- HNT was nearing a breakout from a symmetrical triangle, with a potential target above $9.00.

- Whale accumulation and rising long positions indicated growing confidence in a sustained rally.

As a seasoned crypto investor with battle scars from the 2017 bull run and the infamous bear market of 2018, I’ve learned to read between the lines.

As Helium [HNT] neared a significant turning point, there was growing interest due to the possibility that it might burst through its resistance barriers, potentially leading to a price spike if these barriers were successfully breached.

Trading at $7.08 at press time, HNT has surged by 17% over the past week.

The rise we’ve seen brings the token quite near a significant resistance point. However, the main issue is whether HNT can maintain this progression and spark a more substantial bullish surge?

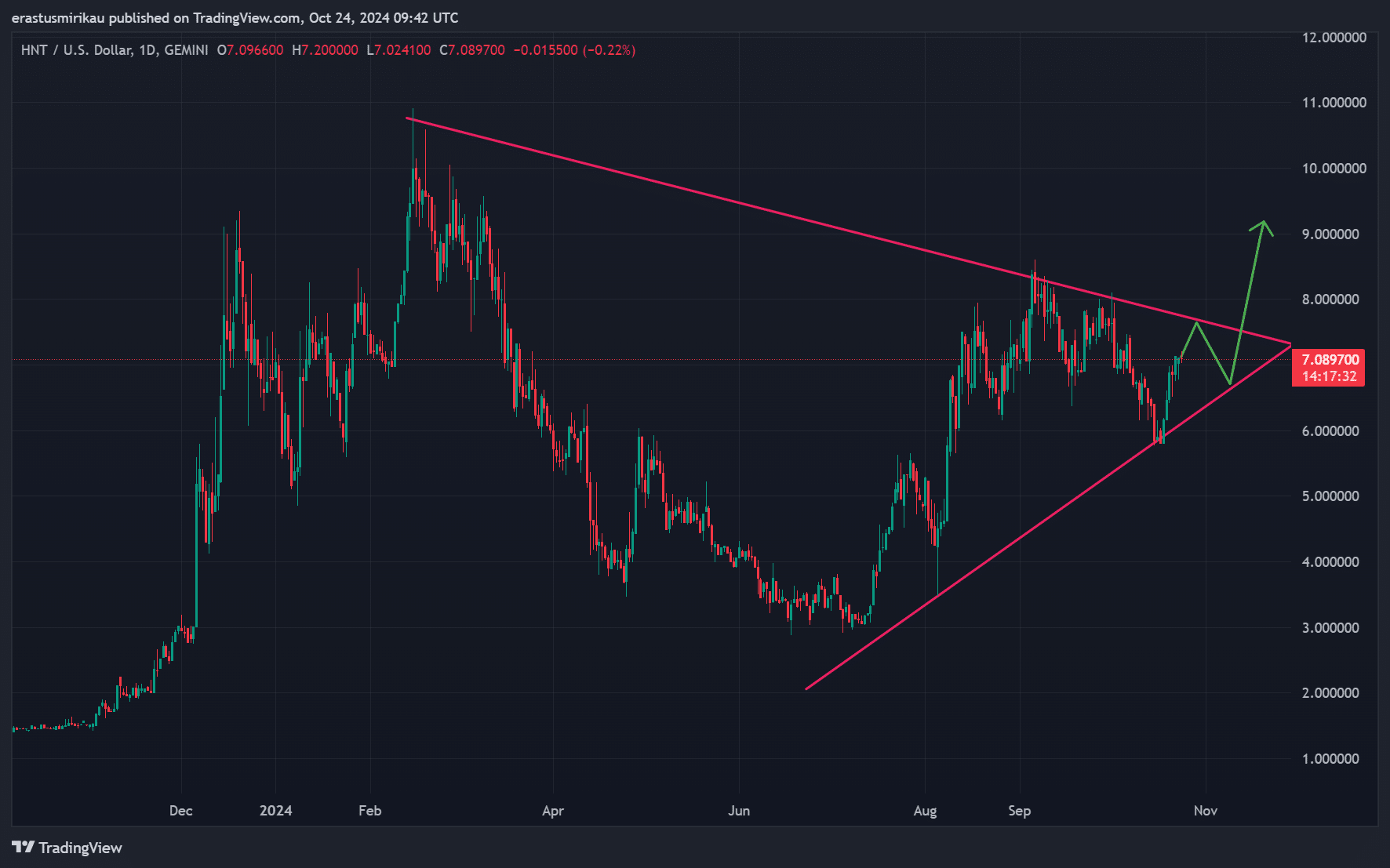

HNT forms a symmetrical triangle

The graph showing Helium’s price movements has displayed a balanced triangle shape, a formation lasting from the start of 2024. This particular pattern is recognized for suggesting a major price fluctuation could soon occur.

