-

SHIB’s network was closing in on overvalued levels, and could draw the price down.

Holders accumulated trillions of tokens between $0.000020 and $0.000023, indicating a possible uptrend rejection.

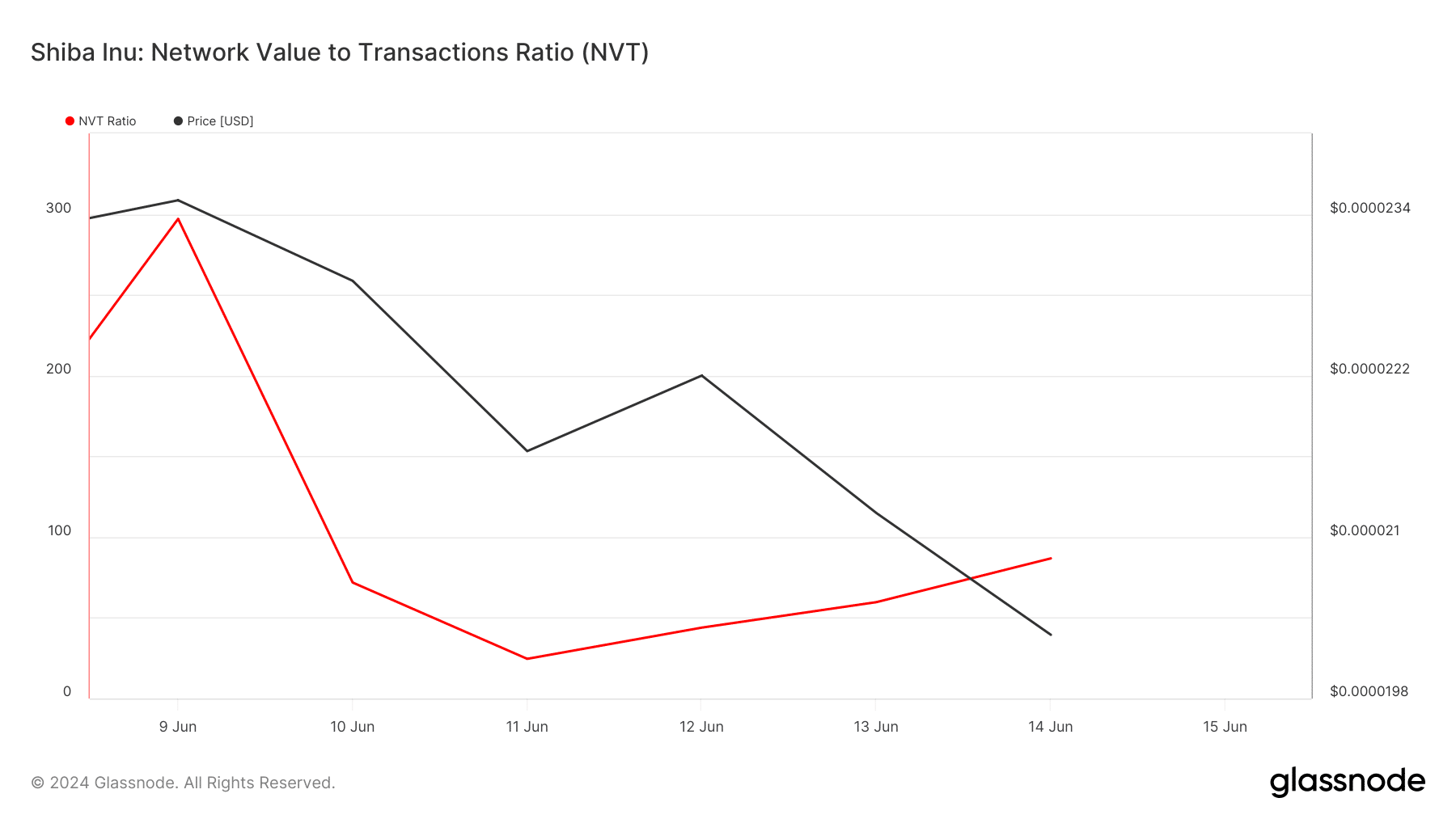

As an experienced financial analyst, I believe that Shiba Inu’s [SHIB] current downtrend is not a mere correction but a potential sign of further price decreases. The Network Value to Transactions (NVT) Ratio, which has been historically indicative of market tops and bullish trends, is currently on the rise for SHIB.

In the last seven days, Shiba Inu’s [SHIB] price has decreased by 10.69%.

Based on AMBCrypto’s evaluation, there’s a possibility that this downtrend could persist in the short term. For SHIB investors, it may mean they have to be patient and wait a while longer for a potential price surge.

