-

The worth of Bitcoin held by the company jumped to $573 million from $220 million.

Dorsey opined that BTC was not a speculative asset like other cryptos, hence the decision to stick to it.

As a researcher with a background in finance and technology, I find Block’s decision to increase its Bitcoin investment fascinating. With Dorsey’s strong belief in the value of Bitcoin as more than just a speculative asset, it makes sense for the company to dedicate a larger portion of its profits towards buying more BTC.

Each month, Jack Dorsey’s fintech firm, Block, sets aside a tenth of its earnings from Bitcoin [BTC] offerings to purchase more crypto.

In my analysis of the Q1 shareholder report released by the company lately, I discovered that they initiated investments in Bitcoin back in 2020. I’ve observed Dorsey’s public affinity for Bitcoin since then.

During that period, some of his online content caused users to label him as a staunch supporter of Bitcoin. Yet, it wasn’t until the year 2020 that Jack Dorsey, the person in question, introduced Bitcoin-centric offerings.

“3% is not enough”

In 2018, I became one of the pioneering investors as the first public company to introduce offerings related to Bitcoin. Nevertheless, according to Block’s annual report, a relatively minor portion of our resources was allocated towards developing these Bitcoin-related products. The report stated, “Only a small team and budget were dedicated to our Bitcoin initiatives.”

As a researcher examining the company’s budget allocation, I discovered that only a minimal proportion, roughly 3%, is set aside for Bitcoin-related initiatives. Notably, these projects have been entirely funded by the profits generated from our Bitcoin exchange, which ranks as Cash App’s fourth most significant revenue source.

As a financial analyst, I would describe Block, formerly known as Square, as the company that owns CashApp and functions as a peer-to-peer payment system. With approximately 21 million active users, CashApp has made significant strides in enhancing global remittances since integrating Bitcoin into its platform. In simpler terms, by adding Bitcoin to CashApp, Block has expanded its reach and facilitated more efficient cross-border money transfers for millions of its users worldwide.

As a researcher, I’ve discovered that Block’s Bitcoin investment experienced a significant growth of 160% in 2020. Initially, the firm invested $220 million in this digital asset. Now, its value has escalated to an impressive $573 million.

In his letter, Dorsey outlined that the company’s significant expansion was among the factors motivating it to allocate a tenth of its earnings towards cryptocurrency investments.

“In addition, we hold the belief that contributing to the value of the bitcoin ecosystem is essential. Starting this month, we will allocate a tenth of our monthly profits generated from bitcoin-related offerings towards purchasing more bitcoin.”

Currently, Block’s significant investment lies in Bitcoin. Yet, it remains unclear whether the team intends to include other cryptocurrencies in their investment holdings.

It’s worth noting that Dorsey’s preference for Bitcoin over other cryptocurrencies may come as a surprise, given his past statements and the current high value of Bitcoin at approximately $64,142.

Last year, there was a staggering 118.87% rise in price. If the value of that coin reaches $73,000 once more, Block’s Bitcoin holdings would exceed $600 million.

As a crypto investor, I’m excited about Block’s latest announcement, which underscores the growing trend of institutional adoption of Bitcoin and cryptocurrencies at large. For instance, Microstrategy, under the leadership of Michael Saylor, has boldly increased its Bitcoin holdings not once, but twice. This move demonstrates their confidence in the long-term potential of digital assets.

Elon Musk leads Tesla, and the company announced that it hasn’t offloaded any Bitcoin recently. If institutions choose to keep holding this cryptocurrency, there’s a strong possibility of significant price increases in the future.

Additionally, Block’s monthly purchases of cryptocurrency could potentially result in significant gains.

CashApp plays its part; the firm targets mining

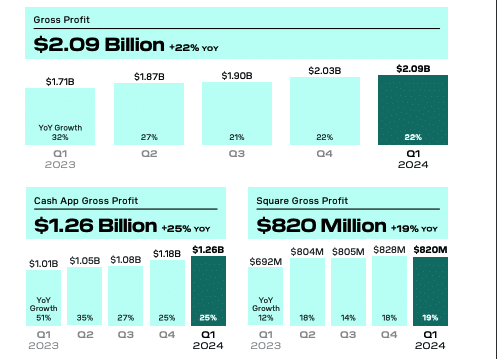

As a researcher, I’ve discovered that CashApp, which is Block’s primary offering, significantly contributed to the company’s revenue growth. The recent financial report indicates a remarkable 22% increase in Block’s profits, reaching an impressive figure of $2.09 billion.

An analysis revealed that CashApp, a subsidiary of Square (part of Block Inc.), brought in a total of $1.26 billion. Additionally, Square itself reported generating earnings amounting to $820 million.

As an analyst, I’d interpret this as a significant 19% growth when comparing the current quarter to the previous one. Additionally, the financial report disclosed this information.

As a researcher analyzing the financial performance of a company in the first quarter of 2024, I discovered significant improvements across all profitability measures. The operating income amounted to $250 million, representing an increase compared to the previous period. Additionally, Adjusted Operating Income reached an impressive level of $364 million. The net income attributable to common stockholders totaled $472 million, and the Adjusted EBITDA came in at a substantial $705 million – marking a 91% rise year over year.

If Block continues to earn such consistent income, there’s a possibility that the 10% allocation for investments may grow.

Is your portfolio green? Check the Bitcoin Profit Calculator

Beyond this investment, Block indicated that they were also developing custom chips for the purpose of Bitcoin mining. To summarize, the company stated that their objective to establish an open standard for digital currency may prevent them from exploring other cryptos.

“What sets Bitcoin apart from other cryptocurrencies? Satoshi Nakamoto developed Bitcoin specifically to address a unique payment issue, and its value in addressing this concern has since been recognized worldwide. In contrast, most other projects focus on resolving distinct problems or serve as potential investment assets.”

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-05-07 01:12