-

BTC has dropped below its 200-day moving average for the second time, the first being July 2024.

An analyst predicted a drop to BTC’s realized price of $31500.

As a seasoned crypto investor with a decade of experience under my belt, I’ve seen Bitcoin dance to the rhythm of the market like a seasoned ballroom dancer navigating through a crowded floor. The recent drop below its 200-day moving average has me feeling a tad nostalgic, reminding me of the time in July 2024 when we last had this dance-off.

Over the past few months, Bitcoin (BTC) has shown significant fluctuations in its value. After reaching a peak of around $70,016 in July, it’s struggle to sustain an upward trend is evident. In fact, within the last month alone, its value has dropped by about 4.63%.

Over the last seven days, Bitcoin (BTC) has made an effort to turn things around with a 4.16% rise. Yet, this surge in price hasn’t managed to maintain its momentum and hold steady.

As of this writing, BTC was trading at $58093. This marked a 0.40% decline over the past day.

Equally, the crypto’s trading volume dropped by 19.90% to $29.7 billion over the past 24 hours.

The uncertainty in this market and the absence of a definite path have caused many market experts to predict a potential fall prior to an upturn. Similarly, well-known crypto analyst Ali Martinez suggests that it might dip down to its average price due to its 200-day moving average.

Market sentiment

Based on his examination, if Bitcoin is trading over its 200-day moving average, it typically signals significant gains. Conversely, when it falls below this threshold, it usually predicts a prolonged decrease in the value of the cryptocurrency.

Over the past month, with Bitcoin trading below $64,000, my analysis indicates a possible downward trend towards its historical realized price of approximately $31,500.

As a crypto investor, I’ve come to understand that when Bitcoin markets consistently trade below its 200-day moving average, it’s often seen as being in a downtrend. Conversely, if the market price stays above this same average, it’s generally considered bullish.

Historically speaking, when Bitcoin (BTC) falls beneath its 200-day moving average, prices often experience a downturn shortly after. For instance, during the bull market of 2016-2017, BTC dipped below its 200-day Simple Moving Average (SMA) for three straight months.

During the period of 2018-2019, it dipped beneath the 200-day moving average in mid-2019, but this trend was interrupted by the onset of COVID-19. In August 2023, it again dropped below the 200-day moving average, and this dip lasted until October, coinciding with a decrease in price.

On the Fourth of July, I observed a 2% decrease in Bitcoin’s value, causing it to trade at approximately $57,300. This dip brought its price below the 200-day moving average, which stood at around $58,720.

Conversely, when Bitcoin (BTC) breaches the trendline, it usually experiences a price increase. An example of this can be seen in October 2023, where BTC soared to $28000 after breaking above its 200-day moving average.

Breaking away from the established trendline sparked anticipation for ETFs, leading to an all-time high of $73,773 in July. However, after breaking free, the price subsequently climbed back up to $70,016.

What Bitcoin charts indicate

Without a doubt, according to Martinez’s theory, when the price falls below the 200-day Moving Average, it signals a decrease based on past trends. However, let’s also consider what other indicators might be suggesting.

