- A trendline break positioned NEAR for a $20 all-time high comeback.

- Surging volume and fees boosted NEAR’s momentum.

As a seasoned crypto investor with a knack for spotting promising projects, I find myself captivated by NEAR Protocol [NEAR]. With its impressive technology and backing from industry giants like NVIDIA, it’s no wonder this blockchain is leaving competitors in the dust.

The NEAR Protocol (NEAR) is swiftly making its mark in the blockchain world, outpacing rivals such as Solana in terms of technological advancements and user acceptance.

NEAR stands out through advanced technologies like sharding, positioning itself among the most scalable blockchain platforms currently in existence.

Under the strong support of NVIDIA, one of the world’s top three companies, NEAR aims to become Ethereum‘s trusted partner. By addressing the balance between scalability, innovation, and practical use cases, it endeavors to bridge this gap in the industry.

Currently trading at $6.69, up 3.11% in the past 24 hours, NEAR boasts a 24-hour volume of $930.76 million.

Though currently 68.08% lower than its peak of $20.42 reached in January 2022, the protocol’s progress and growing market interest indicate a promising opportunity for further growth.

As more tools and features are added, making it increasingly valuable for artificial intelligence projects, experts predict that the value of NEAR could multiply significantly, potentially offering investors a return of up to fifteen times their initial investment, provided adoption continues to expand rapidly.

