-

At press time, ETH was caught in a 4-hour symmetrical triangle, showing no clear directional trend.

On-chain data suggested that a potential rally could be on the horizon.

As a seasoned analyst with years of experience in navigating the cryptocurrency market, I find myself intrigued by Ethereum’s [ETH] current position at press time. Reminiscent of a tightrope walker teetering precariously on a high wire, ETH is perched within a 4-hour symmetrical triangle, showing no clear directional trend.

The trading action for Ethereum (ETH) has been relatively quiet, with its price barely rising by approximately 2.45%, currently hovering near the $2,600 mark.

In a symmetrical triangle, it’s common for the price of an asset to exhibit this type of fluctuation. This pattern is identified by two converging diagonal lines, one ascending and the other descending, which enclose the price movements.

Historically, similar trading activities have frequently resulted in substantial changes in prices, whether they rise or fall.

Analyst forecast for ETH

In a recent tweet, crypto analyst Carl Runefelt highlighted that ETH was at a crossroads, facing a decision that could either trigger a drop to new lows.

It could potentially wipe out bullish momentum or propel ETH it to a new monthly high.

Runefelt posted a 4-hour chart detailing possible price milestones based on Ethereum’s future trajectory.

“Potential bullish target: $2,800

Potential bearish target: $2,350.”

At this crucial stage, it’s vital to find more places where things come together. With that goal in mind, AMBCrypto is delving deeper into examination.

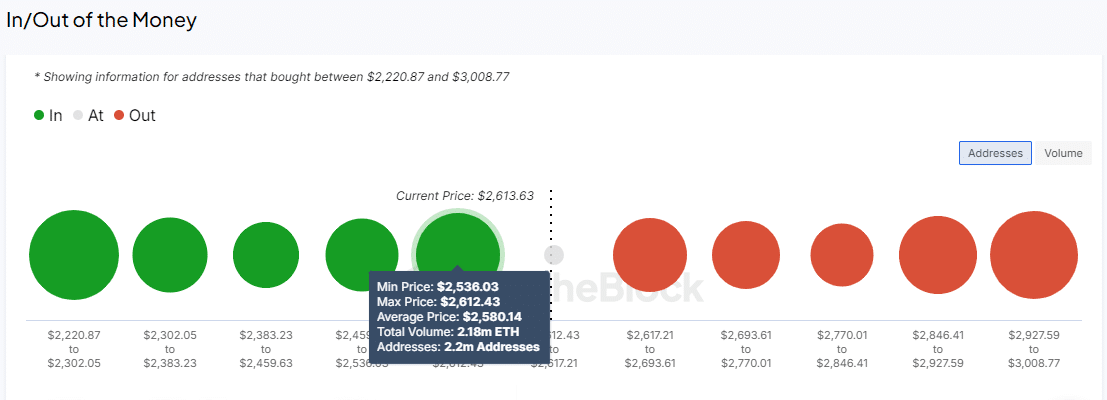

‘In the money’ traders can drive ETH higher

By employing the In-Out of Money Around Price (IOMAP) tool, AMBCrypto examined if traders with profitable positions (in-the-money) or those suffering losses (out-of-the-money) might impact the trajectory of Ethereum’s price movement.

As a seasoned trader with years of experience under my belt, I’ve learned that understanding the terms “in the money” and “out of the money” is crucial for success in financial markets. Being “in the money” signifies trades that are currently bringing profits, acting as a support zone for further gains. This has often been a lifesaver for me during market volatility, providing a sense of stability amidst chaos. Conversely, being “out of the money” means unprofitable trades serving as resistance to any potential growth, something I’ve learned to avoid at all costs. These terms have become my trusted compass in navigating the complex and dynamic world of trading, helping me make informed decisions and maximize profits.

As a researcher, I’ve observed an upturn in Ethereum (ETH) following its support at approximately $2,597.37. Interestingly, this recovery is backed by transactions involving more than 2.39 million unique addresses, collectively holding over $8 billion worth of ETH.

At this stage, it’s crucial as it could help push the price higher. Yet, we expect strong opposition from traders whose positions are out-of-the-money at approximately $2,677.33, $2,760.00, and $2,831.77.

