-

ETH mining wallets showed declining supply since early 2024.

Technical indicators and on-chain data signaled cautious optimism around the altcoin.

As a seasoned researcher with years of experience in the cryptocurrency market, I find myself intrigued by the current state of Ethereum (ETH). The declining supply within mining wallets since early 2024, coupled with technical indicators and on-chain data that signal cautious optimism around the altcoin, paints a compelling picture.

Ethereum [ETH] has been resilient amid increased volatility within the market.

The second-biggest cryptocurrency, as measured by market value, caused curiosity among investors and analysts with a slight jump.

In the first half of 2024, there was a simultaneous increase in demand accompanied by a slow reduction in the amount of cryptocurrency stored in mining wallets.

One of the key on-chain indicators shaping market sentiment is the supply of mining wallets within Ethereum, which often takes a significant role in this area.

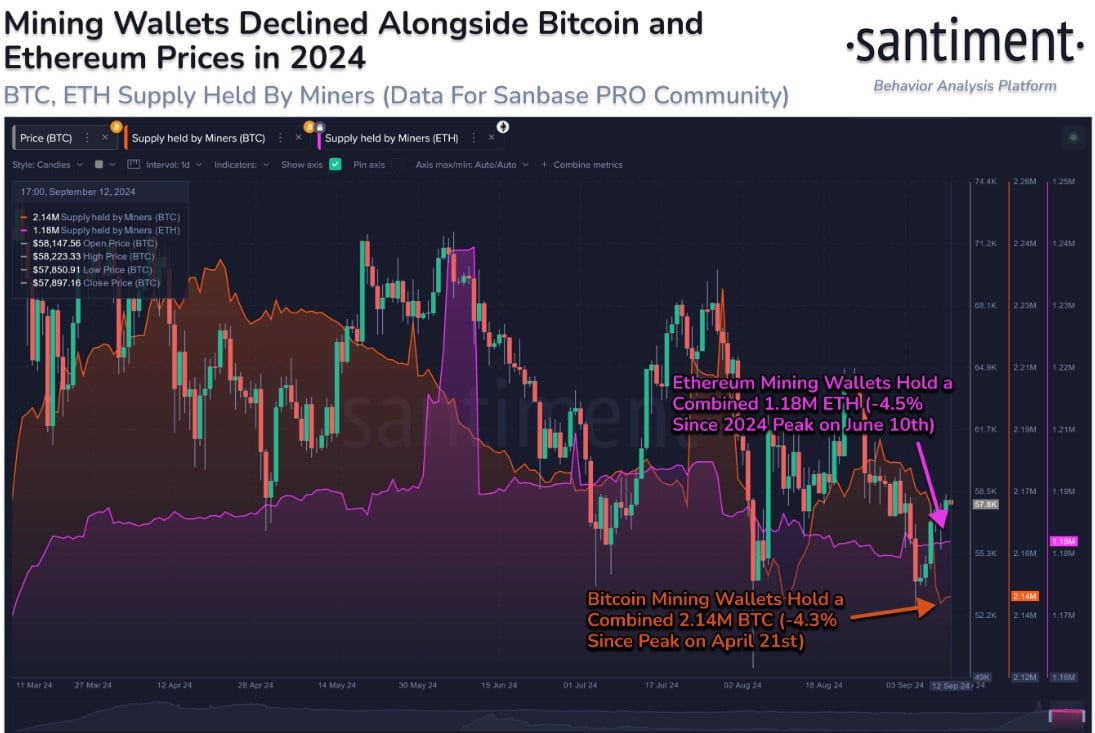

Based on a tweet from Santiment, it appears that about 4.5% of Ethereum’s total reserves held in mining wallets has decreased since its highest point on June 10th. However, this trend could potentially reverse given the recent surge in ETH prices.