Key support and resistance levels

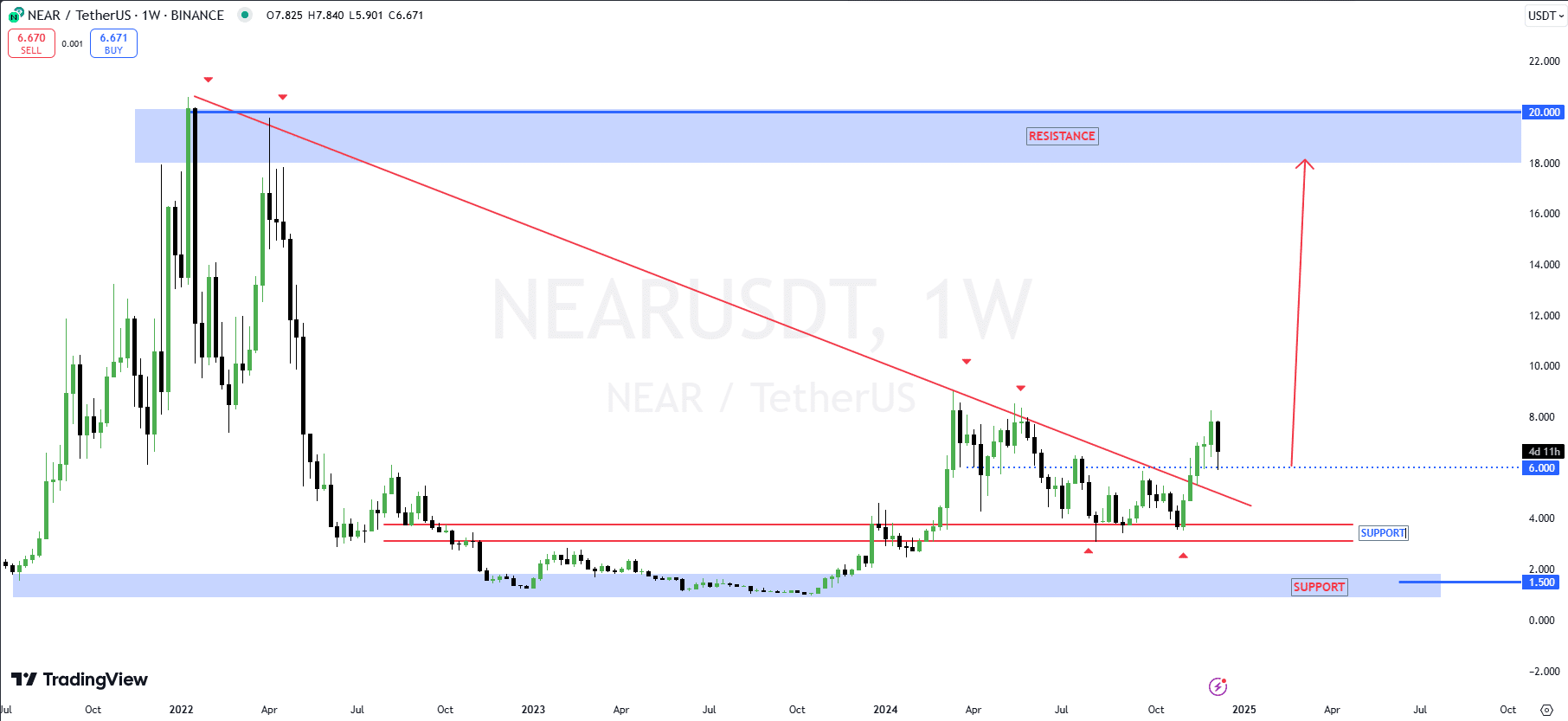

As a researcher, I’ve delved into an analysis of NEAR on a weekly basis, pinpointing crucial technical benchmarks and tendencies. The major resistance area hovers around the $20.00 mark, aligning with the previous all-time high achieved in early 2022.

As an analyst, I’ve noticed a significant change in the long-term trajectory of NEAR. Previously, there was a persistent decline indicated by a downward trendline, suggesting a bearish trend. However, it appears that this trend has been broken, implying a shift towards more bullish momentum.

On the other hand, the present price of $6.69 is lower than the nearby resistance area around $8.00. This conforms to the recent trend of price stabilization and increased selling activity.

On the downside, there appears to be significant backing around $6.00, slightly lower than the current value. This level aligns with earlier resistance that has now turned into support, serving as a crucial base for potential future uptrends.

Underneath the current level, there’s extra backing found approximately at $4.00, and a significant long-term support region can be found around $1.50, which coincides with past record lows.

Breaking through $8.00 with success might open up a possibility for another attempt at reaching $20.00. If we can’t sustain above $6.00, there could be a more significant adjustment heading towards $4.00, or potentially even as low as $1.50.

