-

WIF was the worst-performing meme token of the top five in the past week

The sentiment behind WIF was intensely bearish in the short-term

As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I’ve seen my fair share of market highs and lows. The past week has been a tough one for WIF, the meme token that was unable to break the $2 psychological barrier and instead took a nosedive, leaving the bulls reeling in disbelief.

Despite attempts by the bulls, the dogwifhat [WIF] failed to surmount the psychological $2 barrier a week ago. Consequently, the negative sentiment persists as the bears continue to resist any significant price increase.

The quick gains of the past week were unsustainable.

In the last week, the meme coin market experienced losses exceeding 10%, and out of the top five well-known meme coins, WIF‘s performance was the most disappointing during that timeframe.

Where is dogwifhat headed next?

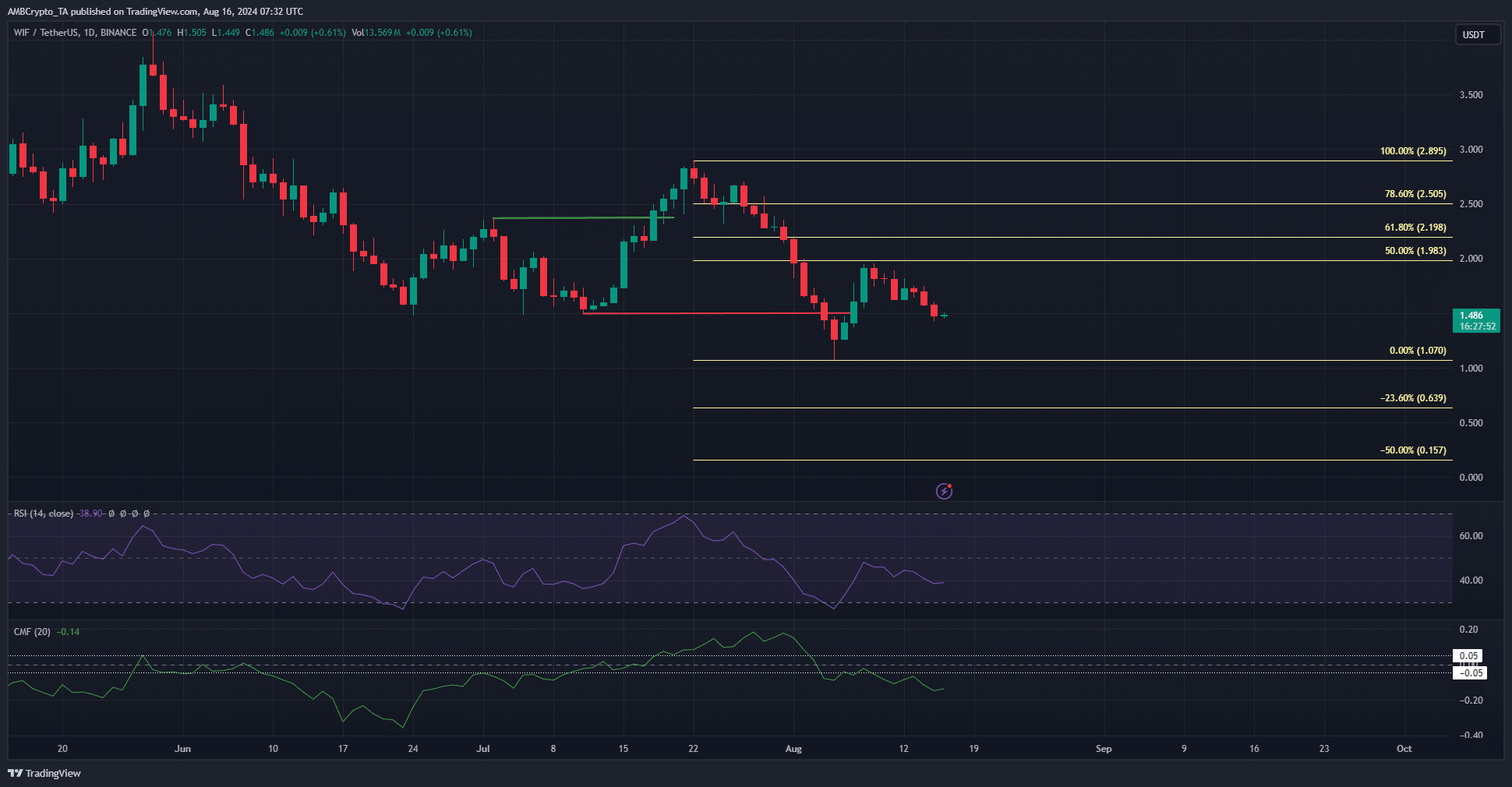

In July, WIF exhibited a strong market pattern (green) that typically indicates optimism. It peaked at $2.895 and subsequently plunged to $1.07 as Bitcoin [BTC] dropped dramatically from $69k to $49k. Unfortunately, WIF has yet to rebound from these significant losses.

