- Ethereum’s price inching closer to $4k as key indicators hint at a potential breakthrough.

- Market sentiments are bullish as Ethereum’s long positions outweigh short positions.

As an experienced analyst, I find Ethereum’s [ETH] current price action quite intriguing. The persistent inching closer to the $4k mark, combined with key technical indicators hinting at a potential breakthrough, is a bullish sign for the cryptocurrency.

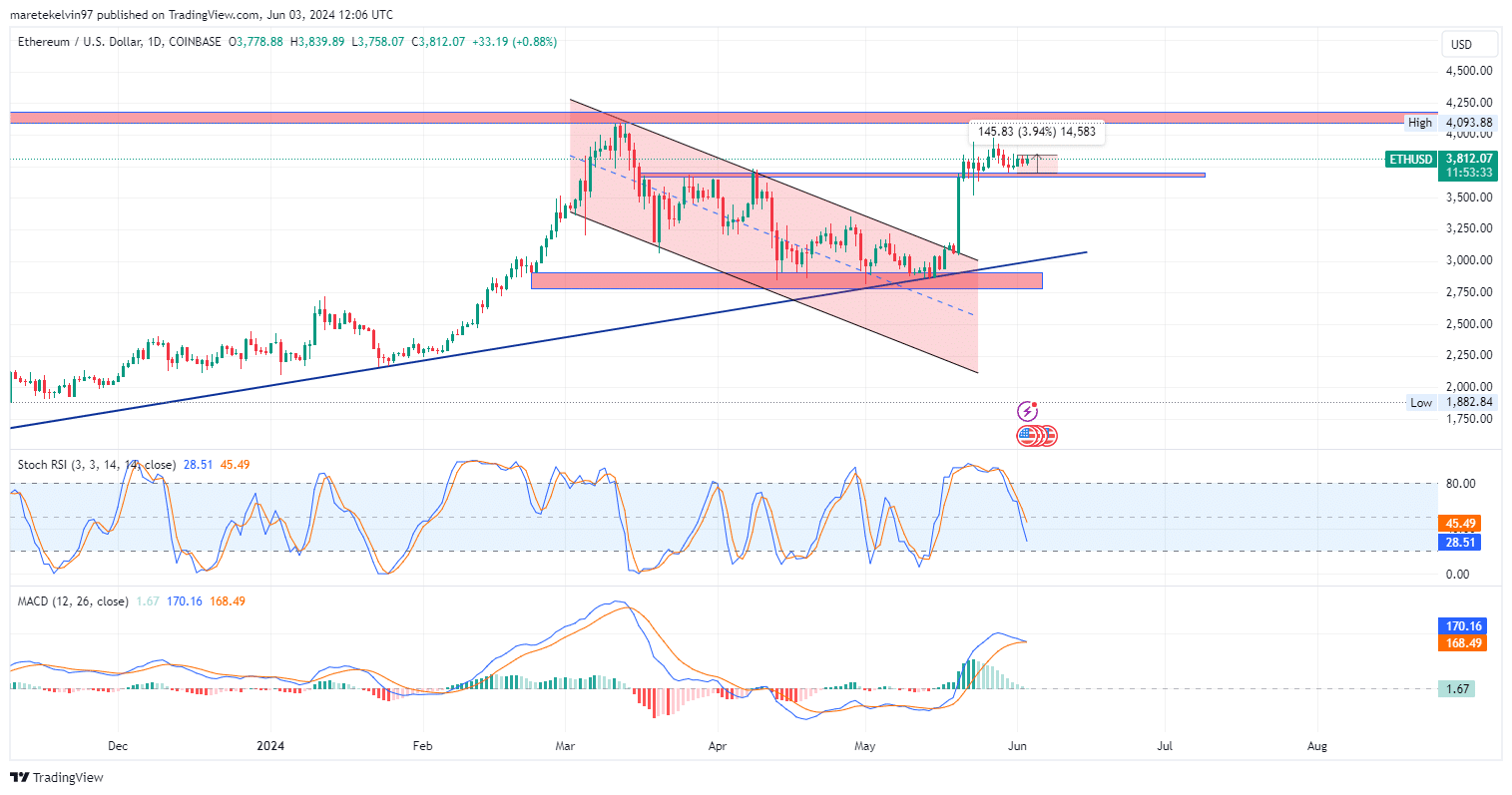

As a researcher studying the Ethereum [ETH] market, I’ve observed that after escaping the confines of the bullish flag, the price encountered resistance at the $3.7 mark on three separate occasions. However, following the 21st of May, this resistance level transformed into a support level.

