-

FET broke through the descending trend line, setting up a potential 76% rally to $2.20 next.

Bullish indicators showed momentum for FET as traders eyed $1.80, $2.20, and $2.60 targets.

As a seasoned crypto investor with years of experience under my belt, I can confidently say that the recent technical signals for Artificial Superintelligence Alliance [FET] are looking incredibly bullish. Breaking through a long-term descending trend line is always an exciting development, and if history repeats itself, we could be in for a 76% rally to $2.20.

At the present moment, the Artificial Superintelligence Alliance (FET) is displaying robust technical signs, hinting at a potential bullish surge or breakthrough.

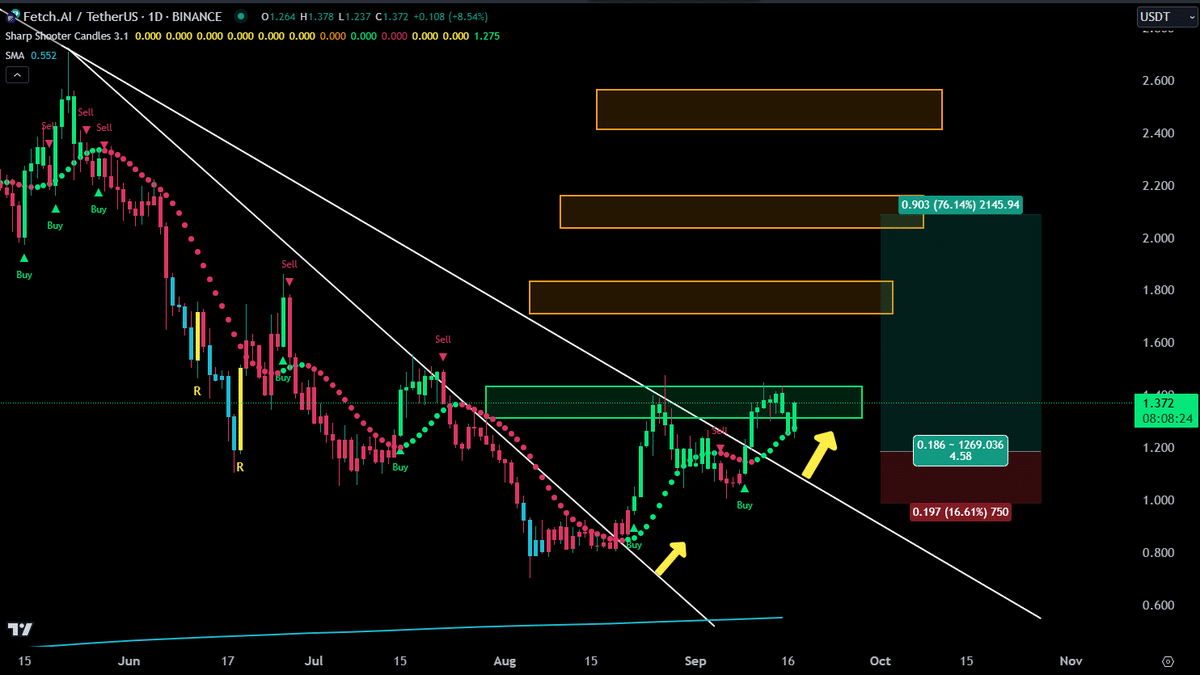

The price has broken above a long-term descending trend line, suggesting a potential reversal of the bearish trend.

This action indicates a change in investor attitude towards the market, as more traders are showing increased curiosity due to the coin’s movement towards a more advantageous spot.

For a long time, the downward sloping line held the price at bay, suggesting that a break above this line might signal the start of a rising phase.

Keep an eye on a significant point: will FET manage to stay above the recently broken trendline? This decision will influence its upcoming direction.

For FET, the range between $1.20 and $1.37 has played a significant role as both a barrier to growth (resistance) and a floor for support. Previously, it stood firm as robust resistance, hindering the price from advancing further.

Indeed, the latest market movements indicate that FET is attempting to establish itself at this level as a potential support point. This implies that it might be able to maintain its position as a new foundation for growth.

