-

There is a risk that DOT could plummet to or below its historical low of $2.00 if it fails to hold the support level at $4.001.

A noticeable lack of interest from retail investors indicates a potential decline for DOT.

As a seasoned researcher who has weathered countless market fluctuations over the years, I find myself cautiously bearish about Polkadot’s [DOT] near-term prospects. The consistent downtrend and lack of retail interest are red flags that demand careful attention.

Over the last year, I’ve found myself grappling with Polkadot‘s [DOT] lackluster market performance. Compared to other cryptocurrencies, it has underperformed significantly, resulting in a 3.36% decrease that essentially wiped out most of my gains as a spot holder.

This downtrend was consistent across both daily and weekly timeframes.

According to additional research done by AMBCrypto, it’s possible that DOT investors should prepare for potential losses if the important support level doesn’t stay strong.

Will major support help DOT?

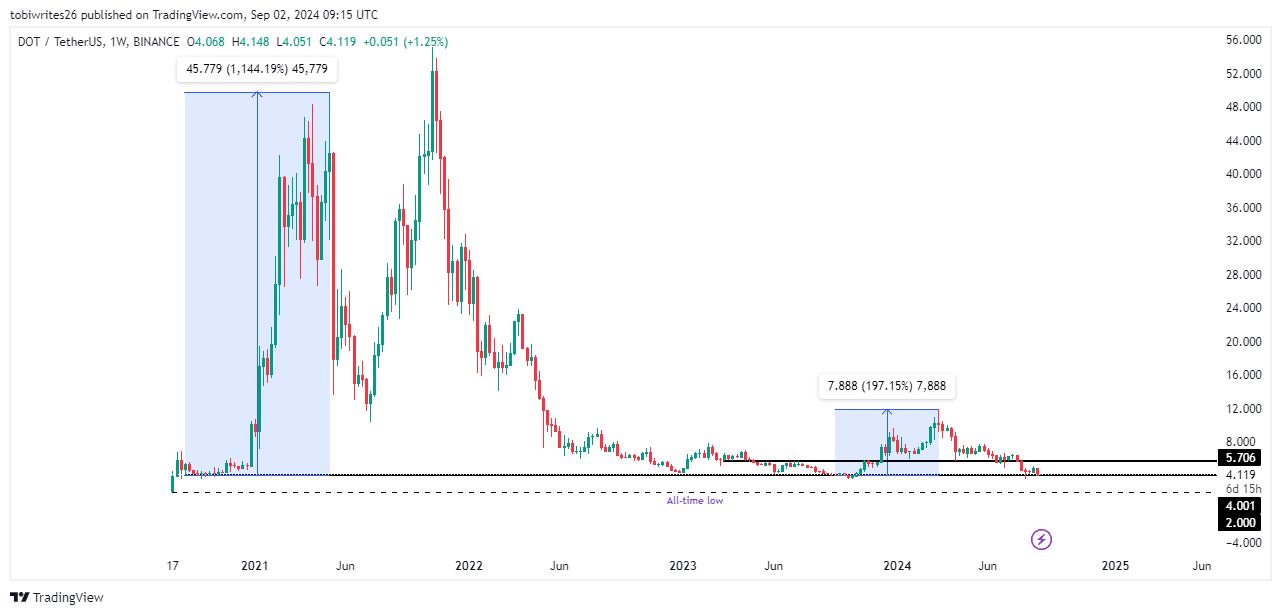

At press time, DOT actively traded at $4.125, descending toward the support level of $4.001.

Previously, this level of support triggered two strong upward movements in DOT. Yet, it seems like the urge to buy that fueled those increases is weakening.

At first, when the price hit that particular support point, it saw a remarkable surge of approximately 1144.19% increase. On its second attempt, the growth was more restrained, amounting to around 197.15%.

If market trends persist and DOT hits that particular support point once more, there’s a possibility it might bounce back towards the $5.706 resistance, which could encounter some resistance from sellers.

Based on additional examination by AMBCrypto, it appears that the support at $4.001 may not hold up, given the increasing selling pressure among individual investors.

