- Bitcoin has historically been bearish for the most part in September, but this time could be different.

- NASDAQ embracing Bitcoin and improving global liquidity conditions could favor a bullish outcome in September.

As a seasoned researcher with years of experience studying the volatile world of cryptocurrencies, I can confidently say that September has traditionally been a challenging month for Bitcoin. However, this year might just be an exception.

If Bitcoin (BTC) fails to surge beyond its current weekly high within the next three days, it is likely to end August with a decline compared to its initial monthly price.

This means the burden of delivering positive monthly gains will push forward into September.

Given its historical performance, it might be surprising to anticipate a bullish trend for Bitcoin in September. Typically, this month has been quite bearish for the digital currency.

The king coin delivered a bearish performance in eight out of 11 Septembers since 2013.

Is it possible that Bitcoin could exhibit a bearish trend in September as it did last year, or might there be an unexpectedly bullish twist this time around? Some crucial elements hint at the potential for BTC to display exceptionally bullish behavior in the upcoming months.

New findings show that worldwide liquidity levels are rebounding and currently reaching record heights. So far, Bitcoin hasn’t significantly benefited from this increased liquidity, but the overall uptrend in liquidity is good news for the market.

An increase in worldwide liquidity, combined with anticipated interest rate decreases in September, may offer the push Bitcoin requires to generate favorable gains throughout the month.

According to an assessment by CryptosRus, circumstances such as interest rate decreases, expanding liquidity, the halving event, and the U.S. elections seem to mirror Bitcoin’s behavior in 2016 and 2020. In both cases, Bitcoin experienced a strong surge.

Bitcoin is breaking into mainstream markets

The availability of Bitcoin has reached unprecedented heights, notably due to the introduction of ETFs this year. It’s possible that this increased access may soon extend to the stock market, given the recent NASDAQ filing.

They plan to introduce Bitcoin options trading, potentially increasing investor enthusiasm even more.

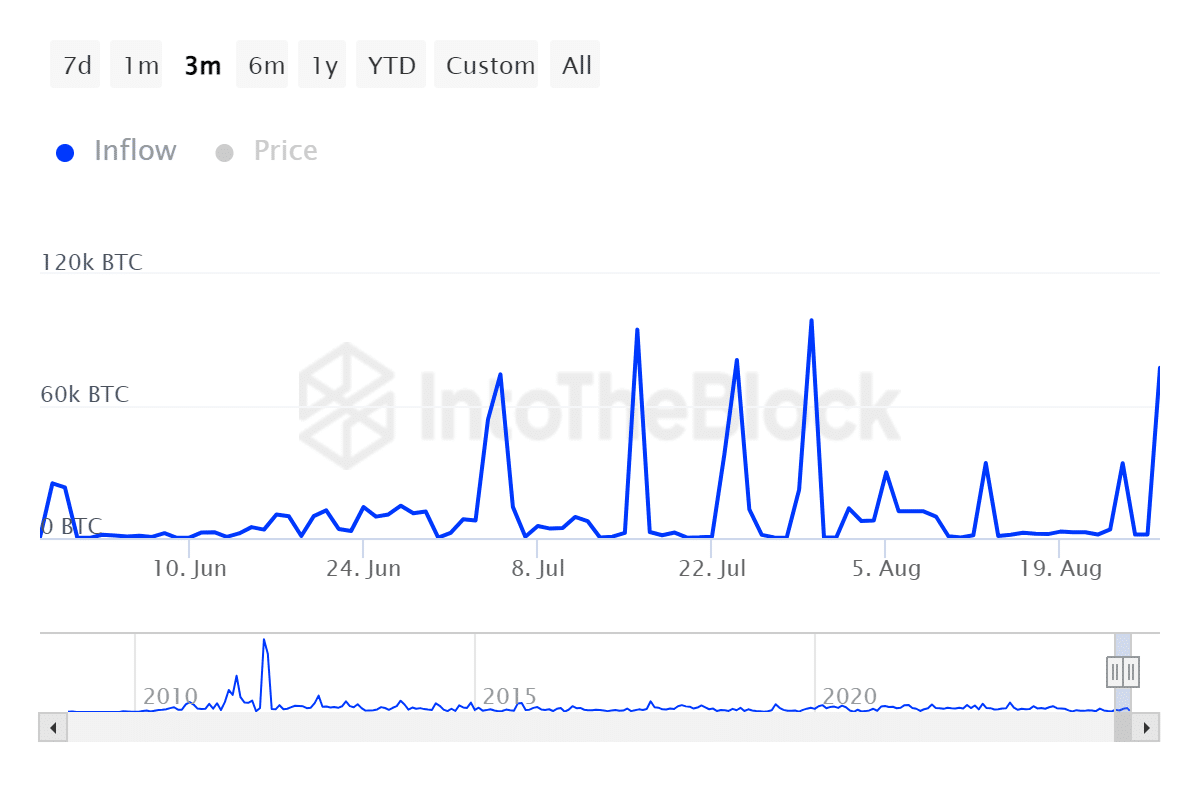

As a crypto investor myself, I’m gearing up for potential price surges in September. In fact, within the past day, large-scale inflows have soared to the fourth highest we’ve seen over the last three months.