Momentum indicators signal reversal

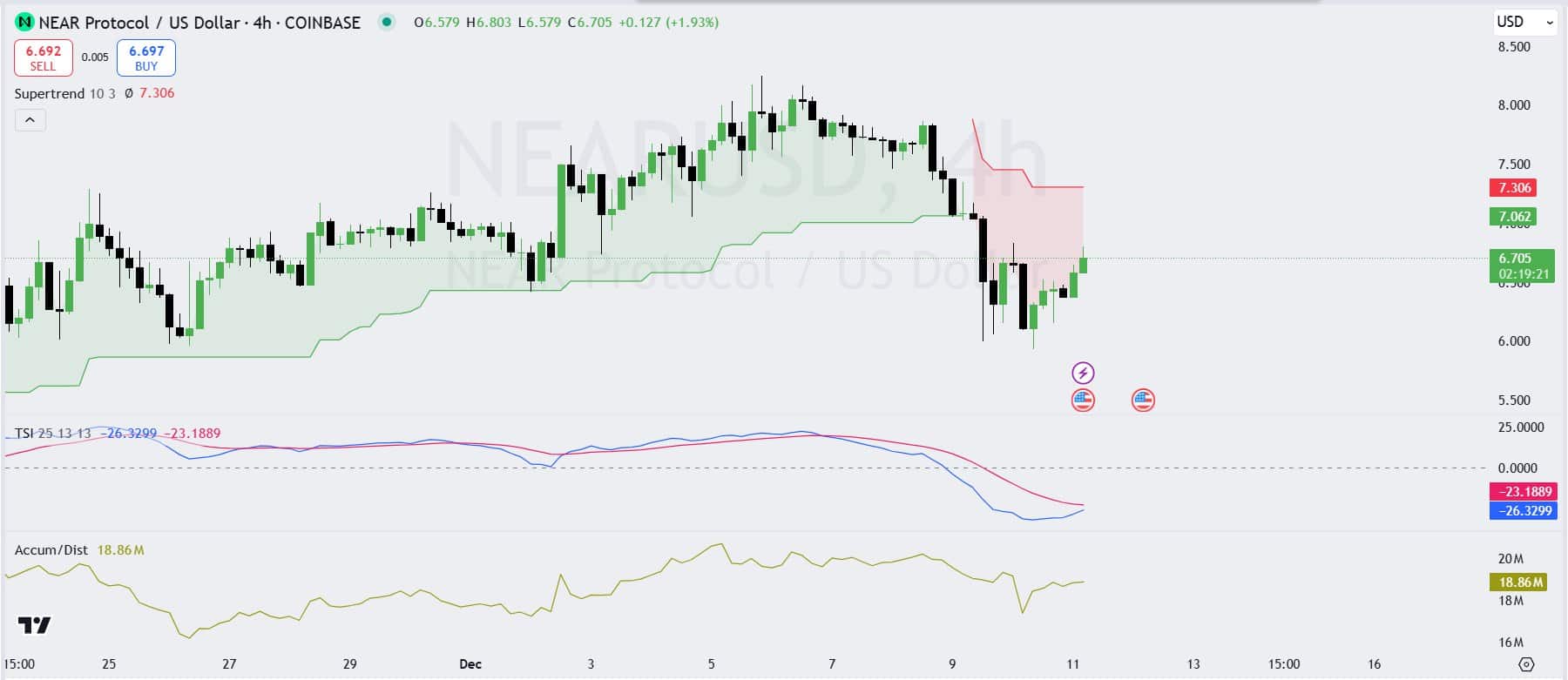

As a crypto investor, I’m closely watching the market trends, and right now, the Supertrend indicator is pointing towards a bearish inclination with a significant resistance level at approximately $7.306. Interestingly, the price has recently rebounded from lower levels around $6.57 and is currently testing the lower boundary of this bearish zone. This suggests that there might be potential resistance at this level, so I’m keeping a cautious eye on the price action here.

Maintaining a rise over $7.306 might indicate an increasing bullish trend. Yet, currently, there’s still more downward pressure.

The True Strength Index continues to show a negative reading, currently at -23.18 for the signal line and -26.32 for the momentum line. This signifies ongoing declining trends, but the shrinking difference between the two lines suggests that the bearish trend’s intensity may be decreasing.

Moreover, the Accumulation/Distribution Line stands at approximately 18.86 million, indicating a gentle buildup of holdings following recent price drops. This suggests a moderate level of purchasing activity, which, if validated by other signals, could potentially foster a rebound in prices.

Surge in NEAR’s volume and fees

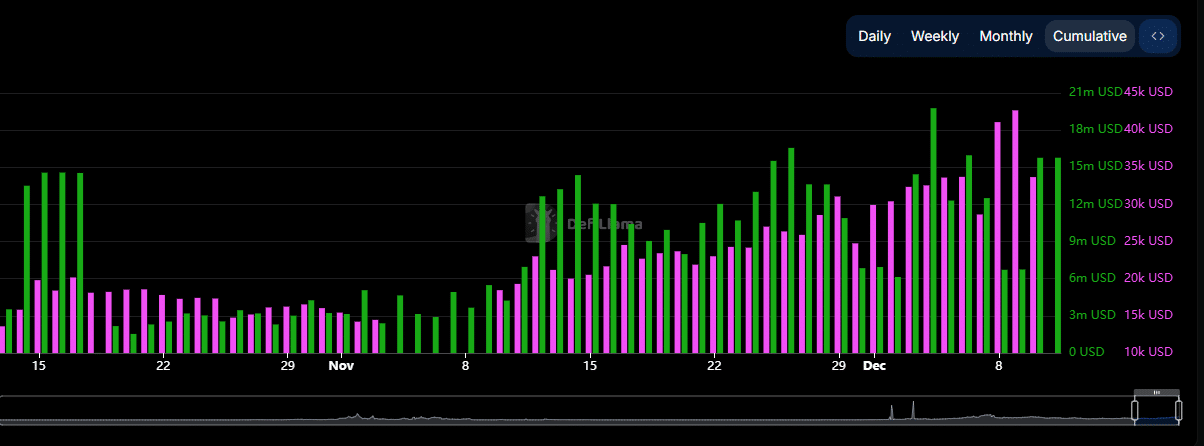

Initially, the green volume showed a modest level of action around mid-November, however, it rapidly increased substantially as we approached the end of the month, reaching its highest point in early December.

