-

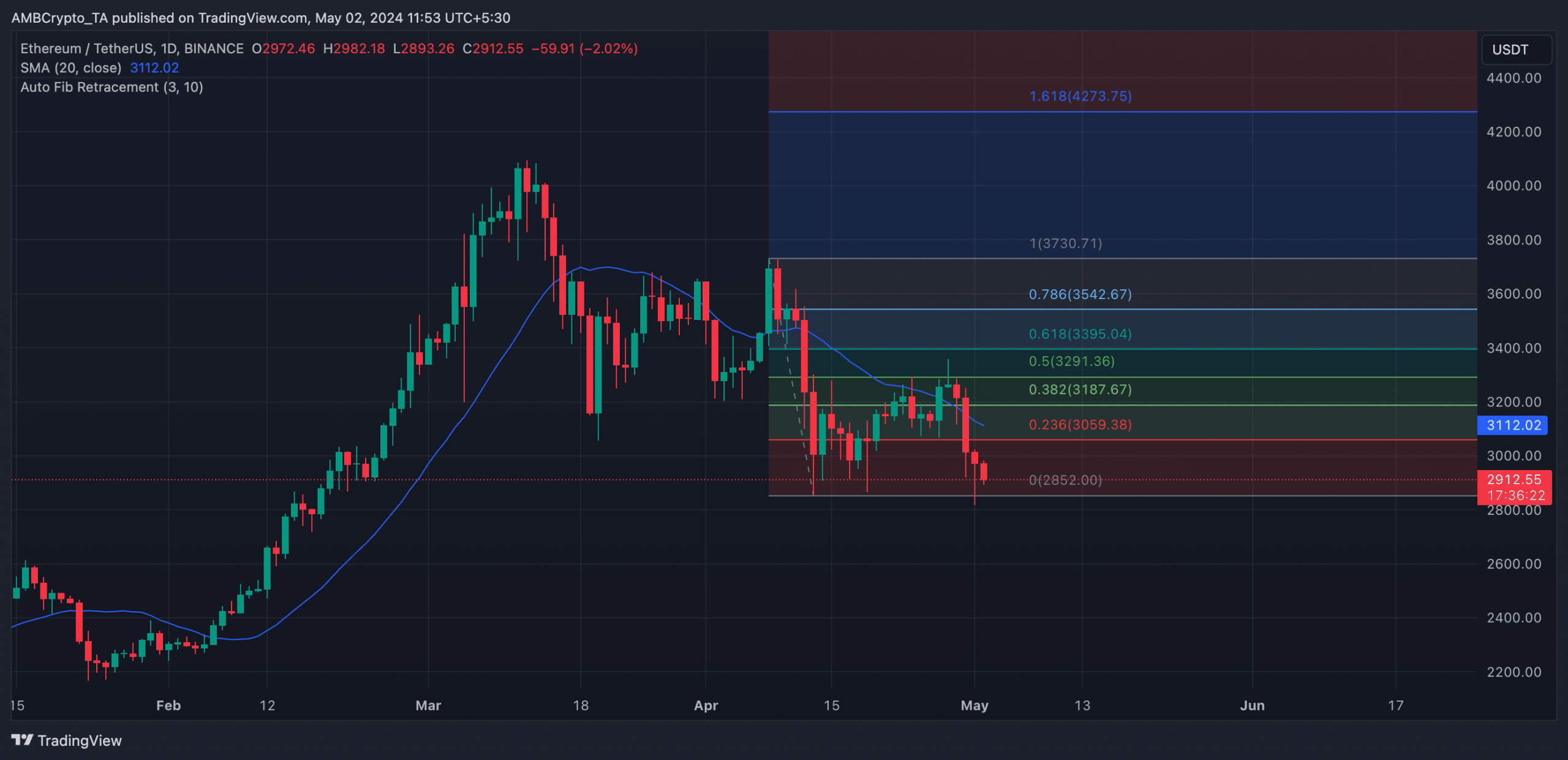

ETH briefly broke support and traded at a low of $2852 on the 1st of May.

Its Futures Open Interest declined considerably since the 10th of April.

As an experienced financial analyst, I believe that Ethereum’s [ETH] recent price action is a clear sign of bearish sentiment in the market. The fact that ETH briefly broke below its 20-day simple moving average (SMA) and closed at a low of $2852 on May 1st is a significant development.

Recently, Ethereum [ETH] has dropped beneath its 20-day moving average (M Average), signaling potential for a possible downward trend in the near future.

As a market analyst, I would interpret a situation where an asset’s price drops below its 20-day Simple Moving Average (SMA) as a sign that the asset’s short-term price trend has turned bearish.

