- The daily volume indicators whispered that the selling pressure was not overwhelming, but who listens to whispers these days?

- Cardano was not guaranteed to bounce from the lows, and traders must beware of BTC’s price moves as well, lest they be dragged into the abyss like so many before them.

Cardano [ADA] faced a rather rude awakening at the $0.75-$0.76 area, much to the dismay of its loyal followers. Bitcoin [BTC], the capricious king of cryptocurrencies, saw a 2.38% decline in seven hours, dragging ADA down by a rather hefty 4.68%. An earlier report noted that the price’s reaction at the $0.8 resistance zone would be a tale worth watching, but alas, the bulls were rebuffed before they could even test that resistance. BTC’s weekend volatility, a true master of suspense, rocked the altcoin market, leaving ADA in a state of bewilderment. Yet, the higher timeframe bias remained stubbornly in place, like an old, unyielding oak.

As long as the range formation was in play, ADA investors had a buying opportunity with a clear, close-by invalidation, a rare moment of clarity in this chaotic market. 🌟

The market sentiment was as shot as a used piñata — the fear and greed index stood at 30, indicating fear. It has denoted fearful sentiment throughout March, a month that seems to have forgotten the meaning of optimism. 🤦♂️

Recent online activity and price action suggest ADA may struggle to maintain support at the $0.6 level, a thought that brings a grim smile to the faces of bears. However, for swing traders, the risk-to-reward ratio still appears favorable, a glimmer of hope in the darkness. 🌠

The range low, highlighted at $0.682, positions ADA’s recent dip to $0.58 as an area where liquidity has likely accumulated, a potential harbinger of further price drops. Despite this, last week’s low at $0.647 offers an opportunity for long entries, with stop-losses recommended at 3%-5% below this level. This opportunity arises from the confluence of support at the range low and the lack of significant bearish pressure in technical indicators, a rare moment of clarity in this chaotic market. 🌠

At the time of writing, the A/D line retraced the gains from early March but did not crash below local lows. Similarly, the CMF was within neutral territory, and capital outflows were significant according to the indicator, a true sign of the times. The Awesome Oscillator also showed weak bearish momentum. All these factors marked the $0.65-$0.68 region as a likely candidate for a price bounce, a moment of respite in the storm. 🌦️

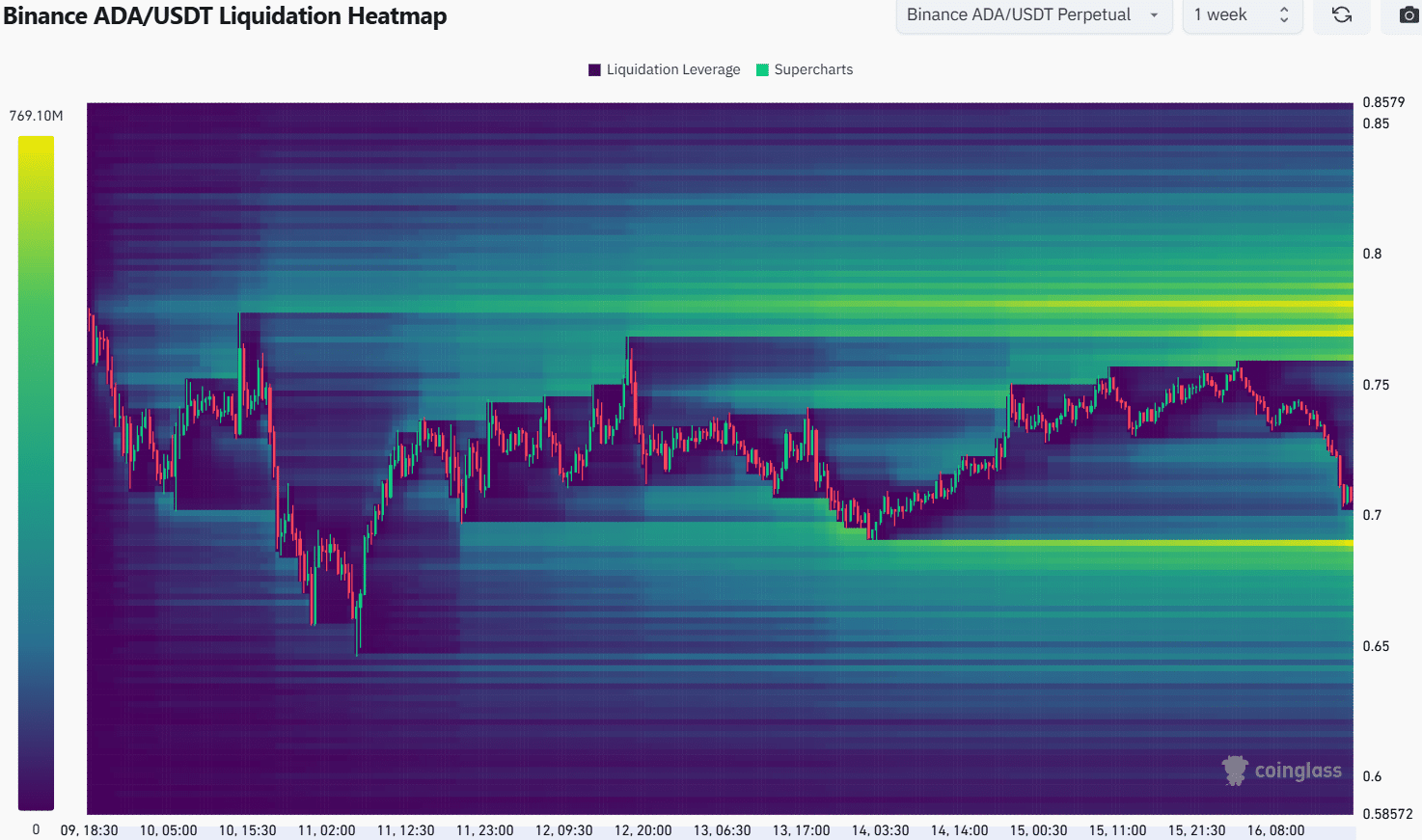

The 1-week liquidation heatmap showed that the lows at $0.68-$0.69 was a liquidity pocket near the price, a potential trap for the unwary. It was likely to pull prices lower before a price bounce, a classic market maneuver. However, it was not a guarantee that Cardano would bounce from here — it would be heavily dependent on BTC trends in the next 24–48 hours, a true test of faith and patience. 🕊️

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-03-17 08:09