-

54 new wallets withdrew 2.08 million LINK tokens worth $30.28M.

LINK looked bullish at press time, with a golden crossover spotted on an hourly time frame.

As a researcher with experience in cryptocurrency market analysis, I find the recent massive accumulation of nearly 54 newly created wallets holding 2.08 million LINK tokens worth $30.28M on the world’s biggest exchange intriguing. This significant accumulation by whales and institutions during a struggling market situation suggests their confidence in ChainLink (LINK) and their belief in its potential price increase.

The cryptocurrency market as a whole is experiencing volatility right now, with major players like Bitcoin, Ethereum, and Binance Coin showing losses.

In the midst of this challenging scenario, approximately 54 new digital wallets successfully withdrew a total of 2.08 million ChainLink (LINK) tokens, equivalent to around $30.28 million, as reported by the on-chain analysis company Lookonchain.

Over the past week, an enormous buildup occurred on the largest cryptocurrency trading platform.

As an analyst, I’ve noticed a significant trend based on data from Lookonchain’s recent X (formerly Twitter) post. Whales and institutions may have recently taken advantage of market conditions to amass large quantities of the asset in question.

These significant purchases of $30.28 million worth of LINK by these large investors and organizations indicate their growing enthusiasm and belief in the asset, as its price approaches a key resistance level.

ChainLink: key levels

Based on technical analysis conducted by experts, LINK demonstrated a bullish trend. On the hourly chart, a golden crossover occurred – that is, the 50 Exponential Moving Average (EMA) surpassed the 200 EMA. Furthermore, the price was approaching a resistance level of $14.8.

However, the recent accumulation data and golden crossover indicated a bullishness in the chart.

As of the current moment, LINK was stabilizing close to its resistance point. The volume of open bets or contracts (open interest) had risen by almost 2% within the past four hours, possibly indicating heightened investor and trader attention towards the token.

As a crypto investor, if the LINK 4-hour candlestick ends with a bullish close above $14.9, I would anticipate potential upside targets around $15.5 and $16.5 in the near future.

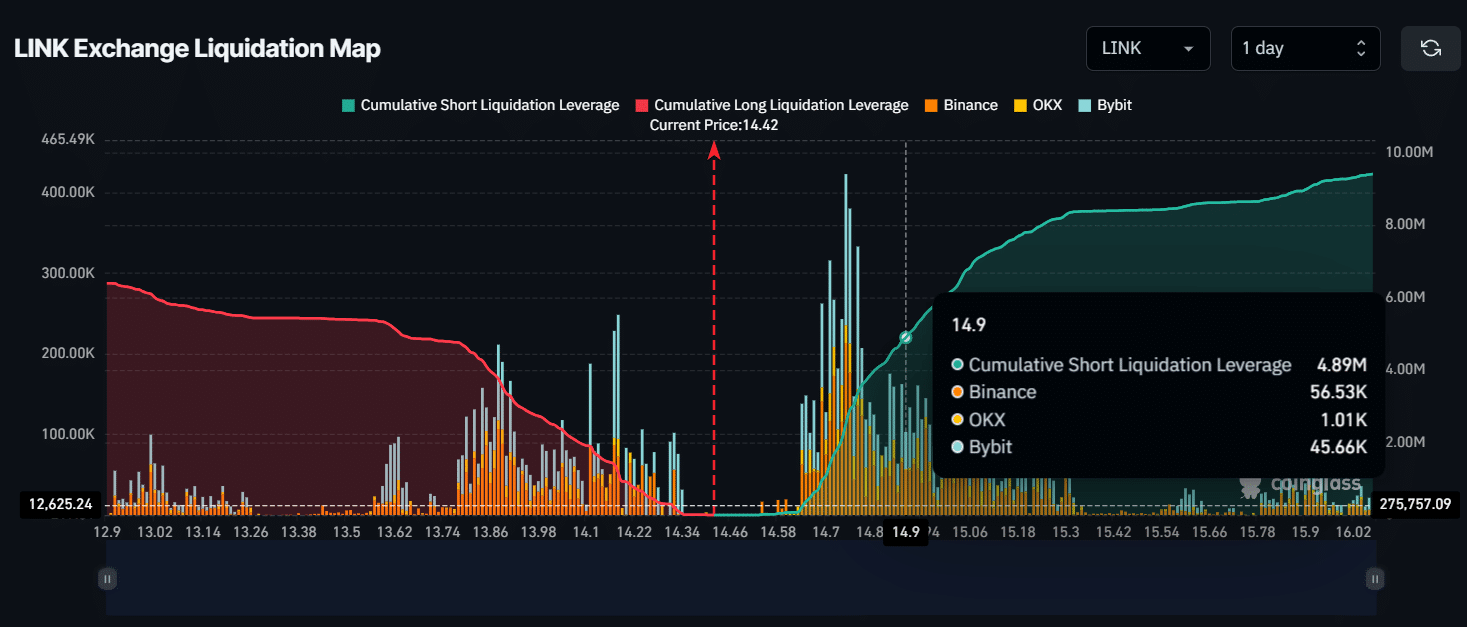

If the price of LINK surpasses $14.9 and forms a bearish candle, Coinglass estimates that approximately $4.9 million in short positions could be liquidated based on their analysis.

However, data also indicates that short sellers are more active than long buyers.

LINK price-performance analysis

As I pen down this analysis, LINK hovers around the $14.40 mark based on my current observation. In the past 24 hours, however, it has witnessed a minor price decrease of approximately 1%. The highest point it touched during this period was $14.71, as indicated by CoinMarketCap’s data.

Realistic or not, here’s LINK’s market cap in BTC’s terms

I noticed an uptick of 2% in the daily trading volume, indicating a potential decrease in engagement from investors and traders in the market.

I’ve analyzed the price trend of LINK over the past 30 and 7 days. Over the last week, LINK has seen a relatively stable period with a minimal 1.3% increase as a result of continuous consolidation. In contrast, during the previous 30-day span, LINK experienced significant losses, shedding more than 20% of its gains.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-07-04 07:03