- Boston FED President Susan Collins hinted at interest rate cuts

- Analysts are still hopeful that cryptos will continue to surge

As a seasoned researcher with a decade of experience in financial markets and cryptocurrencies, I find myself constantly intrigued by the ever-evolving dynamics that govern these realms. The recent hints from Susan Collins, President of the Boston FED, about potential interest rate cuts have piqued my curiosity.

The President of the Federal Reserve Bank of Boston, Susan Collins, hinted that a possible adjustment could occur soon, suggesting lowering interest rates. If implemented, this action might lead to an immediate decrease in rates as early as September 18th, which could spark a substantial upward trend in financial markets, often referred to as a bull run.

In certain circles, there are growing worries. For example, Donald Trump has voiced some apprehensions, suggesting that the United States could experience a deep economic downturn, akin to the 1929 depression, and even hinting at the potential for a global conflict in the near future.

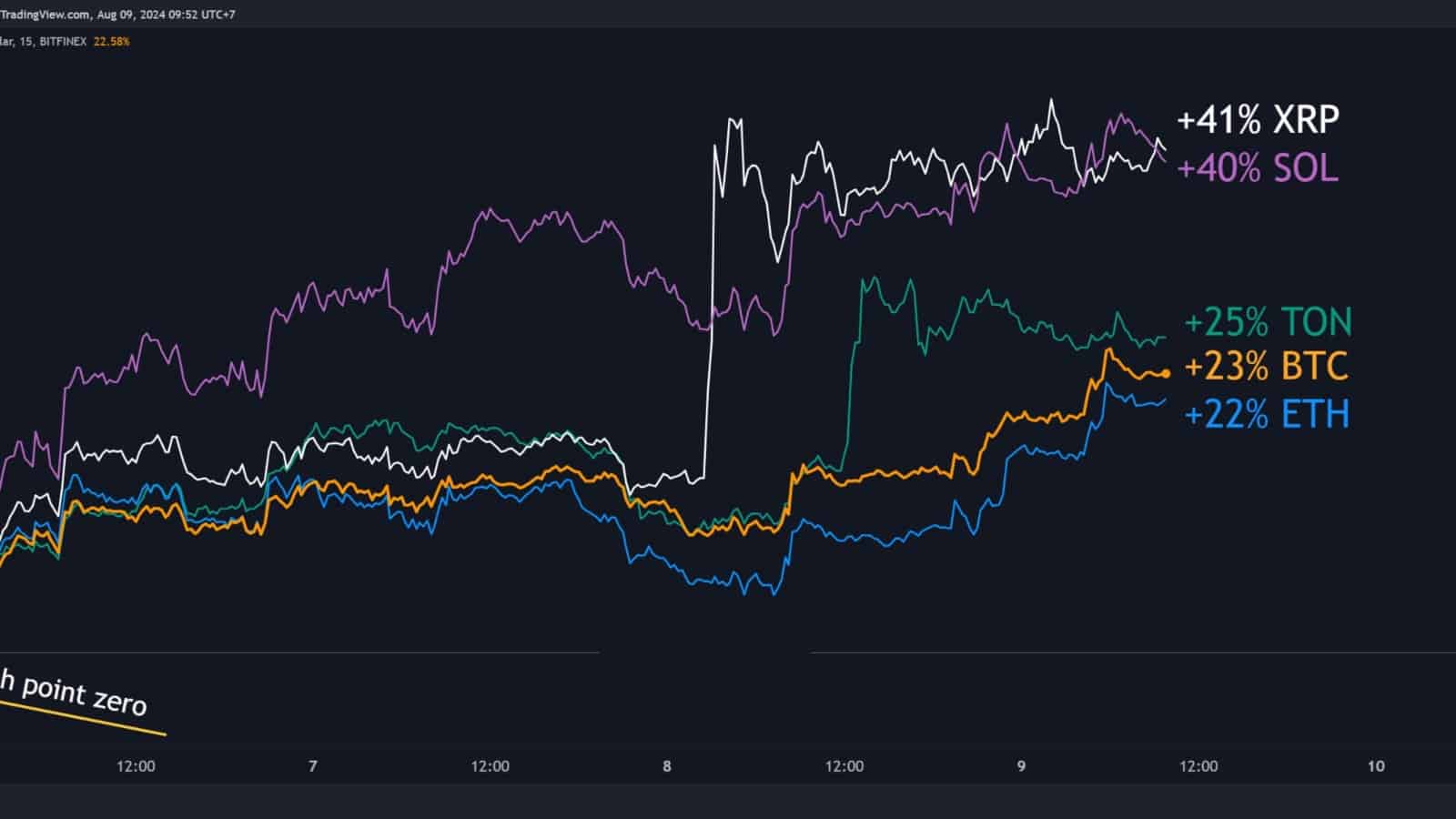

XRP & SOL clear winners as BTC & ETH follow

In the last seven days, both Ripple (XRP) and Solana have made significant strides, recording increases of 41% and 40% respectively. This growth is attributed to the recent settlement between XRP and the SEC, which required a $125 million fine. Given this resolution, it’s no surprise that the value of XRP has risen, with many investors anticipating further price escalations in the future.