Ethereum: Cautious optimism

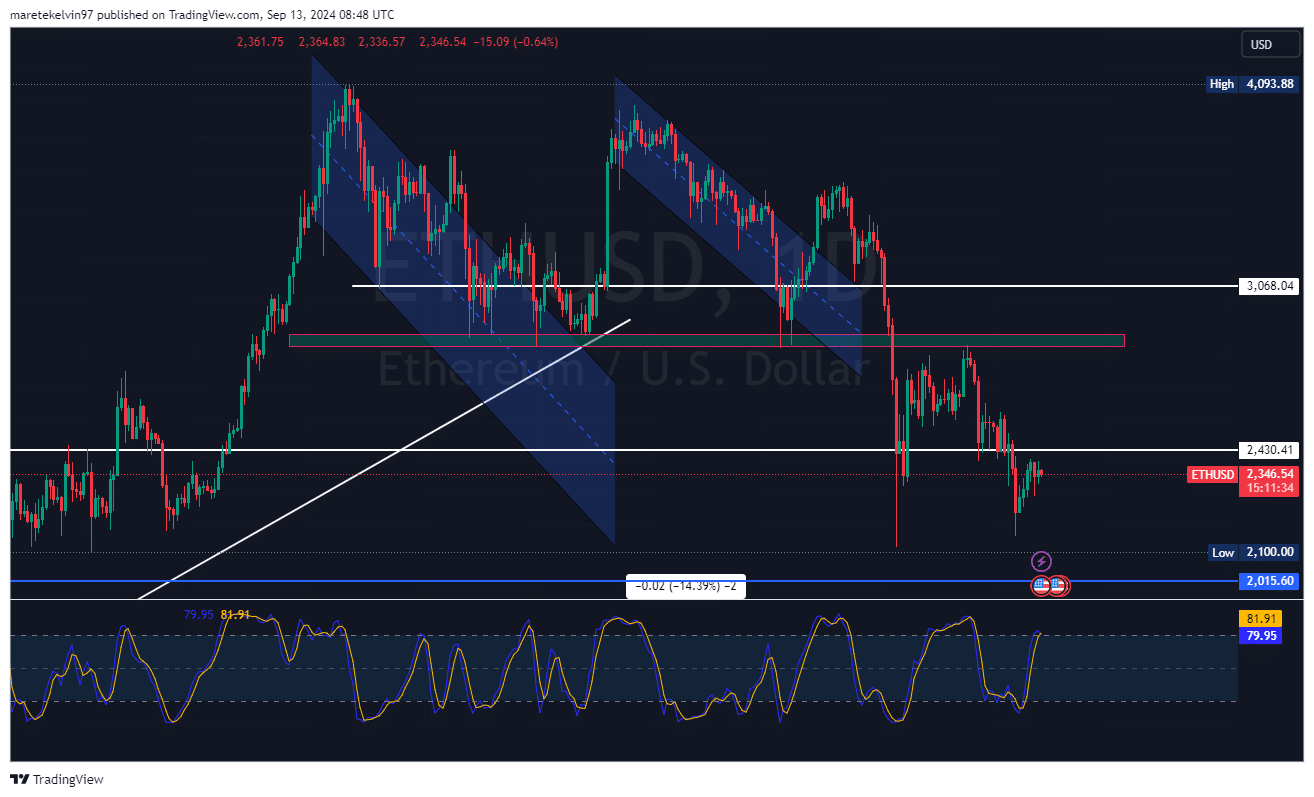

On Ethereum’s graph, there have been repeated instances of lower peaks followed by lower troughs, which suggests a downward trend. However, recent market behavior might signal a possible change in direction, potentially leading to an uptrend.

The stochastic RSI has given a bullish crossover, signaling a rising short-term momentum.

