- Dogecoin approached critical resistance; a break above $0.16460 could trigger a rally toward $0.20.

- Overbought signals hinted at a potential DOGE pullback, while whale activity pointed to increased volatility.

As a seasoned analyst with years of experience tracking market trends and price movements, I see a promising outlook for Dogecoin [DOGE]. The coin’s rapid surge is a testament to its resilience and growing popularity.

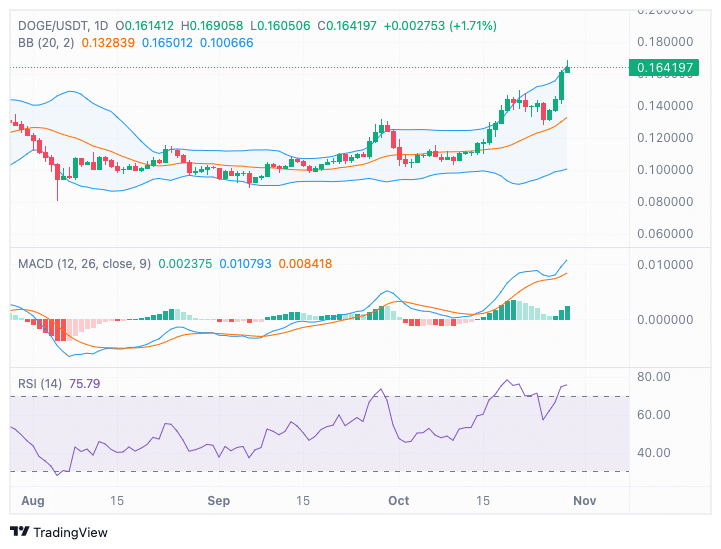

Over the last 24 hours, Dogecoin (DOGE) experienced a significant increase of approximately 16.93%. This surge followed Dogecoin testing its support level at $0.14080, suggesting a solid foundation and propelling it towards a crucial resistance point at $0.16460.

currently, one DOGE coin is valued at approximately 0.1654 USD, and over the past 24 hours, a trading volume of around 4.37 billion USD has been recorded for this cryptocurrency. With a circulating supply of roughly 150 billion DOGE coins in existence, the total market value currently stands at about 24.24 billion USD.

Approaching the resistance at $0.16460, DOGE is getting closer to its middle-term goal of approximately $0.20745. Breaking through this resistance might trigger additional price increases.

If DOGE fails to move past the $0.16460 level, it could revisit support at $0.14080.

A significant drop might challenge the $0.12650 as a potential floor. Meanwhile, our mid-range objective stays within reach, but surpassing the $0.16460 could spark additional gains in the future.

Overbought signals from technical indicators

The cost of Dogecoin has surpassed the top boundary of the Bollinger Band, suggesting a powerful uptrend. However, this could also signal that the coin is excessively purchased, potentially leading to a correction if it breaks above the upper band. In other words, while the upward movement seems strong, there’s a possibility of a reversal when the coin becomes overbought.

This situation might lead to a brief setback or a phase of stabilization. If Dogecoin decreases, the middle Bollinger Band, currently positioned at approximately $0.1328, could potentially function as a support level.

The moving average convergence divergence (MACD) exhibited a constructive trend, as both the MACD line and the signal line were moving upwards. Moreover, the rise in the histogram suggests heightened purchasing enthusiasm.

So long as the Moving Average Convergence Divergence (MACD) continues to be positive, the upward trend for Dogecoin (DOGE) is likely to persist, possibly pushing it up further.

Currently, the Relative Strength Index (RSI) stands at 75.79, indicating that Dogecoin (DOGE) might be overbought and could potentially experience a price correction.

In a robust upward trend, it’s quite normal to encounter high Relative Strength Index (RSI) levels, which might indicate a brief price correction in the near term.

If RSI continues to hold at elevated levels, DOGE may push toward the next resistance at $0.18.

