- Bulls must not place too much faith in the news hype.

- The falling wedge breakout can see an 80% rally from $0.4.

As a seasoned researcher with extensive experience in the cryptocurrency market, I have witnessed firsthand the volatile nature of digital assets and the role that hard forks can play in shaping their price movements. Based on historical trends and my analysis of Cardano’s [ADA] upcoming Chang Hard Fork, here is my take:

If past patterns hold true, Cardano (ADA) could see significant price increases of over 100% by the end of next month, based on observations made by IntoTheBlock in a recent post. The reason being is that Cardano is gearing up for the Chang Hard Fork.

According to reports, the price experienced a significant increase of approximately 130% from $1.35 to $3.1 following the Alonzo hard fork in August 2021. Since then, there have been two more hard forks, each with varying degrees of influence on the market.

Not an automatic 100% price gain

As a crypto investor, I experienced the Valentine upgrade on Cardano, which took place on February 14, 2023, amidst the bear market. This hard fork brought a modest 16.9% price increase for ADA holders within just two days.

After that, the price fell significantly from $0.42 to $0.315 over a three-week period, representing a substantial decrease of 28.5%. Consequently, undergoing a hard fork does not ensure a price increase by a factor of two.

Other factors such as market-wide sentiment and the impact of the individual upgrade also matter.

Before Alonzo, there was another hard fork referred to as Vasil, which took place in September 2022. Following this event, the price experienced a notable increase of 11.1% over just two consecutive days. However, the uptrend did not last and the market downturn resumed afterwards.

Will the Chang hard fork live up to expectations?