The increasing momentum in this area seems to be fueled by a surge in network activity, possibly due to the rising curiosity about NEAR’s scalability solutions and advancements within its ecosystem.

Significantly, the platform saw a surge in daily activity that topped $18 million, indicating robust user adoption and interaction.

The transaction fees (represented by red) mirrored a trend, continuously rising as the volume did. This suggests an upsurge in network usage and higher levels of on-chain engagement by users.

As a researcher, I’ve observed a correlation between network activity (volume) and transaction fees that suggests a thriving ecosystem. This is because transaction fees are intrinsically linked to the demand for transactions within the network.

Short and long Liquidations build…

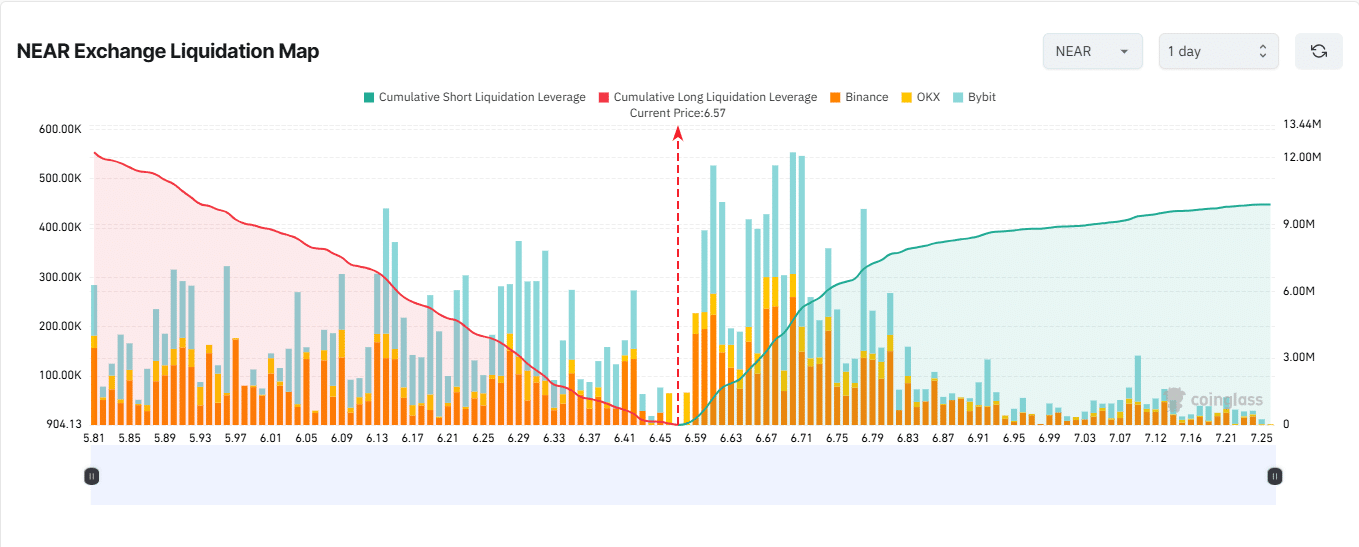

As a crypto investor, diving into the NEAR liquidation landscape provides valuable understanding about the distribution of leveraged positions and anticipated market fluctuations. At present prices, substantial liquidation points cluster together, with long green positions appearing unusually vulnerable, suggesting potential risks for investors.

The amount of accumulated liquidations rapidly increased from approximately $6.45, reaching nearly $6.67, representing around $9 million at potential risk. This trend indicates a dominant bullish sentiment among traders, who are aggressively taking on long positions in expectation of a price surge.

On the downside, or ‘short’ end (represented by red), liquidations gradually decreased as prices surpassed $6.45, eventually leveling off around $6.83. There are fewer short or bearish positions with leverage compared to long positions.

Read NEAR Protocol’s [NEAR] Price Prediction 2024–2025

This situation shows a delicate equilibrium between optimists (bulls) and pessimists (bears), such that an abrupt shift by either group might initiate a chain reaction of sell-offs or buy-ins, leading to increased market turbulence for a while.

Read More

- PI PREDICTION. PI cryptocurrency

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

2024-12-12 13:12