The market’s structure seemed negative, and it had been rejected at the 50% retracement point of $1.98. It looked probable that the Fibonacci extension levels below $1 were potential future targets.

1. Every day, the Relative Strength Index (RSI) stood at 38, signaling a strong trend of decline. The -0.14 value in the Chaikin Money Flow (CMF) suggested substantial outflows of capital from the market during the last seven days.

Bearish sentiment in the Futures market

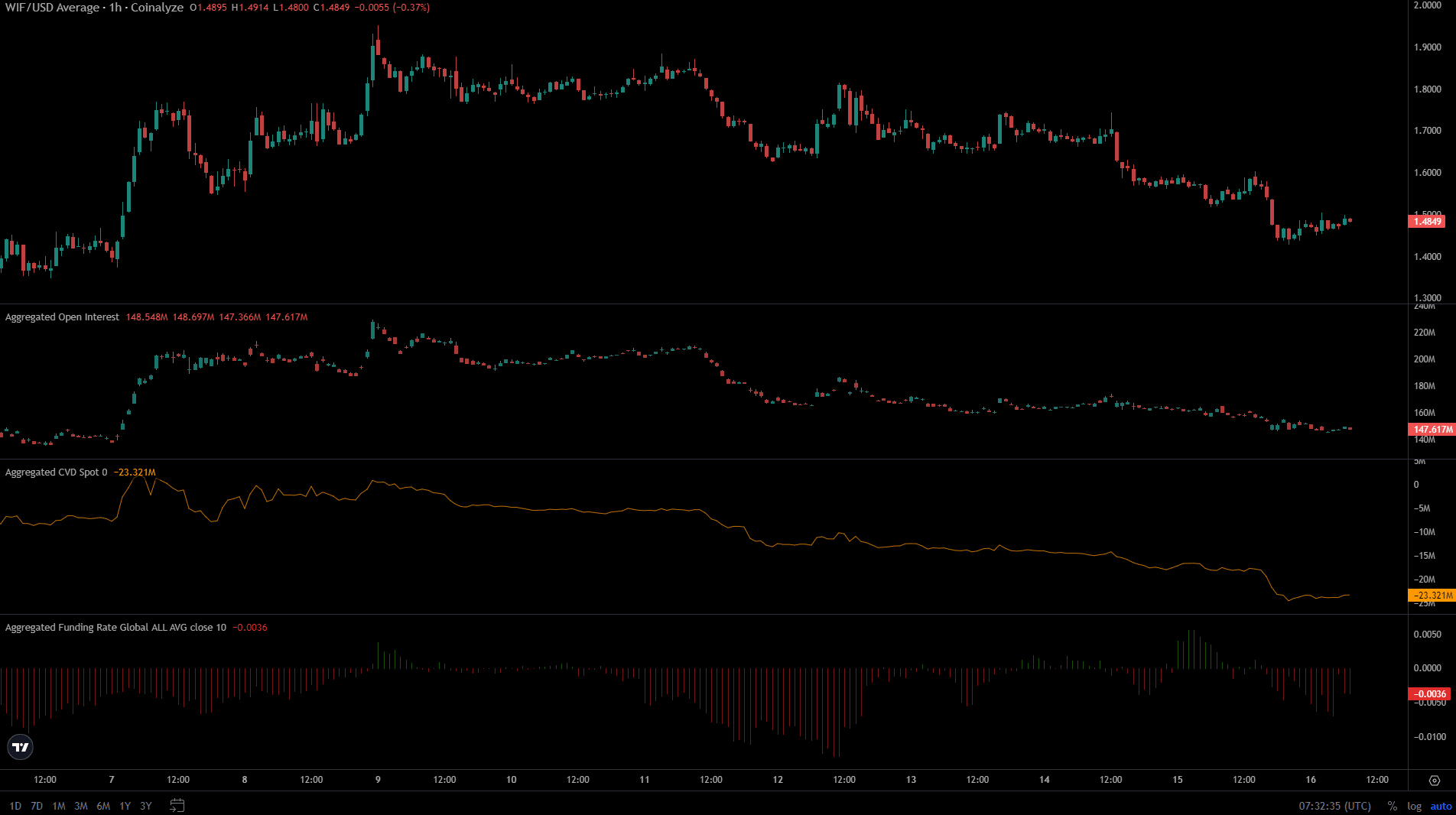

The data from the Futures market showed seller dominance. The Funding Rate was negative, indicating rampant short-selling. Also, the Open Interest has been in decline over the past week alongside the price.

Realistic or not, here’s WIF’s market cap in BTC’s terms

Collaboratively, they demonstrated the readiness among market players to dispose of WIF. Moreover, the falling trend of CVD supported this viewpoint.

Hence, a move toward the local lows at $1.25 is likely to commence over the weekend.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Is Trump’s Presidency a Game Changer for the US Dollar and Bitcoin?

2024-08-17 00:07