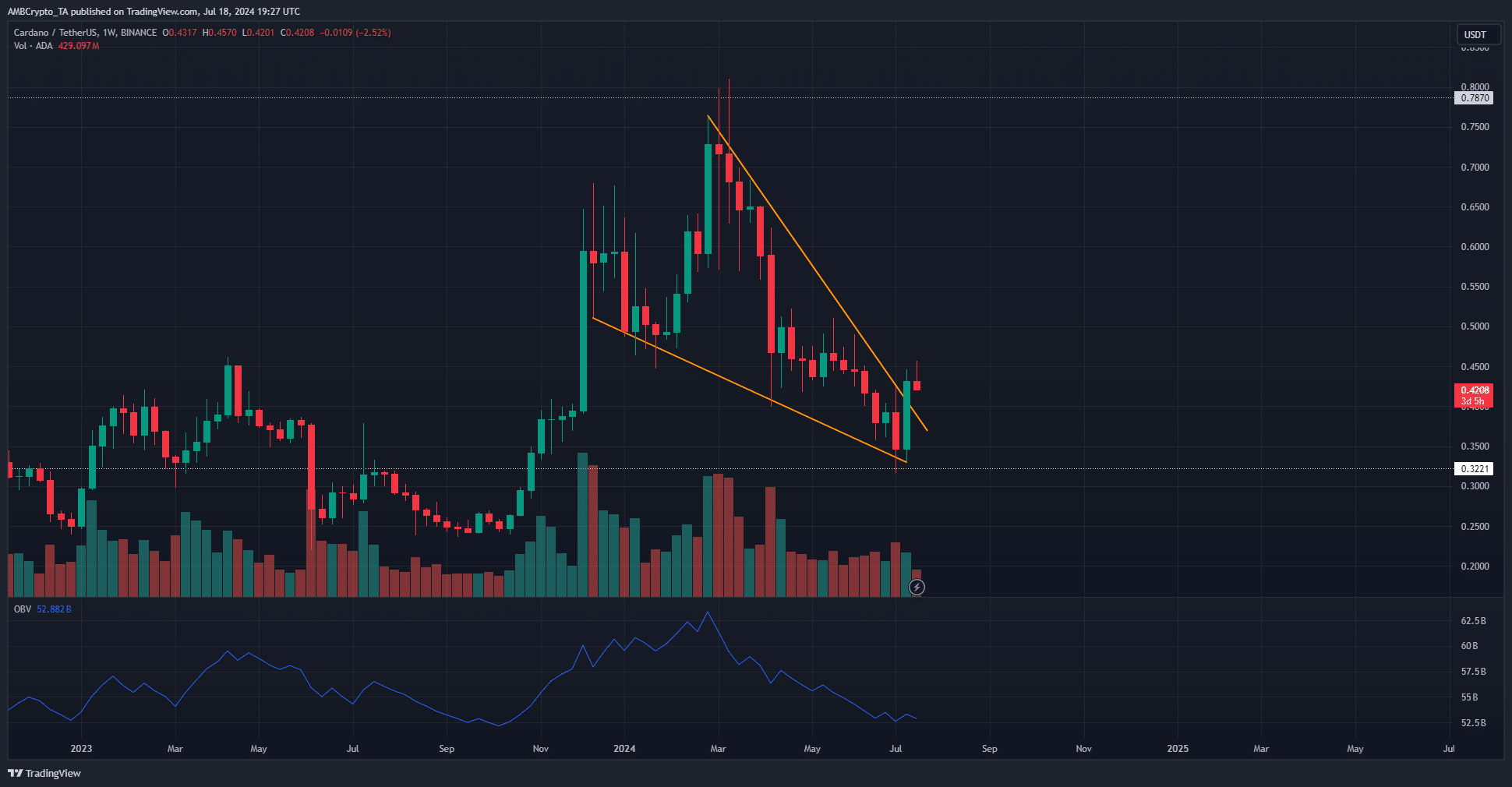

Since December 2023, the one-week chart of ADA has displayed the development of a falling wedge pattern. Over the past seven months, this trend was preceded by a gradual preparation phase. Last week marked a significant breakout above the descending trendline during this period.

Technical analysis indicates that this development is favorable for bulls. The price may head towards the high end of the wedge, around $0.72 to $0.78, within the next few months, resulting in approximately an 80% increase in value.

Based on my extensive experience in financial markets and analysis of trading data, I have observed that a decline in trading volume can be a cause for concern. When fewer shares or contracts are being traded, it may indicate a lack of interest or conviction among investors. This situation has been my observation throughout my career.

