-

The weekly chart indicated that DOT could see a substantial rise to $32 soon if certain conditions are fulfilled.

Both individual investors and large-scale holders, known as whales, are expected to drive DOT’s price to new long-term highs.

As a seasoned crypto investor who has weathered more than a few market storms, I find the current outlook for Polkadot (DOT) particularly intriguing. The weekly chart suggests that we could be on the verge of a substantial rise to $32 if certain conditions are met, which is music to my ears after enduring the recent 4.35% daily decline and marginal weekly decrease of 0.23%.

Despite a 4.35% drop in daily value and a slight 0.23% decrease over the past week, Polkadot [DOT] continues to show positive signs for the future.

As per the weekly analysis, DOT was approaching a crucial support point at the current moment, teetering on the edge of exiting a downward sloping triangle, aiming for a potential high of $32.

Why DOT might rally to $32

A blend of a falling wedge pattern and robust historical data suggests an upcoming bullish trend might occur.

Currently, the price of DOT is being traded at a noteworthy support point of $4.001. In the past, this price level has sparked a rise towards higher zones. Additionally, it’s linked to strong buying interest.

The bullish sentiment was further supported by the formation of a falling wedge at this support level. Typically, a falling wedge suggests that the price of an asset is likely to rise once it breaches the upper boundary of the pattern.

If DOT manages to hold its ground and break through the upper boundary, three potential long-term price levels could be reached:

If the support doesn’t keep the structure stable and the falling wedge breaks lower instead, it’s possible that DOT might touch a fresh record low, dipping beneath $2.000.

Bullish run around the corner

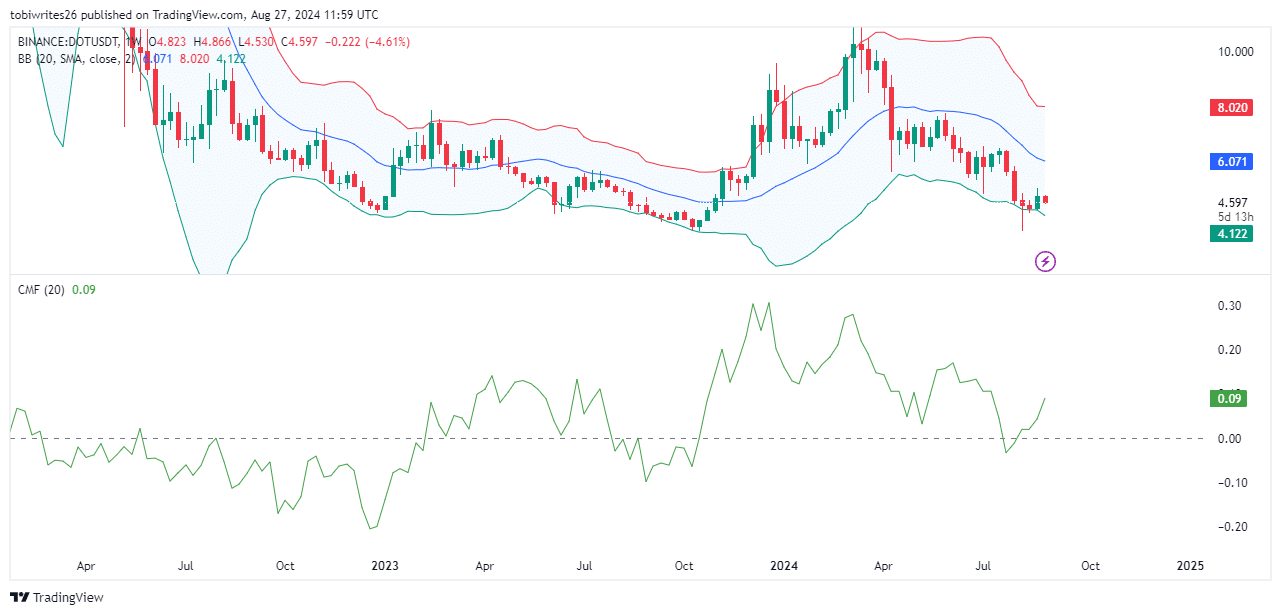

According to AMBCrypto’s analysis, there might be an upward trend coming for DOT, using techniques such as the Chaikin Money Flow and Bollinger Bands to monitor potential changes in price.

