- Market trends favor Ethereum as ETF launch nears.

- The report showed a changing landscape in spot trading volume, options, Futures, and perpetual contracts.

As a seasoned cryptocurrency market analyst with over a decade of experience, I have witnessed numerous trends and shifts throughout my career. The latest development that has piqued my interest is the impending launch of Ethereum [ETH] spot exchange-traded funds (ETFs). Based on recent market trends and data from reputable sources such as Kaiko and the joint report by Block Scholes and Bybit, I believe that Ethereum is poised for significant growth.

Over the past two months, cryptocurrency markets have shown significant fluctuations. There’s been a noticeable change in investor sentiment, with heightened activity following the Securities and Exchange Commission (SEC) approval of Ethereum [ETH] spot exchange-traded funds (ETFs) in May.

With the anticipated launch of ETH spot ETFs, investors are getting increasingly optimistic.

Before ETH exchange-traded funds (ETFs) have begun trading, two reports – one from Kaiko and another co-authored by Block Scholes and Bybit – indicate shifts in investor demand.

A change in trends

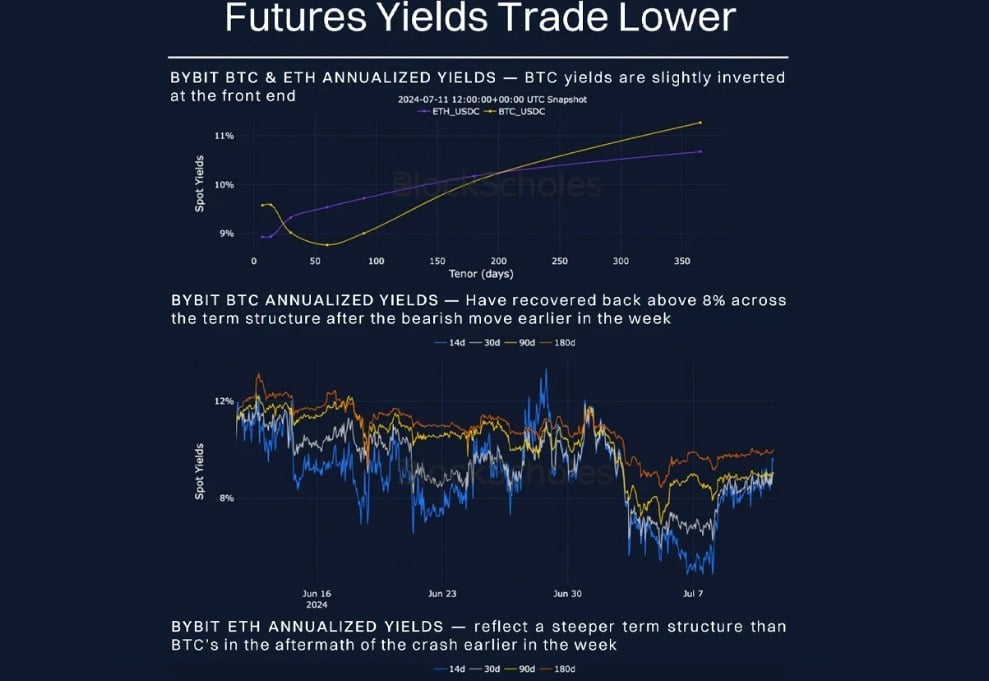

Based on the latest report from Block Scholes and Bybit, there has been a significant transformation in the trading volume distribution between spot markets, futures, options, and perpetual contracts.

As a crypto investor, I’ve noticed an intriguing finding in a recent report. Ethereum [ETH], compared to Bitcoin [BTC], has experienced a more pronounced volatility. This heightened volatility can largely be attributed to two factors: firstly, the surge in address activity on the Ethereum network; secondly, a positive shift in market sentiment towards Ethereum.

Ethereum gains ground over Bitcoin

As a researcher studying the cryptocurrency market, I’ve observed that the ETH to BTC ratio has maintained a value above 0.05 since the approval of Bitcoin Exchange-Traded Funds (ETFs). This is significantly higher than the pre-approval ratios which hovered around 0.045.

As a crypto investor, I believe that a higher ratio between Ethereum and Bitcoin indicates that Ethereum is more likely to surpass Bitcoin in performance once Ethereum-backed exchange-traded funds (ETFs) start trading.

Overall market sentiment

ETH has gained more than BTC in multiple areas since the approval of ETH spot ETFs in May.

Over the last two months, the cryptocurrency market has seen significant fluctuations. However, Ethereum Futures have demonstrated greater stability and swifter bounces back compared to Bitcoin’s Open Interest.

The quicker-than-expected bounce back of Ethereum indicated a growing optimistic outlook, as numerous investors expressed faith in its prospective growth.