As an analyst, I would interpret this observation as follows: When market players notice such a trend, they typically assume that sellers hold the upper hand and that the value of the asset is expected to keep decreasing.

On the 1-day chart for Ethereum’s price movements with ETH, it was observed that the coin dipped beneath its 20-day Simple Moving Average (SMA) on the 30th of April.

During heavy selling of coins, Ethereum dropped below its support level and ended its trading on May 1st at a low of $2850.

Bulls are nowhere to be found

Despite dropping to $2,913 in value during the previous 24-hour period when this statement was made, the bullish force isn’t strong enough yet to spark a substantial price increase in the near future.

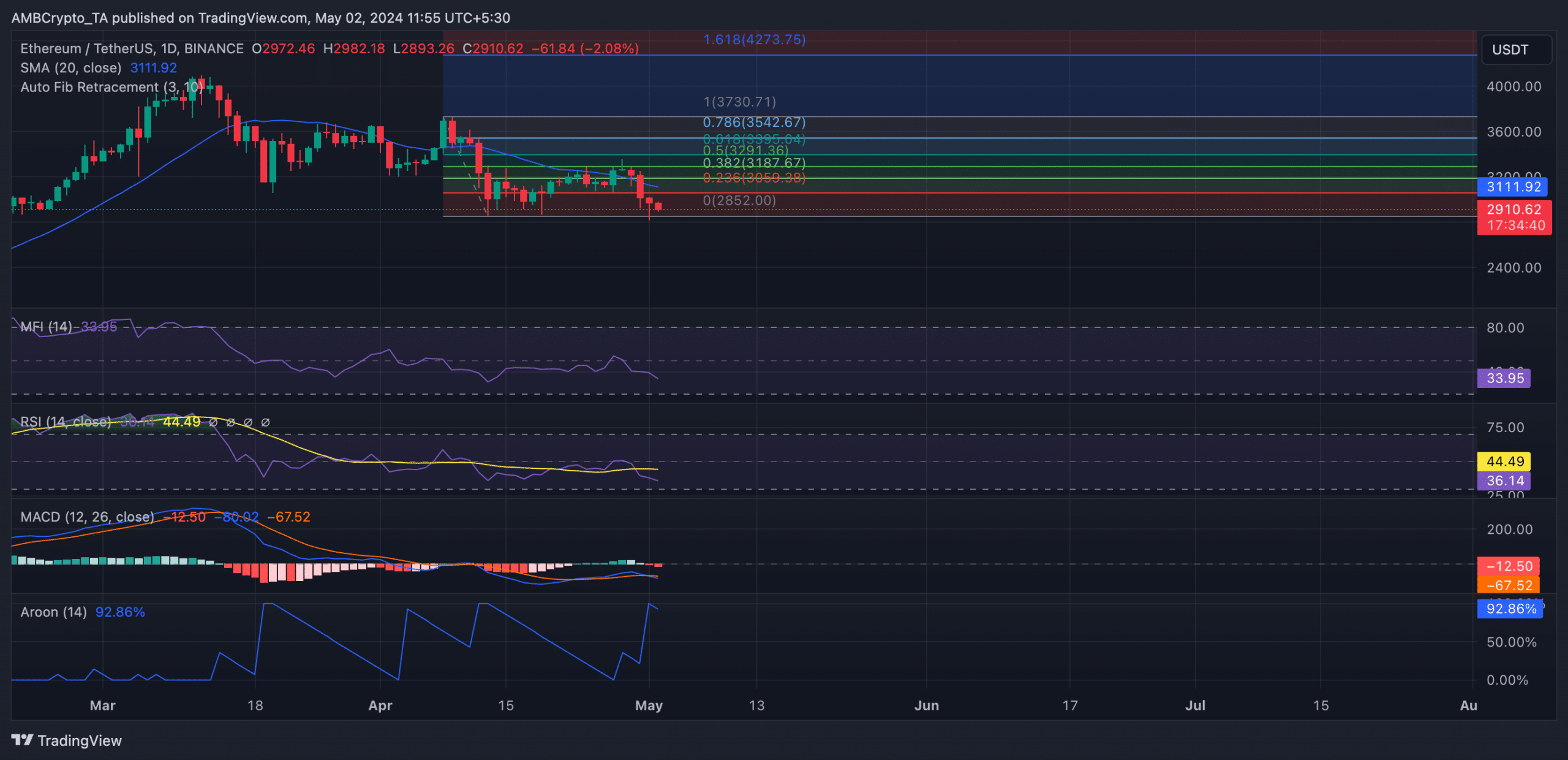

As a crypto investor, I’d rephrase it like this: Based on my analysis using AMBCrypto’s data, on May 1st, Ethereum’s Moving Average Convergence Divergence (MACD) line intersected its signal line while the coin was in a downtrend. Specifically, ETH broke below its support level at that time.