Despite encountering obstacles at these resistance points, the current bullish trend in Ethereum (ETH) has been stronger than the selling pressure, indicating it might continue climbing towards or even surpass $2,800.

Buyers are interested in ETH

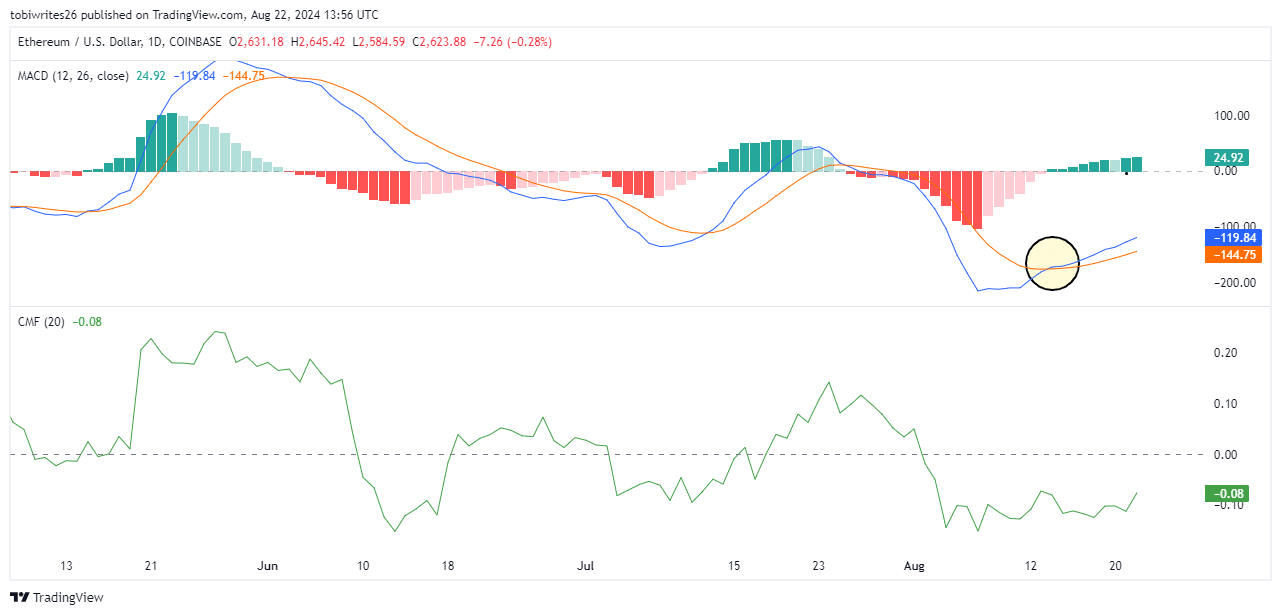

The momentum of Ethereum trading is on the rise, suggested by the Moving Average Convergence and Divergence (MACD) indicator.

As a seasoned cryptocurrency investor with years of experience under my belt, I can attest to the importance of using tools that help me understand market trends and make informed decisions. One such tool I find particularly useful is one that tracks the relationship between two moving averages of ETH‘s price. This tool has been instrumental in helping me spot changes in momentum and direction, which in turn helps me navigate the often volatile world of cryptocurrency trading. In my experience, being able to quickly identify shifts in market trends can mean the difference between a profitable trade and a loss, so I always keep this tool handy.

Lately, the Moving Average Convergence Divergence (MACD) has shown a positive crossover, implying that investors are increasingly buying stocks, potentially driving prices higher in the near future.

Furthermore, the growth of Ethereum is surging, as indicated by the MACD heading towards positive values. This implies a high probability that its price will keep climbing.

The Chaikin Money Flow (CMF) also supports this bullish outlook. It has been rising since the 18th of August, indicating that buying pressure was mounting.

If this trend persists, it could further propel ETH’s price higher to the $2,800 target.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PGA Tour 2K25 – Everything You Need to Know

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- `SNL’s Most Iconic SoCal Gang Reunites`

2024-08-23 12:08