- Ethereum’s price nears $4,000, influenced by optimism around newly approved ETFs.

- Market analysts suggest the potential for Ethereum to reach as high as $10,000 in the current cycle.

As an experienced crypto investor, I’ve witnessed firsthand the rollercoaster ride that comes with investing in digital assets. The recent developments around Ethereum have left me feeling both excited and cautious.

After the SEC’s approval of ETF proposals based on Ethereum (ETH), this leading altcoin has experienced a noticeable surge in value.

Kicking off the week with a robust performance, Ethereum experienced a noteworthy gain of approximately 3.7% over the past 24 hours. This uptick brought its price close to the significant milestone of $4,000 – a notable improvement compared to recent weeks.

At press time, Ethereum traded at $3,899, marking a significant rebound from earlier fluctuations.

Ethereum faces potential $4,500 target

During the recent fluctuations in Ethereum’s pricing, Arthur Cheong, the CEO of DeFiance Capital, proposed a theory that Ethereum could hit a price of $4,500 prior to the initiation of its spot ETF trades, which is predicted to occur around July or August.

As an analyst, I noticed similarities between the current market situation and the 2017 crypto boom. The approval of spot Ethereum ETFs could potentially bring in a large influx of retail investors.

Similar to Bitcoin [BTC], over 70% of the holdings are controlled by retail investors in its case as well.

The anticipation among investors and onlookers regarding Ethereum’s potential future success is evident and strong.

It’s important to keep in mind that these predictions are subject to change based on various influencing factors such as the economy and investor attitudes.

Additionally, the SEC’s existing regulatory framework indicates that initial 19b-4 applications for Ethereum ETFs have been given the go-ahead, but the crucial S-1 submissions are yet to be approved.

Ethereum’s bullish trends

In spite of the regulatory challenges, Ethereum’s market performance has demonstrated impressive expansion, evident not just in its price increase but also in essential on-chain indicators.

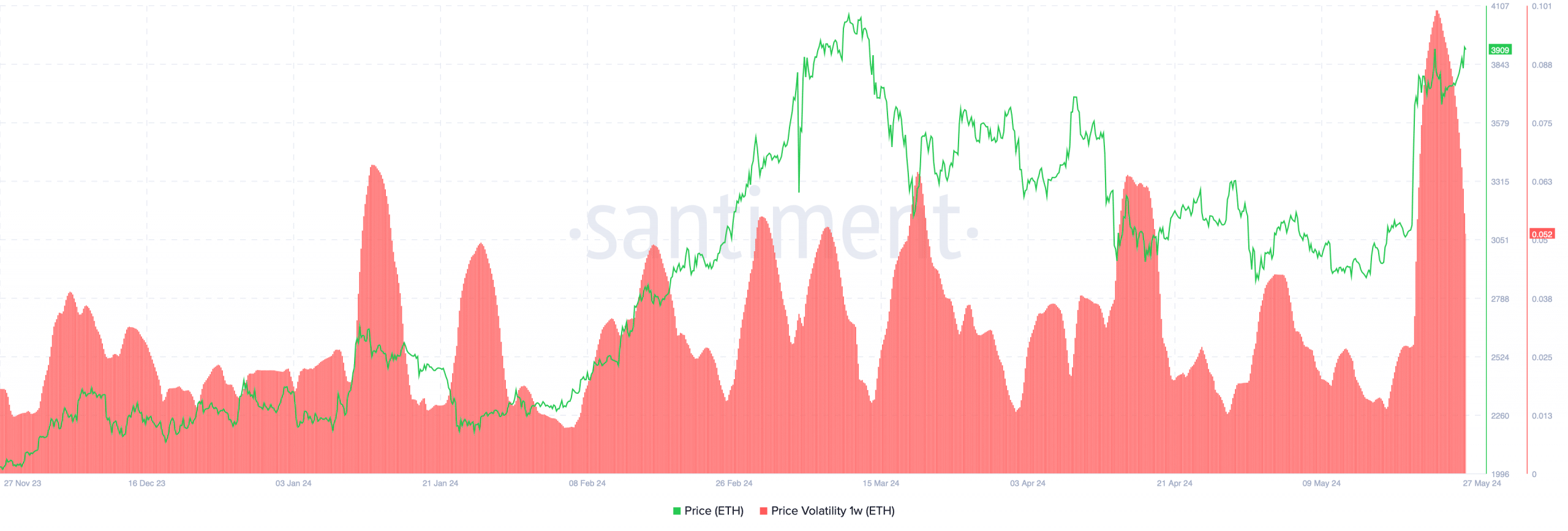

As an analyst examining data from Santiment, I’ve noticed a striking increase in Ethereum’s price volatility. This metric, which had reached a comparatively low point over the past two weeks, has now spiked to a noteworthy high.