As a crypto investor, I can tell you that the bullish sentiment has not quite gained the necessary traction to propel Ethereum’s price above its all-time high of $4,000. However, we are beginning to see a clear view of our objective on the horizon.

As an analyst, I’ve observed a significant surge in Ethereum’s price action over the past three days. Starting from $3.7k, the price has gained momentum and propelled itself to the current level of $3.8k, translating to a 3.94% price increase. If this bullish trend persists, it’s plausible that Ethereum will challenge its all-time high at $4k.

Whales spikes or social likes steering Ethereum?

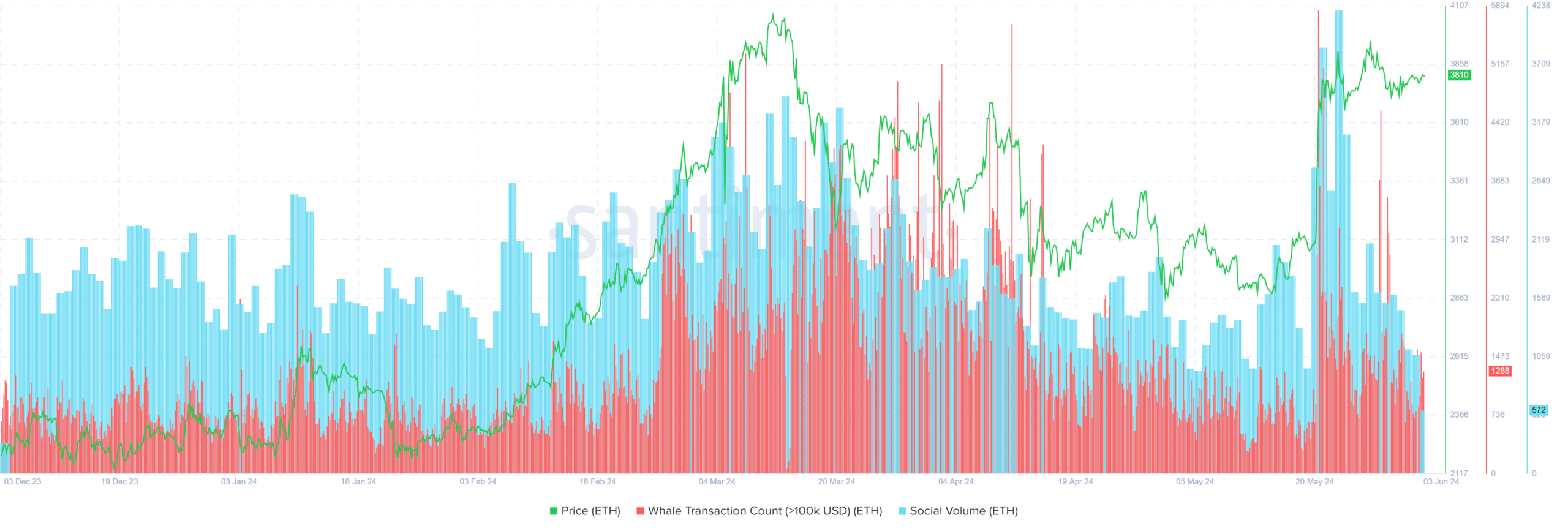

AMBCrypto analyzed the Santiment social volume and whale transaction chart.

The chart showing whale transactions revealed a rise in the number of large investors, leading to recent price surges. This influx of big players signaled a bullish market trend.

As an analyst, I’ve observed a significant correlation between heightened social media chatter and price fluctuations in the market. This suggests that growing interest and conversation on these platforms could potentially trigger further price surges.

According to AMBCrypto’s analysis, there has been a significant rise in the number of long Ethereum positions relative to short ones. This implies that traders have become more optimistic about Ethereum’s price trend and are therefore buying more than they are selling, fueling a bullish sentiment towards ETH.

Based on the reading of 45.59 on Ethereum’s stochastic relative strength indicator, it signaled that the cryptocurrency was neither showing extreme buying nor selling conditions. In simpler terms, Ethereum’s price wasn’t significantly overbought or oversold at this moment.

Is your portfolio green? Check the Ethereum Profit Calculator

In plain terms, taking a neutral stance could mean the price might rise or fall significantly. The MACD histograms suggest an uptrend as the MACD line lies above the signal line, signaling a bullish market condition.

The MACD value of 1.67 further supports the upward momentum.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-04 10:15