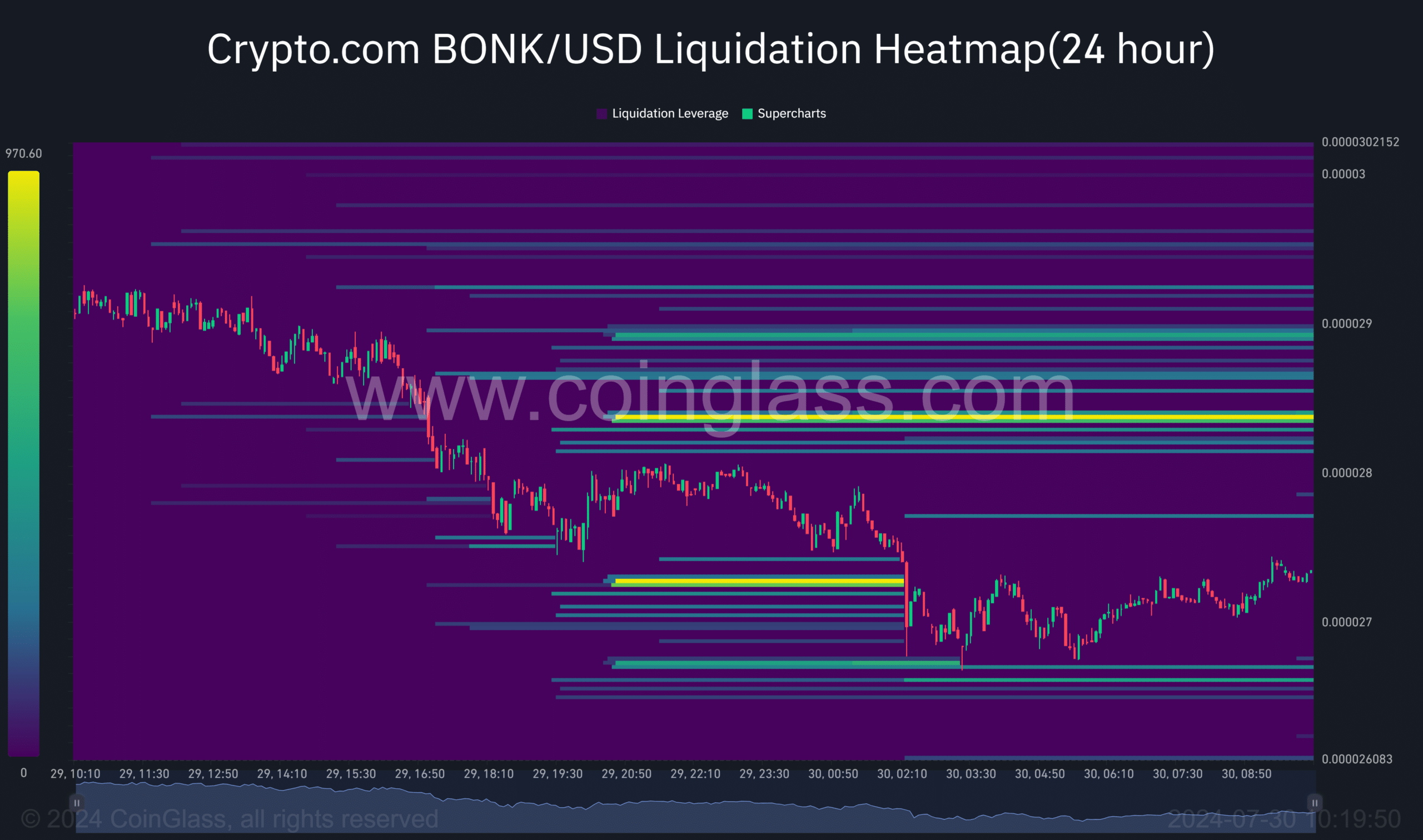

- BONK faces a massive 840.4 billion token liquidation at $0.00002838.

- Recent 4% price surge aims to test the rising wedge support.

As a seasoned researcher with over a decade of experience in the dynamic world of cryptocurrencies, I find myself captivated by the intriguing journey of BONK, the Solana-based meme coin. The recent 840.4 billion token liquidation at $0.00002838 has left an indelible mark on my charts and sparked a keen interest in its future trajectory.

With such exciting volatility, the crypto market is still attracted to meme coins. Among them, BONK has become a recognized player among investors and enthusiasts.

Over the past few days, I’ve noticed some significant fluctuations in the value of the Solana-based token, BONK. This volatility led to it falling below a crucial support threshold. As BONK now endeavors to reclaim its lost positions, the market is on high alert, anticipating a key turning point in its trajectory.