DOGE’s on-chain metrics

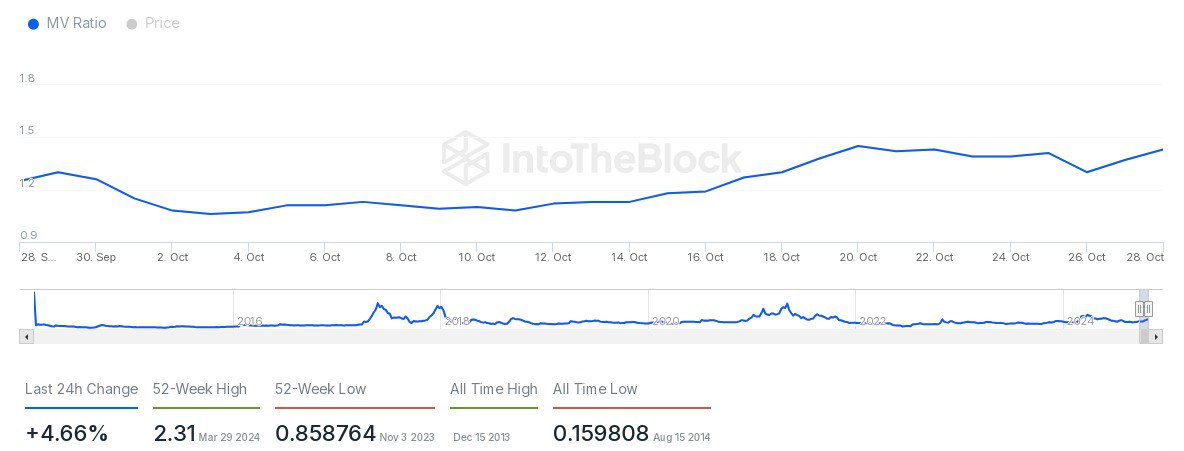

In the last 24 hours, the Market Value to Realized Value (MVRV) Ratio for DOGE experienced a 4.66% rise and has been approximately 1.5. This ratio serves as an indicator of profitability for DOGE holders.

When the MVRR (Majority Vested Ratio) increases significantly, it typically indicates that a larger number of holders are making a profit, potentially leading to increased selling activity as traders decide to cash out their profits. In the past, we’ve observed that when the MVRR surpasses 2.0, there is often an increase in selling.

Currently, MVRV is lower than its highest point over the past year (2.31), indicating there might be more opportunities for growth before significant selling occurs.

If MVRM (Market Value to Realized Value) keeps increasing, it potentially heightens the chances of investors cashing out their profits. This could lead to a decrease in the value of DOGE.

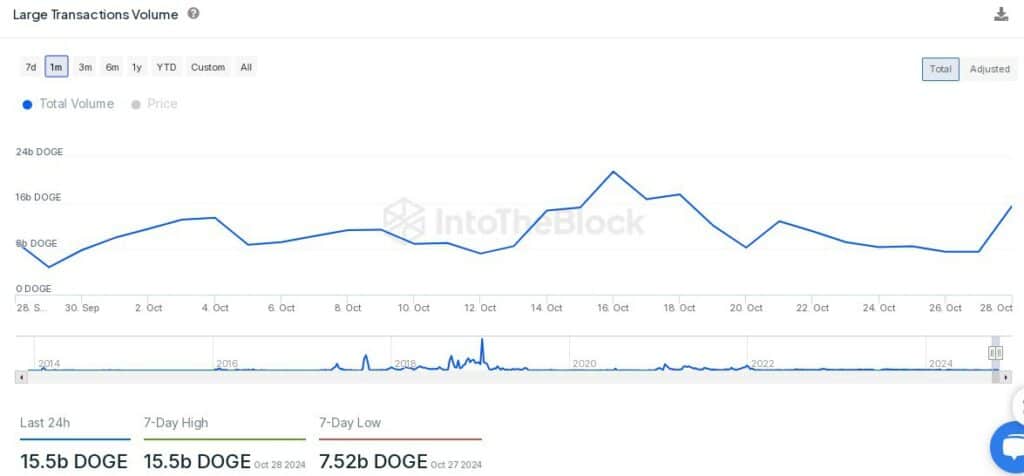

Whale activity on the rise

In the last day, a significant number of large Dogecoin transactions amounted to about 15.5 billion DOGE, setting the highest record for this month so far.

Read Dogecoin’s [DOGE] Price Prediction: 2024-2025

As a seasoned trader with over a decade of experience in the crypto market, I have noticed that increased activity from whales and institutional investors often signals heightened interest in a particular asset. These players have significant influence over price direction due to their massive holdings and frequent trades. From my perspective, an uptick in whale activity could indicate accumulation, distribution, or preparation for larger market moves. Based on my past observations, it’s always essential to closely monitor such developments to stay ahead of the curve and make informed trading decisions.

Recently, large transaction volume had dropped to 7.52 billion DOGE, making this spike significant.

Read More

2024-10-29 20:08