Bitcoin and Ethereum also saw notable hikes, rising by 23% and 22% from their weekly lows.

A suggestion from the Federal Reserve about possible reductions in interest rates might boost these profits even more, since it would likely make it simpler for traders and investors to obtain loans to purchase these resources.

Bitcoin is up by 23% this week

Despite Bitcoin’s recent fluctuations in value, significant financial companies such as MicroStrategy and BlackRock continue to show faith in it. Interestingly, neither of these firms have liquidated their Bitcoin assets during these price dips. On a positive note, Bitcoin has experienced a surge of more than 20% over the past week, bouncing back from its recent lows.

Anticipating possible interest rate reductions by the Federal Reserve soon, there’s a growing belief that the worth of Bitcoin may further increase due to increased availability of investor capital.

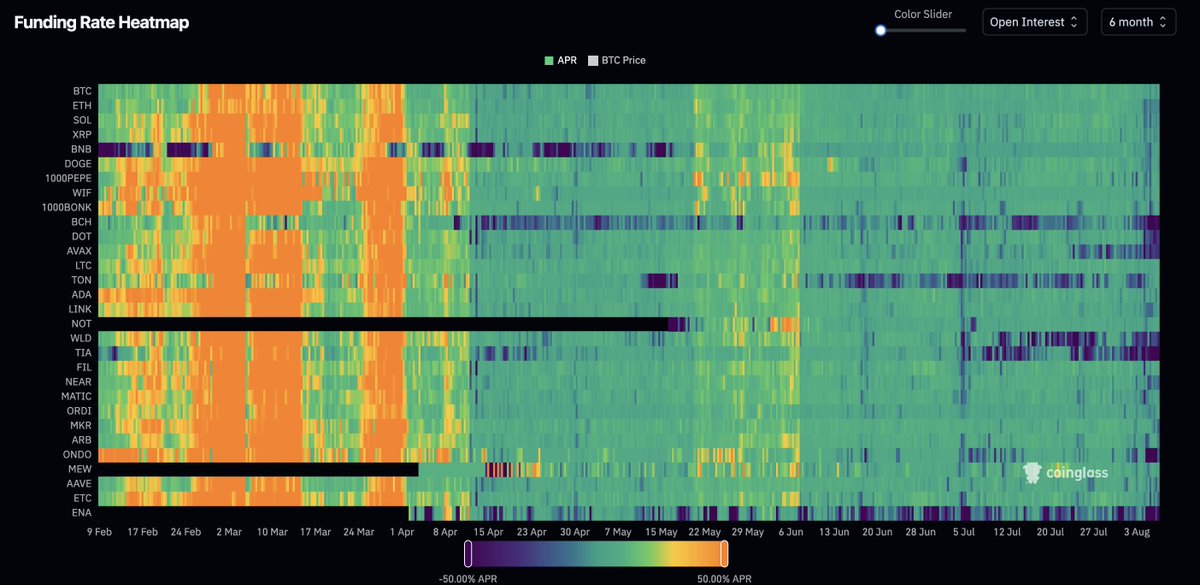

Crypto funding rates for top 30 coins

The funding rates for cryptocurrencies have noticeably changed from the heated market conditions seen in February and March of this year. As a matter of fact, these rates are now at their minimum points experienced throughout 2024.

Prolonged phases of reduced interest rates might persist, yet suggestions from the Federal Reserve about potential rate reductions may swiftly reshape market patterns, possibly causing adjustments in these financing costs.

Altcoins excluding BTC form a cup & handle pattern

In summary, we’re seeing optimistic signals on macro charts once more. An example is the weekly candle reappearing at the lowest point in a 2.5-year cup and handle formation.

Consequently, following the Federal Reserve’s suggestion of interest rate reductions, it seems that a surge upward is imminent. The market has been restrained for quite some time now, and the last significant rise might occur shortly, as the candlestick approaches its close in just two days.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- SOL PREDICTION. SOL cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-10 14:15