- ONDO declined by 9.55% over the past 24 hours.

- With strong bearish sentiments, an analyst foresees a drop to $1.05.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have seen my fair share of bull runs and bear markets. The current state of ONDO Finance [ONDO] is reminiscent of the turbulent times we’ve witnessed before.

Over the past week since reaching a peak of $2.1, Ondo Finance [ONDO] has found it challenging to keep its price trending upwards.

Over the last while, the value of ONDO, an altcoin, has dropped to $1.47. At the moment, it’s being traded at $1.51. This represents a decrease of 9.55% in the past 24 hours. Furthermore, on a weekly basis, its value dipped by approximately 19.70%.

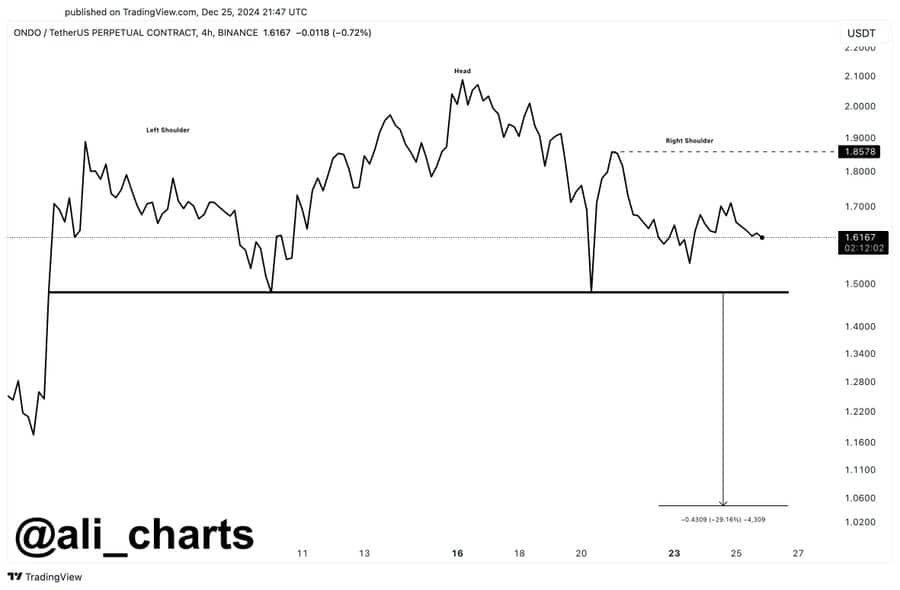

Currently, the crypto market is causing some uncertainty among its followers, who are anticipating a possible drop might continue. Notably, well-known crypto expert Ali Martinez proposes that the price could potentially dip down to $1.05 based on the head and shoulders charting pattern.

Market sentiment

According to Martinez’s interpretation, ONDO might be shaping into a head and shoulders chart configuration at the moment. If ONDO ends its day trading below $1.48, there’s a possibility of a 30% downward price adjustment, taking it down to approximately $1.05.

To clarify, the head and shoulders chart formation is a bearish indicator that suggests a possible downward trend following an uptrend. It’s like a warning sign for investors that the current rise in prices might be about to reverse direction.

When the price dips beneath the support level (neckline), it may signal a possible fall that is equivalent to the distance between the support level and the highest point above it (the head).

As a crypto investor, I find myself closely watching ONDO’s performance. For it to buck the bearish trend and stabilize, it needs to hold above $1.86 as support. If this level is breached, unfortunately, the altcoin may continue its downward trajectory.

ONDO: A look at the charts

While the previous analysis indicates a pessimistic forecast, it’s crucial to examine other market signals as well.

Based on AMBCrypto’s evaluation, ONDO appeared to be in a corrective stage at the moment, exhibiting dominant bearish tendencies.

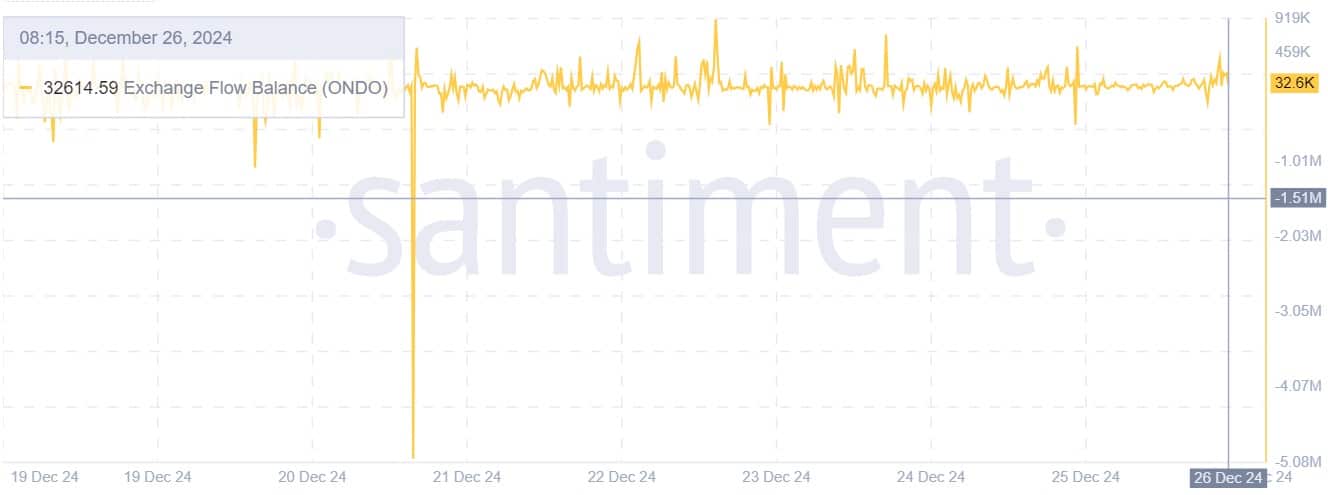

The increasing gap between trades and holdings on ONDO suggests a growing number of traders are moving their assets into exchanges, likely with the intention of selling or preparing for a sale.

