- ENA has formed a head and shoulders pattern on its price chart, highlighting increased selling activity.

- An upcoming ENA token unlock is expected to amplify this pressure, potentially driving the asset’s value even lower.

As a seasoned analyst with more than a decade of experience navigating the volatile crypto market, I’ve seen my fair share of bull runs and bear markets. The current state of Ethena [ENA] has me raising an eyebrow due to the clear signs of a potential downturn.

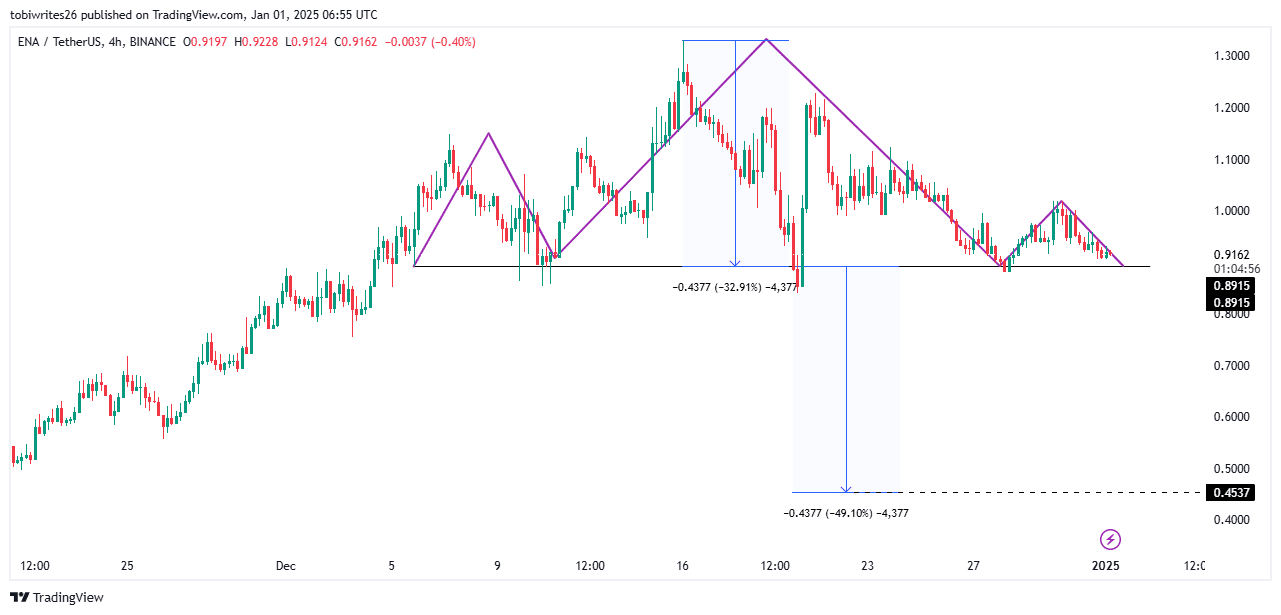

The formation of the head and shoulders pattern on the 4-hour chart is reminiscent of similar patterns I’ve witnessed in the past, which have often preceded significant price declines. Given the current market structure and bearish trends, it seems ENA could be gearing up for another bearish phase.

The upcoming token unlock scheduled for January 1st, adding 12 million tokens to the circulating supply, further amplifies my concerns. This additional supply, combined with the prevailing bearish sentiment, could accelerate a price decline if there is insufficient demand to stabilize the market.

