- Curve breaks out on the higher time frame.

- Why are big holders offloading amid upcoming altseason?

As a seasoned crypto investor with battle-tested nerves and a knack for spotting trends, I find the current state of CRV intriguing. The breakout on both the 2-day and weekly timeframes is a bullish signal, and if history serves as any guide, the Lux Algo indicator has a proven track record. However, reaching the short-term high of $0.50 remains uncertain, and the potential retest of the $0.30 or $0.33 levels could provide an entry point for aggressive investors.

On a two-day timeline, the graph of CRV has burst through, hinting at an upcoming rise in value. With the help of the Lux Algo indicator, CRV has confirmed the breakout point and is now aiming for new record highs.

As a crypto investor, I’ve noticed that CRV has formed a five-wave bottom and found solid support at $0.30. There’s a resistance level set at $0.42 for now, but whether we’ll hit the short-term high of $0.50 in the near future is still up in the air.

At the current moment, I’ve observed that the value of CRV has burst free from its previous consolidation, indicating a potential return to the $0.30 or even $0.33 price points based on recent price movements as a researcher analyzing market trends.

At these levels, purchasing might present attractive chances, but for certain investors, making bold purchases could prove psychologically tough.

Will altseason boost CRV?

In simpler terms, the overall market for alternative cryptocurrencies (altcoins) appears to be gaining momentum. These altcoins are poised to break free from a nine-month downward trend on the weekly chart, which could potentially escalate the value of CRV even more.

Presently, the overall market value of alternative cryptocurrencies (altcoins) resembles figures from the year 2023, hinting at the possibility of another comparable rise in the near future. Such optimism might trigger a wave of bullish sentiment, which could potentially boost CRV‘s price.

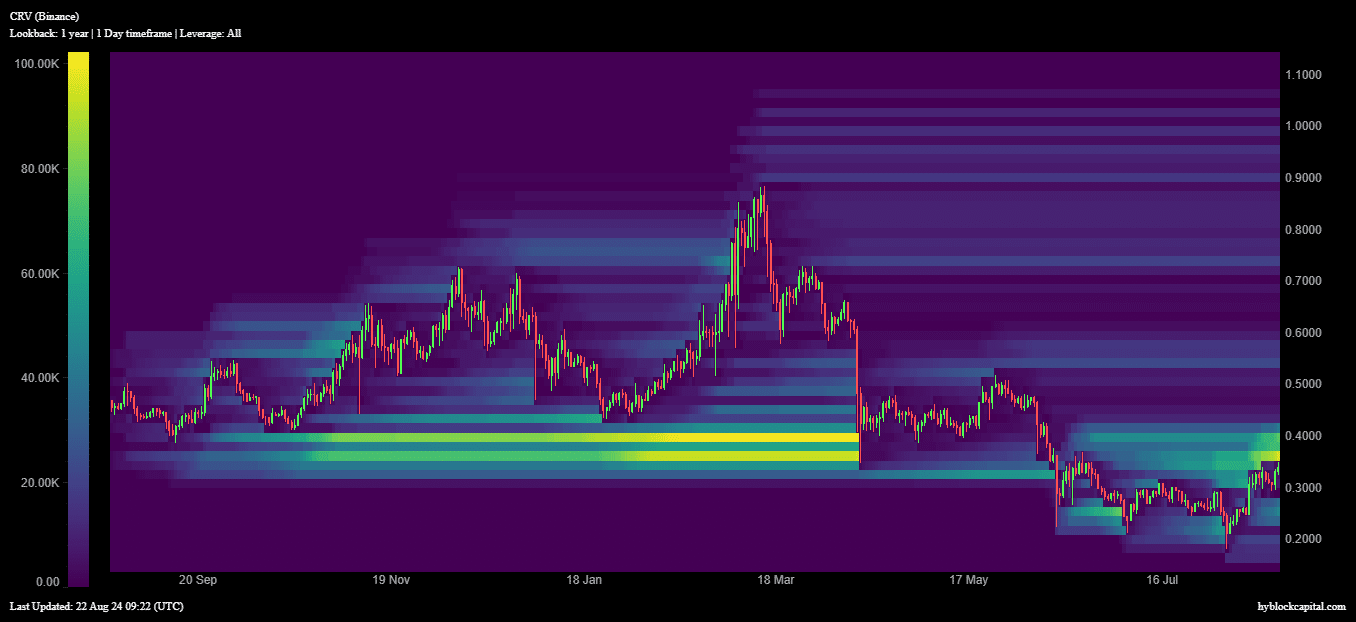

Liquidation levels and market cap

The digital currency CRV is gradually rebounding, alongside other cryptocurrencies. At the moment of reporting, liquidity for CRV stands at approximately $22.36K around the price point of about $0.50. As more orders for CRV are processed, it appears likely that this level could be reached in the not-too-distant future.

Currently, the total value of Circular (CRV) in the market is approximately $385 million. At the same time, there was a trading volume of around $157 million. This significant trading volume, when compared to the market cap, equates to a 42.22% ratio, suggesting high liquidity and a relatively stable market with reduced volatility.