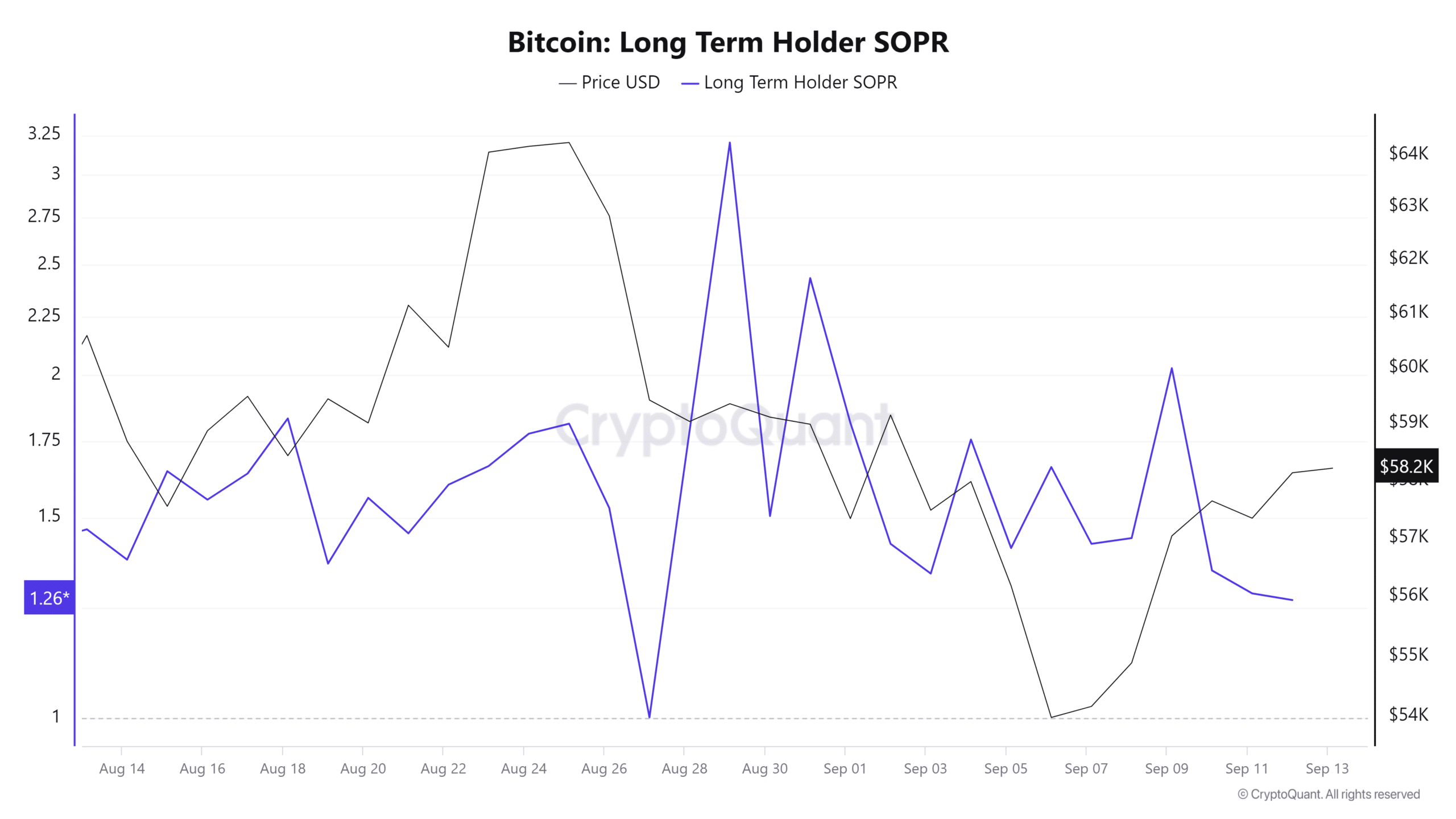

Initially, since August 29th, the SOPR (Spent Output Profit Ratio) for long-term Bitcoin holders has been trending downwards in a falling pattern. The LTH SOPR (Long-Term Holder SOPR) has dropped from 3.2 to 1.2, suggesting that there’s growing pessimism among investors who have held Bitcoin for a longer duration, as this ratio indicates bearish sentiments when it falls below 1.

This implied they no longer expected BTC to recover, thus selling to avoid further losses.

Such market behavior results in selling pressure, driving prices down.

