- OP token was up 19% in the last 30 days but has shed 53% since the start of the year.

- Optimism concluded its fifth airdrop last week, with roughly 10 million OP distributed.

As a seasoned analyst with years of experience navigating the crypto market, I find myself intrigued by Optimism (OP). The token has shown impressive growth over the past month but remains in the red for the year – a rollercoaster ride that many of us crypto enthusiasts are all too familiar with.

As an analyst, I’ve found Optimism to be a remarkable Ethereum-compatible Layer 2 scaling solution that has stood out since its mainnet launch in December 2021. Glancing at DeFiLlama’s dashboard, it currently ranks as the fourth-largest L2 chain, with an impressive $688 million locked into its smart contracts at this moment.

Nevertheless, the token named after it has shown less-than-impressive results in the open market. Over the past four months, its value has remained relatively stable within a prolonged holding pattern.

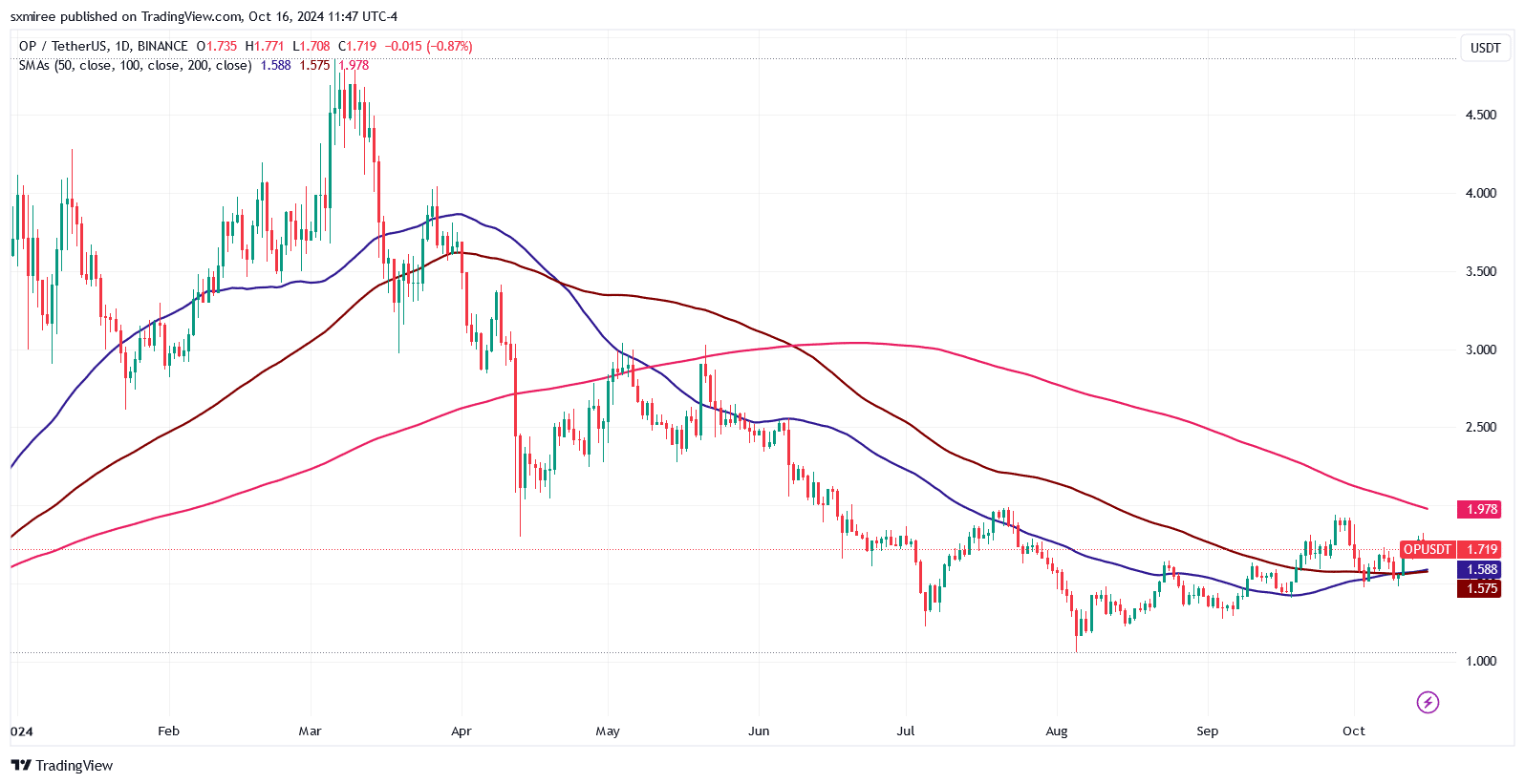

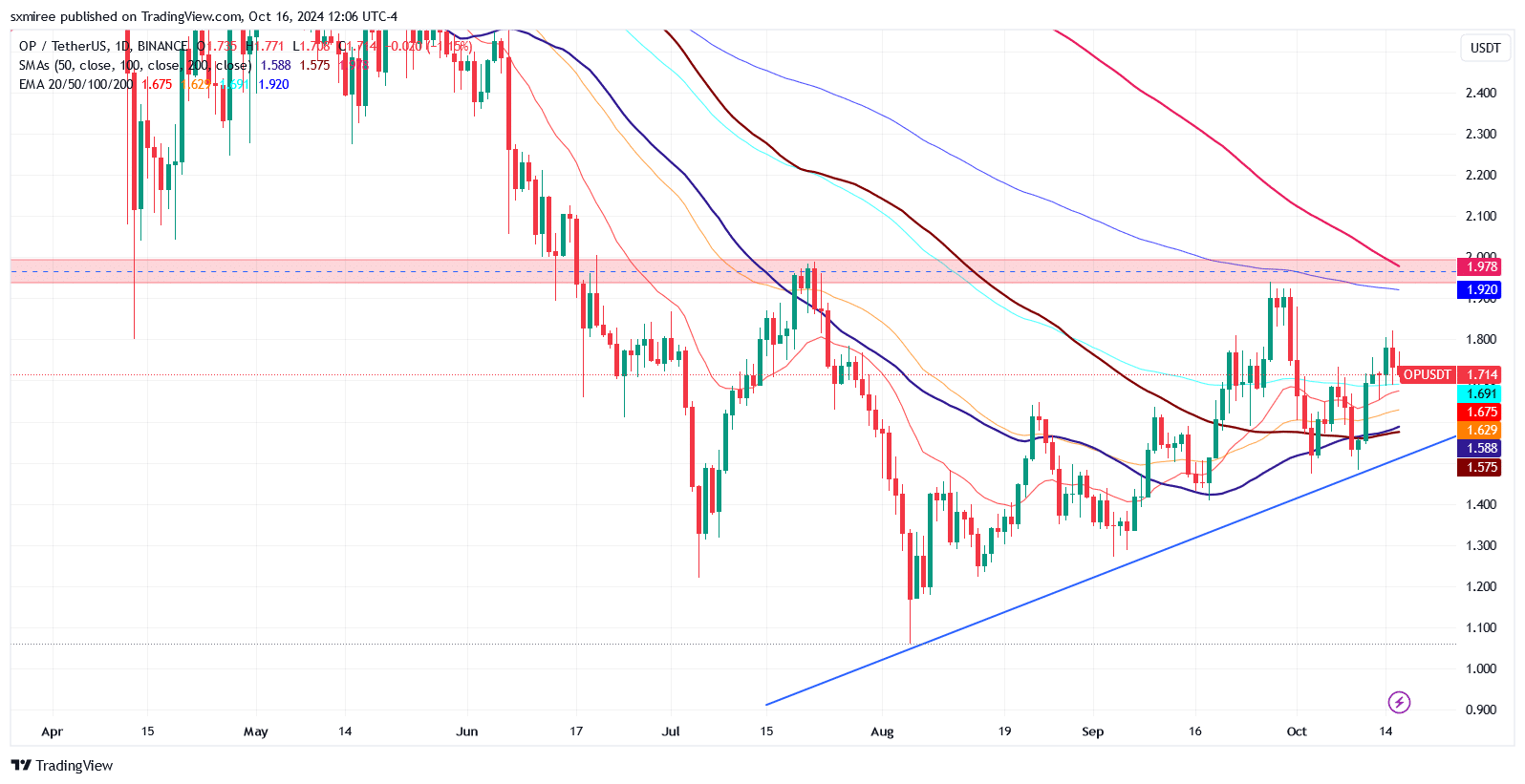

For shorter periods of time, both the Short-Term Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) were persistently lower than their 200-day averages, which indicates a continued downtrend or bear market condition.

