-

Rising accumulation could validate LTC’s move northward.

Most holders refrained from selling, indicating a possible rise above $180.

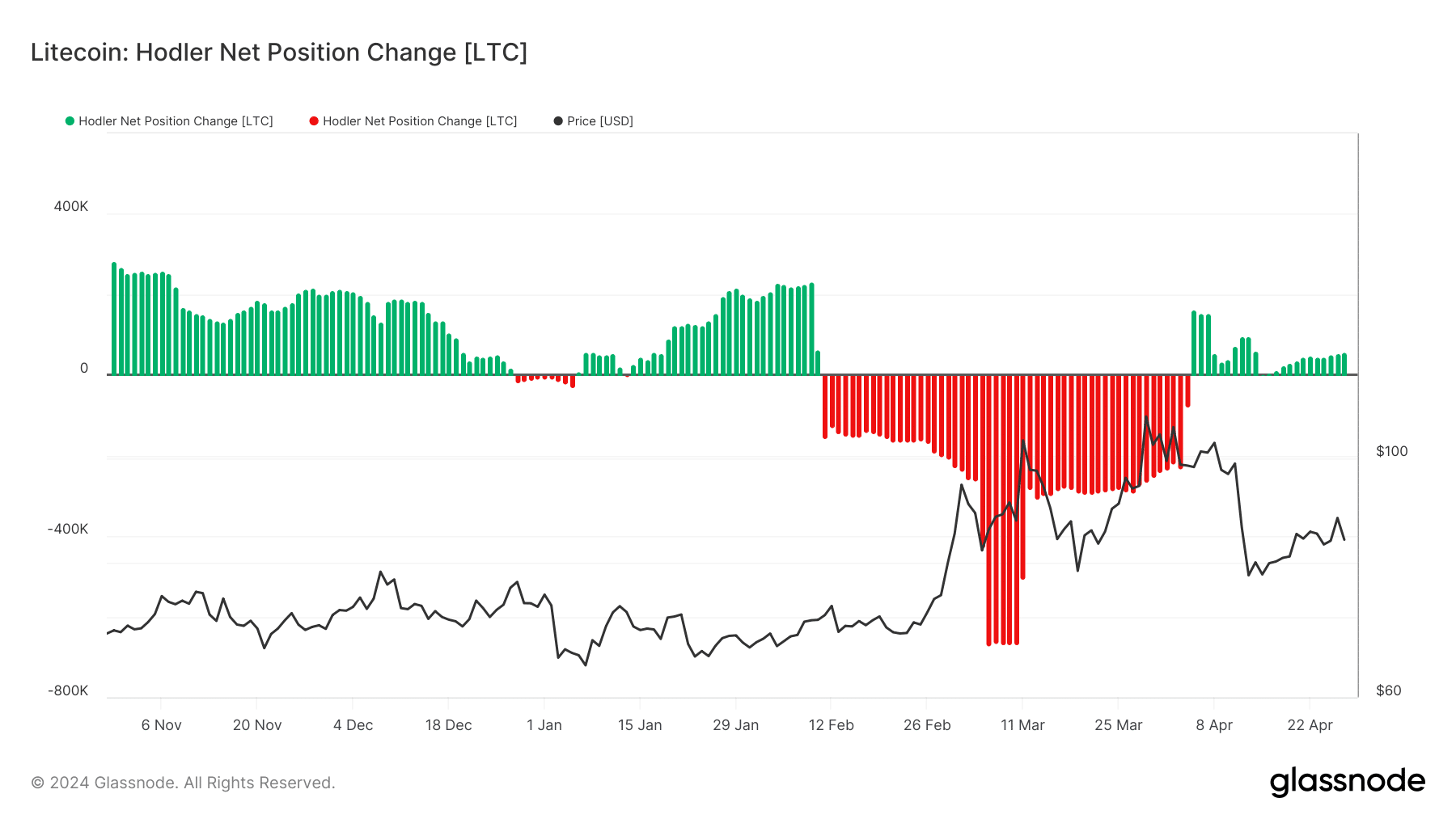

In April, the crypto market, including Litecoin (LTC), experienced significant shifts. However, let’s focus on the Hodler Net Position Change, which indicates investors’ behavior.

As a researcher studying the crypto market in April, I’ve observed significant shifts for a considerable portion of the market, including Litecoin [LTC]. It’s essential to note that these changes weren’t limited to price fluctuations. Instead, the Hodler Net Position Change saw a notable rotation during this period.

As an analyst, I’ve observed that a negative reading for this metric implies investors are selling off their assets. On the other hand, a positive value suggests they are buying and accumulating more coins. Based on my analysis of Glassnode data from AMBCrypto, long-term holders purchased approximately 57,095 coins on the 27th of April, as indicated by a positive Hodler Net Position Change.

