-

ETH has declined by 7.95% over the last 30 days.

Despite the unfavorable market conditions an analyst is eyeing 48% surge to $3,550.

As a seasoned analyst with over two decades of experience in both traditional and digital markets, I find myself constantly scanning the horizon for signs of market trends and shifts. When it comes to Ethereum [ETH], the current state of affairs has me intrigued, albeit cautiously so.

Although Bitcoin [BTC] has managed to climb above $60k, pushing past its previous highs, Ethereum [ETH], the second-largest digital currency by market value, has been facing a significant decline in value.

Currently, the price of Ethereum stands at approximately $2,410. However, over the past month, it has experienced a decrease of about 7.95%.

After reaching a peak at $2,820 in the local market, this cryptocurrency hasn’t been able to sustain its growth and has dropped down to a minimum of $2,150 instead.

Previously, ETH had been thriving following its peak at around $3,563 in July due to heightened interest in ETFs. However, since that time, the market has been experiencing a decline, leading to concerns about potential further losses.

Despite the ongoing challenging market situations, analysts maintain a positive outlook. Consequently, prominent crypto analyst CryptoWZRD foresees a potential rally based on Bitcoin’s recent breakthrough.

What market sentiment says

Based on CryptoWZRD’s evaluation, the state of the Bitcoin market plays a significant role. This assessment suggests that if Bitcoin gains momentum, Ethereum could potentially rise by approximately 48% to reach around $3,550.

Using this comparison, it’s clear that Ethereum’s price movement closely mirrors Bitcoin’s. If Bitcoin experiences a strong rise, we can expect Ethereum to bounce back and potentially reach its July levels again.

In the given scenario, it’s worth noting that Bitcoin’s fluctuations often impact the overall altcoin market. If Bitcoin experiences growth or strong performance, altcoins such as Ethereum usually follow suit. In contrast, when Bitcoin encounters a downturn, coins like Ethereum may also experience a decline.

Therefore, when BTC has favorable market conditions, Ethereum will follow.

What ETH charts suggest

Although CryptoWZRD’s assessment suggests an optimistic view, other signals hint at something contrasting. Consequently, it seems that Ethereum might experience additional drops given the prevailing market circumstances.