One method supporting this argument is the examination of the Network Value to Transactions (NVT) Ratio. An elevated NVT Ratio implies that the value of a network, represented by its market capitalization, is increasing at a quicker pace than its transaction volume.

As a researcher studying market trends, I’ve observed that when a situation resembles what we have now, it often aligns with a market peak. Conversely, a low NVT (Network Value to Transactions) Ratio indicates that network usage is growing faster than the market capitalization.

It’s a struggling period for the token

historically, a low NVT (Network Value to Transactions) ratio has been indicative of bullish market trends; for Shiba Inu specifically, its NVT ratio, as reported by Glassnode, has been on an upward trend recently.

On the 11th of June, the ratio was 24.58. But at press time, the reading had increased to 86.80.

The upward trend suggests a changing perspective that justifies the high valuation of the Shiba Inu network. Consequently, recovering from the current price slump may prove difficult for SHIB.

At the moment of publication, SHIB was being traded for approximately $0.000020. In a past piece, AMBCrypto predicted that the price could potentially drop down to this value.

With the recent development, there’s a possibility of another downturn for SHIB. Based on the NVT ratio trend, it may fall as low as $0.000018.

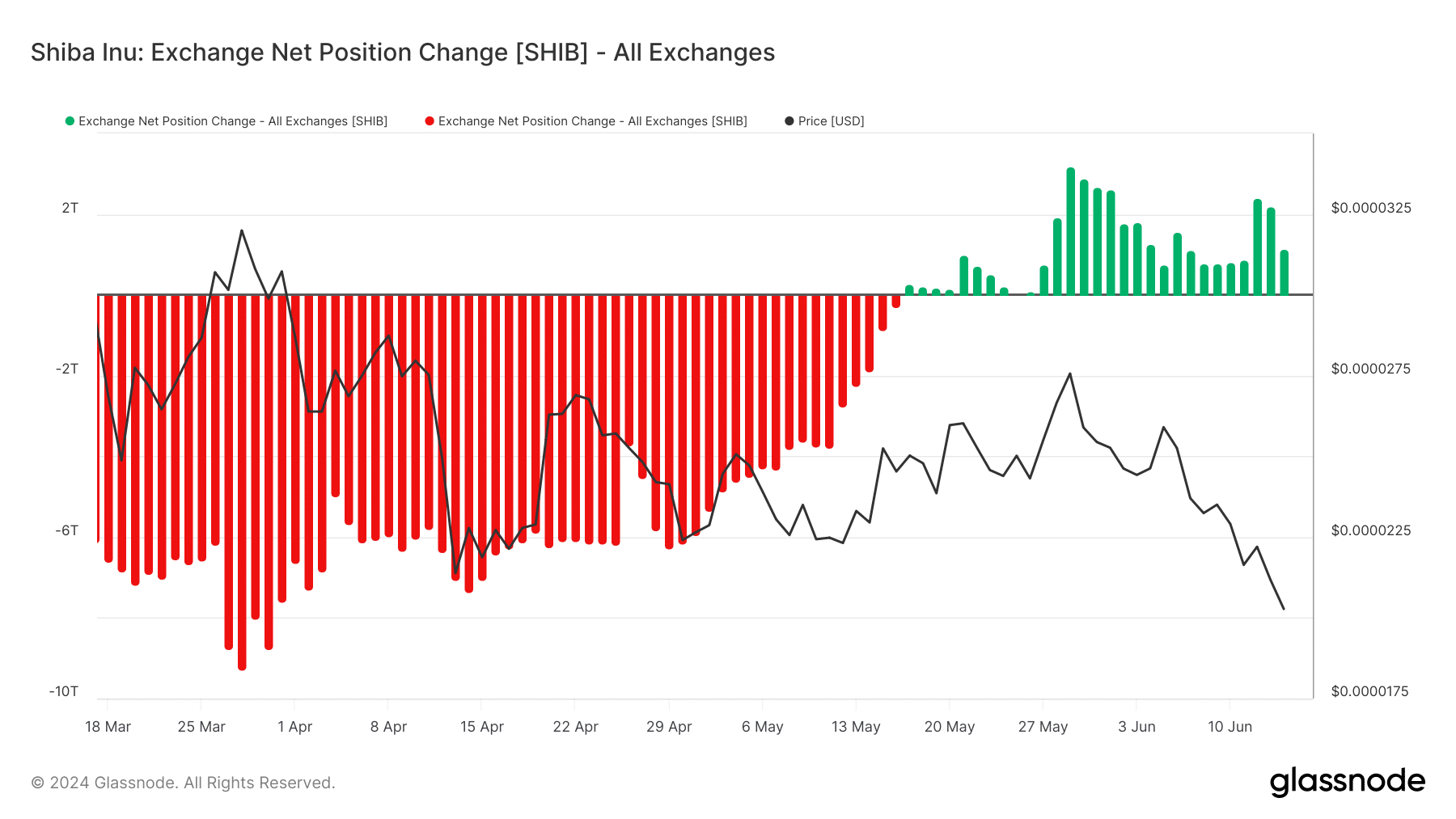

In addition to the previously cited indicator, the Exchange Net Position Change provided evidence of an possible price decrease.