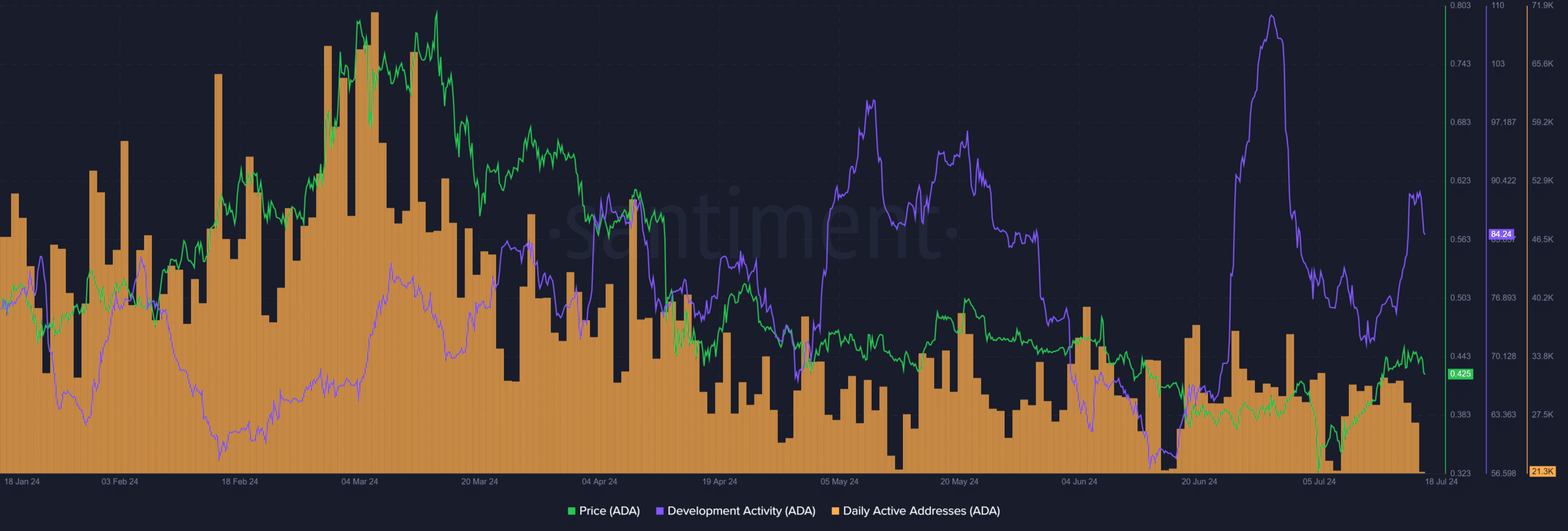

Since late April, the number of daily active addresses showing little change can be attributed to the scant involvement or engagement that might be leading to decreased demand.

Since February, the pace of development has been consistently advancing, providing reassurance for those holding long-term.

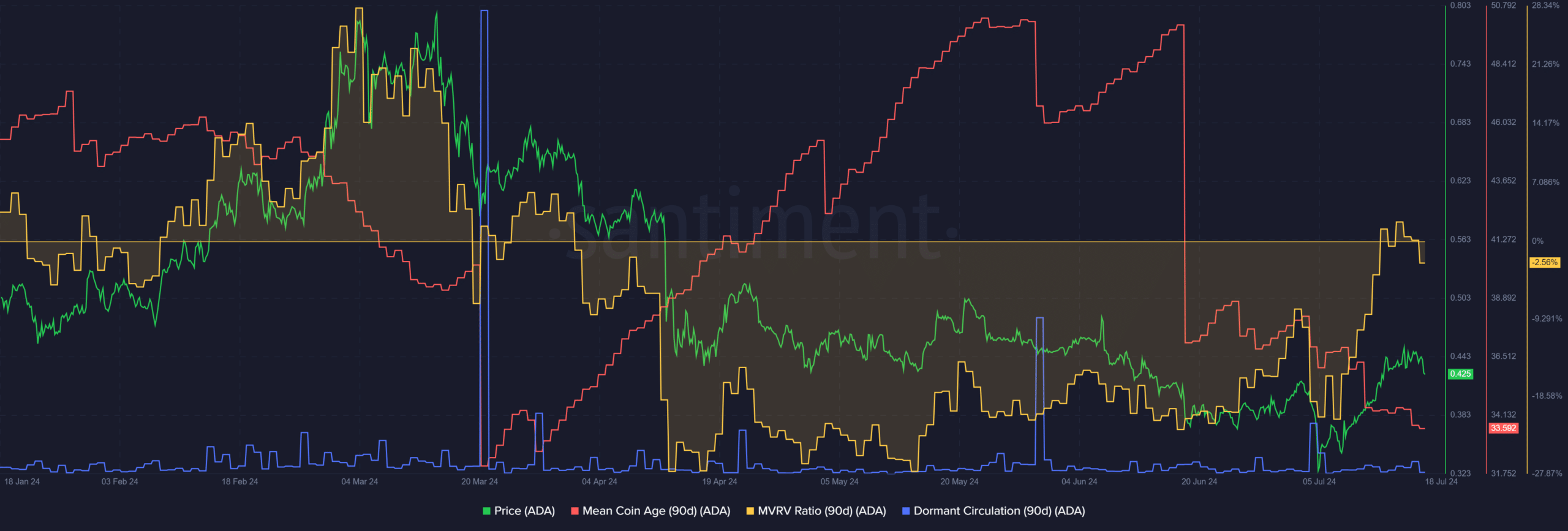

It’s worrying that as prices surged past the wedge pattern, the average age of coins in circulation dropped significantly. This indicated a distribution phase for Cardano.

Without the strong belief of investors, the Chang hard fork may not experience significant price increases exceeding 100%.

Read Cardano’s [ADA] Price Prediction 2024-25

During the past 90 days, the average investor experienced a small loss based on the moving average of value realized and unrealized gains (MVRV ratio) being under zero.

In simpler terms, the data didn’t indicate it was a good time to buy or that the bullish trend would continue. To spark a significant rally, there needs to be a consistent uptick in buying activity as reflected by the On-Balance Volume (OBV).

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-07-19 12:07