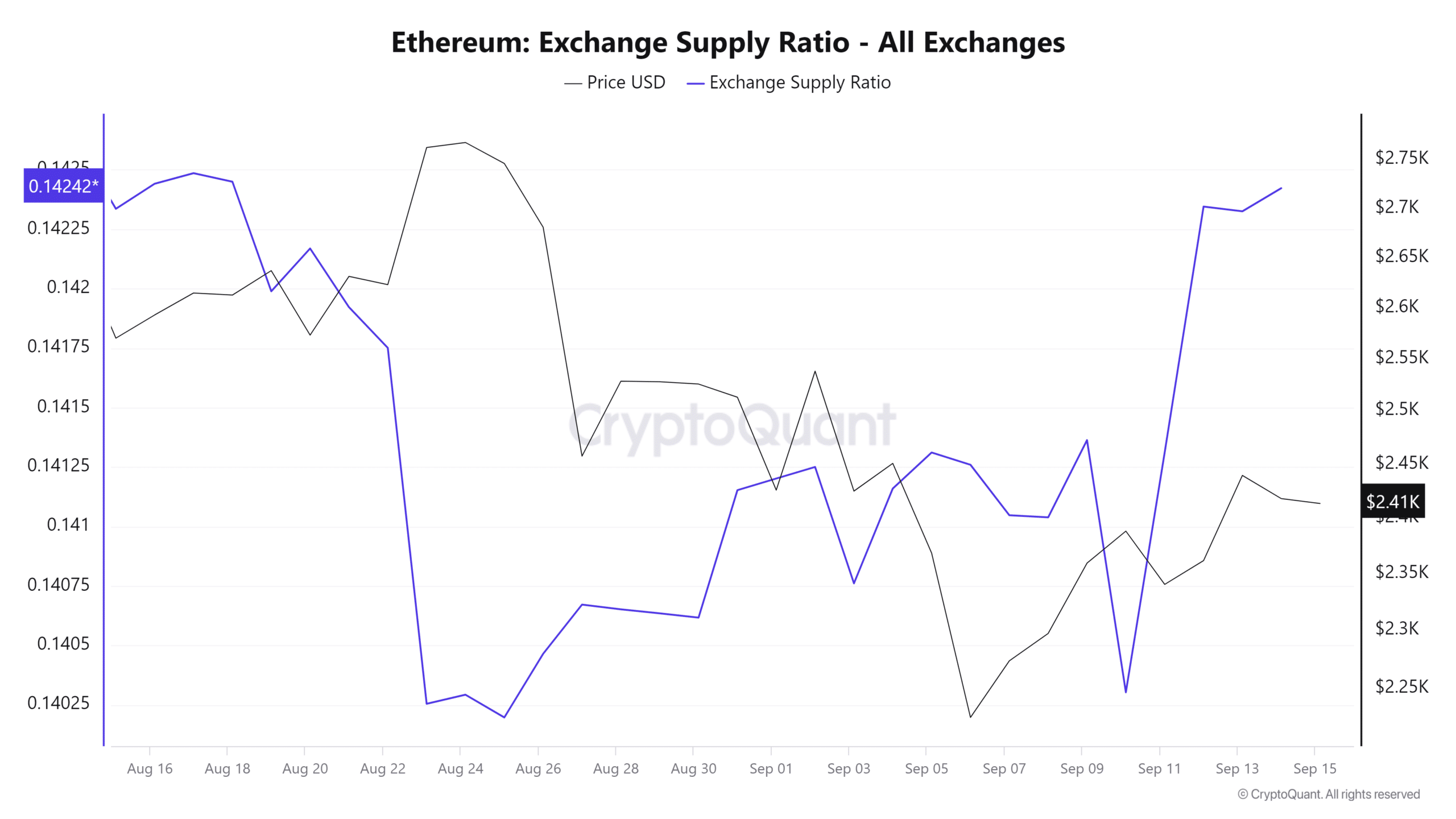

In simple terms, during the last month, there’s been more Ethereum going into exchanges (deposits) compared to being taken out (withdrawals), as indicated by a predominantly positive exchange net flow.

As a crypto investor, I’m currently sensing a bearish vibe since more and more people are transferring their assets into cryptocurrency exchanges, intending to sell due to anticipated further price decreases. A positive netflow indicates that there’s increased selling pressure on the horizon, which typically leads to a downward trend in prices.

Over the past five days, I’ve observed a significant surge in the exchange supply ratio. This trend indicates an influx of assets moving into exchanges, which could be a sign that market sentiment is turning bearish. It appears that investors might be gearing up to offload their holdings.

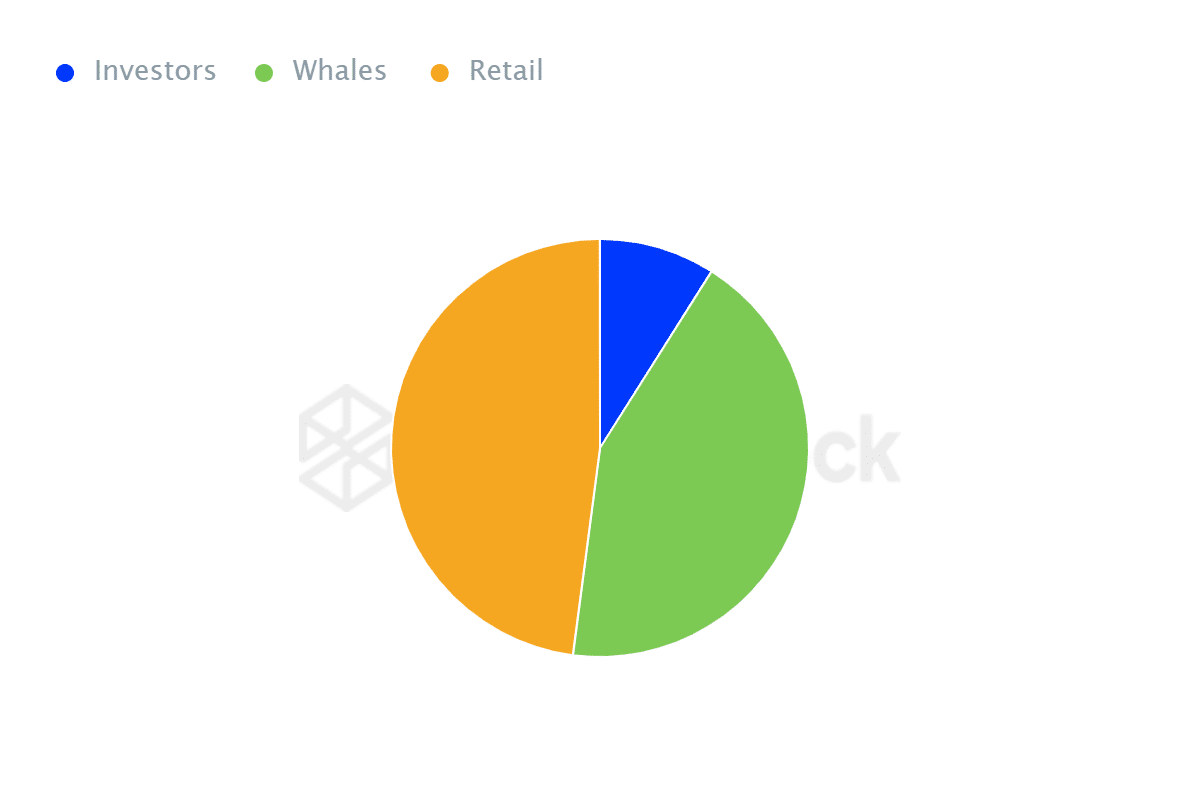

To summarize, a significant portion of Ethereum is owned by retail traders, accounting for approximately 47.93%, compared to whales and investors who collectively own about 43.10%. This information comes from IntoTheBlock’s analysis.

In simpler terms, when individual investors (retail traders) collectively own more shares than larger institutions like whales, the market becomes extremely unpredictable due to the emotional selling behavior of these individual traders. They tend to react swiftly to news and sell their stocks accordingly, unlike institutional investors or whales who make decisions based on long-term strategies.

Read Ethereum (ETH) Price Prediction 2024-25

Whales will hold even during downturns and accumulate anticipating further gains. While retail traders would sell to avoid more losses.

Given the present market trends, there seems to be a bearish outlook for Ethereum (ETH). If these conditions persist, the price of ETH could drop down to around $2224. Conversely, if ETH manages to break free from this trend, it might surge up to approximately $2527.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-16 01:12