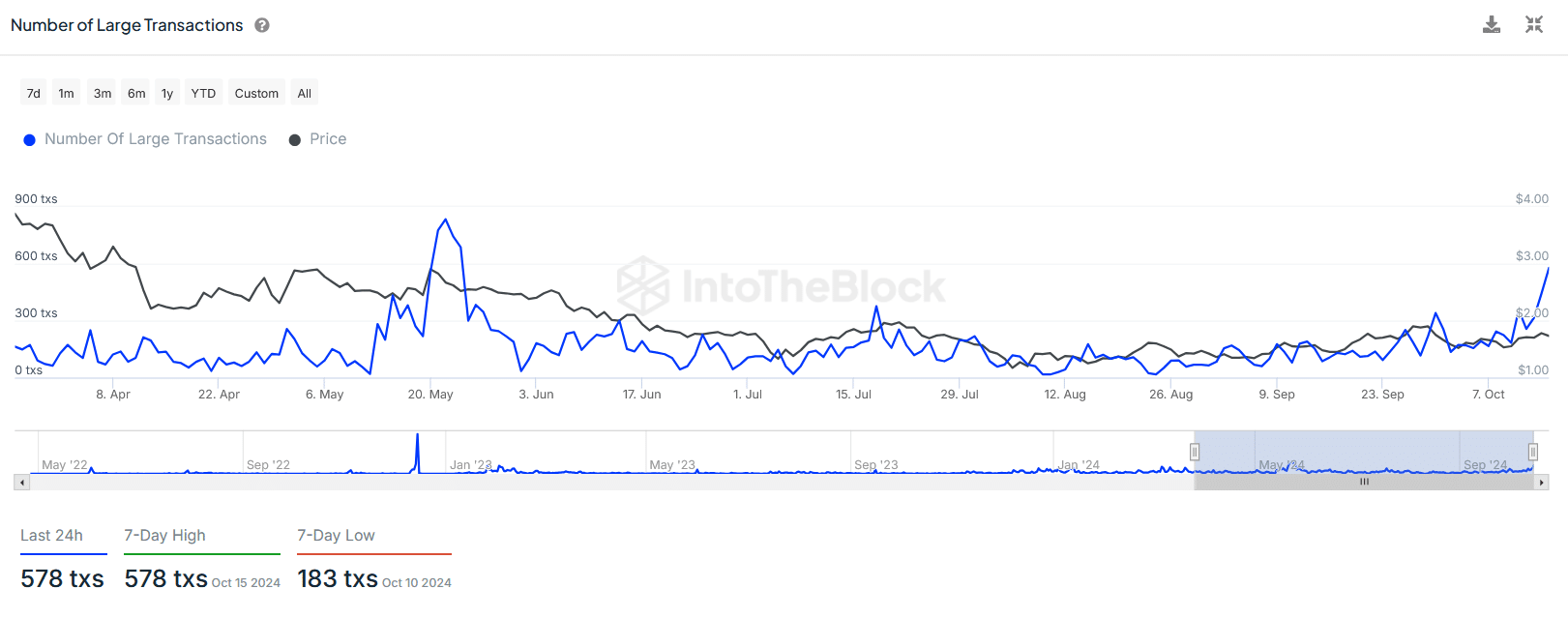

Despite the recent decline in prices, there’s been an uptick in on-chain activity as of late. For instance, the volume of significant transactions on the Optimism platform surged nearly to a five-month peak on October 15, based on data from IntoTheBlock.

This increase in significant transactions could indicate that wealthy investors might be strategically arranging their assets in preparation for forthcoming events, potentially predicting changes in the Open Price Market.

