-

MATIC has surged 12.5% at press time, with analysts predicting a potential 450% rally.

Despite growing investor interest, MATIC’s overbought RSI suggested possible short-term risks.

As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I find myself intrigued by the recent surge of MATIC. Having weathered multiple bull and bear markets, I can’t help but feel a sense of cautious optimism about this potential 450% rally predicted by analysts like Javon Marks.

2021 has been a tough ride for MATIC (Polygon), as it hasn’t performed as well as its major crypto counterparts in terms of market capitalization rankings.

Despite significant growth in many key assets, even doubling in value for some, MATIC experienced a decrease of 3.5% over the same timeframe.

Lately, there seems to be a hint of changing trends as evidenced by recent advancements. In just the last 24 hours, MATIC‘s value has surged by an impressive 12.5%, currently sitting at $0.5303 per unit.

Remarkably, this surge stood out because the value of the token had been quite low recently, dipping as low as under $0.400 just a few days ago in this month.

MATIC: 450% rise coming?

Analysts have taken notice of the latest changes in pricing, and one notable cryptocurrency expert, Javon Marks, has expressed a positive perspective regarding MATIC on platform X (previously known as Twitter).

Marks pointed out that MATIC was beginning to show “major strength” and suggested that the token could be on the verge of a substantial rally.

The digital currency equivalent to Bitcoin might reach unprecedented peak values, possibly surging more than fourfold from its current value at the moment.

The optimistic outlook on MATIC was reinforced even more when Marks presented a chart depicting it as part of a widening trend channel or pattern.

In simpler terms, this technical structure is frequently viewed as a bullish progression pattern, suggesting that MATIC might be gearing up for a substantial price rise.

Fundamental analysis

To determine if MATIC has the potential for a strong upward trend, AMBCrypto examined its core strengths.

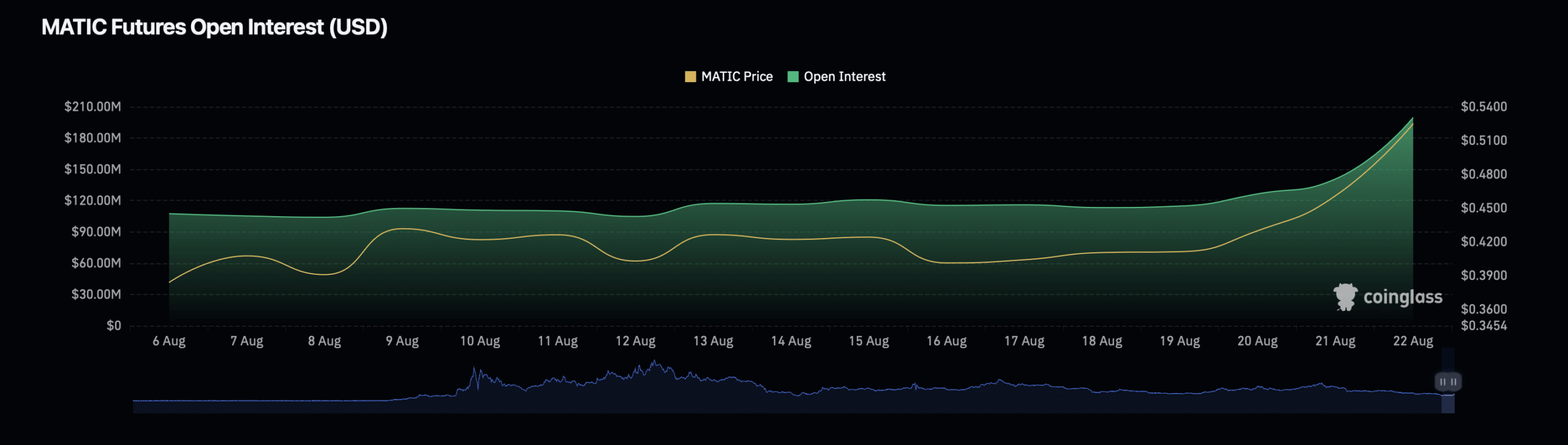

One such level is the surge in Open Interest, which refers to the total number of outstanding derivative contracts for the asset.

Based on information from Coinglass, the Open Interest for MATIC saw an approximately 40% rise in the last 24 hours, with its current market value standing at about $209.39 million.

Additionally, it’s worth noting that the Open Interest volume has experienced a significant increase of approximately 216%, currently standing at a value of around $1.30 billion.

The rise in Open Interest and trading activity indicates a surge in investor enthusiasm and active involvement within the MATIC market.

When the Open Interest increases together with the price, it usually means fresh funds are entering the market, potentially causing further price growth.

As a crypto investor, I should mention that rising Open Interest could indicate a bullish trend, but it might also trigger higher market volatility – particularly when traders are using significant leverage. This means the price swings could be more dramatic, potentially leading to increased risk.