As the cost approaches the upper line of the triangle’s trend, HNT is approaching a crucial turning point.

Should the token successfully breach the barrier at $8.00, it might pave the way for additional growth, possibly propelling HNT to the $9.00 level. Consequently, this potential breakthrough could be significant for attentive traders.

What do major indicators suggest?

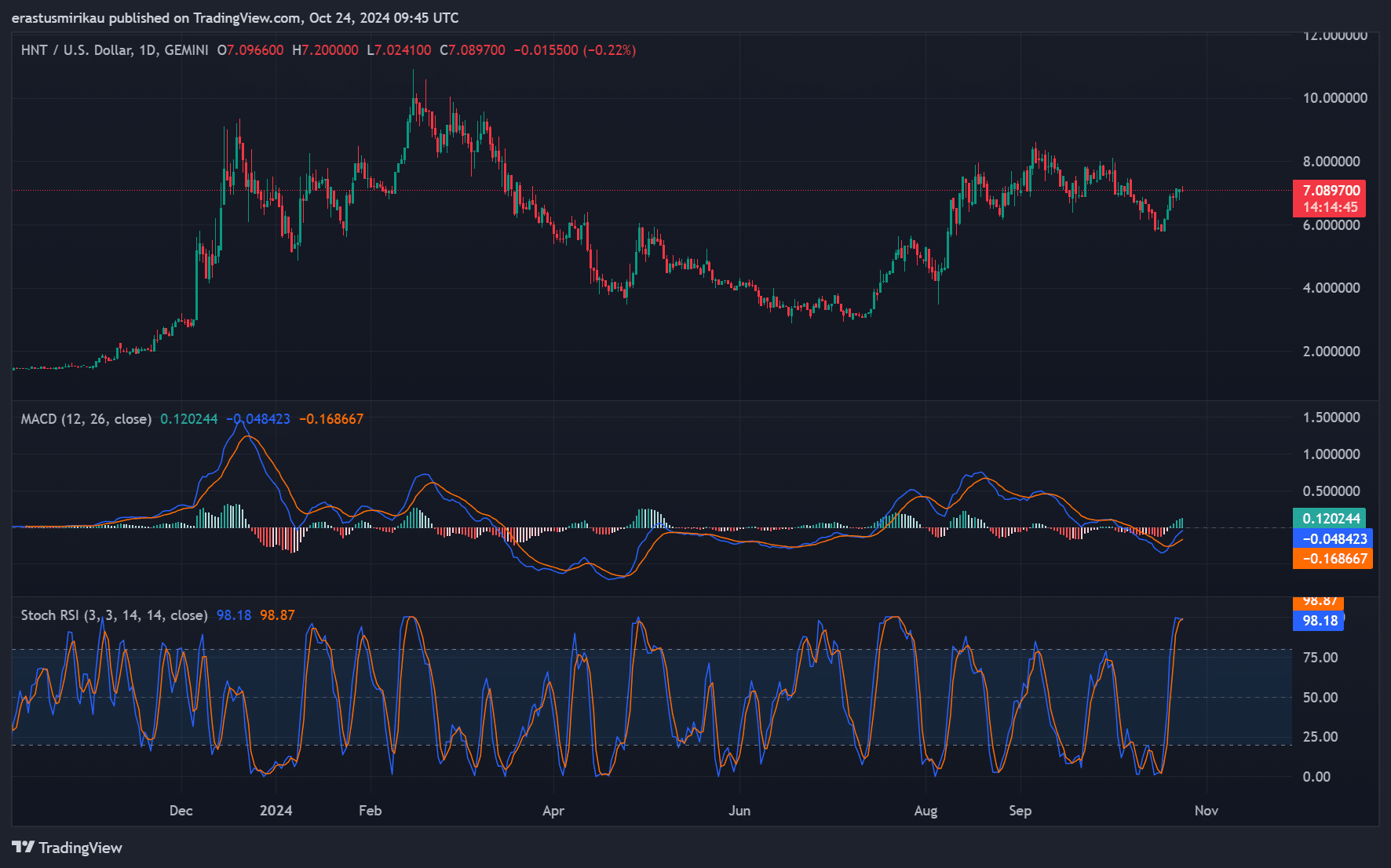

When analyzing technical indicators, the Moving Average Convergence Divergence (MACD) gives optimistic signs. Specifically, when the MACD line surpasses the signal line, it suggests a strong trend moving upwards.

Moreover, the histogram’s change to green strengthens the positive viewpoint. This upward trend might draw in more investors, fueling the market further.

Nevertheless, the Stochastic RSI presents a somewhat contrasting narrative. Currently in the overbought region at 98, it hints that HNT might experience a temporary dip before resuming its uptrend.

Even if the pullback is small, there’s a possibility that the market may experience another rise, thereby reinforcing the optimistic outlook.