During that timeframe, there were inflows totaling 77,400 Bitcoin, while outflows amounted to just 11,240 Bitcoin over the same period.

After Bitcoin dropped below $60,000 yet again, many had hoped it would rise to $70,000. However, despite this setback, investor enthusiasm persisted, as indicated by the aggressive buying activity observed at reduced price levels.

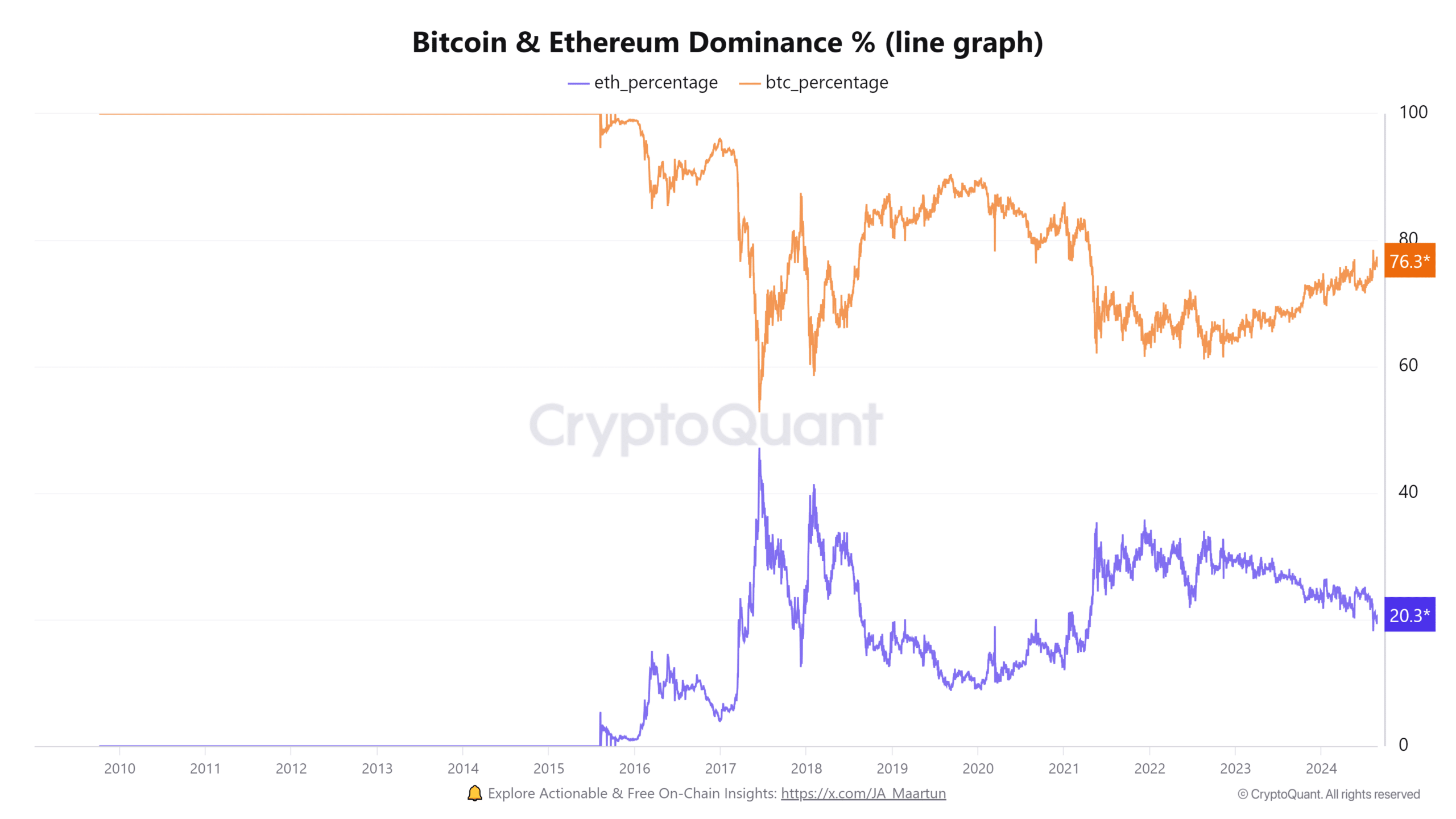

Bitcoin continues to hold a substantial lead over Ethereum [ETH] and other alternative cryptocurrencies, indicating that it’s well-placed to capitalize on the majority of the funds entering the digital currency market.

Thus, Bitcoin still commanded most mainstream attention despite the presence of many altcoins.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

In conclusion, Bitcoin is set for a potentially bullish September if interest rates come down.

As a researcher, I am optimistic that advancements in global liquidity and increased acceptance within traditional markets could potentially boost Bitcoin’s performance before this year comes to an end.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-29 05:12