-

Polkadot consolidated in a falling wedge pattern at press time, signaling potential for a major price breakout.

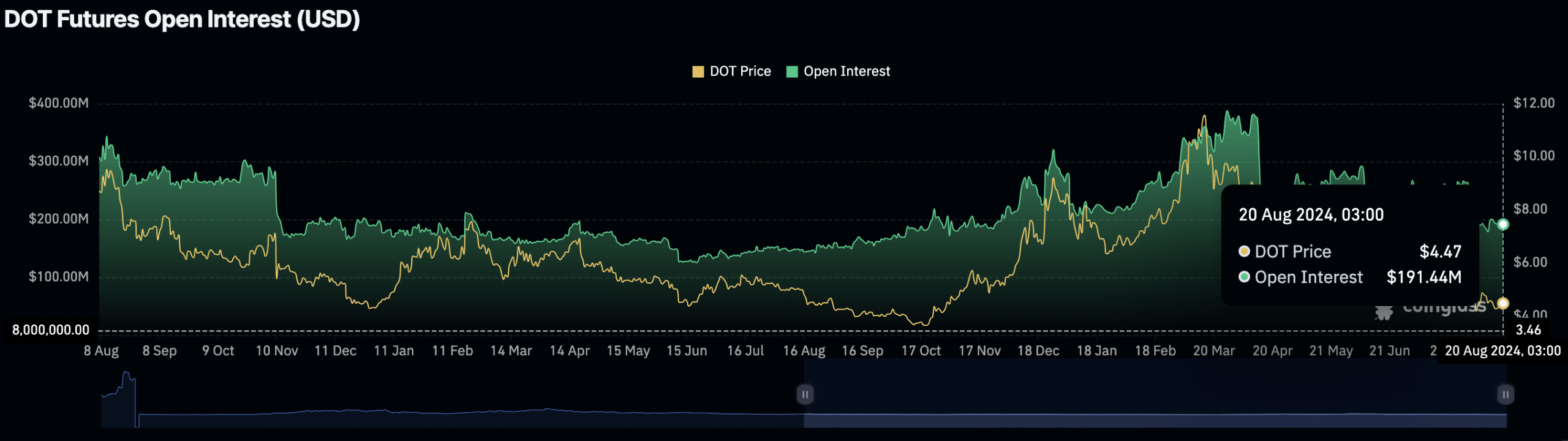

The Futures market surged with $190M in Open Interest, suggesting renewed trader confidence in DOT.

As a seasoned analyst with over a decade of experience in the crypto market, I see the recent movements in Polkadot (DOT) as an intriguing opportunity for potential growth. The consolidation within a falling wedge pattern, combined with the surge in Open Interest in Futures markets, indicates renewed trader confidence and a readiness to bounce back.

At the moment of reporting, Polkadot (DOT) was exchanging hands for approximately $4.56, marking a 3.68% rise over the past day as per AMBCrypto’s analysis based on data from CoinGecko.

The market cap has risen to $6.76 billion, positioning DOT as the 15th largest crypto.

Over the last day, the price has gone up and down, dipping to $4.39 at one point but then climbing again. This pattern suggests that it might continue to rise, fueled by an optimistic outlook in the market.

Over the past 24 hours, there’s been a slight uptick in trading volume up to approximately $104.9 million, indicating a 1.59% growth. This could potentially signal growing investor attention.