Significantly, the rising price instability and value of cryptocurrencies suggest an escalating level of investor engagement and market excitement, frequently fueled by speculative purchases.

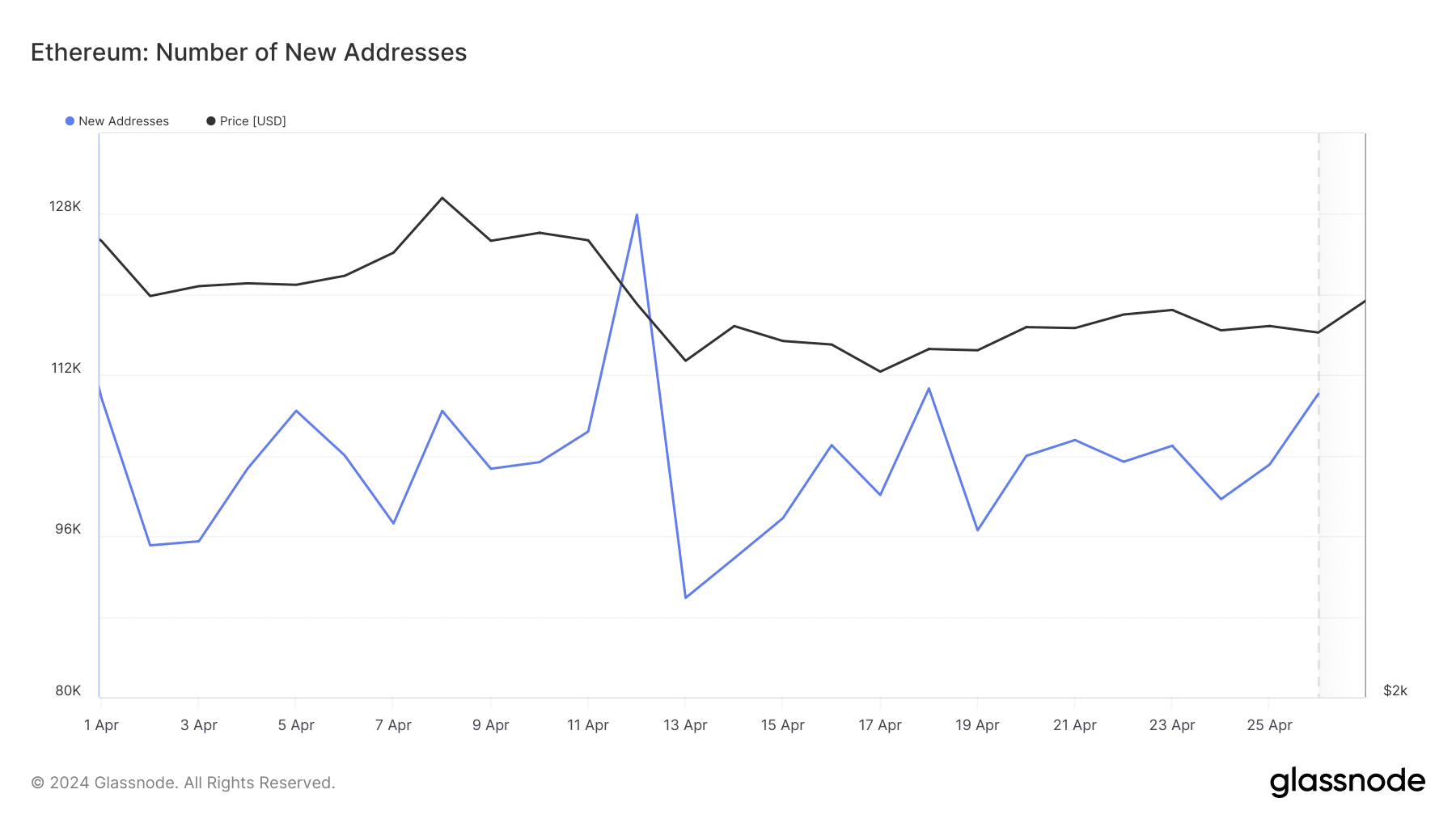

Enhancing the existing buzz, Glassnode noted a surge in the formation of fresh Ethereum wallets, implying a broadening user base for the network.