As a crypto investor, I’d interpret this occurrence as follows: When both moving averages dipped below the zero line, it was a clear bearish signal for Ethereum (ETH). This event not only reinforced the ongoing downtrend but also hinted at the potential for even lower ETH prices in the near future.

Affirming the market downturn’s robustness, Ethereum’s Aroon Down Line stood at 92.86% as reported currently.

this metric determines the robustness of an asset’s price trend and signals possible turning points for price reversals.

When the Aroon Down line approaches 100, this signifies a robust downward trend, suggesting that the latest low was reached not too long ago.

As a crypto investor, I’ve noticed some concerning signs regarding Ethereum (ETH). The altcoin’s demand seems to be weakening based on several key momentum indicators. For instance, its Relative Strength Index (RSI) stood at 36.46, which is considered oversold territory. Similarly, the Money Flow Index (MFI) was reported at 33.96, suggesting a strong selling pressure in the market.

Market participants demonstrated a preference for distributing Ethereum (ETH) rather than amassing new coins based on the data from these indicators.

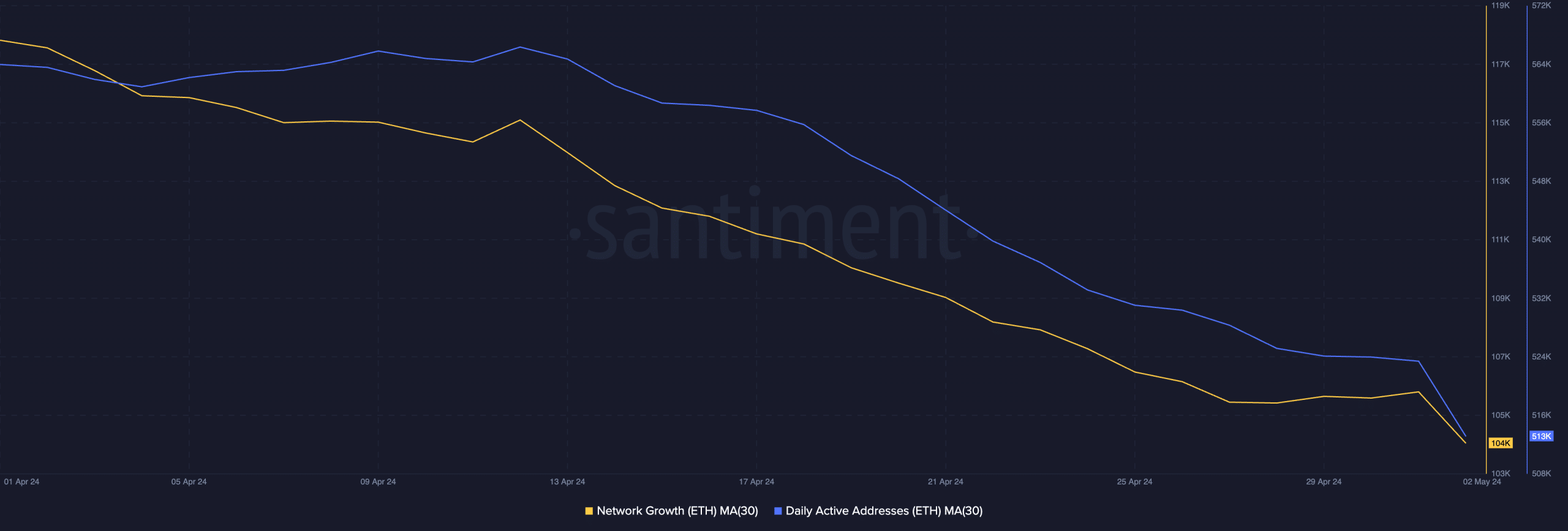

As a crypto investor, I’ve been closely monitoring Ethereum’s (ETH) network activity based on AMBCrypto’s analysis using a 30-day moving average. The data shows that there has been a noticeable decrease in demand for ETH over the past month.

Read Ethereum’s [ETH] Price Prediction 2024-25

Based on Santiment’s data analysis, there has been a 7% decrease in the number of unique Ethereum (ETH) addresses engaging in any transaction over the past month.

In the previous month, there was a 10% decrease in the formation of new Ethereum addresses based on on-chain data.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

2024-05-03 03:35