-

A falling wedge pattern hinted at a 214% rally for INJ, according to crypto analysts.

On-chain data showed that 67.32% holders were awaiting a breakout.

As an experienced crypto investor who has weathered multiple market cycles and navigated through various trends, I can’t help but feel a sense of optimism when looking at Injective [INJ]. The falling wedge pattern suggested by Captain Faibik and the consolidation above the middle Bollinger Band are strong bullish indicators that could potentially lead to a 214% rally.

Recently, Injective (INJ) has been attracting significant interest, as it appears to be shaping a potentially bullish trend that could soon materialize.

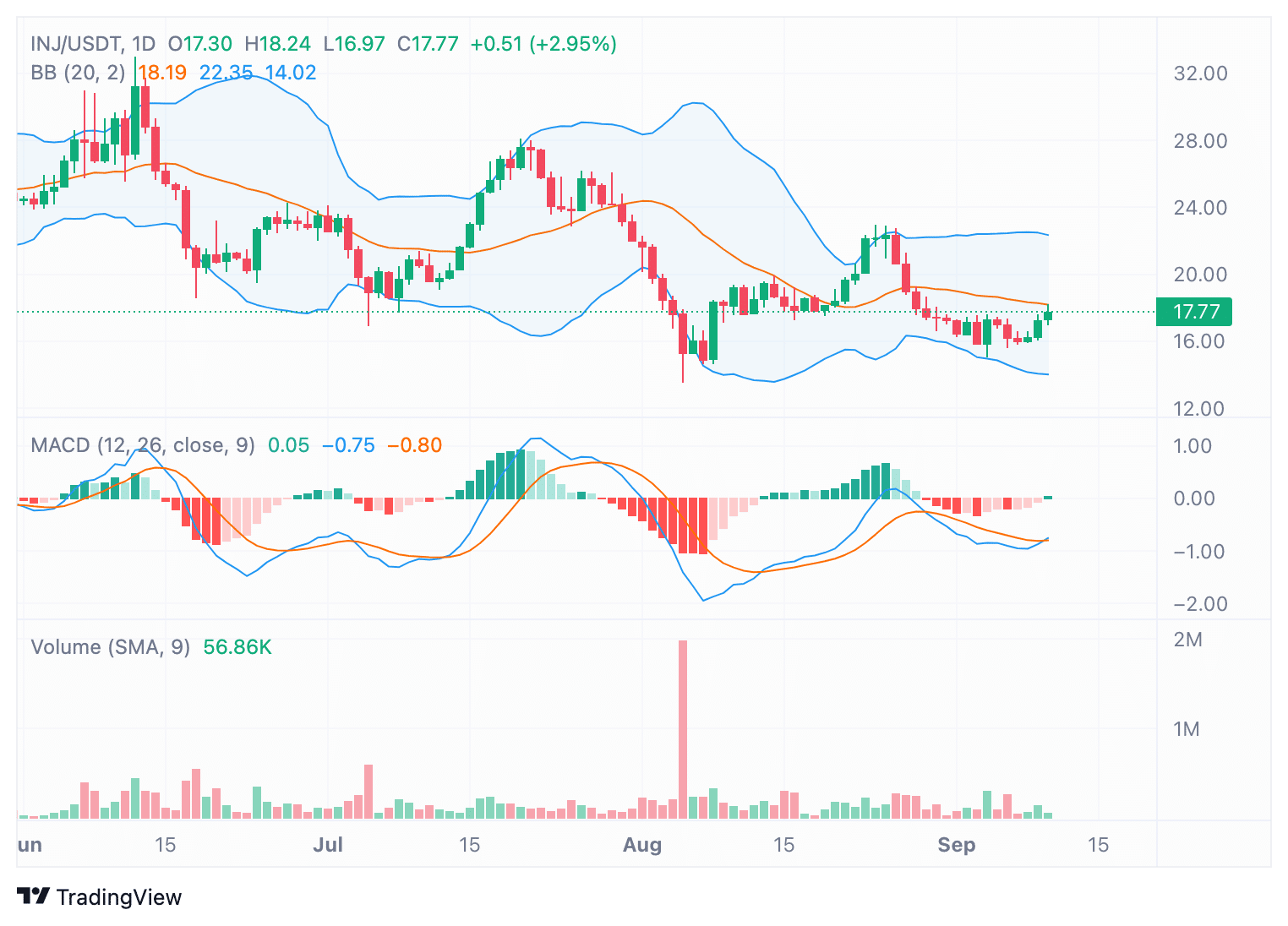

At the moment of reporting, the value of INJ was $17.77, marking an 8.08% jump in the last 24 hours and a 5.04% growth over the previous week.

The market capitalization stood at $1.73 billion, with a circulating supply of 98 million tokens, indicating increased interest in the asset.

Moreover, crypto expert Captain Faibik has noticed a descending triangle structure on the 3-day graph, indicating that a potential breakout might trigger a 214% surge in price.