Additionally, the profit-loss balance seemed advantageous for traders, as they could stand to earn as much as 76%, should the price hit the predicted $2.20 mark.

If the price stays elevated at this level, it might prompt an attempt to break through more significant resistance points, aiming for potential peaks at $1.80, $2.20, or even $2.60.

Should the FET maintain its position above the specified support point, it could play a significant role in upcoming price fluctuations, with traders looking forward to potential additional growth.

Bullish momentum for FET

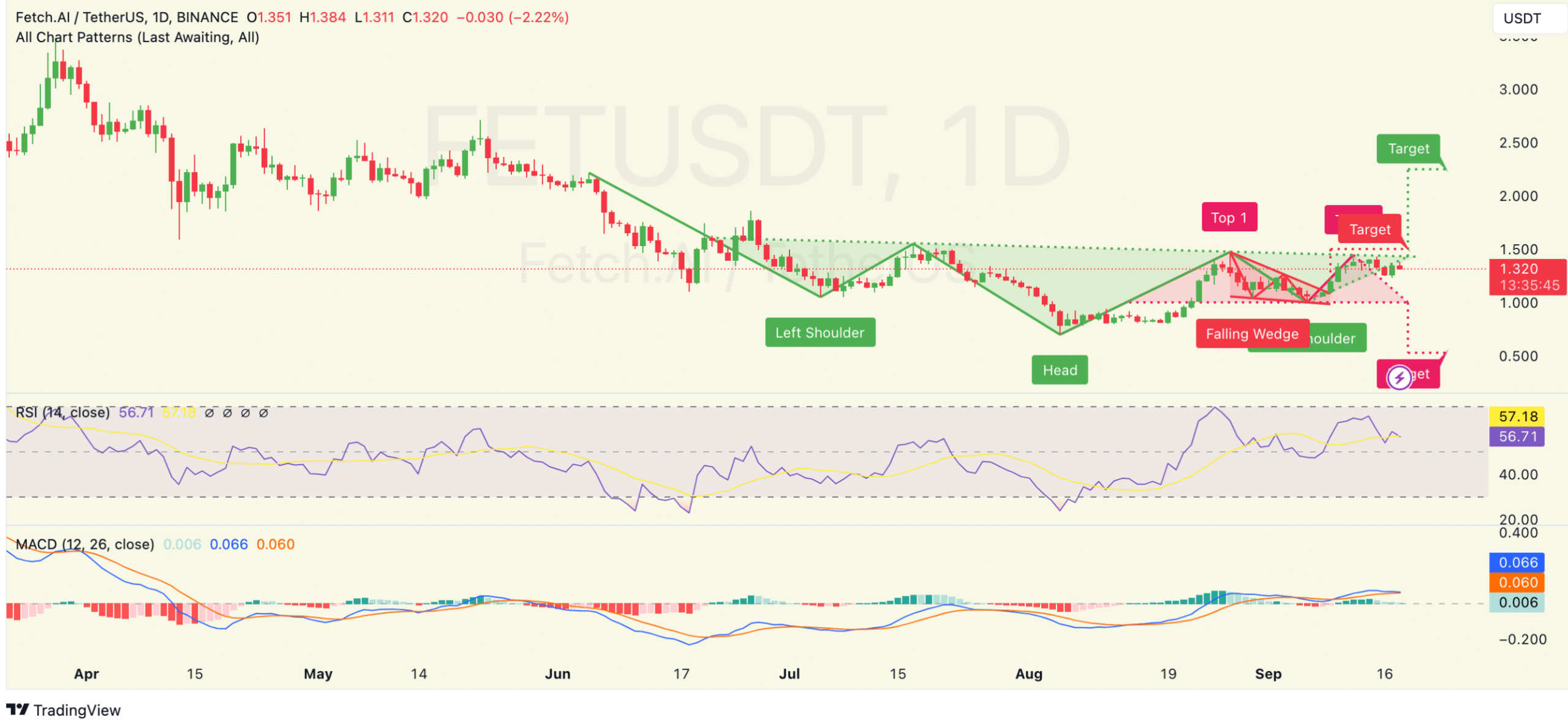

In simpler terms, multiple factors pointed towards a favorable view of FET‘s future. Among these were ‘buy signals’ and the Parabolic Stop and Reverse (SAR), which suggested an optimistic trend. The Parabolic SAR, with its dots placed under the price, signified increasing buying pressure.

