-

A bearish flag pattern has emerged, signaling potential further declines for FLOKI in the near term.

Despite this, there is a possibility for delay or rebound.

As a seasoned analyst with years of experience navigating the cryptocurrency markets, I find myself cautiously bearish about FLOKI at present. The bearish flag pattern that has emerged suggests potential further declines for FLOKI in the near term, but there is always the possibility for delay or rebound.

Over the past day, there’s been a significant decrease for Floki [FLOKI], falling by approximately 9.94%. Given recent technological advancements and data indicating a bearish trend, it seems that this memecoin might keep following a descending path.

However, it’s important to consider that FLOKI’s downturn is not fully confirmed, leaving room for a potential rally. AMBCrypto provides an in-depth analysis to explain this.

A 65% decline for FLOKI?

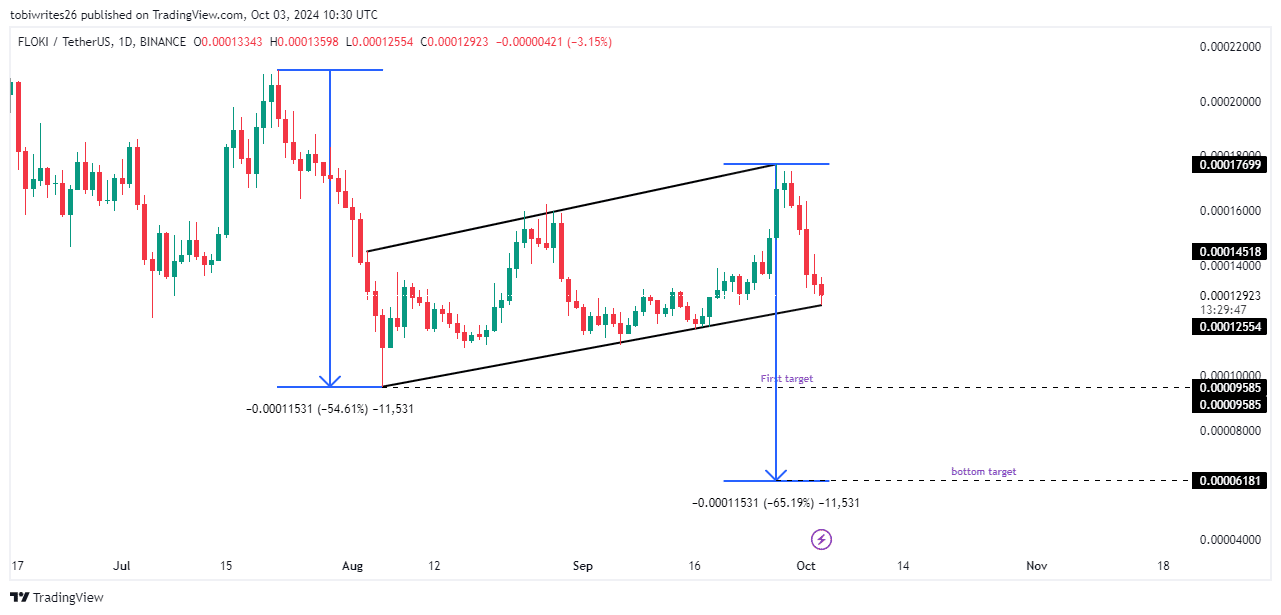

This pattern exhibits a substantial decrease in price, followed by a period of stabilization where the price oscillates minimally while generally moving upwards, and then a steep decline.

After reaching a significant resistance level within its trading channel, the price usually starts falling, breaking past the initial support. At the moment of reporting, FLOKI was moving towards the support zone of its channel.

Should it break from here, there are two targets to watch.

The initial target for FLOKI is the bottom of the channel, currently at 0.00009585.

If the pattern repeats its significant downward trend before consolidating, FLOKI may continue to decrease and possibly drop to the level of 0.00005373.

