-

WIF’s Futures Open Interest has dropped by 10% in the last 24 hours, indicating that traders were hesitant to build new positions.

At press time, 53.4% of top WIF traders were holding short positions, while 46.6% were holding long positions.

As a seasoned crypto investor with over a decade of experience navigating market volatilities, I must say that the current state of WIF leaves me slightly concerned but not entirely surprised. The 8% price drop within 24 hours is a stark reminder of how unpredictable this space can be, and it echoes my own investment lessons learned the hard way.

After a decent market recovery, the overall cryptocurrency market faced selling pressure.

In the current economic slump, I’ve observed a significant decline in the value of Doguifhat [WIF], a well-known meme coin built on the Solana [SOL] platform. This downturn has led to a noticeable dip in its price by more than 8%.

WIF’s bearish on-chain metrics

It appears that trader and investor sentiment has turned bearish, according to the on-chain data.

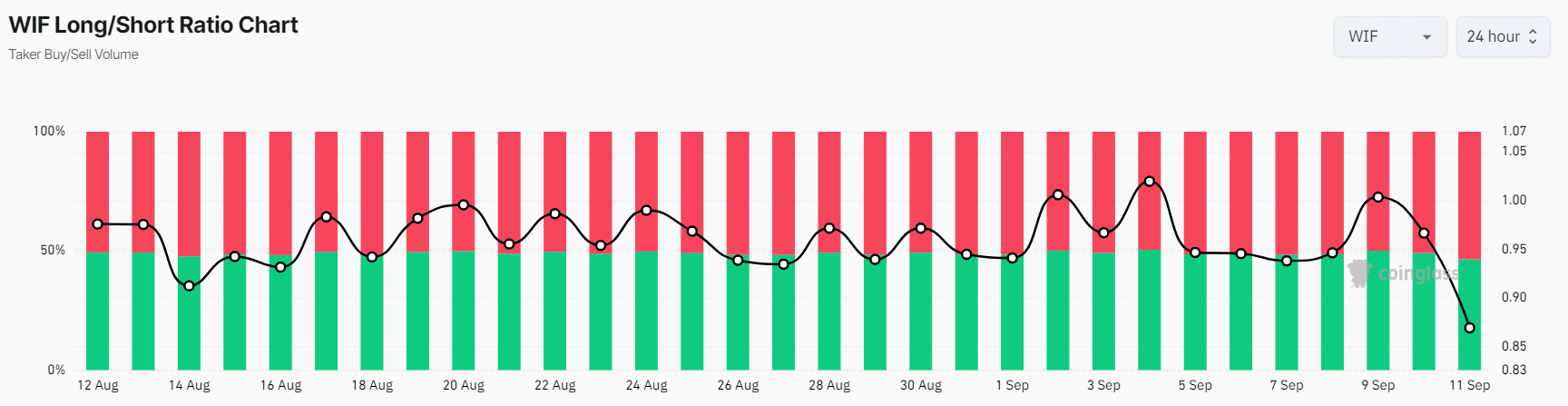

At the current moment, the Long/Short Ratio for WIF stood at 0.87, which is the lowest it’s been since early August 2024. This low figure, less than 1, suggests a predominant bearish attitude among investors (meaning they expect prices to fall).

Approximately 53.4% of the prominent WIF traders had taken a short position, compared to around 46.6% who were holding a long position, as per the available data.

Conversely, the number of open positions for WIF‘s Futures contracts decreased by 10% within the past day. This suggests that traders may be closing their existing trades or choosing to hold off on creating new ones.