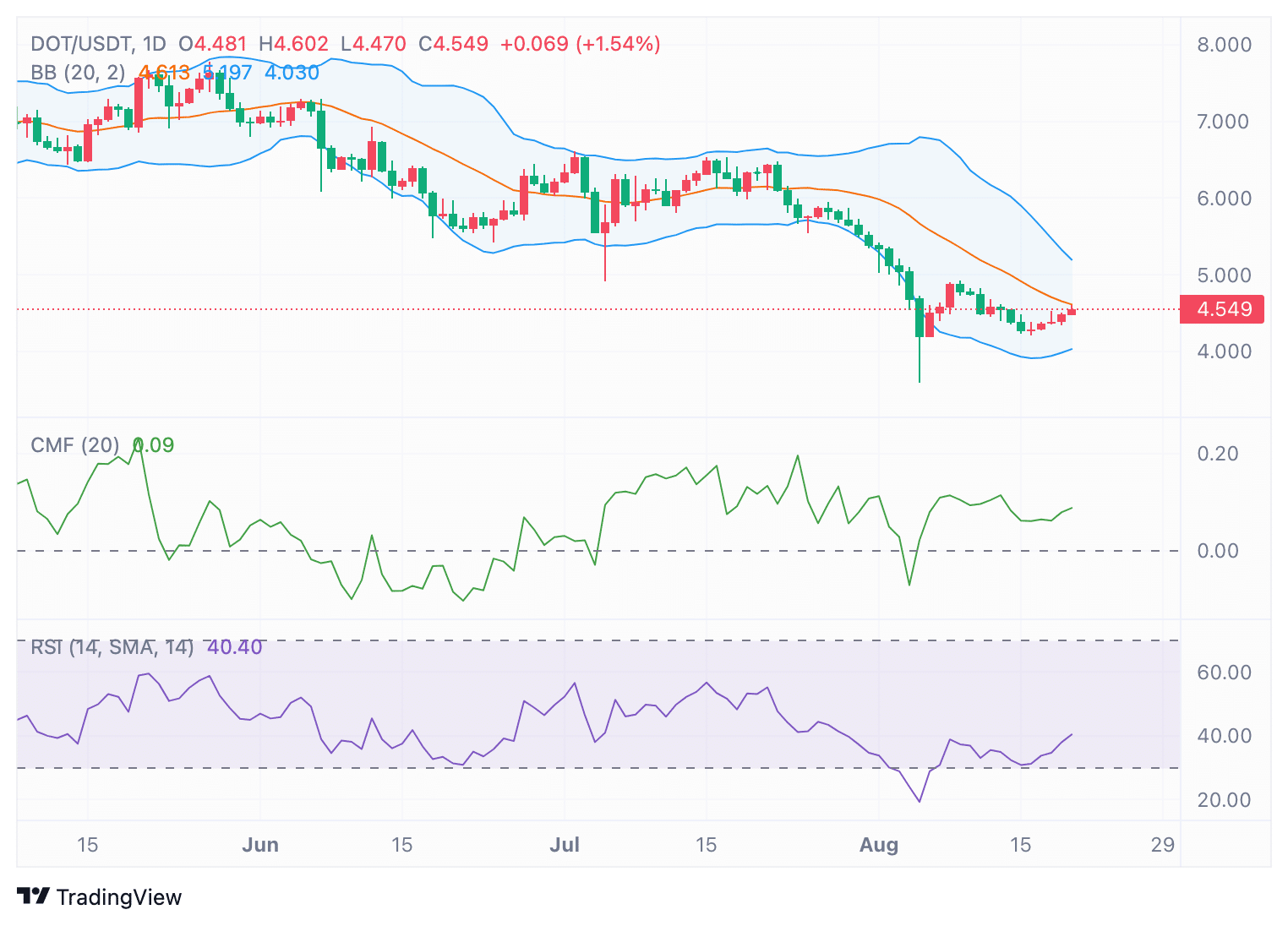

Polkadot’s falling wedge pattern

Currently, as reported, Polkadot seems to be stabilizing in a declining triangle formation on its daily graph. As per the analysis by cryptocurrency expert Captain Faibik, this pattern could indicate that DOT might be preparing for a potential shift.

“Bottomed out and is ready to bounce back.”

The cost was bouncing back from the lower boundary of this channel, suggesting a potential brief recuperation might be on the horizon.

In simpler terms, the point where we might encounter more resistance is found at the top line of the upward trend, while a supportive area can be found near the bottom edge of this price channel.

Since mid-June, the Bollinger Bands – a tool used to gauge market volatility – have indicated that Polkadot has been experiencing a downward trend. Specifically, it’s been frequently touching the lower boundary of these bands.

At the moment of writing, DOT was trying to bounce back, but it encountered obstacles near the midline at approximately $4.60.