In other words, there’s still a chance for more growth, but it comes with a higher likelihood of significant fluctuations in the price, up or down.

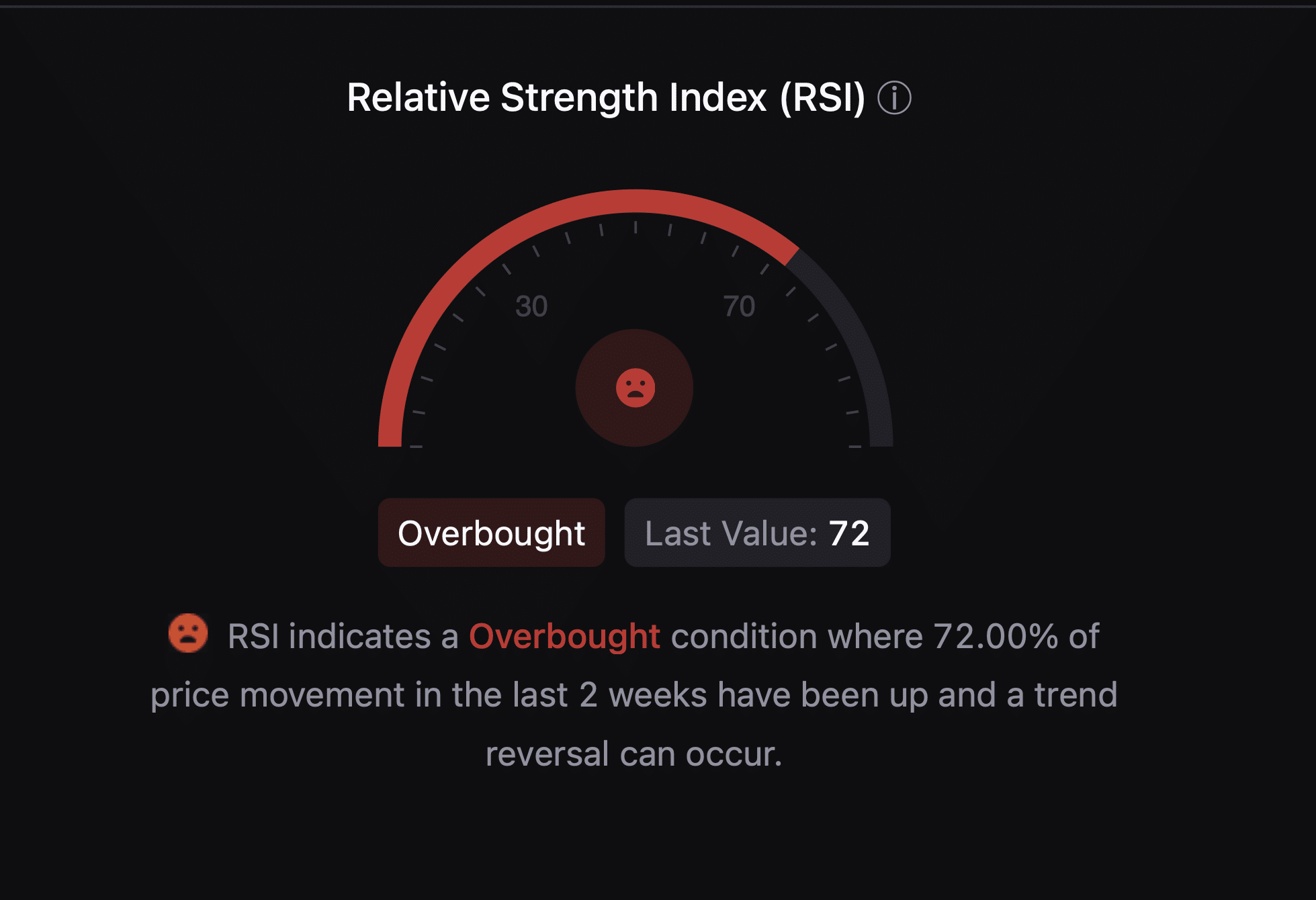

Another critical metric to consider is the Relative Strength Index (RSI), which measures the speed and change of price movements.

In simple terms, when the Relative Strength Index (RSI) of an asset exceeds 70, it usually means the asset has been bought too much and may be due for a correction, whereas if the RSI falls below 30, it could indicate that the asset is undervalued and might see an increase in buying activity.

Based on statistics from CryptoQuant, it appears that the RSI for MATIC stands at 72 as we speak, indicating that the token has moved into an area where it’s considered to be overbought.

Traders frequently employ the Relative Strength Index (RSI) as a tool to determine if an asset has been pushed too far in one direction and might soon require a pullback or correction.

For MATIC, an overextended Relative Strength Index (RSI) implies that despite its recent significant growth, a temporary downward force might emerge in the price if traders decide to cash out their earnings.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- BLUR PREDICTION. BLUR cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

2024-08-23 03:36