- Ah, the daily candle of our dear DOGE has closed, rebounding from the illustrious $0.143, with a cheeky little lower wick at $0.14297. How delightful! 🎉

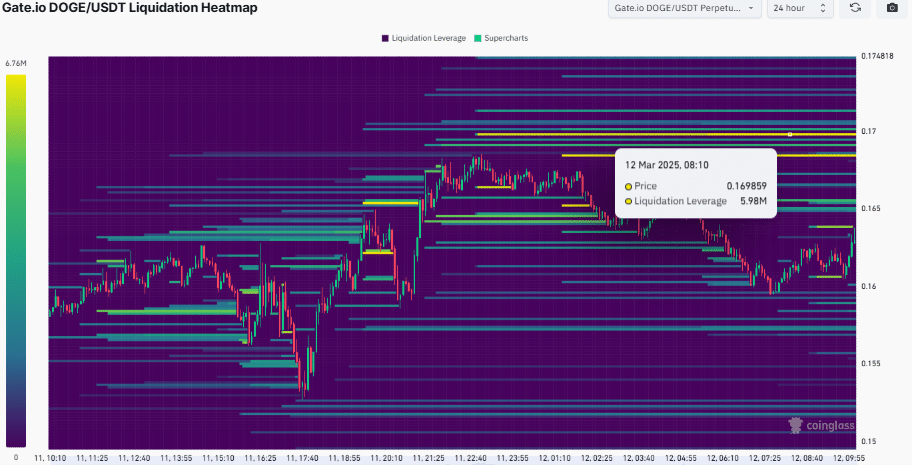

- But wait! The key liquidation levels hover above like a hawk, between $0.16 and $0.17, as the SEC decides whether to play nice with the ETF. Oh, the suspense! 😏

Our beloved Dogecoin [DOGE] has confirmed a bounce off the key support at $0.143, with a lower wick at $0.14297. The rejection at this level suggests a potential accumulation, or perhaps just a gathering of hopefuls. 🐶

Yet, the recent red candles are like a gloomy cloud, indicating continued downside momentum. More downward tests are likely before we see a reversal, if we’re lucky! ☔️

While the latest green candle hints at short-term buying interest, DOGE must reclaim the $0.17542 resistance level to establish a more stable trend. A tall order, indeed! 🎩

Should it fail to hold the $0.143 support level, we might see increased volatility, potentially driving the price down to $0.134 before a genuine rebound takes place. Oh, the drama! 🎭

If DOGE can maintain steady support at $0.143 or higher, it could build momentum for a move toward $0.168. Buyers will need to see increased trading volume and higher lows to signal market strength. A tall order, but who doesn’t love a challenge? 💪

Without these factors, any rally risks being a mere liquidity grab before another drop. A push above $0.14297 might trigger stop hunts, shaking out weaker positions before a potential rally. How thrilling! 🎢

Key liquidation levels

Further analysis reveals DOGE’s strongest liquidation area is between $0.16 and $0.17, meaning price will be attracted to this level like moths to a flame. The density of liquidations at $0.169859 could help validate the upside target. How charming! 🔥

If momentum is gained, DOGE can trend upward to seek stop orders, causing delightful volatility. But clusters of liquidity follow traders like a loyal puppy, meaning new groups of liquidation can form lower, which is what turns the price. 🐾

If new liquidity builds below $0.16, DOGE can recapture these levels before attempting to move above. A classic tale of redemption! 📖

Failing to recapture $0.17 could trigger another sell-off, building more pools of liquidity near $0.155, a bear trap leading into the rally. How very theatrical! 🎭

Implications of SEC’s extension on DOGE ETF

Bloomberg ETF analyst James Seyffart, in a moment of brilliance on X (formerly Twitter), noted that the SEC’s 45-day delay shifts the Dogecoin ETF decision to a deadline of the 4th of April 2025. Mark your calendars, darlings! 📅

This delay could result in mixed price reactions, though Seyffart emphasized that the chances of approval remain high. Fingers crossed! 🤞

If approved, the ETF could provide a significant boost, with Polymarket assigning a 75% probability of approval, potentially driving DOGE’s price to $1 or higher. A splendid prospect! 💸

Institutional demand and broader acceptance would further support a rally, and a quicker decision could enhance the current bullish outlook. How positively delightful! 🌟

However, a rejection or further delay may lead to a price decline. DOGE, already down 16% recently, is testing support at the $0.14 level. Heightened uncertainty could amplify volatility, deterring risk-averse investors while attracting speculators betting on gains. Quite the conundrum! 🤔

Analysts remain divided, with many optimistic about a possible $2+ rally, while others express concerns about regulatory challenges. The SEC’s review of Bitwise and Grayscale submissions remains central to DOGE’s prospects

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2025-03-12 21:16