Key liquidation areas

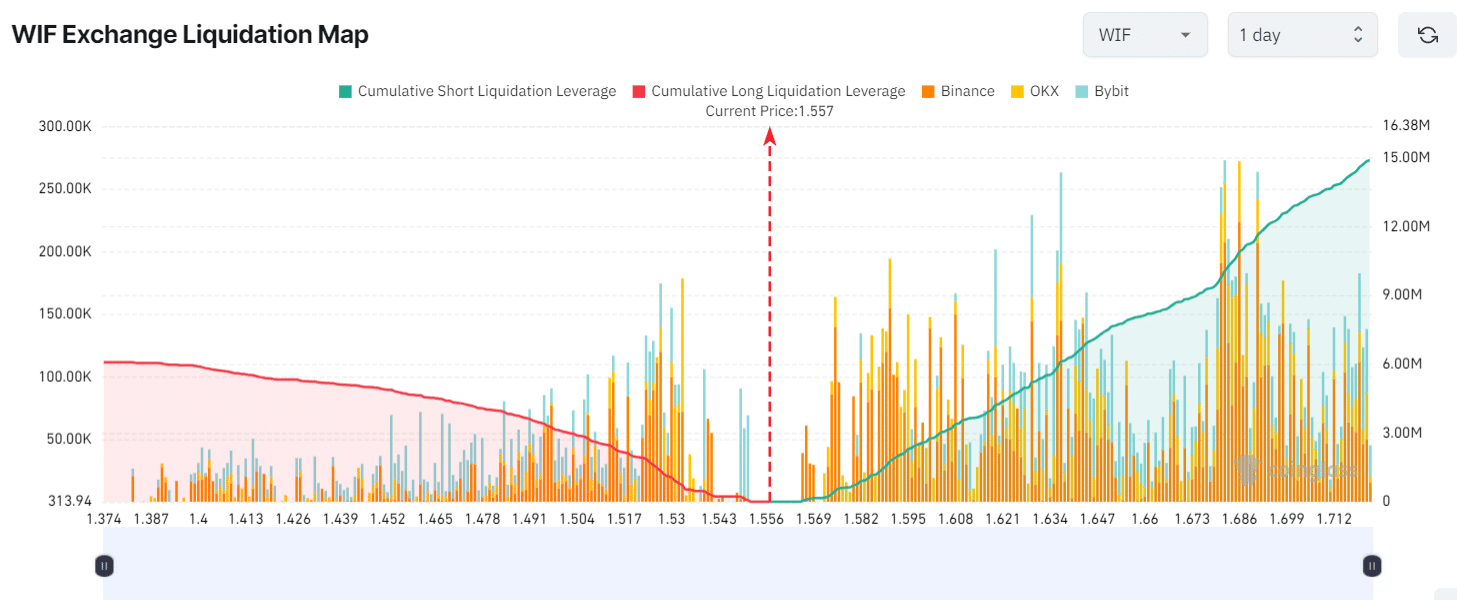

At the point of writing this, significant support and resistance levels appeared to be around the $1.52 mark on the downside and approximately $1.637 on the upside, based on current trader positions, as suggested by data from Coinglass.

As a researcher studying the market dynamics, if the overall sentiment persists in being bearish and the price of WIF dips down to $1.52, it’s estimated that approximately $1.36 million in long positions might get liquidated.

If the sentiment changes and the price moves upwards to about $1.637, it would force a closure (liquidation) of around $6.13 million in short positions.

The information indicated a pessimistic perspective on the WIF token, since speculators who sell short felt that the price wouldn’t rise to $1.637 and had taken on too much risk at that moment.

Additionally, it showed signs that the bears were in control of the asset, suggesting a possible drop in its price within the next few hours or days.

WIF price momentum

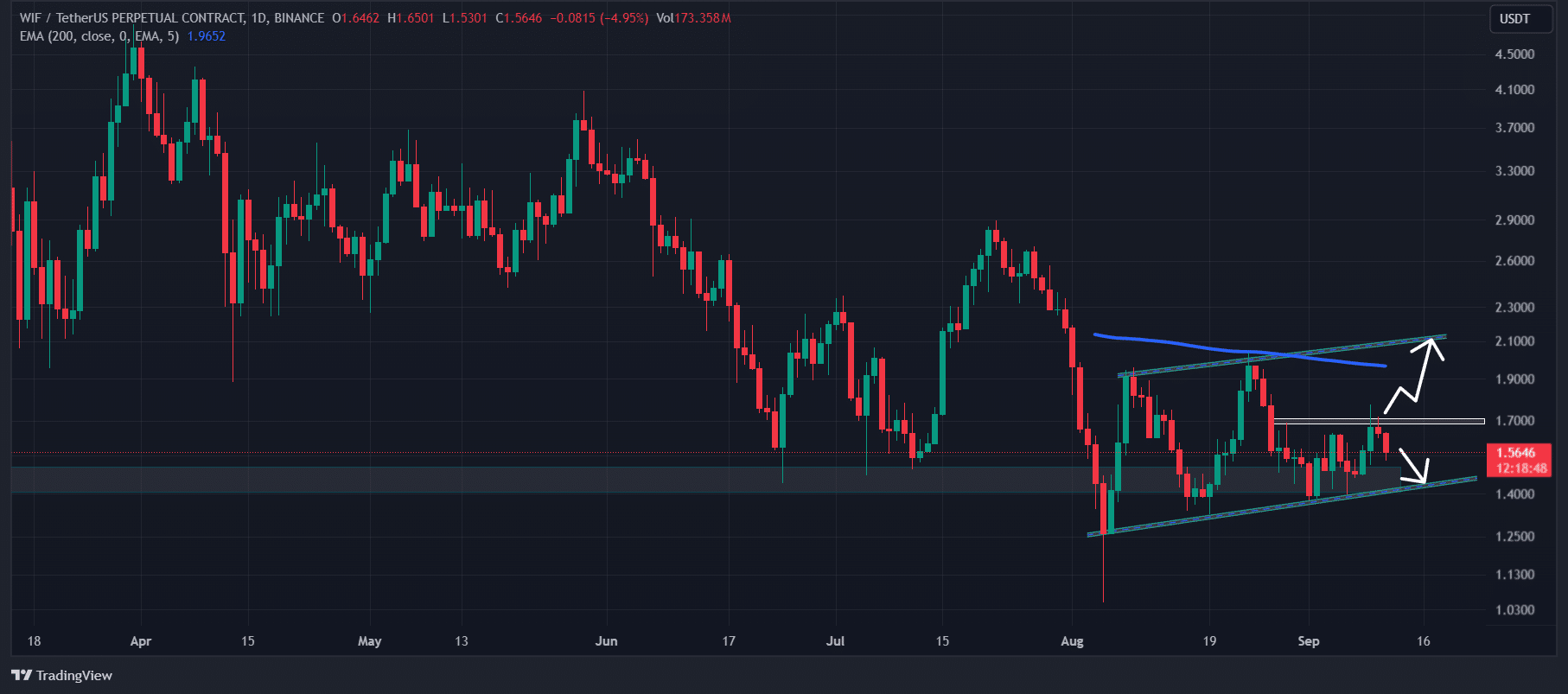

Currently, at this moment, the WIF was found close to the $1.54 mark, with a decrease of more than 8% in its value over the past day.

During the same timeframe, the trading volume decreased by 40%, suggesting that fewer traders are actively participating due to the recent drop in prices.

On a daily basis, WIF dipped beneath its 200-day Exponential Moving Average (EMA). Moreover, it followed an upwardly sloping channel trend, with WIF appearing to approach the lower limit of this channel pattern.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

As a crypto investor, I’ve noticed that the historical trend of WIF suggests a potential 10% decrease in its value, which might bring it down to around $1.43.

As long as the WIF stays under the $1.70 mark, a pessimistic view remains valid. However, if it surpasses this level, this bearish outlook could be called into question.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-12 00:40