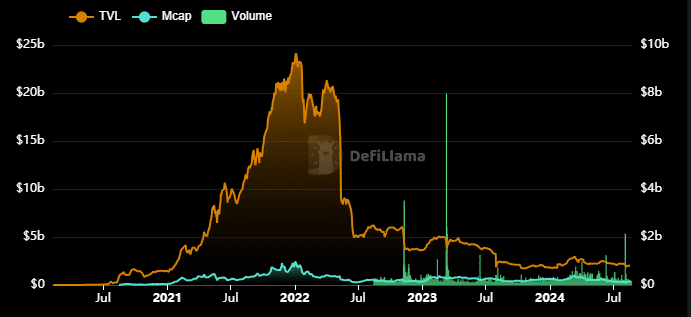

Despite these positives, the total value locked in CRV has remained low.

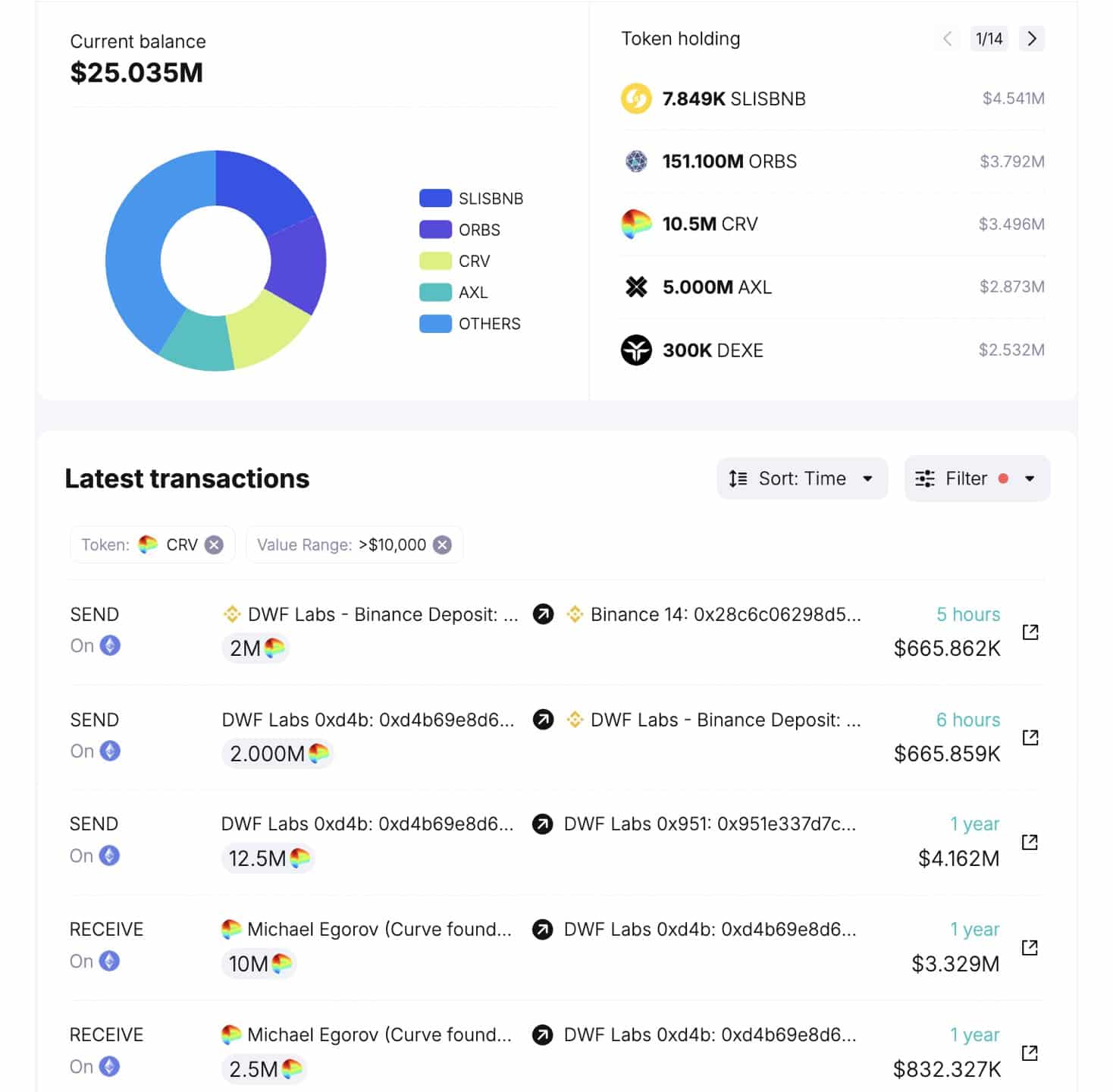

Are DWF Labs offloading CRV?

DWF Labs, a significant holder of CRV, recently deposited 2 million CRV ($683K) to Binance.

For those new to this, DWF Labs earlier acquired 12.5 million CRV from Curve’s founder, Michael Egorov, during a liquidation predicament. Currently, they still possess 10.5 million CRV.

At the moment, they are looking at a projected overall loss of approximately $824,000 (-16.5%). The effect that DWF Labs’ actions may have on the price of CRV is yet to be determined. However, if DWF Labs were to sell CRV, it could potentially shift market opinion.

Read Curve DAO’s [CRV] Price Prediction 2024 – 2025

Keeping an eye on CRV‘s progress is advisable, given its potential for significant growth within the wider cryptocurrency market. It’s crucial to stay attentive to important levels of both support and resistance as they can influence price movements significantly.

The course of action for CRV is expected to be influenced by wider market trends and decisions made by major stakeholders such as DWF Labs.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-23 04:08