Despite the recent dip in the cryptocurrency market that hints at potential price consolidation or further decline in September, Ethereum [ETH] continues to hold its ground as a major player

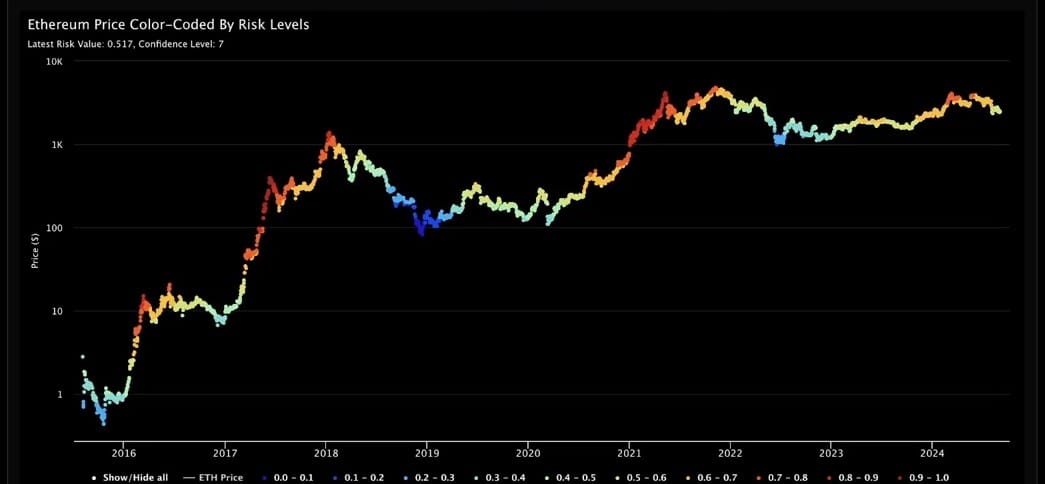

As per Benjamin Cowen, a recognized technical analyst, the risk profile of Ethereum seems to resemble patterns observed in 2016 and 2019

In retrospect, the Ethereum price readings back in those days were identical to what they are today for me – exactly 0.5. Remarkably, during that period, I observed an initial slight uptick followed by a downturn that ultimately paved the way for a bull run in the value of Ethereum

That’s quite an intriguing and challenging reading, doesn’t seem to be poised for a similar move this year, leading to a potential bull in the fourth quarter of 2017

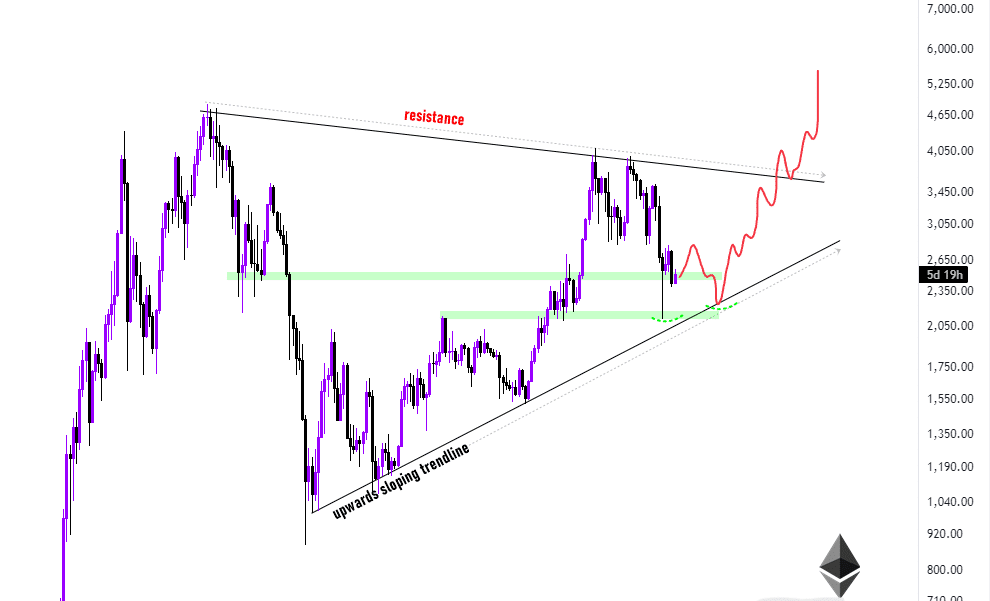

ETH trades in massive triangle

This is an interesting play on the use of cryptocurrency investing in a triangular pattern on a massive triangle-shaped P.D. cloud, in the cloud, there’s in the same on the weekly timeframe

In the years 2016 and 2019, following a short-term price rise, Ethereum experienced a period of stability before escalating into a thriving bull market

The use of the Ethereum, in the second phase of the second phase of the pattern-setting is a weekly candiscovery, if you will find yourself at the end of this pattern, there’s no way to enter the second stage of the second phase of this pattern

This line, from E-Tag (or Ethernet is a type of Ethernet (E-E20 near the cloud, it could be in the cloud, it could signal the beginning of a price surging trendline support

On the weekly chart, the randomized Relative Strength Index (RSI) indicates oversold conditions, hinting that although the price might decrease temporarily, a potential turnaround could be just around the corner

If the upward line indicating a trend in Ethereum’s price breaks and heads downward, it could be prudent to minimize losses and hold off on investing for the long term until a more favorable opportunity arises

In simpler terms, some investors who focus on quick profits may think about selling ETH short following a break of its support level. However, this move goes against the overall optimistic view towards Ethereum’s long-term growth

Fear and greed index

A closer examination reveals that the Fear and Greed Index stands at 32 now, as Ethereum trades at approximately $2,424. Earlier in August, there was intense fear, but this current index suggests a rising level of confidence or optimism among investors

