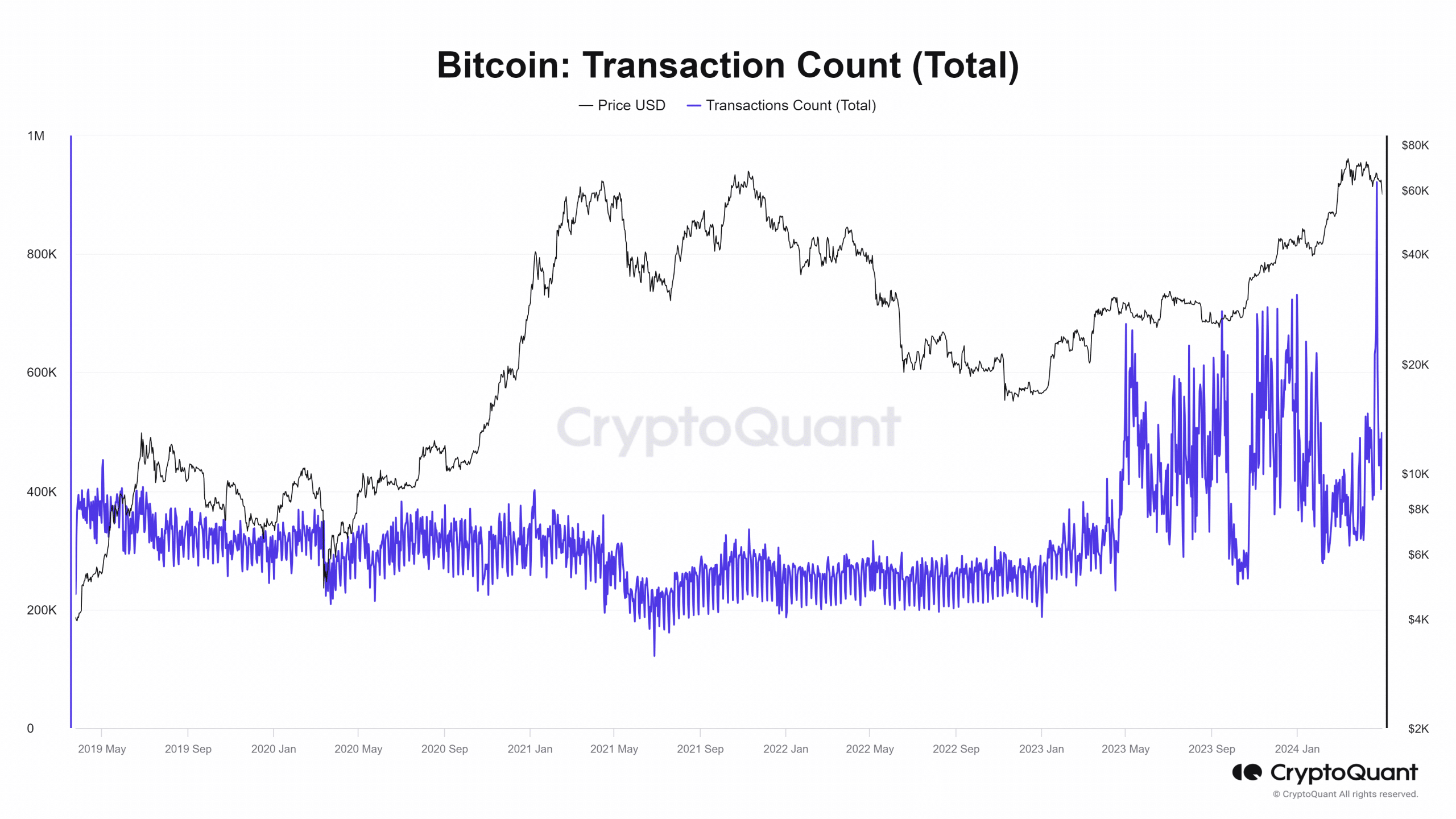

- Bitcoin saw a strong uptrend in the daily transaction count compared to the previous cycle.

- The active addresses and volume declined over the past month.

As a seasoned crypto investor with several years of experience under my belt, I’ve seen my fair share of market trends and network activity. The recent surge in Bitcoin’s [BTC] daily transaction count compared to the previous cycle is an encouraging sign for me. Reaching the milestone of 1 billion transactions is a testament to its increasing adoption and usage.

