Grounded 2 vs Grounded 1 – What’s New?

Sequel’s world is much larger

Sequel’s world is much larger

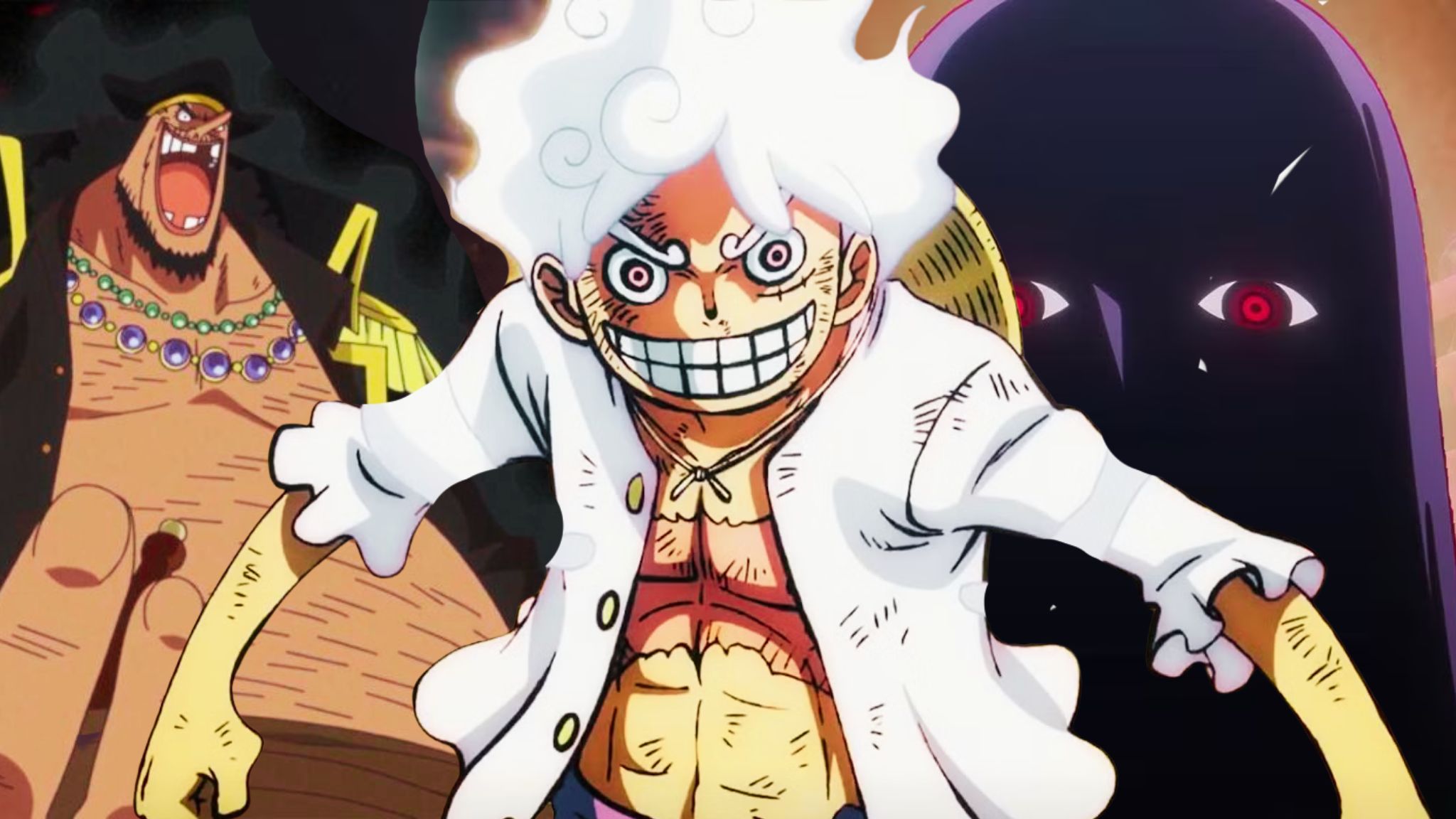

Based on the unveiling of the mural and Imu’s significant role in the current storyline, as well as their existence since Joyboy’s time, it seems plausible to speculate they could be the final antagonist. Nevertheless, there’s another formidable candidate who has consistently been Luffy’s greatest adversary. Although this character has been at odds with him from the start, the recent disclosure that Rocks D. Xebec is Blackbeard’s father might suggest that Blackbeard could be the true final adversary Luffy will confront.

The unique John Wick-themed video game, John Wick Hex, will no longer be available for purchase on all platforms as it’s set for permanent removal. This development comes as a bit of surprise since there isn’t another official John Wick game in the market.

A vigilant Reddit user named Tozzeb recently noticed the trademark in question on the European Union’s database. It was recently approved, as it was officially registered on July 1st.

The game centers around the tale of Pirate Bai Wuchang, where the primary theme revolves around a deadly disease called the Feathering. This malady transforms any individual it affects into mindless beasts.

Following the former Supernanny‘s open discussion about living with anaphylaxis throughout her life, she was inundated with heartfelt messages appreciating her bravery and many others recounting their personal tales of encounters with this sudden allergic reaction.

Ver. 20.2.0 (Released July 14, 2025)

A number of captivating and thrilling television series throughout history have unexpectedly ended prematurely. Shows like The OA, Sense8, 1899, Firefly, Heroes, The Get Down, among others, fall into this category. There’s a chance that these shows might be revived or rebooted in the future, but such continuations don’t always meet the expectations of networks, resulting in additional letdowns. It seems to be part of the natural course for many TV series that these ten shows, which should have had longer runs, were cut short on our screens.

In an exclusive sneak peek, ComicBook unveils the covers and interior pages of Craniacs #1 penned by Sholly Fisch (known for his work on Batman and Scooby-Doo) and illustrated by Joe Simko (renowned for Garbage Pail Kids). The comic immerses readers in the realm of Craniacs, blending two narratives into one via a flip book. One tale transports us to the prehistoric era with Retrovia, while the other unfolds in the future with Futerra. Readers catch a glimpse of children rushing off to school, trying to make it on time.

In simple terms, the final season of “My Hero Academia” will start airing from October 4th, which means fans don’t have long to wait until Deku bids farewell. To commemorate the birthday of its protagonist, Izuku Midoriya (also known as Deku), on July 15th, the official website unveiled the key visual for the “My Hero Academia FINAL SEASON”. This highly anticipated anime will be streaming on Crunchyroll from October 4th. For a sneak peek, you can view the new poster for the final season below.