If the price surpasses this barrier, it may signal a move towards a bullish market, while failing to exceed it could result in more sideways movement or continued consolidation.

At the current moment, the Chaikin Money Flow (CMF) indicator shows a value of 0.09, suggesting a relatively steady flow of funds into DOT, implying moderate investment activity.

As an analyst, I find that the current trend seems to be upward moving, but it’s important to note that the influx of funds isn’t particularly strong or overwhelmingly bullish. To maintain a robust buying pressure and potentially fuel further growth, a more substantial increase in the Chaikin Money Flow (CMF) is needed.

Additionally, the Relative Strength Index (RSI) stood at 40.40, suggesting that DOT was in a bear market zone. Yet, it’s worth noting that the RSI has shown signs of recovery from earlier oversold levels, hinting that the momentum could be regaining some positive traction.

As a researcher, I find myself observing that if the Relative Strength Index (RSI) consistently surpasses 50, it might be indicative of an impending shift in trend direction. This could potentially point towards a more neutral or bullish market movement.

Is a breakout looming?

In the Futures market, DOT’s Open Interest stood at $191.44 million, per Coinglass data. This marked a moderate recovery from recent lows, suggesting renewed participation from traders.

Even though there was a bounce back, the Open Interest stayed beneath past highs, indicating that traders are adopting a more reserved approach.

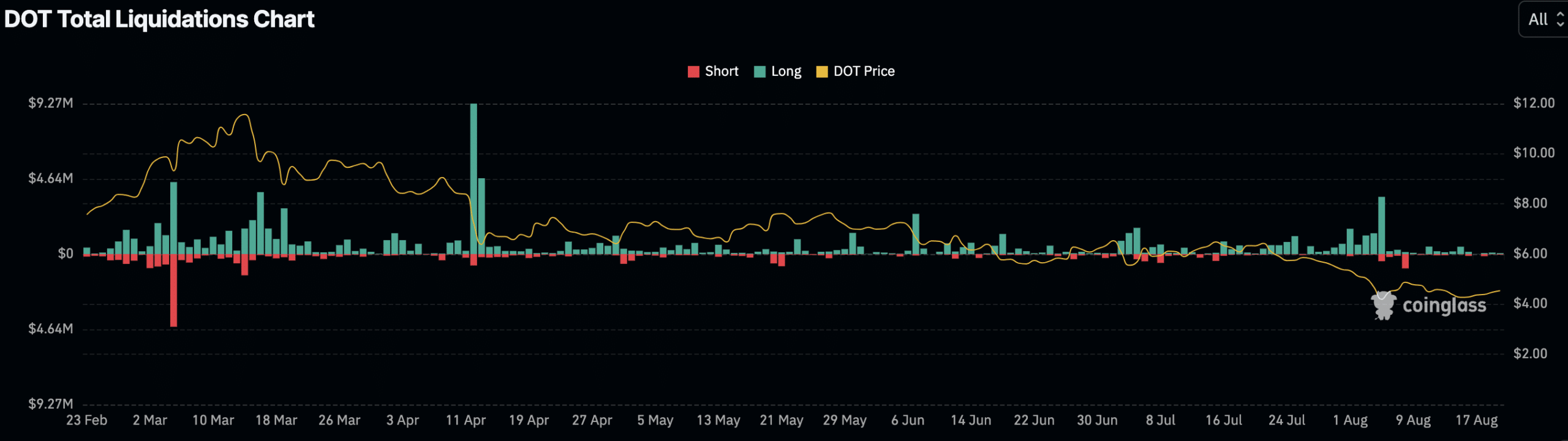

Additionally, the total liquidations in DOT Futures were $34,150 from short positions and $56,250 from long positions, with Binance [BNB] representing a significant portion of these amounts.

The liquidation data showed that both long and short traders were affected, with a slight bias towards long liquidations.

Read Polkadot [DOT] Price Prediction 2024-2025

As a result, the traders continued to grapple with market uncertainties, experiencing fluctuations in prices that affected both buyers and sellers alike.

Ultimately, Polkadot’s current market trends hint at a possible major surge, as the cryptocurrency approached crucial resistance points in its ongoing price pattern.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-08-21 01:44