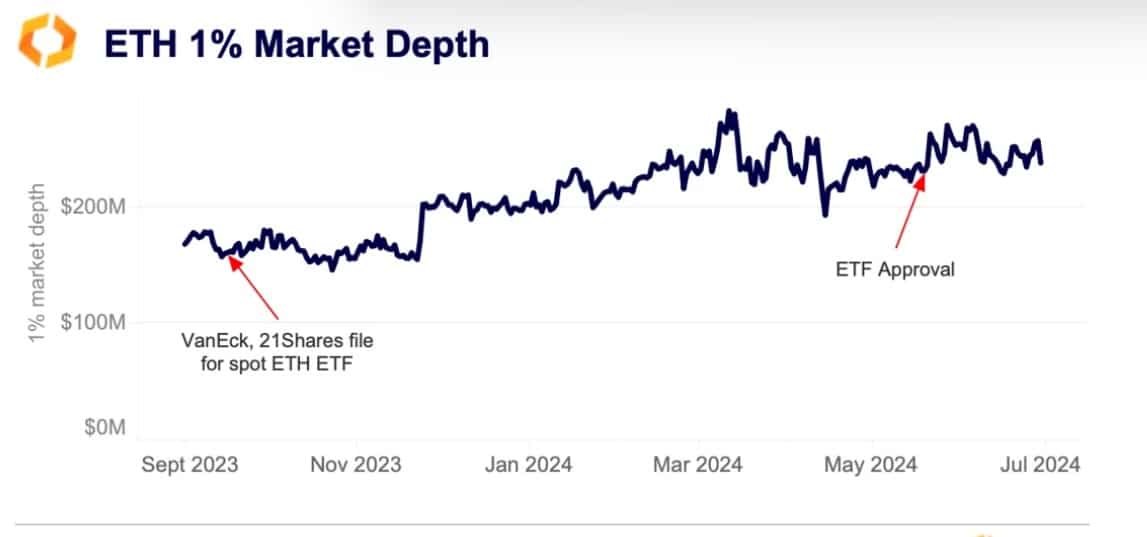

Since May, Ethereum’s trading activity has remained stable at around the same level, with a reported liquidity of approximately $250 million and a consistent depth of 1%, as indicated by Kaiko.

As an analyst, I’ve observed that the Securities and Exchange Commission (SEC) approval of the ETF significantly influenced its trajectory. Prior to the approval, the ETF’s assets had dipped below the $200 million mark, indicating a downward trend. However, once the SEC gave its nod, there was a noticeable reversal in this trend. This shift in sentiment among investors led to increased anticipation towards the ETF, which in turn played a pivotal role in enhancing its liquidity.

As a researcher studying the cryptocurrency market, I’ve observed an uptick in trading activity for Ethereum (ETH) perpetual contracts. This surge in demand indicates that investors are prepared to pay a premium to maintain long positions on ETH. Their willingness to do so underscores their optimism regarding Ethereum’s future prospects.

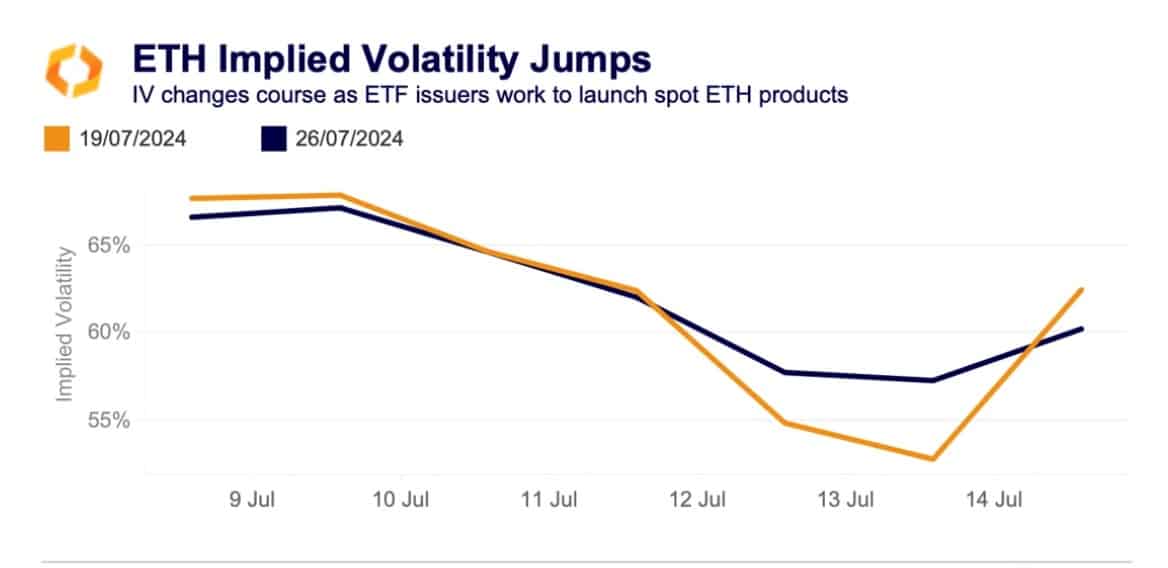

According to Kaiko’s latest update, there has been a significant increase in Implied Volatility over the last week. For example, the Implied Volatility for ETH options due to expire on Friday jumped from 53% on July 13th to 62% as of now.

Read Ethereum’s [ETH] Price Prediction 2024-25

As an analyst, I’ve noticed a significant increase in the number of contracts being entered into with a protective bias. This trend suggests that investors are proactively hedging their portfolios against potential price spikes in the near term by paying for the right to sell an underlying asset at a specified price.

The outlook for Ethereum in the market is quite positive, with many investors expressing confidence in its future due to the anticipated launch of ETFs (Exchange-Traded Funds) coming up this week.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-07-17 04:08