As a crypto investor, I’ve learned that markets frequently correct themselves when the Fear and Greed Index reaches extremes. This indicates to me that the Ethereum (ETH) price might find some stability close to its current level while we wait for the overall market to find balance

The risk indicator’s alignment with past trends strengthens the likelihood that Ethereum might take a course similar to its path in 2016 and 2019

Ethervista mania

The debut of Ethervista, similar to Solana’s Pump.Fun-like counterpart equivalent, Ethervista, resembling Pump.Fun-like Solana’s’s its success, a shrewrote in the Ethere to Solana pseudonym “John Doe,” it is evidentlystered out his real identity

Through acquiring more than 5% of the token’s total amount and dispersing it amongst various digital wallets, the trader successfully earned a profit exceeding 130 times that amount, converting it all into Ethereum (ETH)

As a researcher, I am uncertain whether Ethervista will yield similar effects on Ethereum’s pricing dynamics as Pump.Fun did for Solana. While there seems to be an uptick in trading volume and network activity with both platforms, it remains questionable whether these factors will translate into price growth for Ethereum, given the unique characteristics of each blockchain

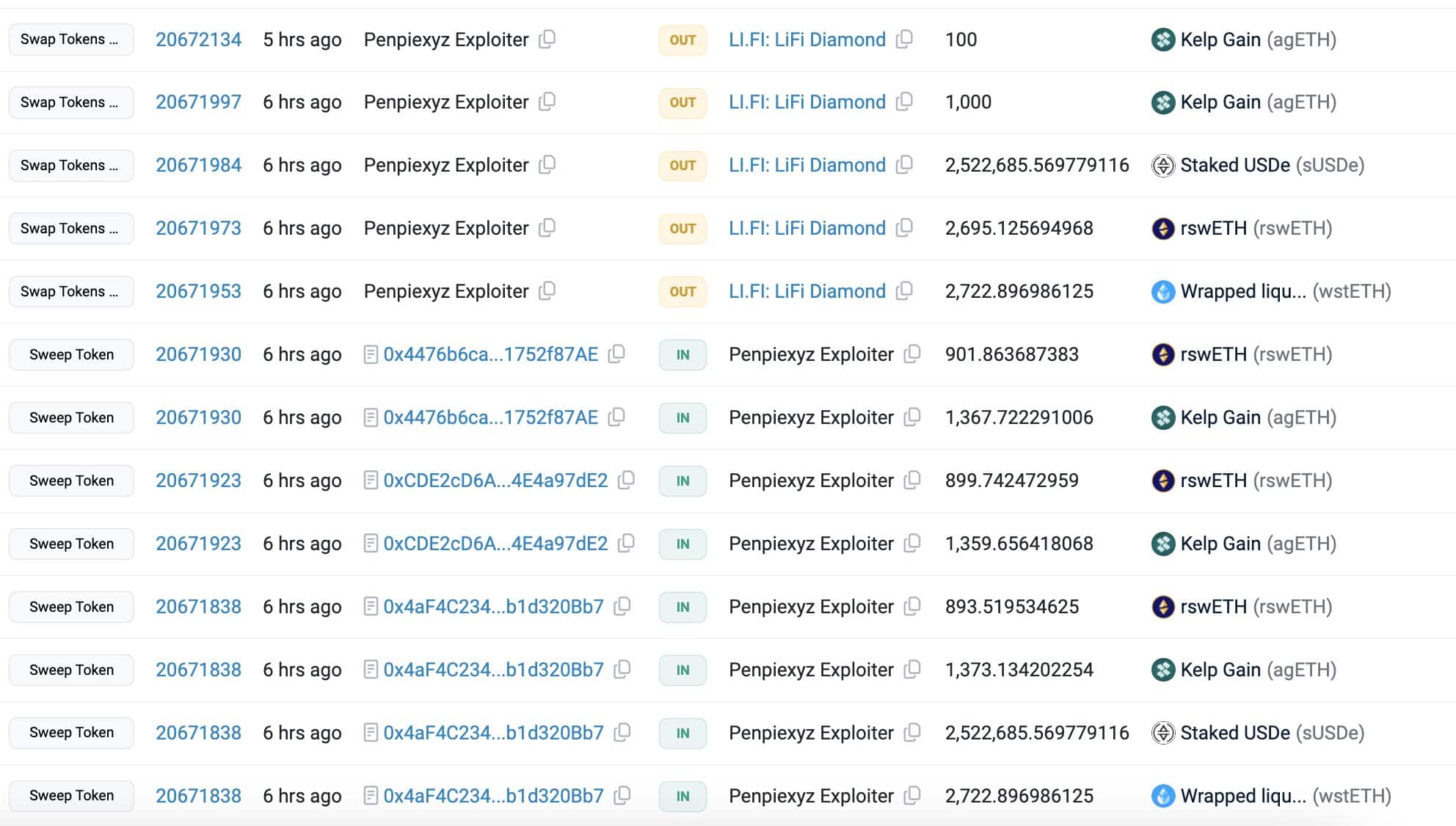

Penpie losses $27M ETH to hacking

In a change of topic, it’s unfortunate to report that Penpie has incurred a substantial financial setback amounting to approximately $27.3 million. This loss encompasses several types of Ethereum tokens, including rswETH, agETH, and wstETH, according to Lookonchain’s data

Read Ethereum’s [ETH] Price Prediction 2024–2025

The hacker converted the assets into 11,109 ETH and deposited 1,000 ETH into Tornado Cash.

The security issue introduces an extra degree of intricacy into the forecast for Ethereum’s market, as it faces both technical hurdles and economic fluctuations

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-09-05 03:04