Mixed bag of signals

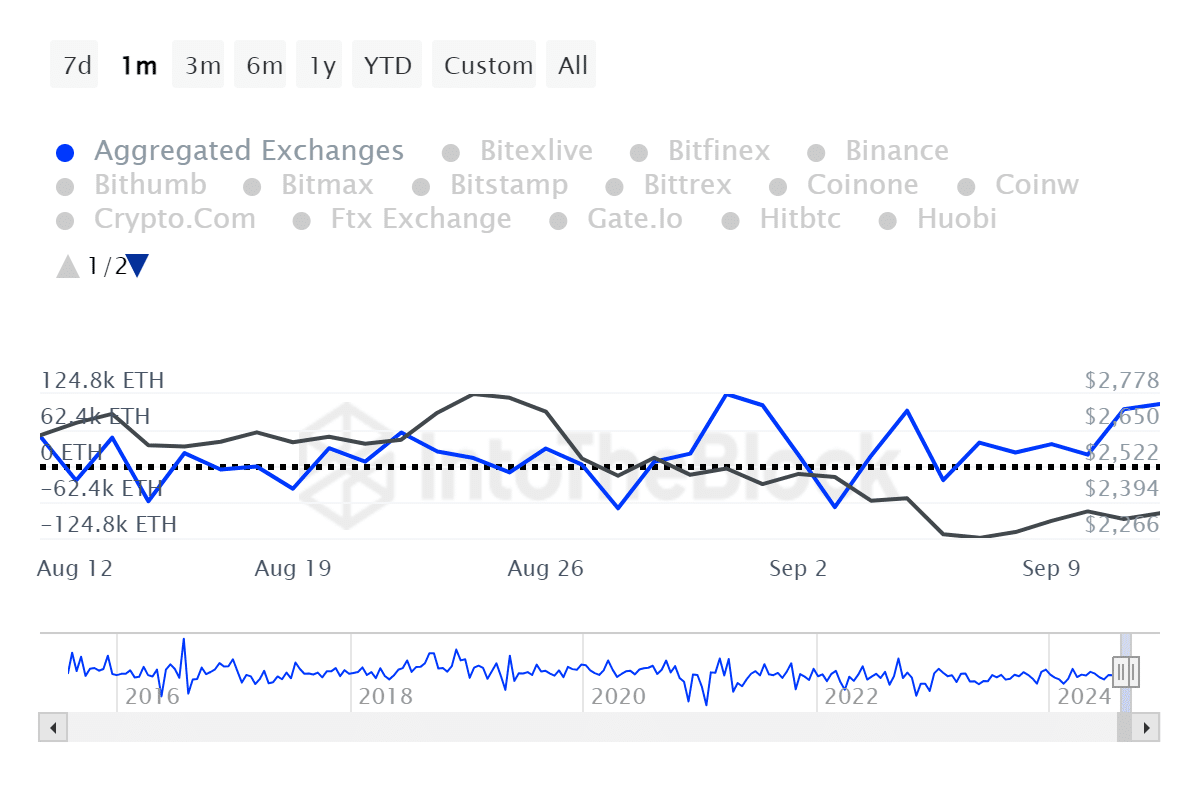

It’s worth noting that the overall amount of supply on these trading platforms has remained relatively consistent. Yet, we’ve observed recurring spikes in both deposits (inflows) and withdrawals (outflows).

The volatility in exchange activity simply underpins how uncertain the market is at this juncture.