A substantial increase in this often indicates heightened involvement in the market, possibly fueled by optimistic market feelings and wider acceptance.

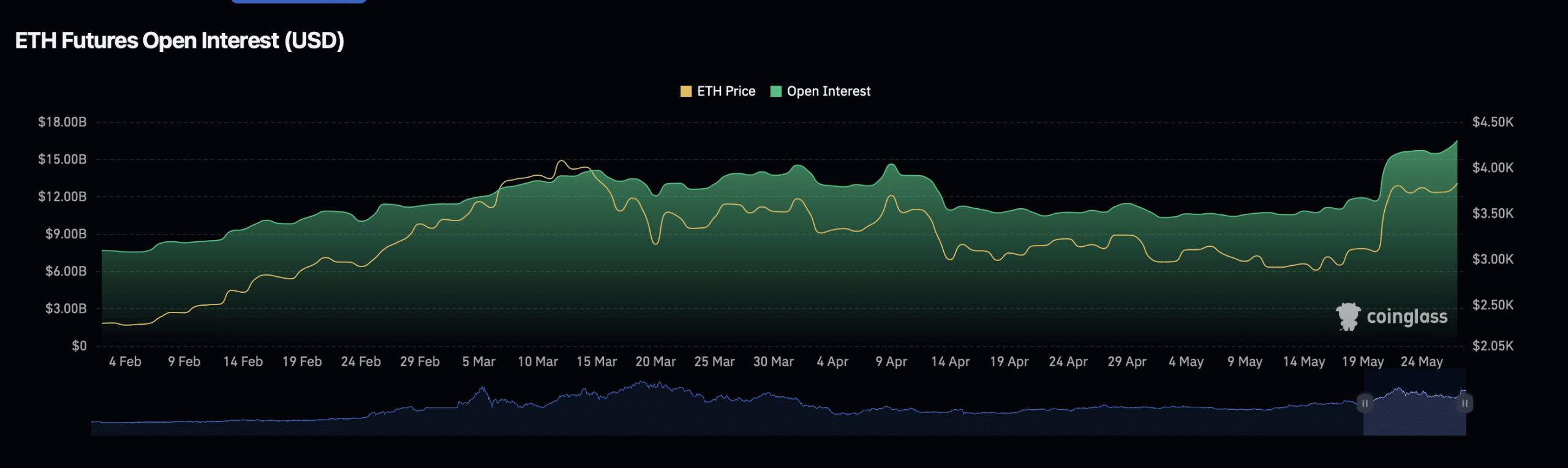

Additionally, the data from Coinglass showed a significant increase in Ethereum’s Open Interest, indicating a robust derivatives market with elevated trading activity.

This indication signaled both heightened market liquidity and growing speculation among traders, who were positioning themselves in expectation of upcoming price fluctuations.

Despite an increase in Open Interest, this signifies enhanced market exposure, potentially intensifying profits as well as potential losses based on the market’s movement.

