Key Highlights

- In a most alarming turn of events, 263 million PI tokens shall be liberated in June, followed by 233 million in July and a further 132 million in August. One might wonder if the world is prepared for such a deluge!

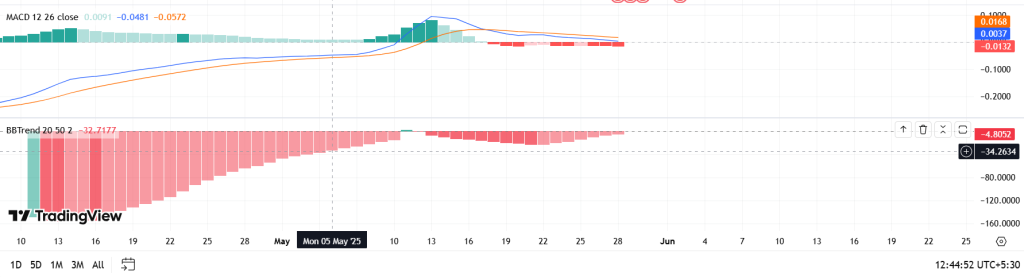

- Alas, the technical indicators remain decidedly bearish, with the BBTrend languishing at -34.26 and the MACD, that fickle friend, signaling a descent.

- The price, dear reader, hovers precariously near the support of $0.7411; the impending unlock pressure and the inflow of tokens to exchanges raise the specter of risk.

- Sentiment, it appears, is as mixed as a poorly made pudding: while some small investors cling to hope, the recent token unlocks and whispers of insider dealings have cast a pall over confidence.

Unlock Wave Builds as Demand Weakens

Our dear Pi coin finds itself trading at a critical juncture of $0.7411, amidst a veritable storm of token unlocks. The protocol, in its infinite wisdom, shall release 263 million coins in June, 233 million in July, and 132 million in August — a staggering total of over 1.5 billion tokens within the year. One can only hope the market is ready for such a bounty!

On-chain data reveals a troubling trend: more PI tokens are making their way to centralized exchanges, suggesting a potential sell-off as demand appears to wane. This unfortunate imbalance between the surging supply and the retreating buyer interest has rendered Pi rather vulnerable, much like a lone sheep in a field of wolves.

Insider Concerns, Rug Pull Fears, and Privacy Issues Add Fuel

Market sentiment has been further besmirched by concerns raised in a recent CCN report, which hints at a possible insider dump of 12 million PI tokens around the peak in May, igniting speculation of a potential rug pull, coinciding with a rather sharp price drop. How scandalous!

Meanwhile, the Pi Network’s app has drawn the ire of many for its rather excessive collection of user data without clear opt-ins, raising most pressing questions about privacy practices and the very essence of decentralization.

Other concerns abound, including the murky waters of unclear tokenomics, delays in utility rollout, and a distinct lack of transparency regarding circulating supply — all of which are common red flags in suspected rug pull scenarios. Oh, the drama!

PIUSD Ichimoku Cloud Analysis: Bearish Momentum Dominates

The Ichimoku Cloud on the 1-day chart presents a rather dismal picture for our beleaguered bulls. Price action is firmly below the ominous red cloud (Kumo), suggesting that the broader trend is indeed under considerable downward pressure.

The Tenkan-sen (blue line at $0.7767) and Kijun-sen (red line at $0.7950) are flat and perched above current prices, indicating a most unfortunate market indecision and a lack of short-term momentum, with no sign of a bullish crossover in sight. How tragic!

Looking ahead, the cloud remains thick and red, extending through mid-June. The bearish Kumo twist, where Senkou Span A remains below Span B, confirms that resistance is likely to remain formidable unless there is a most unexpected shift in market momentum.

RSI sits at 47.25, below the neutral midpoint, further confirming the downward pressure on the Pi coin value in USD. The MACD, in its usual dramatic fashion, shows a bearish crossover with red histogram expansion — confirming the growing downside momentum.

BBTrend has plummeted to -4.89 from a prior +4, reflecting a sharp reversal in sentiment that mirrors the recent weakness in the pi price today. Oh, the humanity!

PI/USD EMA Stack and OBV Signal Weakness

PI finds itself trading below its major EMAs:

- EMA 20: $0.7435

- EMA 50: $0.8277

This unfortunate alignment acts as a formidable resistance, capping any attempts at recovery. The On-Balance Volume (OBV) remains flat at -$12.73M, showing no signs of new accumulation by large investors. How very dull!

Pi Coin Price Levels to Watch

- Support: $0.7411, $0.6598, $0.5722

- Resistance: $0.7950, $0.8692, $1.3050

If PI were to lose $0.7411, it risks a most unfortunate descent to $0.6598 or even $0.5722. A recovery above $0.7950 could, however, open the door toward $0.8692 and $1.3050. One can only hope!

At present, Pi Coin is trading at $0.7368, down 2.12% on the day, with a 24-hour volume of $97.52 million and a market cap of $5.34 billion. The current price is approximately 55% below its May high of $1.6760, reflecting the broader loss of bullish momentum following its peak. How very unfortunate!

Pi Crypto Price Outlook — Analyst Prediction

Given the unlock timeline, bearish technicals, and ongoing on-chain sell pressure, analysts anticipate continued downside risk in the near term. Should Pi Coin break below $0.7411, the price could slip toward $0.6598. Conversely, reclaiming $0.7950 may indeed revive short-term bullish interest. Fingers crossed!

Conclusion

With large unlocks scheduled, bearish technicals, and ongoing exchange flows, Pi Coin finds itself under considerable pressure. Unless the bulls can reclaim $0.795 and reverse momentum, further losses remain likely. How delightful!

Trend Bias: BearishCatalyst Risk: Token unlocks and on-chain sellingKey Support: $0.7411

Conclusion: Rising Supply Meets Weak Demand — Pressure Builds

With more than a quarter billion coins set to unlock next month and technicals firmly in bearish territory, Pi Coin faces growing downside risks. Exchange flows suggest that some holders are preparing to exit, and without strong demand to absorb the new supply, $0.741 is shaping up to be a make-or-break level. How thrilling!

Until the bulls reclaim $0.795 and key trend indicators flip bullish, the broader outlook for Pi remains decidedly defensive. What a predicament!

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

2025-05-28 16:24