Momentum is building, and traders are watching for additional signs of a strong upward move.

Additionally, other technical signals such as Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicated a strong bullish trend. Specifically, the RSI reading of 57 implied that there was still potential for further growth before the market reached overbought levels.

Crossing of the Moving Average Convergence Divergence (MACD) line over the signal line served as additional confirmation of a growing bullish momentum, hinting that FET might keep climbing in the immediate future.

Volume and network activity

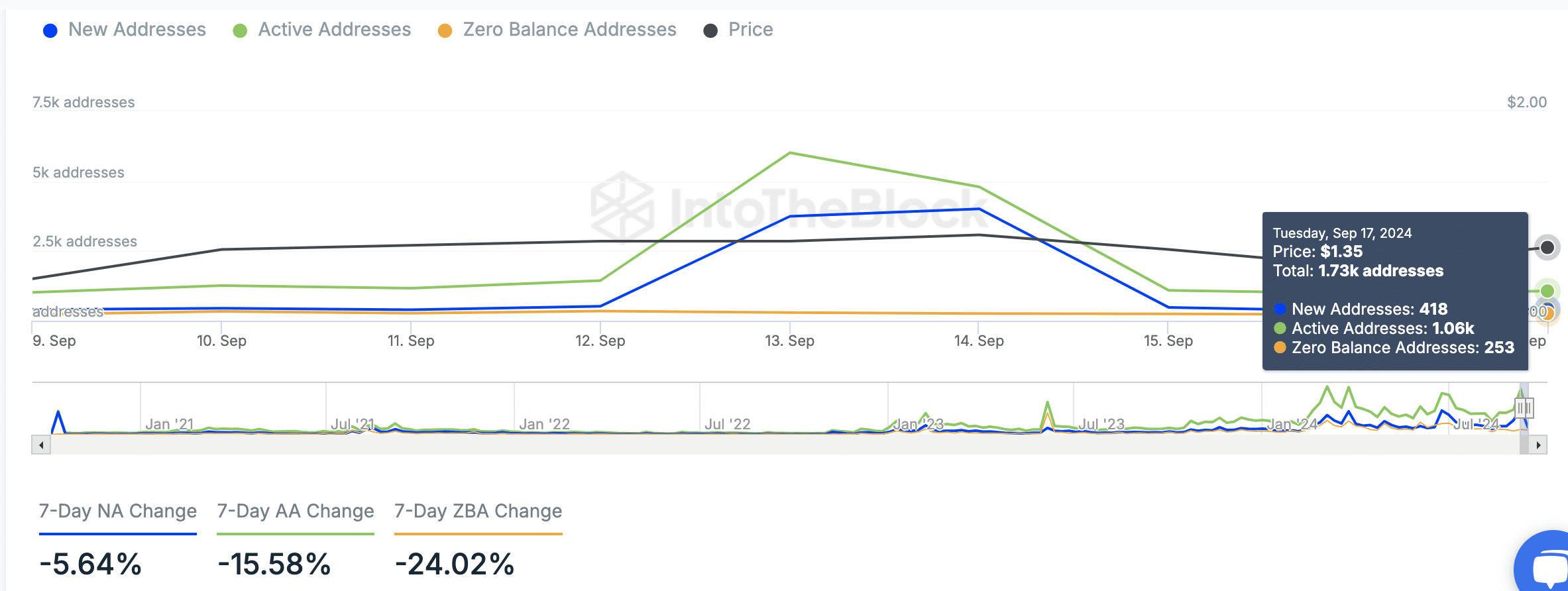

According to data directly recorded on the blockchain, provided by IntoTheBlock, FET showed a diverse scenario as of September 17th. At that time, there were approximately 1,730 total wallets involved, with 418 newly created wallets and 1,060 active wallets.

Conversely, there’s been a 5.64% decrease in the creation of new addresses during the past week, and active addresses have fallen by 15.58% as well.