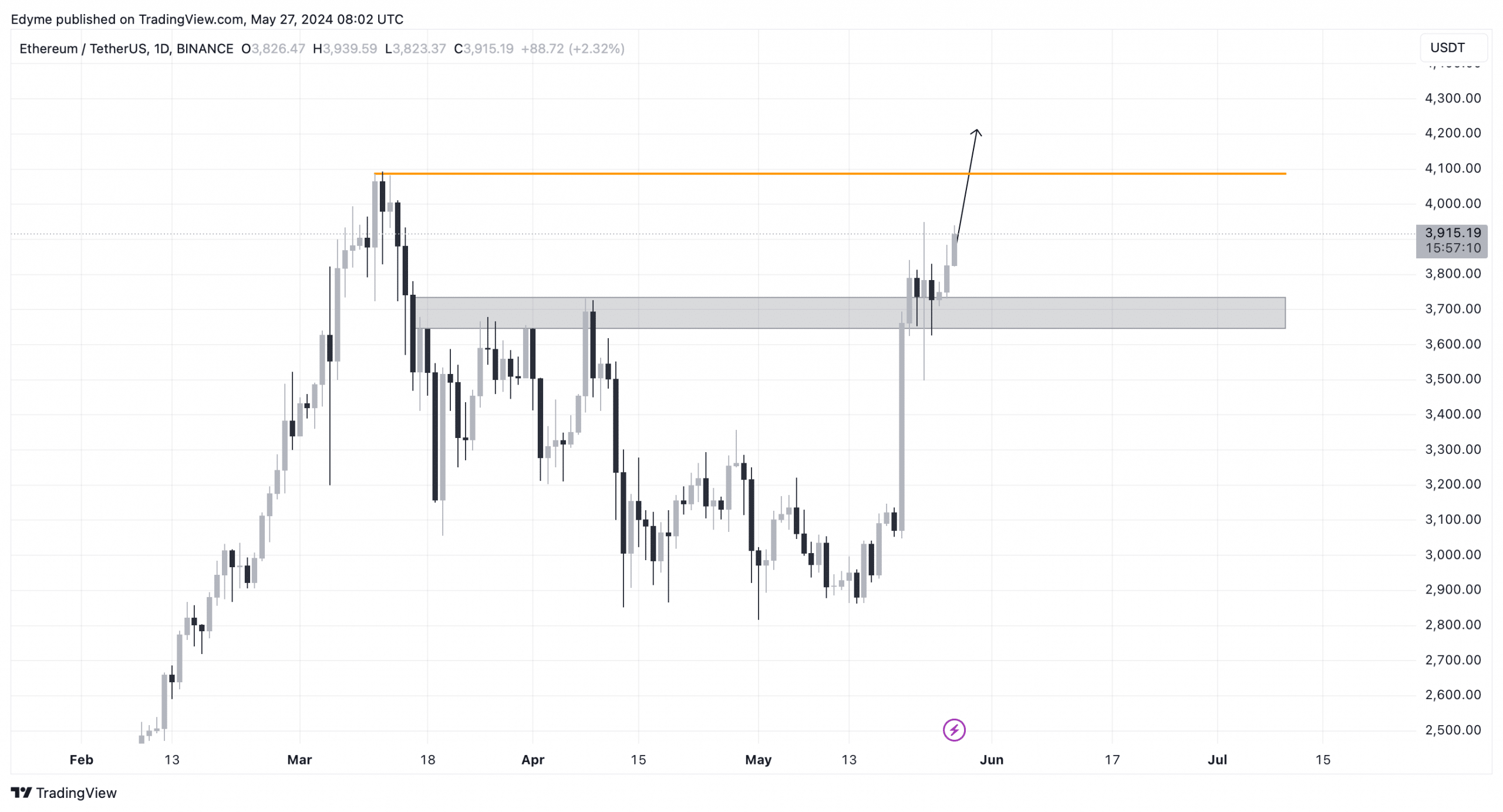

As a crypto investor, I’ve been closely monitoring Ethereum’s daily chart, and I’m excited to report that we’ve just breached the $3,700 resistance level. This means that $3,700 is now acting as support for Ethereum, paving the way for our next significant milestone: reaching $4,000. Let’s keep a close eye on this trend and prepare ourselves for potential gains!

This breakthrough suggests that bullish momentum is strong, potentially driving further gains.

As a crypto investor, I’ve noticed that according to AMBCrypto’s recent report, there has been a notable reduction in Ethereum’s Network Value to Transactions (NVT) ratio, as indicated by data from Glassnode. This metric measures the relationship between the network value and the transaction volume. A lower NVT ratio suggests that the price of Ethereum is undervalued relative to its transaction activity.

If the asset’s value in relation to this ratio is decreasing, it could be a sign that the asset is presently underpriced. This situation might lead to an increase in the asset’s market value in the near future.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-05-28 02:15