A potential halt may be on the horizon

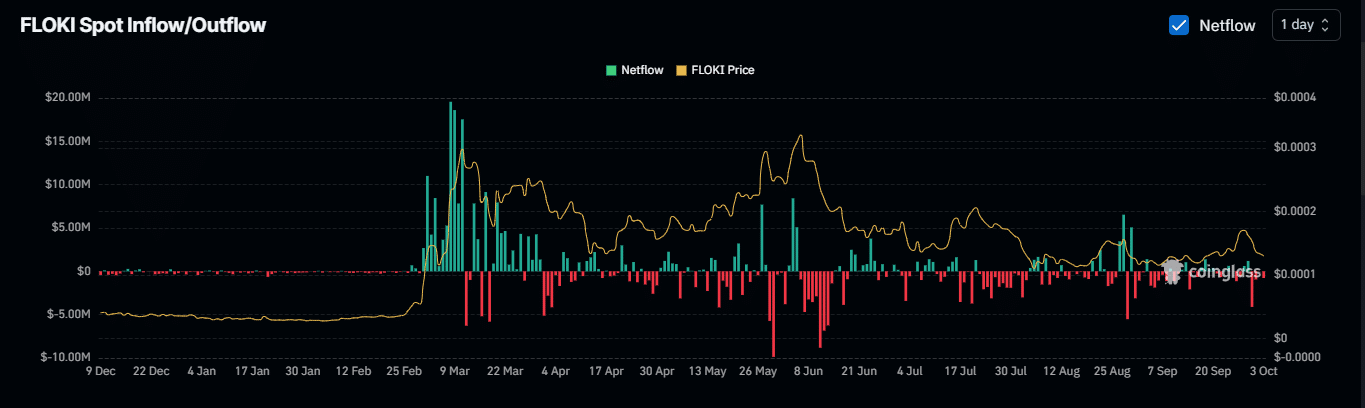

Based on additional examination, it appears that Coinglass has noted a substantial withdrawal of FLOKI tokens, with Binance being a standout platform, having offloaded approximately $2.06 million worth of FLOKI over the past day.

This trend of negative netflows has persisted over the past week.

A small amount of outgoing flow usually results in a shortage of supply, since the scarcity of FLOKI might increase demand, which can then boost its cost.

As a researcher examining market trends, I noticed an intriguing discrepancy when looking at the Open Interest (OI) as a gauge of sentiment. Contrary to what one might expect from current market conditions, the OI significantly dropped by 25.79%, reaching only $17.88 million.

Based on my years of trading experience, I believe that the significant drop in prices we are currently witnessing suggests a strong bearish outlook among traders. This could potentially weaken the impact of the current supply squeeze and result in further price declines. I’ve seen similar market conditions before, and it often pays to be cautious when the overall sentiment is bearish. It’s important to keep a close eye on market developments and be prepared to adjust your trading strategy accordingly.

Sentiment remains bearish

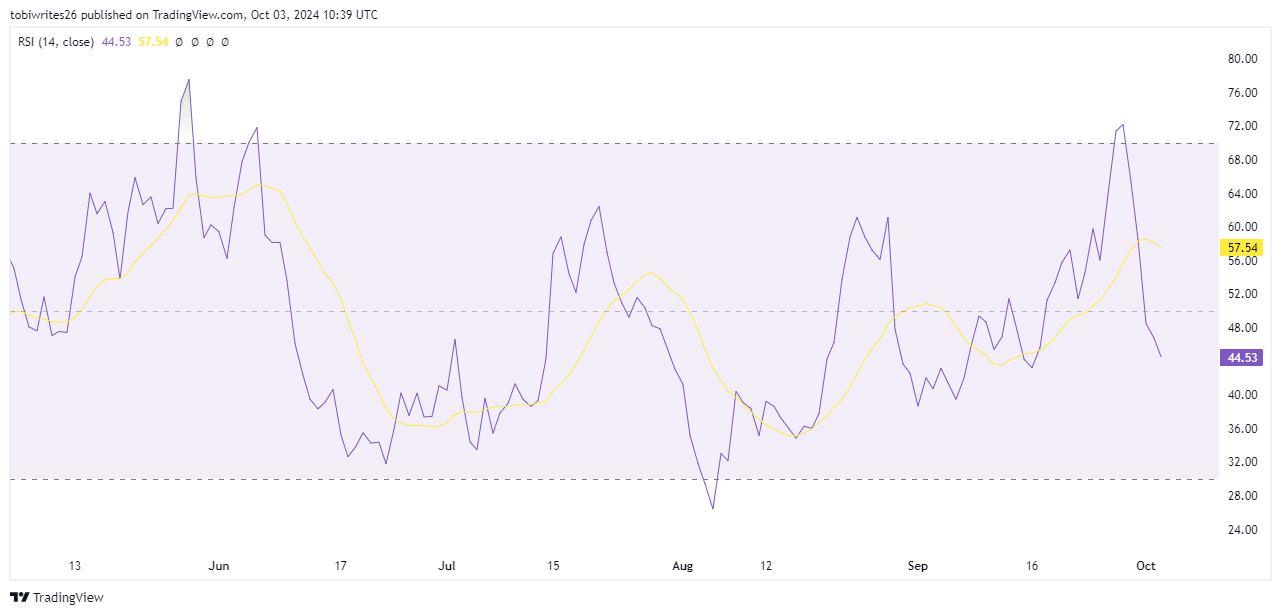

As a researcher examining market trends, I’ve noticed an interesting pattern using the Relative Strength Index (RSI). It appears that traders are consistently taking a bearish stance towards FLOKI, indicating continued betting against this cryptocurrency.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

The RSI (Relative Strength Index) has dropped below the 50-neutral line and is still moving down, indicating a potential decline or weakness in the market.

With this ongoing trend, there’s a strong possibility that the memecoin will return to its initial level around 0.00009585. Should the present market mood continue, it may even lead to a decline towards the channel’s lower limit.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-10-04 02:15