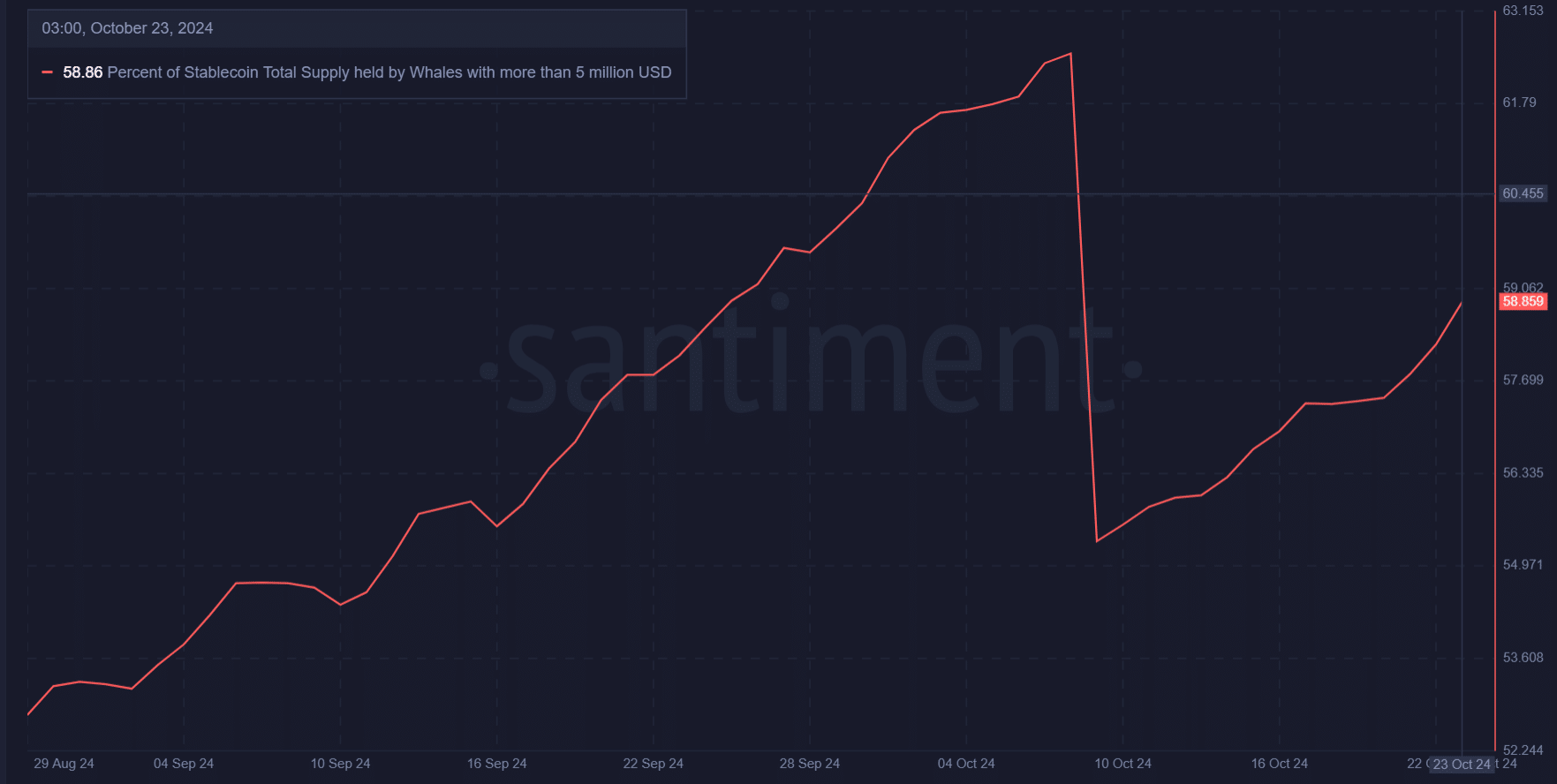

Whale accumulation: A sign of confidence?

Major financial backers are expressing enthusiasm for HNT, a trend that is evident through the significant ownership of over half (58.86%) of the total stablecoin supply by investors holding more than $5 million US dollars in assets.

As a researcher, I’m noticing an increasing stacking (or accumulation) of tokens by major players in this space, which implies a growing confidence in HNT. If this pattern persists, it might serve as a robust base for the potential price trajectory of Helium Network Token (HNT).

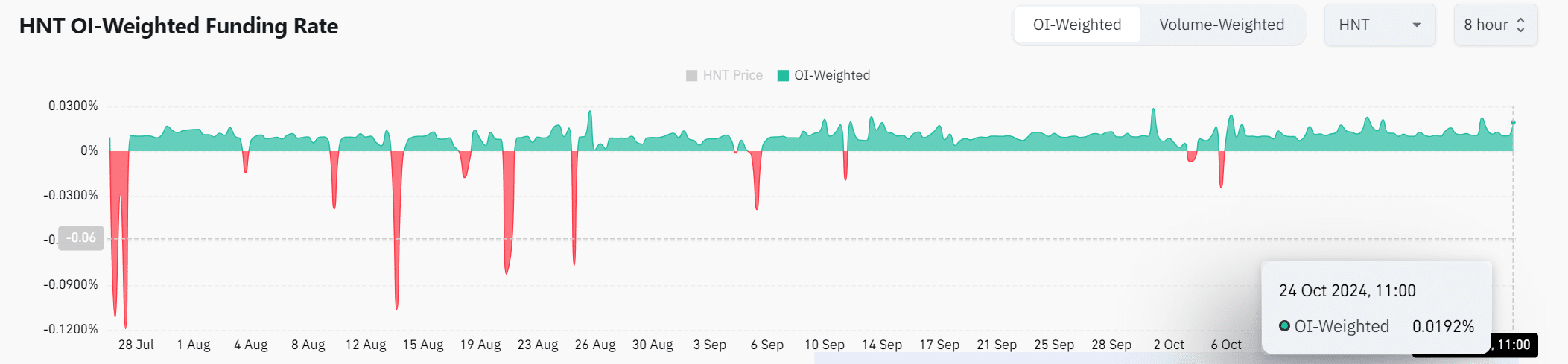

OI-Weighted Funding Rate: What does it reveal?

Among Futures traders, the rising bullishness is reflected in the Open Interest (OI) – Weighted Funding Rate of HNT, currently standing at 0.0192% as we speak. This suggests a growing optimism in the market.

This favorable Funding Rate signifies that a larger number of traders anticipate price rises, since they are prepared to pay to sustain their long-term investment positions.

Can HNT sustain its breakout?

Investors ought to exercise caution, as the high Stochastic Relative Strength Index (RSI) might indicate a temporary reversal or correction in the near future.

If Helium Network Token (HNT) manages to surpass the $8.00 barrier and maintain its position, it sets itself up for a potential significant increase, potentially reaching $9.00 or even higher.

Read More

- OM PREDICTION. OM cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- WWE’s Braun Strowman Suffers Bloody Beatdown on Saturday Night’s Main Event

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Christina Haack and Ant Anstead Team Up Again—Awkward or Heartwarming?

- Elevation – PRIME VIDEO

- Serena Williams’ Husband Fires Back at Critics

2024-10-24 19:38