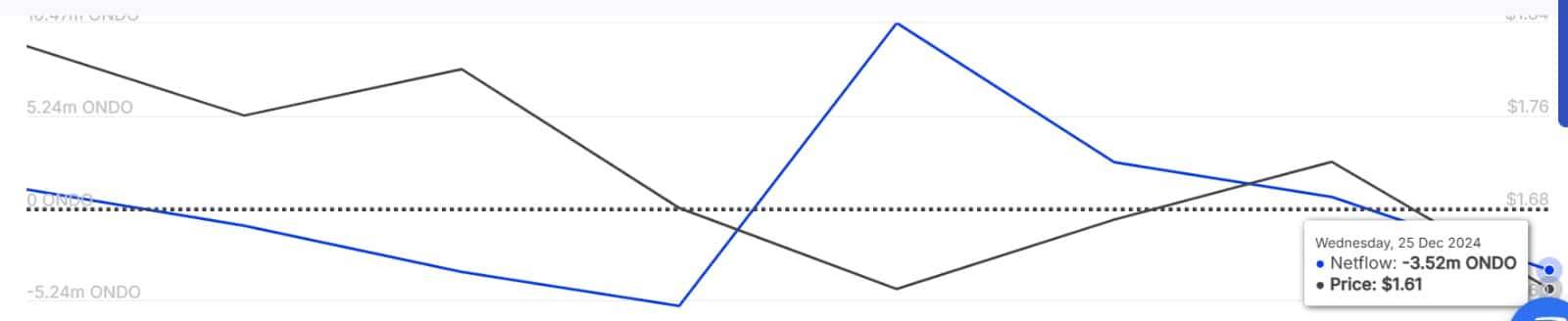

The trend towards trading activities is particularly noticeable among major investors. As reported by IntoTheBlock, the net outflow of coins from large holders has decreased significantly over the last week, amounting to approximately -3.52 million.

This shows that there’s more outflows from whales, compared to inflows.

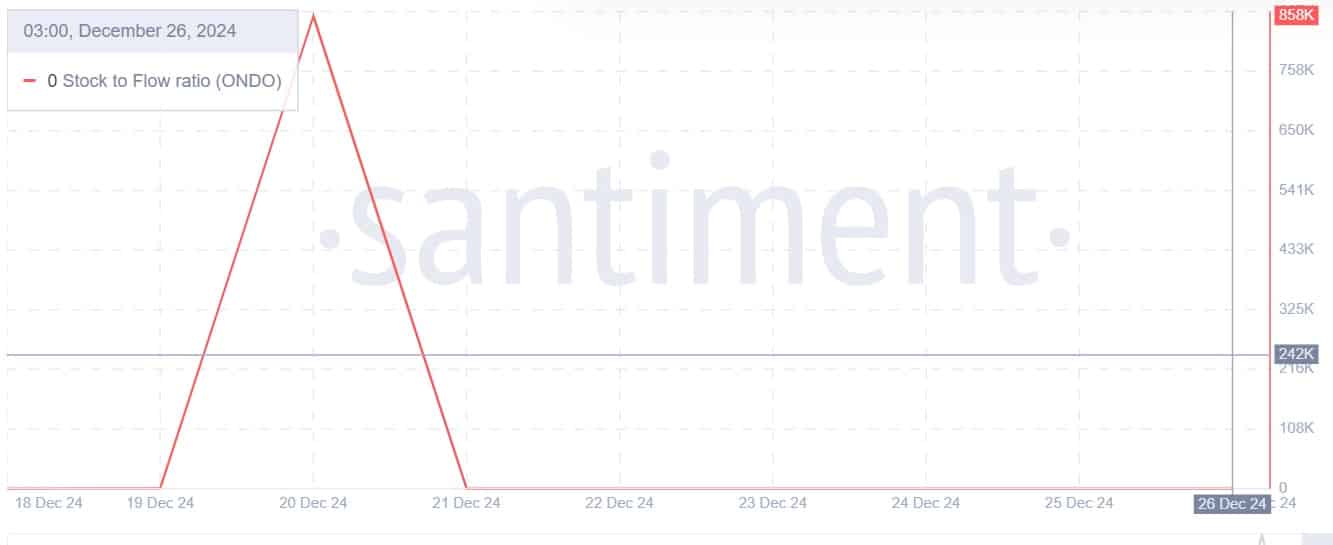

Moreover, there’s been a significant increase in ONDO’s Network Value to Transaction (NVT) ratio along with transaction volume recently, leading to worries about potential overvaluation.

This indicates reduced activity within the network, as there are fewer transactions taking place, fewer active wallets, and a decrease in overall network utilization.

Ultimately, the altcoin’s supply-demand ratio (stock-to-flow) suggests excess availability, reinforcing our previous finding that there’s been a rise in deposits into exchanges.

Read Ondo Finance’s [ONDO]Price Prediction 2025–2026

With ONDO being over-supplied, it risks further decline as it causes selling pressure.

Should the present market trends continue, it’s likely that the price of ONDO might stabilize near $1.04. On the flip side, if the trend changes direction, ONDO could regain its short-term value of approximately $1.7.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-12-26 13:43