-

Polkadot’s Coretime sales and Plaza Update could drive major demand and adoption in Q4 2024.

DOT’s falling wedge pattern and reduced unstaking period hinted at a potential bullish breakout.

As a seasoned crypto analyst with over a decade of experience navigating the ever-evolving digital asset landscape, I find myself intrigued by the bullish outlook for Polkadot (DOT) in Q4 2024. The combination of Polkadot’s upcoming upgrades and its technical indicators point towards significant growth potential for the network.

In the cryptocurrency world, Polkadot (DOT) is attracting noticeable interest. Notably, analyst Mister Crypto has highlighted various indicators predicting a substantial price surge by the end of 2024’s fourth quarter.

Here’s a look at the key elements that could drive DOT’s value higher.

Polkadot’s upgrades signal explosive growth

Polkadot is shifting from its existing parachain auction mechanism to Coretime sales, a change that simplifies the process for projects to obtain Polkadot’s security.

Making this adjustment should simplify the procedure, thereby enabling a greater number of projects to connect with the network. Such expansion may boost the desire for DOT.

Furthermore, the forthcoming Plaza Update aims at improving user interaction by combining the Asset Hub with support for Ethereum‘s Virtual Machine (EVM).

The purpose of this update is to establish a harmonious and intuitive platform that might draw in additional programmers and users to our community.

As a researcher delving into the fascinating world of blockchain technology, I’m currently observing an intriguing development within the Polkadot ecosystem. A governance proposal is underway that aims to diminish the network’s inflation rate. If successful, the new rate could potentially drop from 10% to a more conservative 5%. This adjustment could have significant implications for the long-term growth and stability of the network.

Implementing this reduction might aid in maintaining the value of DOT by lessening the number of fresh tokens being introduced into circulation.

A decrease in the inflation rate could make investing in DOT more appealing, possibly resulting in an increase in its value over time.

Moreover, Polkadot plans to reduce the unstaking period from 28 days to as little as two days.

This change would improve liquidity by allowing stakers to access their funds more quickly, which could incentivize more participants to stake DOT.

Additionally, the network is developing trustless connection methods such as Snowbridge and Hyperbridge, which facilitate effortless collaboration between various blockchain networks.

These bridges enable the movement of resources and information between diverse networks, reducing dependency on centralized middlemen. This could enhance Polkadot’s attractiveness as a versatile, multi-network platform.

In addition, Polkadot is positioning itself to take advantage of the growing Web3 gaming sector.

From my perspective as an analyst, I’m observing that the decentralized gaming sector is experiencing a surge in popularity. To draw in more gamers and developers, I see Polkadot positioning itself by offering an attractive infrastructure.

Exploring Web3 gaming might fuel increased interest in DOT, since an influx of new projects and participants will interact with the network.

Polkadot’s bullish setup

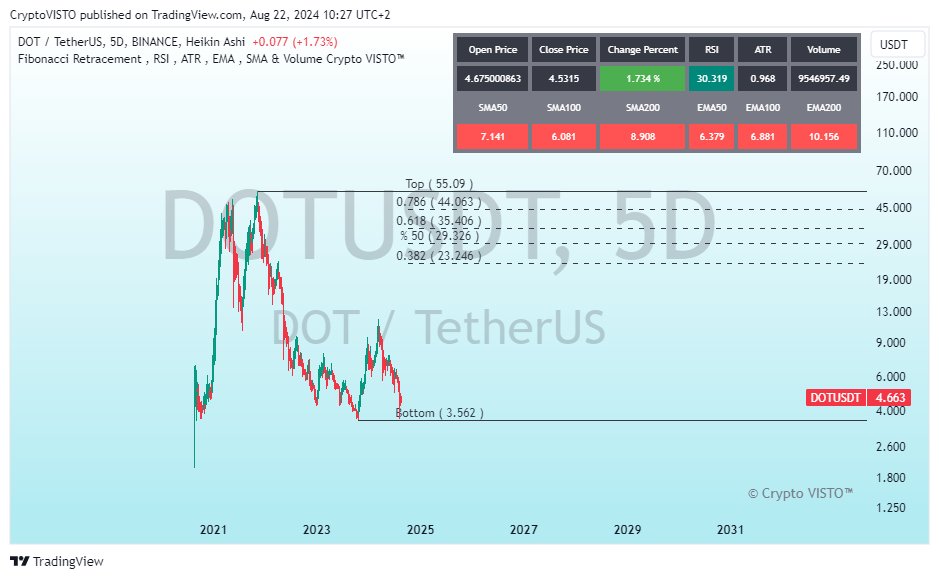

cryptoVISTO™ endorsed this view by responding to Mister Crypto’s post, stating that the technical signals of DOT, such as its Fibonacci retracement points and Relative Strength Index (RSI), suggested a possible price surge or breakout could occur.

Currently, DOT is trading at $4.66. Potential resistance levels have been pinpointed at $23.24, $29.32, $35.40, and $44.06. There’s a chance it may test its record high of $55.09 again.

According to a recent analysis by AMBCrypto, it appears that the price of Polkadot might be following a descending diagonal trend (also known as a “falling wedge”) in its daily chart. This pattern is generally considered positive or bullish because it suggests a potential reversal from a downtrend to an uptrend.

Read Polkadot’s [DOT] Price Prediction 2024 – 2025

Crypto analyst Captain Faibik noted that DOT might have –

“Bottomed out and is ready to bounce back.”

Having spent years observing financial markets and trading patterns, I’ve come to recognize certain signs that indicate potential short-term recoveries. One such sign is when the price rebounded off the lower trendline of a specific pattern. This happened in my recent analysis, and it made me believe that we might be on the verge of a recovery. It’s crucial to keep an eye on these patterns as they can provide valuable insights into market behavior and help make informed trading decisions.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-08-22 23:36