Optimism’s recent airdrop and upcoming token unlock

Over the past week, I’ve been excitedly participating in Optimism’s fifth airdrop, which distributed an impressive 10.3 million OP tokens to around 54,700 wallets. Initially launched with a total supply of 4.294 billion OP tokens, this platform had a bumpy beginning as its mainnet struggled under the heavy demand during the first airdrop, leading to performance issues. Despite these initial challenges, I’m optimistic about the potential growth and success of Optimism moving forward.

In June 2022, the Optimism Foundation dispersed 200.1 million OP tokens to approximately 248,699 unique recipients in an initial airdrop. The second distribution saw increased participation, with over 308,000 qualified addresses collectively receiving a total of 11.7 million OP tokens.

On October 31st, the monitoring tool Tokenomist indicates that there is a significant token release event planned for Optimism. Roughly 31.34 million tokens, equivalent to 2.5% of the total circulating supply of OP, will be distributed to investors and key contributors.

Can OP break out of its downtrend?

At the moment, optimism is priced higher at approximately $1.72, supported by a steadily rising trendline. This situation offers a potential chance for bulls of OP to test the resistance levels around $1.93 and $1.98. These resistance levels align with both the 200-day Exponential Moving Average (EMA) and Simple Moving Average (SMA), respectively.

As a crypto investor, I’m keeping a close eye on OP/USDT. For a clear breakout from its current trading range, it needs to convincingly surpass the significant psychological barrier at $2.00. Once that happens, if the price holds and starts to trend downwards, that level could potentially act as new support.

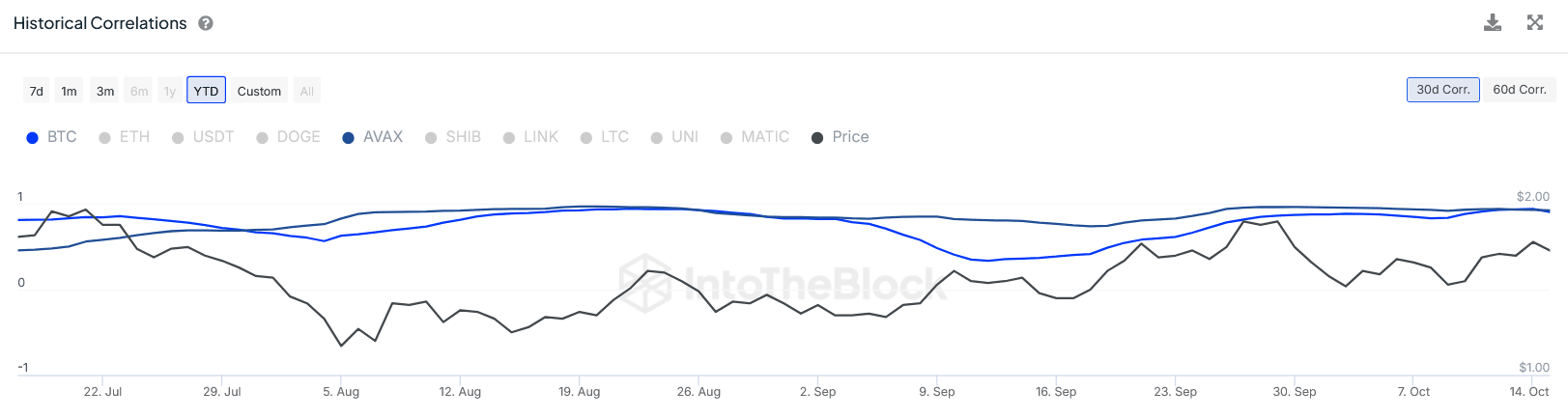

It’s worth noting that over the past month and half, OP’s price appears to have a particularly strong relationship with Avalanche (AVAX). This correlation seems more consistent than its correlation with Bitcoin (BTC), which has shown more volatility.

Realistic or not, here’s OP market cap in BTC’s terms

Two similar yet distinct Ethereum-compatible blockchain networks, Optimism and Avalanche, were developed with the aim of overcoming scalability issues. Despite this shared goal, they vary significantly in their structural foundations.

In simpler terms, Optimism boosts optimism through Optimistic Rollups, where multiple pieces of transaction data are combined into one transaction on the primary Ethereum network. Conversely, Avalanche operates independently as its own Level 1 blockchain, utilizing a unique consensus methodology.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

2024-10-17 11:04