- Will crypto recover? It’s the burning question as BTC tumbles back to $94K.

- The path ahead could be volatile – but also ripe with opportunity for those willing to hold firm.

As a researcher with years of experience tracking the crypto market, I have seen my fair share of bull runs and bear markets. The recent tumble of Bitcoin back to $94K has me thinking about the age-old question: will crypto recover?

It’s intriguing that the Federal Open Market Committee (FOMC) meeting occurred at the exact time Bitcoin [BTC] achieved its record peak of $108K. Just a minor hiccup in the broader economy was enough to create a significant ripple effect throughout the market.

Within just a few days, the advancements achieved over the past week were essentially erased, placing Bitcoin precariously close to a crucial $93K support point. What once appeared as substantial earnings is now either sold off at breakeven or held onto with a potential loss.

Indeed, it’s apparent that these investors are maintaining their positions, hoping for an improvement. However, to determine whether cryptocurrency can indeed bounce back, it’s crucial to delve deeper than mere conjecture and examine the historical context, current trends, and potential future developments within this dynamic market.

Key factors distinguishing the past from the present

The lessons of history are particularly relevant in the cryptocurrency market, and it appears that the number ‘four’ carries some unique importance. Approximately every four years, the market undergoes a significant trial, and the subsequent three years often experience repercussions from this event.

Reflect on the year 2020, when Bitcoin gained prominence due to the pandemic causing a shift in conventional investment methods such as bonds, banks, and government returns.

Consequently, Bitcoin experienced a significant rise, approximately tripling its value, going from around $10,000 in October 2020 to approximately $42,000 by January 2021. This milestone signified the start of a new phase for BTC.

Moving on to present times, it’s worth noting that Bitcoin has experienced a staggering increase of around 140% over the last four years. This impressive growth can be attributed to a series of interconnected factors such as the post-halving boom, election-related liquidity, and fluctuating macroeconomic trends.

However, what could potentially be the real game-changer is the entry of institutional capital into Bitcoin. As AMBCrypto points out, this influx will play a significant role in the upcoming months. Not only will it aid in the crypto market’s recovery, but it may also guide Bitcoin through the volatile period that lies ahead.

On the flip side, a potential issue arising this year is ‘over-leveraging’. Over the last four years, there’s been a significant influx of borrowed funds into the market, which has introduced an additional level of risk.

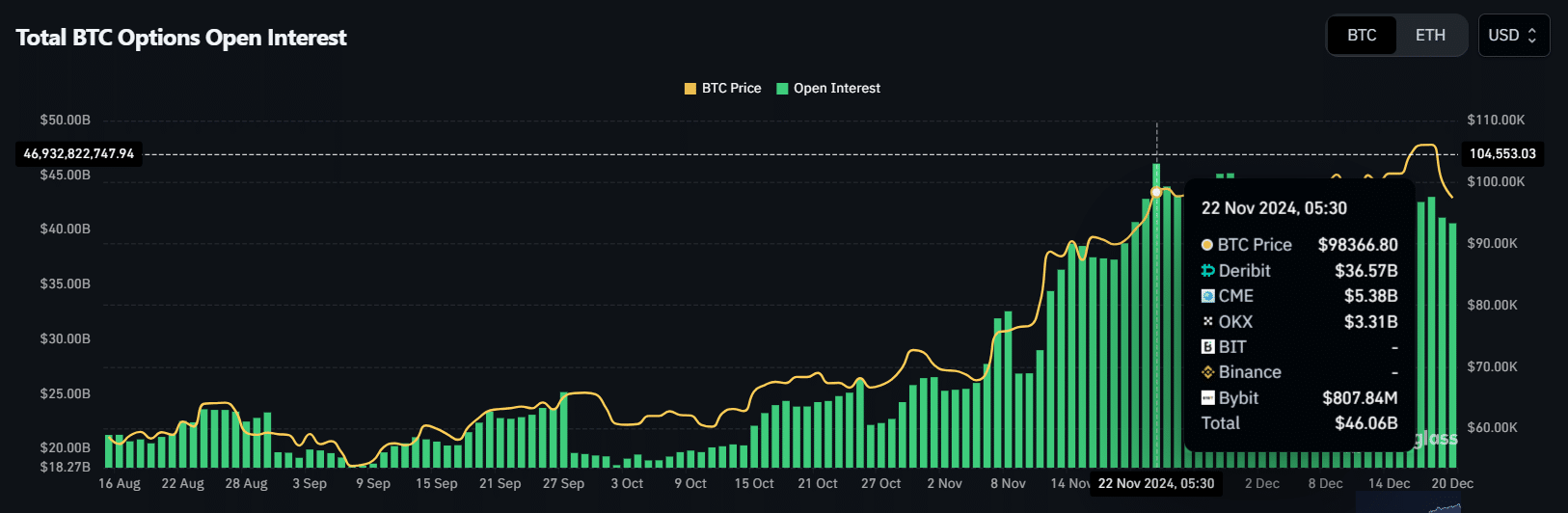

Source : Coinglass

The impact is clear in the surge of open interest (OI), which recently reached an all-time high. As Bitcoin neared the $100K mark, the market saw a staggering $47 billion in leveraged positions, with traders betting on both directions – up and down.

With these factors in mind, when will crypto recover?

The upcoming resistance level for Bitcoin could become a battlefield, with the bearish traders currently holding strong dominance.

Beyond mere market dynamics, it’s crucial to consider AMBCrypto’s perspective: The FOMC’s reduction in interest rates by 0.25% wasn’t just a move to boost the economy, but rather a sign of an economy that is deemed healthy.

Here’s a possible way to rephrase the given statement while maintaining its meaning:

Contrarily to what one might expect, the U.S. dollar is actually gaining strength instead of contributing to Bitcoin’s growth. This indicates that individual investors are moving towards conventional secure investments such as the dollar and bonds, preferring to avoid the risks associated with cryptocurrency trading.

This dip might just be the perfect catalyst for the market to rebound and stabilize. Interestingly, a potential robust buying opportunity may surface near the $90,000 level, triggering fear of missing out (FOMO) and drawing investors back in again.

To put it simply, given the current situation, the risks involved seem significant. It’s evident that Bitcoin ETF investors are showing signs of growing uncertainty, as they collectively withdrew approximately $671 million.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Clearly, we’re at a crossroads here. This could be a make-or-break moment for Bitcoin.

Moving on, let’s closely monitor the dollar index, ETF investments, and above all, those who are maintaining their positions steadfastly. Now is when resilient investors will stand out, but the path forward will undoubtedly be bumpy.

Read More

2024-12-21 01:12