-

The Hedera network has posted a significant increase in revenues from transaction fees and new addresses.

However, HBAR has not responded to the network growth, as it continued to underperform.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I have seen my fair share of bull and bear runs. The growth of the Hedera network is certainly intriguing, despite the underperformance of its native token, HBAR.

Over the past year, Hedera’s digital currency (HBAR) hasn’t stood out as a leading performer among cryptocurrencies. Instead, it has experienced a decrease in value, losing approximately 39% since the start of this year.

However, despite the bearish price outlook, the Hedera network has seen significant growth. Per a recent report by Messari, the network saw an upsurge in key metrics during the second quarter of 2024.

Hedera’s network growth

Based on the findings of the report, earnings from Hedera’s transaction fees amounted to approximately $1.4 million in Q2 of 2024. This figure represented the second highest quarterly revenue and marked a notable 26% increase compared to the previous quarter.

During the quarter, the typical amount of new addresses increased significantly by 31%, reaching approximately 11,000. Meanwhile, the average daily transactions saw the most substantial growth of 46%, totaling around 132.9 million.

Furthermore, although HBAR‘s price has indicated a downtrend this year, the report highlighted that its market cap position improved. This improvement is primarily due to an expansion in the circulating supply.

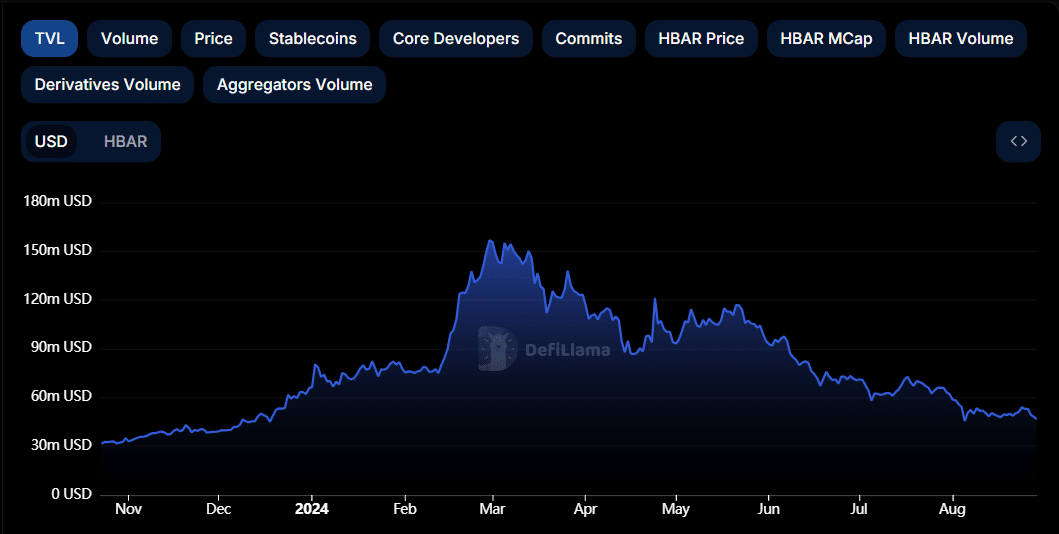

Although this perspective portrays a positive trend, other key indicators present a different picture. For instance, Hedera’s Total Value Locked (TVL) has decreased significantly from its yearly peak of $156 million to the current $46 million, as observed on DeFiLlama.

This showed a significant decline in activity by decentralized finance applications.

Given the ambiguous indications from blockchain data, could Harmon (HBAR) be poised for a surge beyond current levels, or is it more likely to adhere to its downward trajectory?

Will HBAR break the bearish trend?

At the moment of this text, Hedera was being traded for approximately $0.051 following a 3.8% decrease. A glance at the daily chart reveals that the token has been fluctuating between the $0.0514 and $0.062 price range since early August.

0.514 has been serving as a significant support point for HBAR, managing to stay steady over the past few weeks. Should the price fail to maintain this level, it could potentially fall towards the 0.0453 mark to gather liquidity, or even continue to decrease further.

Every time HBAR hits around $0.514, its price tends to rebound, suggesting a significant accumulation of buy orders at that particular price point.

In simpler terms, when the Relative Strength Index (RSI) dropped to 40, it indicated a downtrend or bearish momentum. But after the price retested the support level, the RSI rebounded, hinting that the support may still be strong and potentially prevent further price drops.

For about a month now, the market’s direction has primarily been influenced by bears. Since the beginning of August, the Awesome Oscillator has consistently indicated a bearish trend.

The AO has also failed to flip positive for weeks, further indicating bearish momentum.

Read Hedera’s [HBAR] Price Prediction 2024–2025

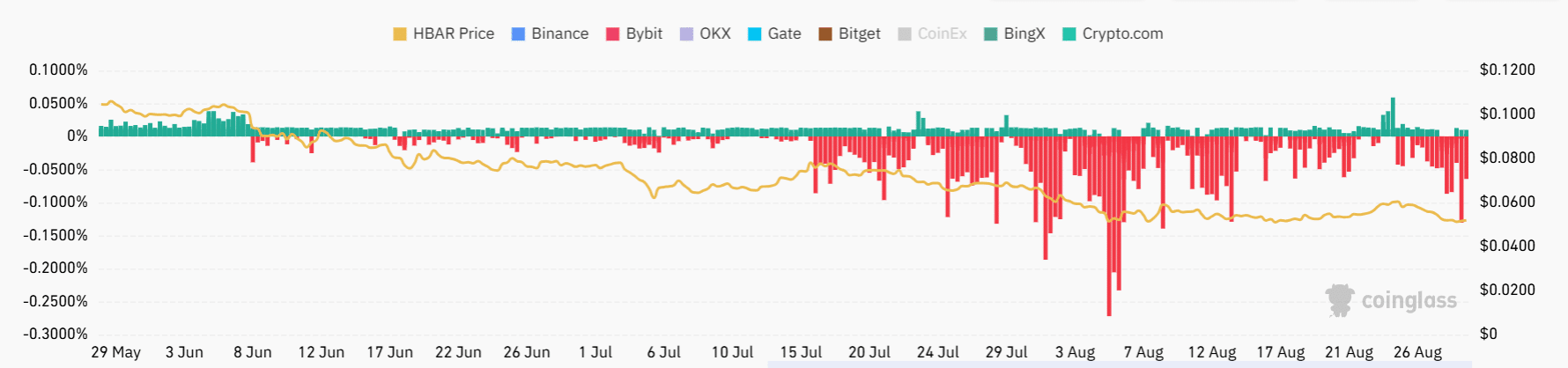

According to data from Coinglass, it’s been mostly negative for HBAR‘s Funding Rates during the last two months. This suggests that traders have maintained a long-term bearish stance by taking on short positions.

Consequently, if HBAR is to break free from the downward trend, it requires a significant increase in buying enthusiasm and backing from the wider investing community.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-08-29 21:12