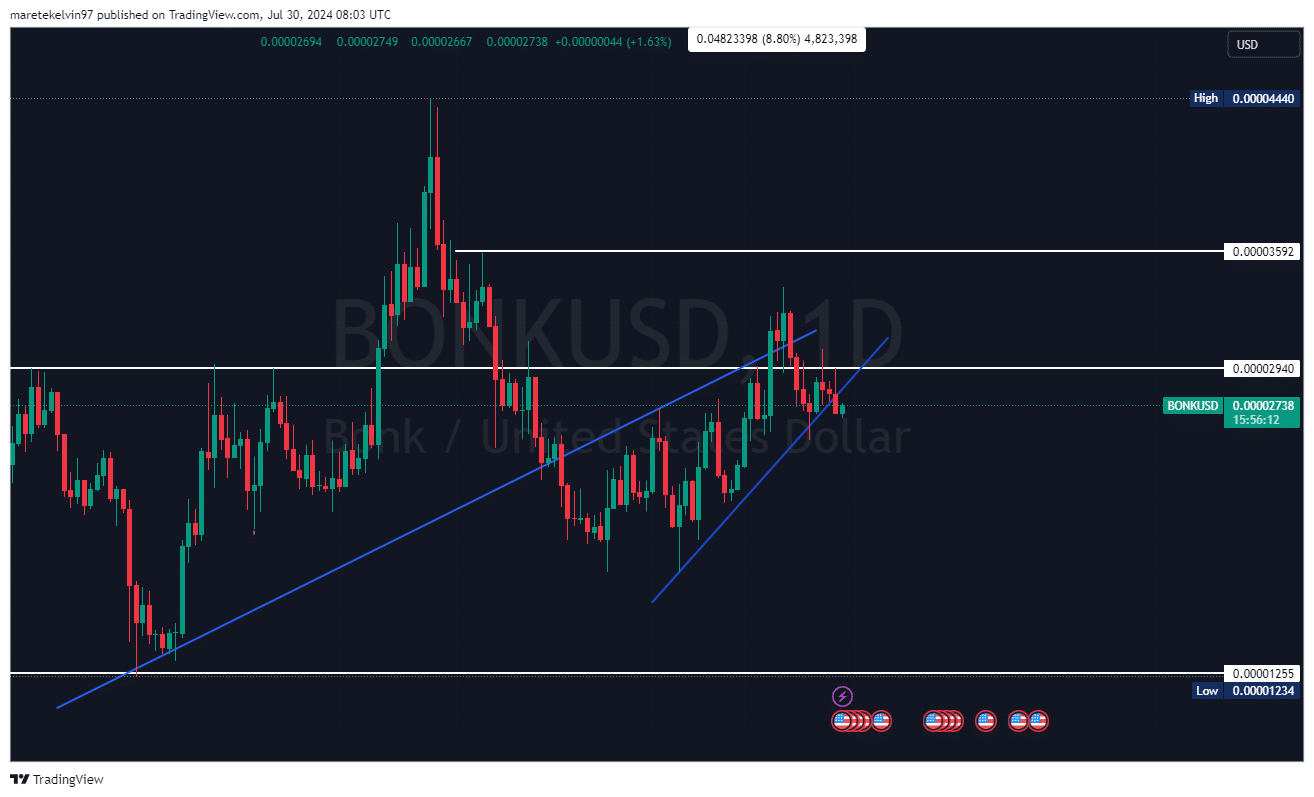

As an analyst, I’ve noticed some positive movements in the price of BONK. It’s currently spiking by 4%, which could potentially be a reversal to touch on a crucial support level formed by a rising wedge pattern.

Following a drop beneath the significant support point on the 29th of July, there’s uncertainty among traders whether this dip represents a temporary rebound or possibly the initiation of a more substantial uptrend.

As BONK nears the potential support line of a rising wedge, investors are eagerly watching for either a breakthrough or a refusal. A successful break above this level could potentially signal a resumption of the bullish trend.

However, if the move is rejected, it could result to further dips.

Liquidation pool influence

Having a substantial amount of liquidated tokens valued at $0.00002838 could offer an opportunity and pose a risk simultaneously when it comes to the future value of BONK.

Should the price reach that point, it might trigger additional sell-offs, potentially causing the price to climb higher. On the other hand, the high volume of available shares could act as a significant barrier for further increases, serving as a resistance within the market.

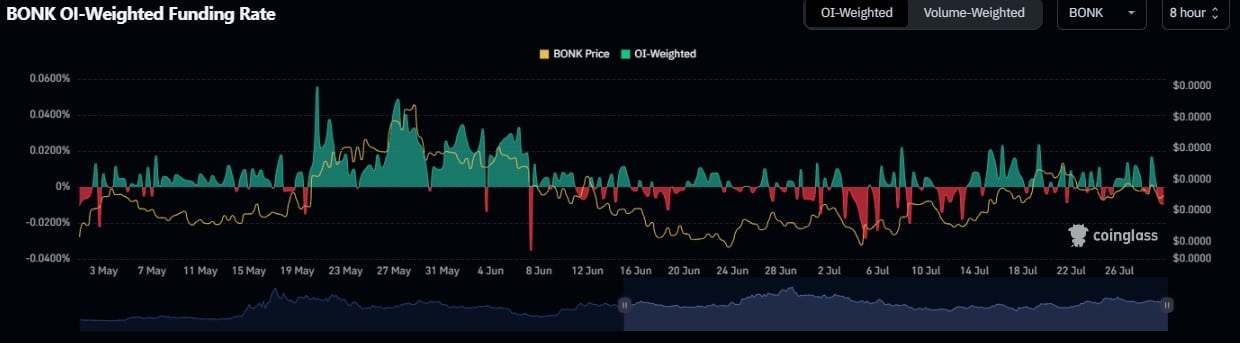

BONK’s fluctuating interest

As a crypto investor, I’ve noticed some wild swings in the token’s value. This volatility is evident not only in the price action but also in the weighted open interest data for the same timeframe. Interestingly, during these recent price surges, the open interest has spiked significantly, suggesting a rise in bullish trades and heightened optimism among traders.

Indeed, on certain occasions, a decrease in the number of open contracts (open interest) can be preceded by significant price drops, indicating that traders may be taking profits or liquidating their positions.

Realistic or not, here’s BONK’s market cap in BTC’s terms

In the coming days, we might observe substantial changes in the price of BONK. If it manages to build upon its current momentum and effectively execute the planned liquidation of the pool, this could pave the way for the expected price recovery.

However, if it fails to break above the key level, it could suggest renewed selling pressure.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- OM PREDICTION. OM cryptocurrency

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Gold Rate Forecast

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Meta launches ‘most capable openly available LLM to date’ rivalling GPT and Claude

2024-07-31 02:16