A double-edged sword

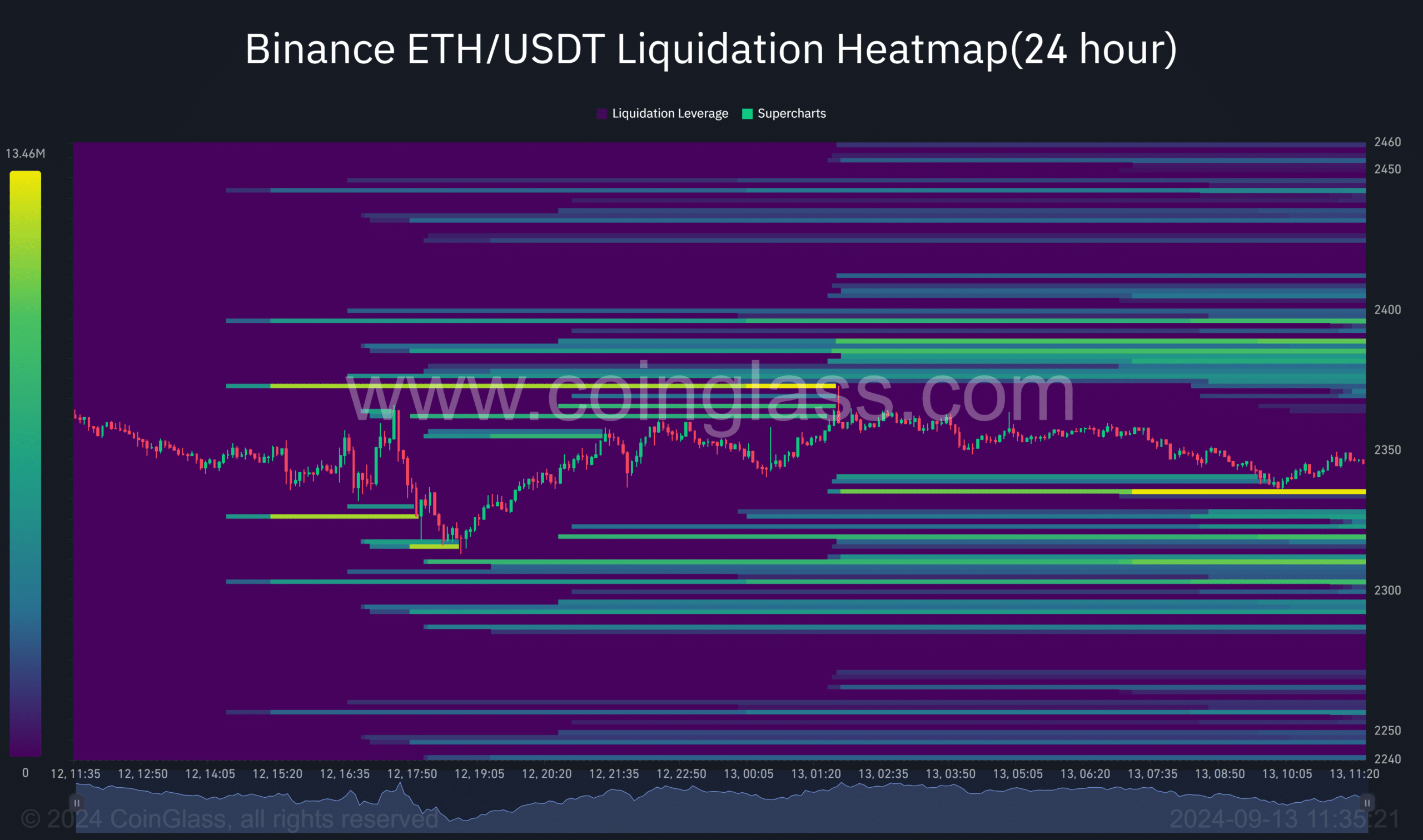

According to the liquidation data from Coinglass, there were significant amounts of liquidations taking place around the price ranges of $2,300 and $2,450.

This implies a positive tilt in the market, as there are substantial liquidation pools totaling over 32 million dollars’ worth of Ethereum. These large amounts could potentially attract price increases, acting like magnets.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Ethereum bull run on the horizon?

Essentially, even though the cryptocurrency market is going through turbulent periods, Ethereum continues to maintain its strength. A minor recovery observed recently might signal a larger upcoming shift.

Investors should pay close attention to decreasing numbers of mining wallets, as an uptick might signal the upcoming surge of the next cryptocurrency bull market.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-09-13 15:35