No more cash-out

Starting from the second week of February until the end of March, I noticed a consistent downturn in this important metric for Litecoin (LTC). This trend left me and other investors questioning Litecoin’s potential as a top-performing altcoin contender for the upcoming months.

As a crypto investor, I’ve noticed that Litecoin’s net position change has remained consistent since April 5th. If this trend continues with more accumulation than cash outs, Litecoin could potentially buck the bearish trend and lean towards a bullish outlook.

At the current moment of reporting, Litecoin was being traded at $18.37, marking a 18.42% drop over the past week. Although AMBCrypto proposed a potential rise to $110 in the near future, Litecoin could potentially soar beyond that price point within the upcoming months.

The bulls are preparing

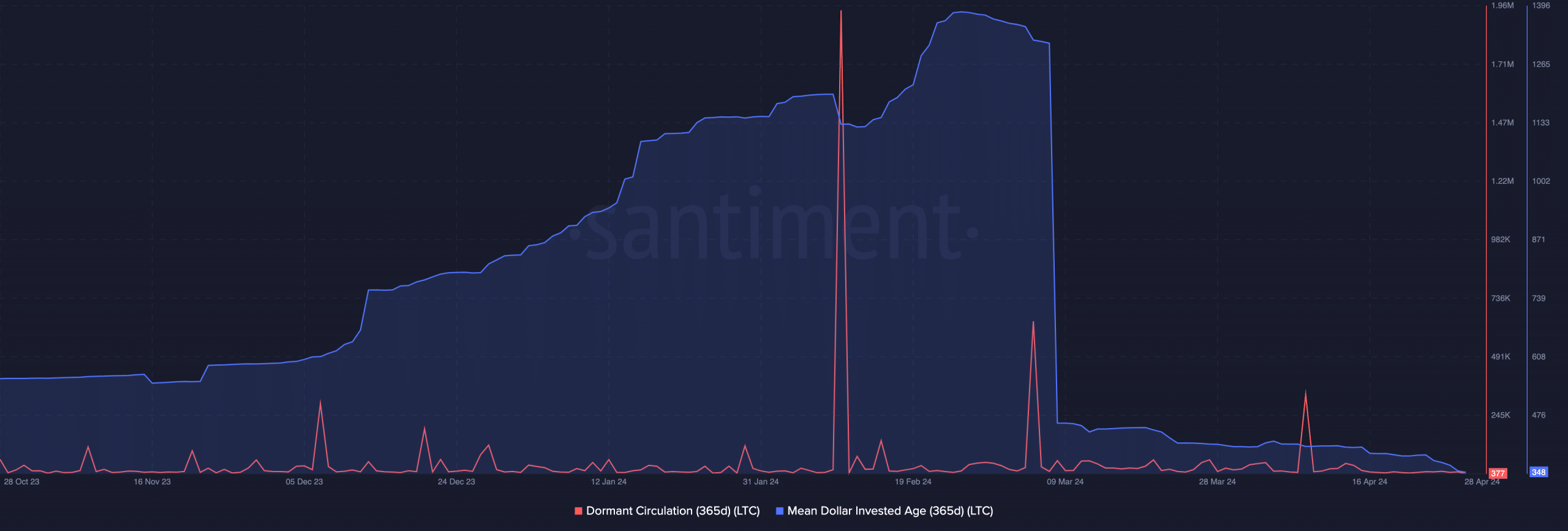

In order to provide some perspective, we examined various factors that might influence the cryptocurrency’s performance over the long run. Initially, we looked at the amount of coins that were not in circulation, which is referred to as dormant circulation.

This on-chain indicator monitors the count of distinct cryptocurrencies that have lain dormant for an extended period but became active in daily transactions. Typically, surges in inactive coin circulation are preceded by price declines.

As an analyst, I’ve observed that the longest period without any transaction activity on the Litecoin network lasted for 365 days, which is the minimum since 9th of April. This observation implies that a significant number of long-term holders are likely to be holding onto their coins rather than selling them at current low prices.

As an analyst, I would interpret this as follows: The Mean Dollar Invested Age (MDIA) reached a record low of 348 days for me. This metric represents the average age in dollars of all the cryptocurrencies being analyzed based on their purchase prices.

As an analyst, I would interpret a decrease in the average age of Litecoin investments as a potential indicator of an upcoming bull run. Conversely, an increase in the average age would have suggested that the coin might be nearing a local top.

While it’s true that the anticipated bull market doesn’t assure a price surge of LTC to $400, it’s essential not to overlook the recent fluctuations in its value. The coin has been traded between the ranges of $180 and $250.

Read Litecoin’s [LTC] Price Prediction 2024-2025

Despite the seemingly linear upward trend, it’s essential to remember that if LTC experiences a surge, a correction could occur at an unexpected juncture.

If the price of the coin falls below $84, it may attempt to decrease further before experiencing significant growth towards doubling or tripling in value.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-04-29 08:07