The particular pattern, often regarded as a positive signal, continued unchanged, and the analyst underscored the need for investors to exercise patience.

INJ signals consolidation

From my perspective as a crypto investor, I noticed that according to AMBCrypto’s analysis, Injective (INJ) seems to be stabilizing above the midpoint of the Bollinger Band, which stands at approximately $17.77 on the daily chart. This could indicate potential consolidation or sideways movement in the near term.

In simpler terms, the shrinking Bollinger Bands indicate reduced market volatility in recent periods. This might mean that the asset is building up power for a possible price change.

In simpler terms, the MACD line (which is blue) moved slightly higher than the signal line (orange), indicating a positive or ‘bullish’ trend.

Despite the positive indication, the MACD line was hovering near a neutral position, implying that the trend was not yet fully established.

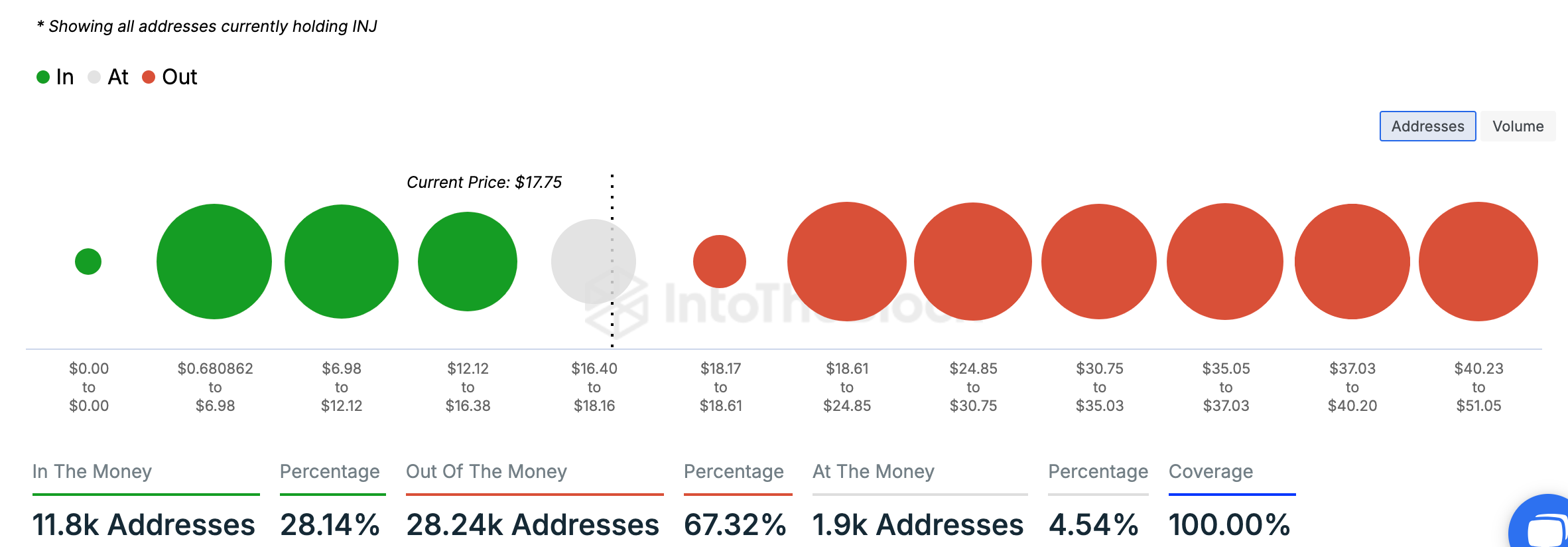

At the current moment, information from the blockchain indicates a somewhat ambiguous situation for INJ owners. As we speak, approximately 28.14% of wallets are in profit, as they bought INJ when its price was below the present $17.75 mark.

Nevertheless, around two-thirds (67.32%) of the addresses had not yet reached their break-even point, as they had purchased at relatively higher prices, primarily between $18.61 and $24.85.

Even though there were some challenges, it was found that the highest number of profitable purchasers bought INJ within the price range of $6.98 to $12.12. This suggests that a significant group of investors continued to be hopeful about INJ’s potential.

Approximately 4.54% of the locations were close to breaking even, which adds more credence to the notion that this asset might be gearing up for a significant shift or change.

DeFi activity and market liquidity

According to DefiLlama’s data analysis, the total value locked within the Injective platform stands at approximately $37.06 million. Notably, stablecoins make up about 60% of this figure, amounting to roughly $22.45 million.

Read Injective’s [INJ] Price Prediction 2024–2025

Over the course of 24 hours, the trading platform recorded a volume of approximately $10.75 million, while also receiving around $133,190 during this timeframe.

This shows a continuous curiosity towards INJ in the Decentralized Finance (DeFi) sector, potentially driving the expected surge.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-09-11 12:07