Furthermore, a decrease of 24.02% was observed in the number of zero-balance addresses, which might suggest either active funds being transferred out or dormant wallets.

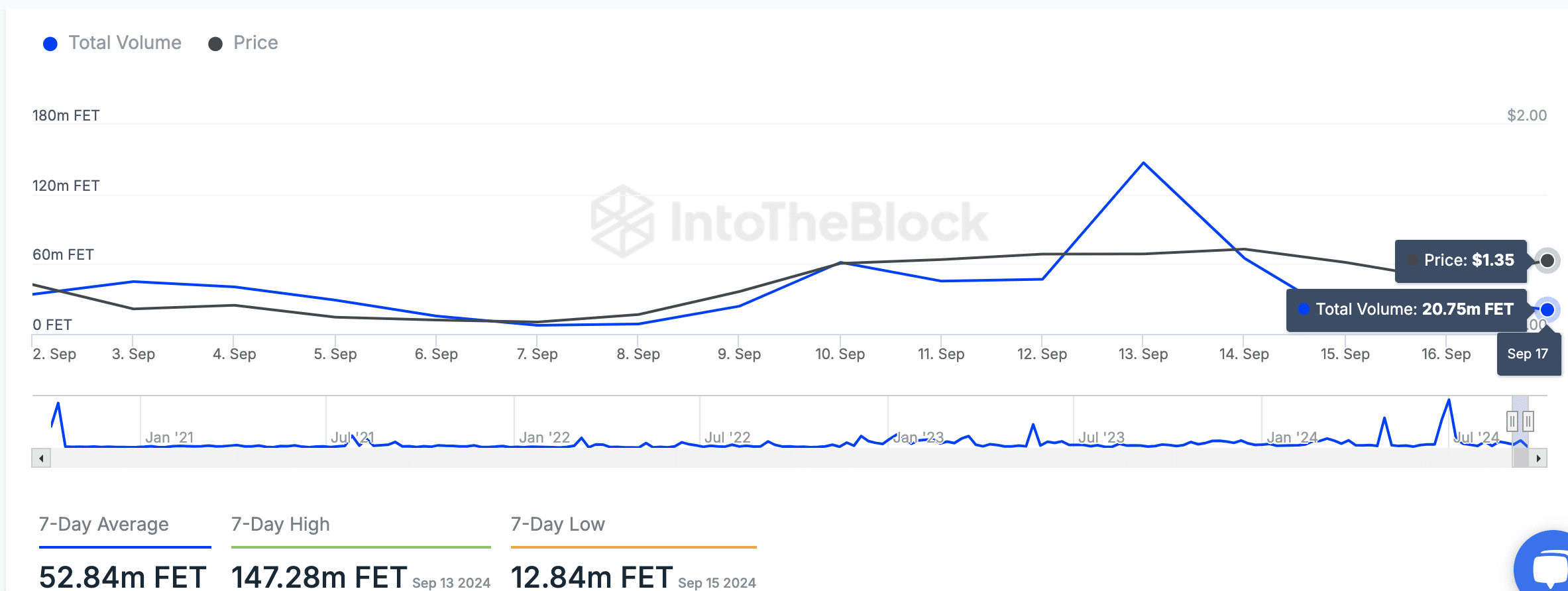

In the past few days, the number of transactions has seen some ups and downs. The highest point was reached on September 13th with a total of 147.28 million FET transactions, but it dropped significantly to just 20.75 million FET by September 17th.

Regardless of the drop, the daily average for the past week stayed steady at approximately 52.84 million FET, indicating that market action continued to be lively.

The decrease in trading activity we’ve seen recently might signal a temporary decrease in investor enthusiasm or profit-making by traders after the previous price increase.

Based on Coinglass statistics, the trading volume for FET saw a significant jump by approximately 20.56%, peaking at around $229.41 million.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

Meanwhile, Open Interest declined by 9.05% to $62.43M, suggesting a shift in market positioning.

As long as volumes stay high, the drop in trader participation (Open Interest) could indicate a sense of caution, yet the overall market’s activity continues to be robust.

Read More

2024-09-18 17:44