Bitcoin (BTC) has reached a significant achievement with over a billion transactions recorded in its history. The current tally of transactions stands at approximately 1 billion as of the latest update.

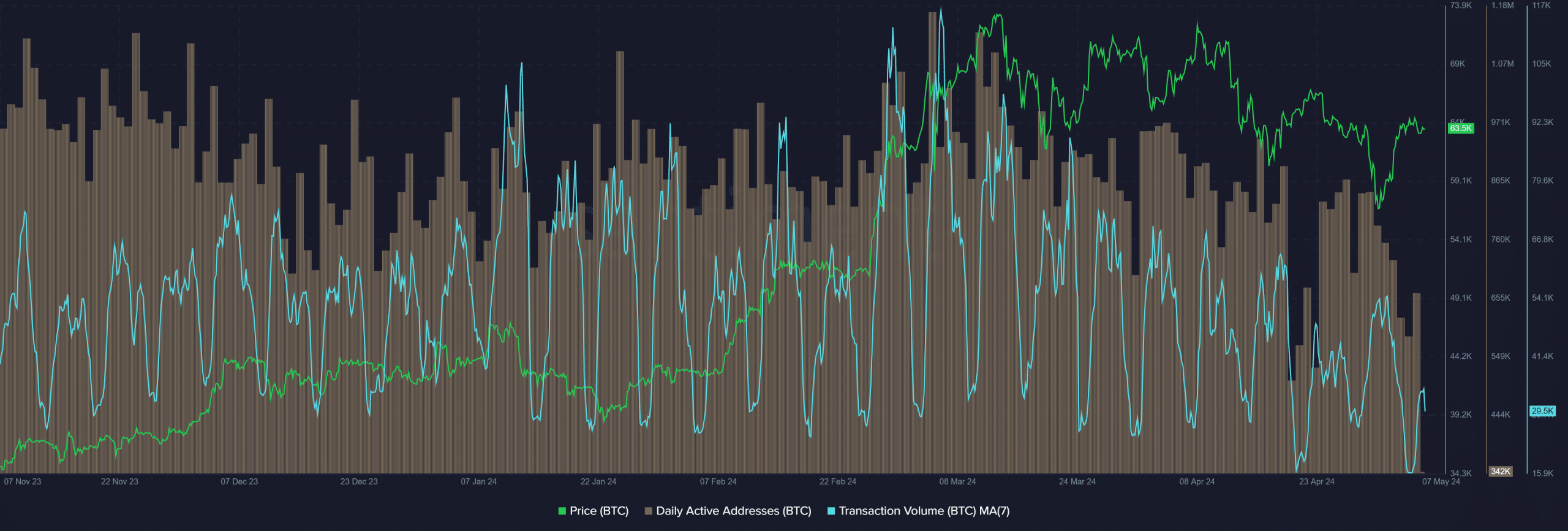

Its price was back above the $62k mark but lacked a strong short-term trend.

The news of one 10-year-old dormant BTC wallet moving its holdings sparked interest.