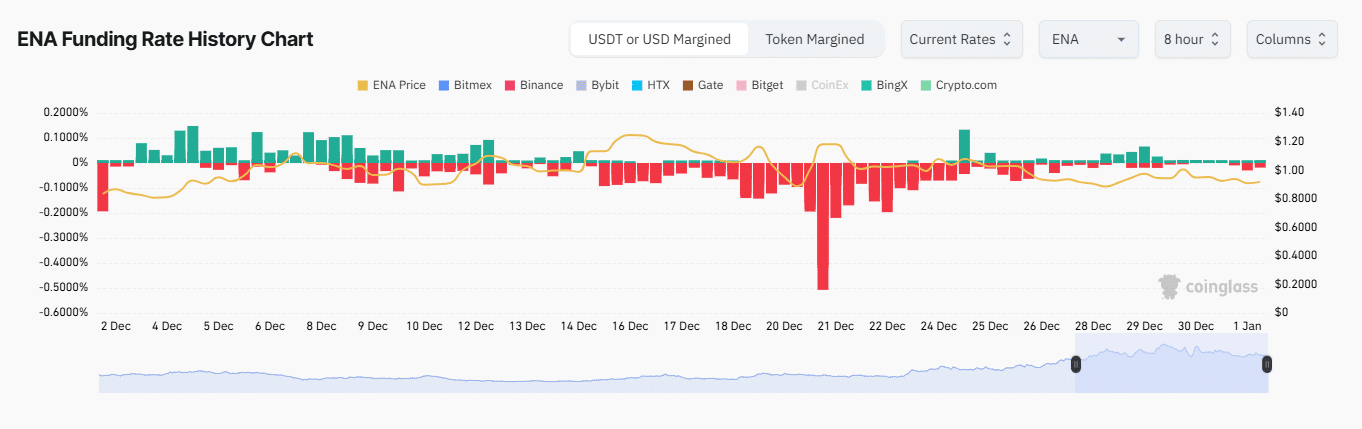

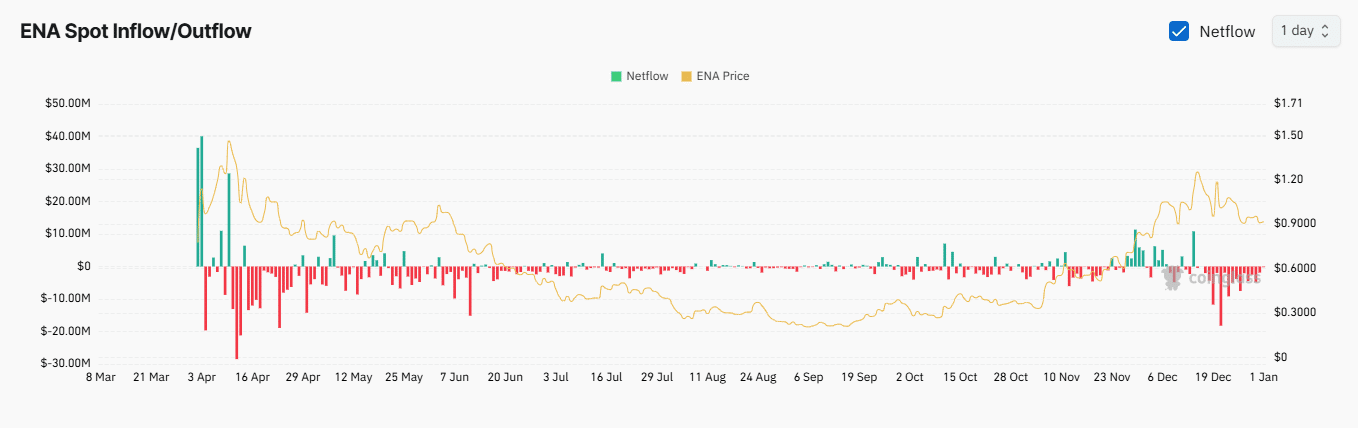

Moreover, the high selling pressure in the derivative market, as indicated by the negative Funding Rate and decreasing Open Interest, suggests that traders are intensifying their short positions. The continued reduction in outward token flows, as evidenced by the Exchange NetFlow data, also points to a potential oversupply of ENA tokens on exchanges, adding further selling pressure.

While I’m not one to make light of market conditions, sometimes humor can help alleviate the stress. So here goes: If you thought 2021 was the year of the bull, brace yourself for 2025 – it might just be the year of the bear for ENA!

Over the past seven days, Ethena (ENA) has seen a decrease of about 11.89% in its market worth. The decline continued over the last day as the token fell an additional 2.01%.

Based on the existing market setup and the ongoing negative market sentiment, it’s expected that ENA may experience additional drops, potentially reaching new record-low prices.

Head and shoulders pattern emerging on ENA chart

According to the 4-hour chart analysis, it seems that ENA might be shaping up into a head and shoulders formation, which typically indicates a bearish trend in technical analysis. This pattern appears almost complete; we’re likely just waiting for one more candlestick before it gets officially confirmed.

If the pattern completes, ENA might move into another downward trend. Dropping beneath the resistance level, often called the neckline, is likely to initiate a substantial decrease in its value.

The graph suggests a potential decrease in ENA’s value to approximately $0.454, which equates to a significant 49.10% drop from its present price of $0.92. If there isn’t enough support to counteract the selling pressure at this point, the token may experience even more substantial losses.

The market’s behavior continues to support a pessimistic perspective, as traders are increasingly strengthening the downward trend by increasing their selling actions.

Selling pressure intensifies in the derivative market

In simpler terms, the derivative market was under heavy selling force, as sellers were heavily outnumbering buyers during trades.

As of press time, the Funding Rate stood at -0.0019%, firmly in negative territory.

Having navigated through various market cycles in my trading journey, I can attest that a negative Funding Rate is a clear indication of a bearish sentiment among short traders. This means they are paying a premium to keep their positions open, essentially betting against the market. From my experience, such a scenario often unfolds during periods when the overall market outlook is gloomy and investors are cautious about taking on new long positions. It’s crucial for traders like myself to closely monitor these trends as they can provide valuable insights into the market’s direction.

If the Funding Rate continues to decrease, it’s possible that ENA’s price may experience increased downward pressure, possibly dropping to around $4.5, as suggested by the chart.

The amount of active positions on ENA’s Open Interest has lessened by 2.43%, now standing at $558.53 million over the past day. This decrease suggests that traders are closing their deals under the influence of increasing selling pressure, indicating a reduction in the number of open positions in the market.

This kind of action is frequently displayed when someone is trying to prevent bankruptcy and minimize additional losses, a significant indicator of waning trust in the market conditions.

The reduction in the number of ENA tokens being withdrawn from exchanges, as observed over the last four days, aligns with a bearish perspective.

As fewer ENA tokens move out of exchanges, the supply within them increases, leading to a surplus. This excess can contribute to increased selling pressure, potentially causing the asset’s price to drop even more.

ENA supply set to increase

As per Layergg’s announcement, a total of 12 million ENA tokens will become available for trading in the market starting from the 1st of January. This event is expected to boost the overall number of ENA tokens in circulation.

Read Ethena’s [ENA] Price Prediction 2025–2026

If extra stock is added to the market alongside negative investor feelings, it might lead to a faster drop in prices if the demand isn’t high enough to balance things out.

This scenario appears increasingly likely for ENA, given current market conditions.

Read More

2025-01-02 03:04