The Bollinger Bands, which are created using trendlines that lie two standard deviations from a moving average of an asset’s price, function as tools to help predict market fluctuations.

As the price nears the lower green band, it usually indicates an upcoming surge, whereas getting close to the upper red band may hint at a possible price decline.

As of now, DOT is close to the lower boundary, hinting at an upcoming potential rise. This proximity suggests that the support level around $4.0001 could potentially stay intact.

Moreover, the Chaikin Money Flow, a tool used to determine if funds are entering or exiting an asset based on buying and selling pressure, signaled that investments are being directed towards DOT.

A surge in funds often indicates growing demand to purchase an asset, which strengthens investors’ faith in the market and usually pushes the price upwards.

The market outlook for DOT remains bullish

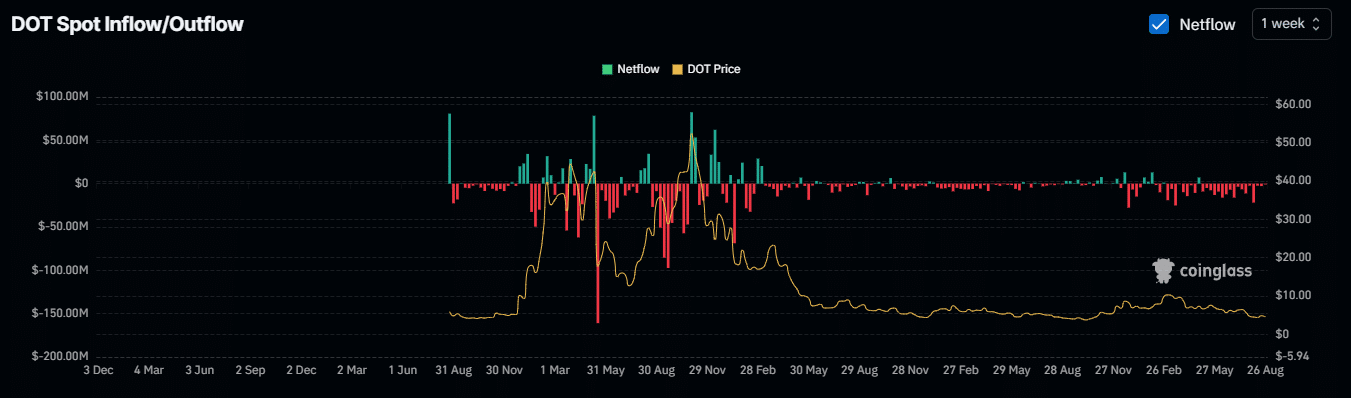

Over the course of the last seven days, as per analysis by AMBCrypto using Coinglass, we’ve seen around 2.833 million DOT tokens being taken off exchanges and withdrawn.

Based on my personal experiences and observations in the crypto world, it seems that the decrease in Netflow for DOT indicates a trend where holders are transferring their assets from exchanges to more secure wallets. This shift might be due to a growing concern about security or perhaps a desire to exercise greater control over their digital assets. As someone who has lost funds to hacking and phishing attempts in the past, I can’t blame them for taking this step. It’s always better to be safe than sorry when it comes to managing cryptocurrencies.

Investors’ behavior usually shows enthusiasm, suggesting they anticipate rising prices in the future. They tend to keep their investments as they believe it’s advantageous to do so.

Read Polkadot’s [DOT] Price Prediction 2024–2025

Currently, I’m observing a surge in optimism amongst market players, indicating a potential upcoming bull run could be on the horizon.

In summary, the signs suggest a positive trend for DOT, as analysts predict it may reach a future value of around $32.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

2024-08-28 06:16