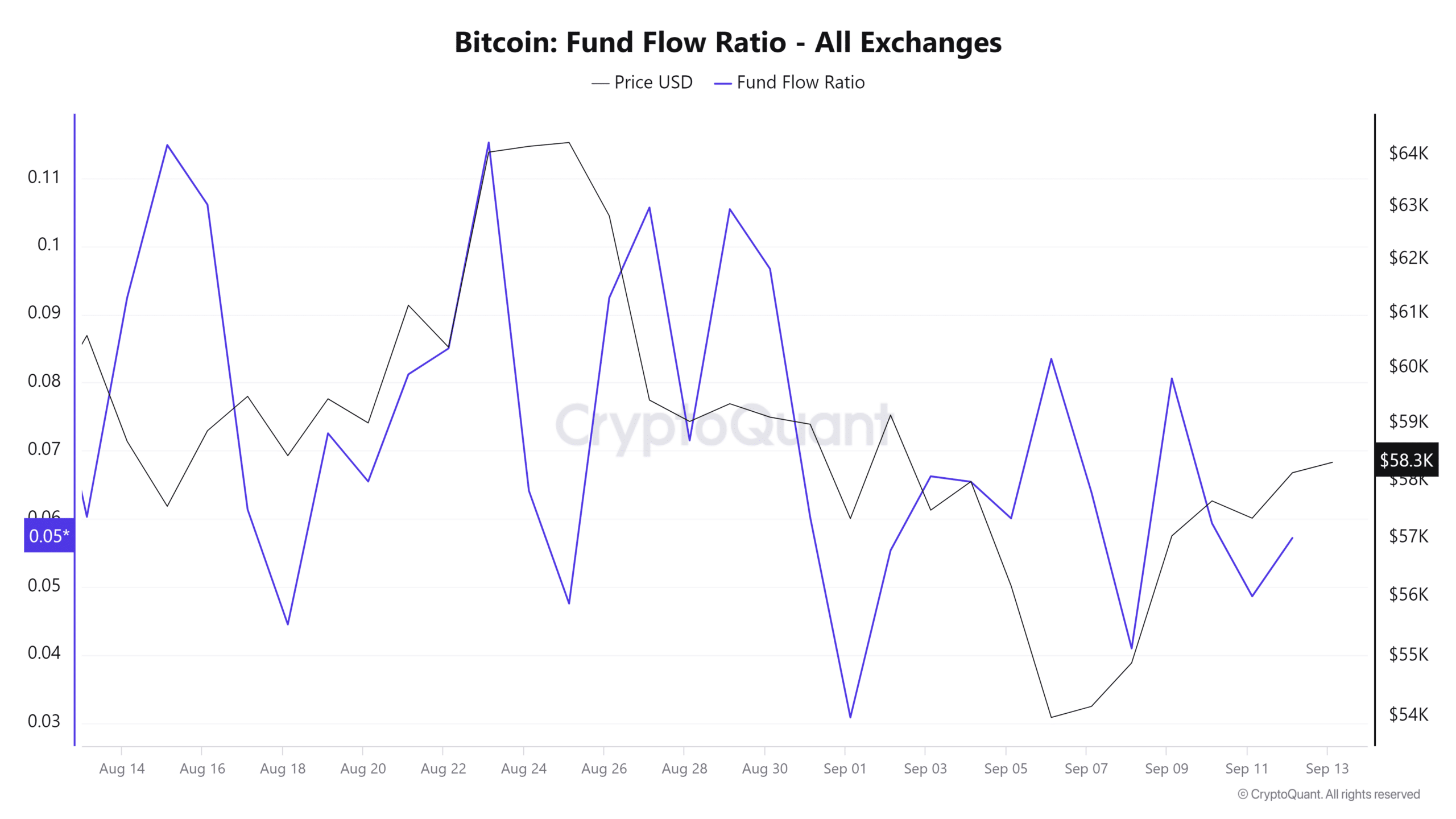

Furthermore, it appears that Bitcoin’s Fund Flow Ratio has dropped significantly over the last month, suggesting a decrease in incoming capital compared to the total transaction volume.

This implies a diminished trust from investors, as they are not adding fresh investments. When investors decide to exit their holdings, this creates a selling force that continues to drive the prices lower.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Consequently, following Martinez’s argument, if the price of BTC dips below its 200-day moving average, it suggests a potential for further decrease. Given the prevailing market mood, BTC might drop to around $54,147 in the near future.

However, a breakout from this trendline will push prices up to $64727.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-14 02:16