When the Exchange Net Position Change indicator displays a positive value, it signifies an uptick in the amount of tokens available on exchanges for trading, suggesting that suppliers have added more tokens to the market. In contrast, a negative value indicates a decrease in the quantity of tokens being held on exchanges, meaning market participants are withdrawing or selling fewer tokens from the exchange platform.

Holders are prepared to let go

As a crypto investor, I’ve observed that buy orders from exchanges can have a significant impact on the market. They often serve to stabilize prices or even cause a short-term increase. With Shiba Inu specifically, the Exchange Net Position Change came in at a positive 1.13 trillion. This suggests that there were more buy orders than sell orders, which could potentially lead to price growth for SHIB.

This means this number of tokens are available for sale.

Should SHIB‘s current stance persist in the coming days, there is a strong possibility that its price could decrease, potentially reaching a low of $0.000018.

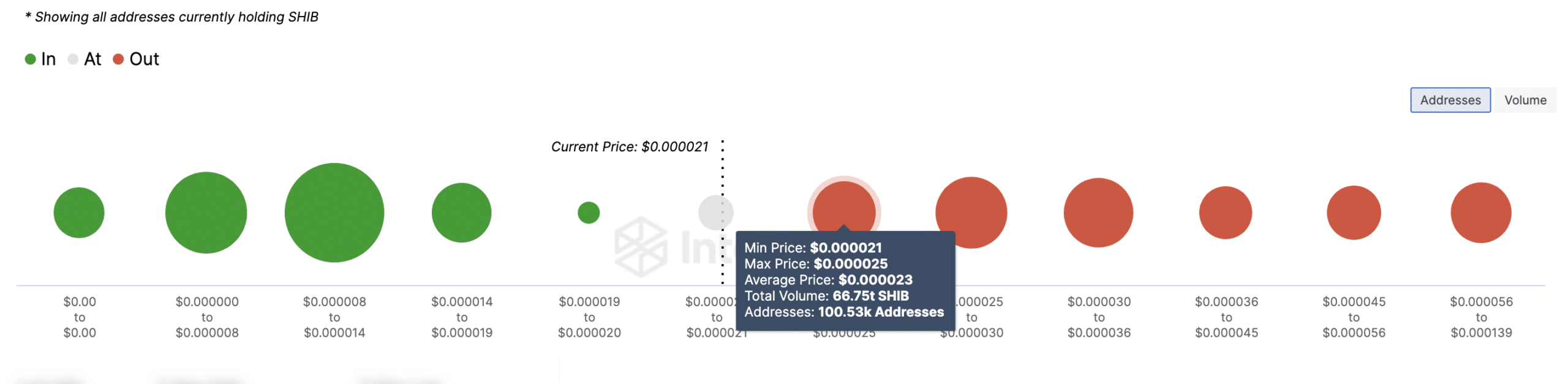

Furthermore, AMBCrypto examined the Global In/Out of Money indicator in their analysis. This marker identifies addresses that have realized profits or incurred losses, and can influence price trends by acting as potential support or resistance levels.

As a crypto investor, I’ve noticed that the more tokens I’ve acquired at a specific price level, the greater their potential impact on the market trend. These tokens can act as significant support or resistance points depending on market conditions.

Based on IntoTheBlock’s analysis, the gap in purchase prices was significant for investors who bought at an average price of $0.000019 compared to those whose average purchase price ranged between $0.000020 and $0.000023.

Approximately 1,720 addresses bought a total of 452.8 billion SHIB tokens, with each token costing an average of $0.000019. Conversely, around 100,530 addresses acquired a collective 66.75 trillion SHIB tokens, paying an average of $0.000023 per token.

Read Shiba Inu’s [SHIB] Price Prediction 2024-2025

Therefore, it was evident that the token might face resistance at the upper level.

If certain investors choose to sell their Shiba Inu tokens at prices ranging from $0.000020 to $0.000023, the coin’s value could drop. The support level at $0.000019 might then prevent further decline towards $0.000018.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered – Ring of Namira Quest Guide

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Quick Guide: Finding Garlic in Oblivion Remastered

- Matty Healy’s Cryptic Response Fuels Taylor Swift Album Speculation!

2024-06-16 16:08