Retail traders withdrawing support for a DOT rally

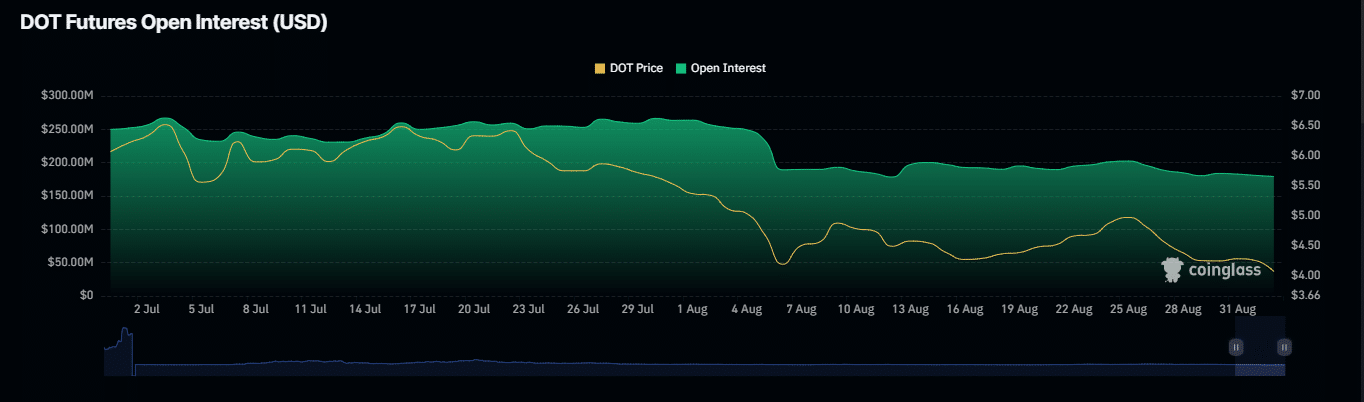

The level of Open Interest (OI), an important measure indicating market activity and liquidity, appears to indicate decreased excitement towards DOT.

As a researcher, I’ve observed a significant decrease in the Open Interest (OI) for the DOT token as per Coinglass data. Specifically, the OI has dropped from approximately $202.3 million to $178.9 million since August 25th. This decline suggests that retail enthusiasm for maintaining the price of DOT may be waning.

According to AMBCrypto’s analysis of data from Coinglass, it appears that traders who held long positions have experienced significant losses, with a total value of approximately $339,930 in long positions being liquidated from the market.

The pattern implies that those traders expecting DOT‘s price to rise have found it difficult to overcome the current downward selling trends.

Should the selling pressure persist from retail traders, there’s a significant possibility that DOT might drop beneath its crucial support threshold of $4.001, possibly sliding down to around $2.00.

Indicators signal further declines

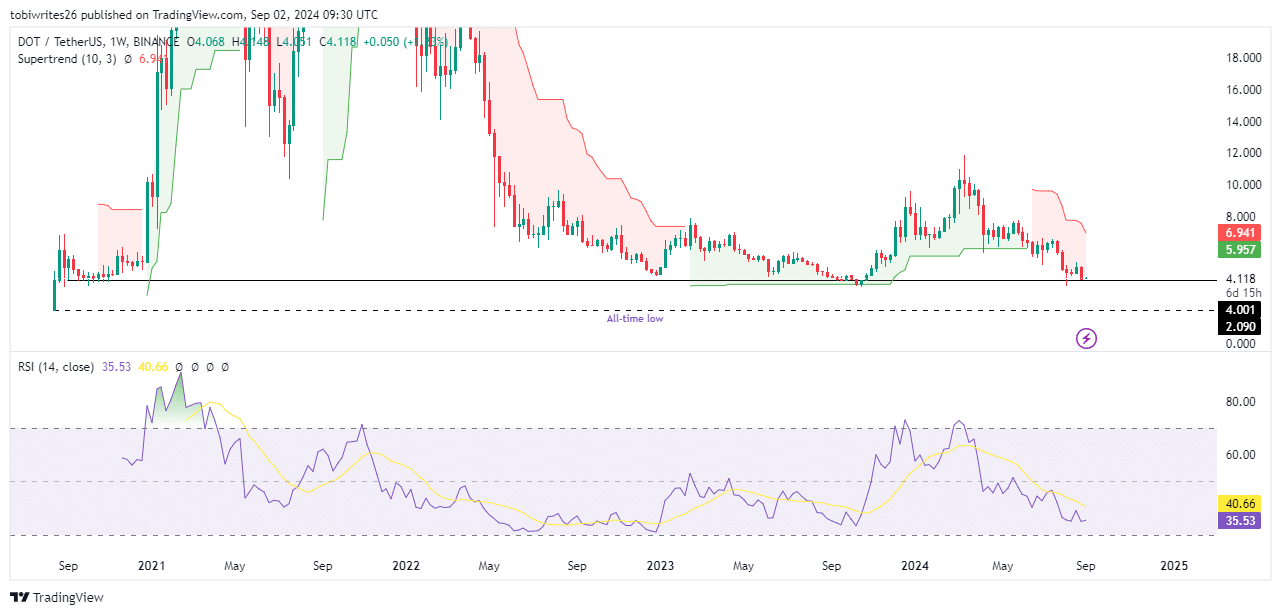

Based on additional examination, employing the Super Trend and Relative Strength Index (RSI), it appears that DOT‘s price may drop.

The Super Trend system is an indicator used for predicting market trends, by taking into account both price fluctuations and the typical daily trading range to ascertain the overall trend’s direction.

At present, the trend for DOT appears to be descending because its price stays beneath the indicator line, which indicates a pessimistic market scenario.

Read Polkadot’s [DOT] Price Prediction 2024–2025

Currently, the Relative Strength Index (RSI), a tool that gauges the rate at which prices are rising or falling, is indicating a decrease. With an RSI value of 35.52 and a downward trend, this suggests increased selling pressure may cause DOT‘s price to fall further.

As a researcher, I’m suggesting that based on these aggregated signals, there appears to be a possibility of an ongoing downward trend in pricing, potentially reaching as low as $2,000.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-09-03 01:12