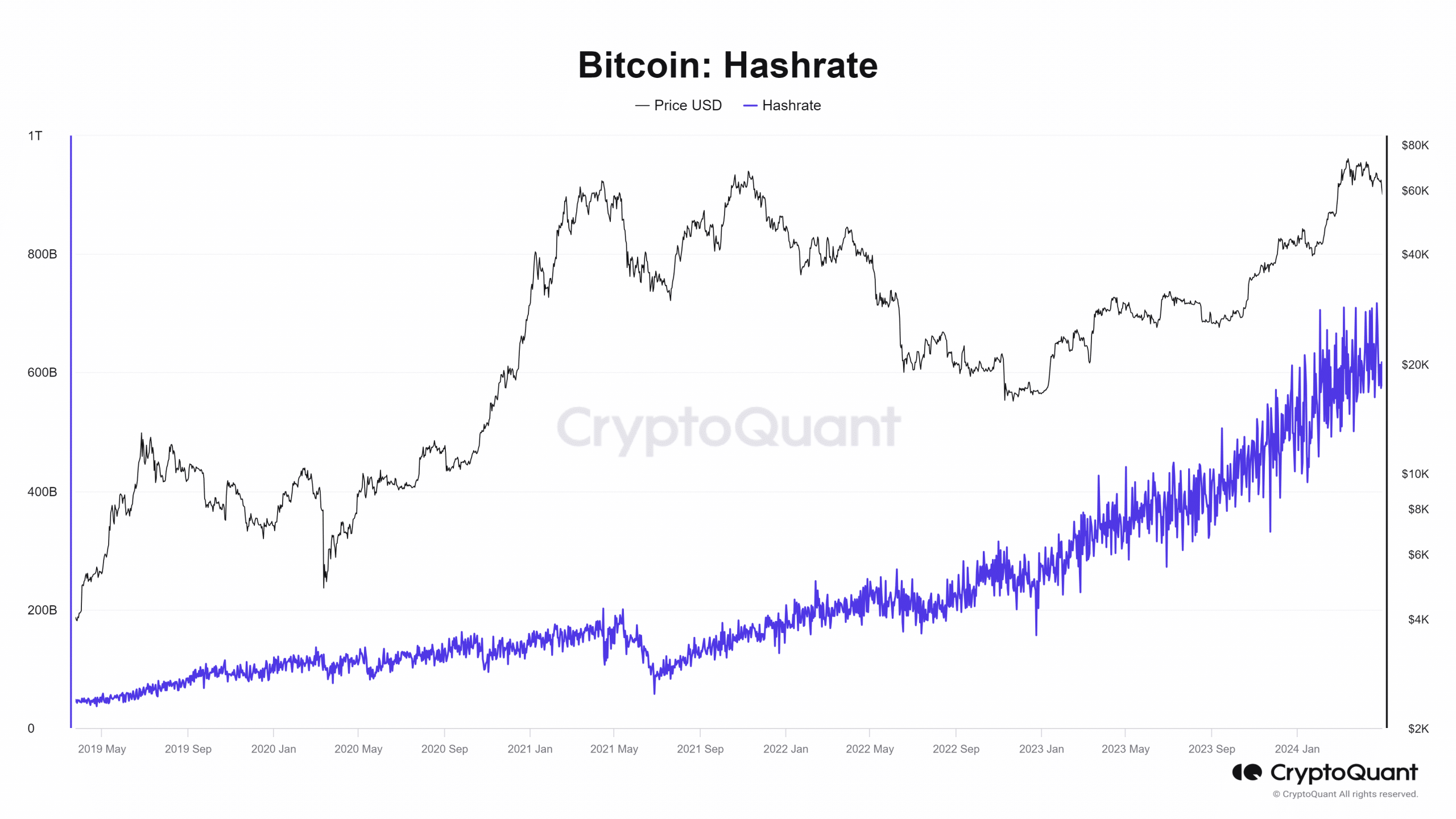

Over the last two months, there was a significant increase in Bitcoin purchases by large investors, or “whales,” implying a potential robust rally ahead. The cryptocurrency’s network security remained robust during this period.

Examining the transaction count

As a crypto investor, I’ve noticed that the number of daily transactions has been gradually increasing over the past year. However, there was a brief dip from January to March. But since then, the transaction count has picked up again and continued to rise steadily until mid-April.

It saw a huge spike on the 23rd of April, reaching 921k transactions for the day.

Four years ago, the level of activity was significantly lower than what we’ve seen in the recent past. Moreover, the transaction count during the previous bull market pales in comparison to the volume of activity observed over the past year.

This was a positive sign of increased adoption and usage.

The hash rate consistently rose, implying that miners would have to use more energy to maintain the network’s security. Consequently, it grew increasingly challenging for outsiders to attempt taking over the network.

This security is hugely comforting for long-term investors and the cornerstone for Bitcoin’s value.

Transaction volume showed a short-term downturn

During February and March 2024, Bitcoin’s price surged from $42,100 to a peak of $73,000. Simultaneously, the seven-day moving average for Bitcoin transactions showed a consistent upward trajectory.

The periodic dips account for the drop in activity during the weekends.

Despite a significant number of transactions, the value of these transactions has decreased compared to the peak in March. Additionally, the number of daily active addresses has been gradually declining over the past five weeks.

As a researcher observing the data, I’ve noticed an uptick in this activity’s prevalence over the last year. However, more recently, within the past month, there seems to be a decline in its occurrence.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Comparison with other networks shows that BTC pales in terms of daily transaction count.

In the previous two months, Ethereum network [ETH] has processed approximately 1.1 million transactions per day on average, with a peak of around 1.96 million transactions recorded on January 14th.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PGA Tour 2K25 – Everything You Need to Know

2024-05-08 04:07