-

Why the latest SOL uptick could be the start of the next push towards key price levels.

Evaluating Solana network’s health and why its recovery from August’s slump could play out well for SOL demand.

As a seasoned analyst with years of experience navigating the volatile crypto markets, I find myself optimistic about Solana’s latest uptick. The cryptocurrency’s resilience and ability to recover from the August slump indicate a strong underlying network that could potentially push towards key price levels.

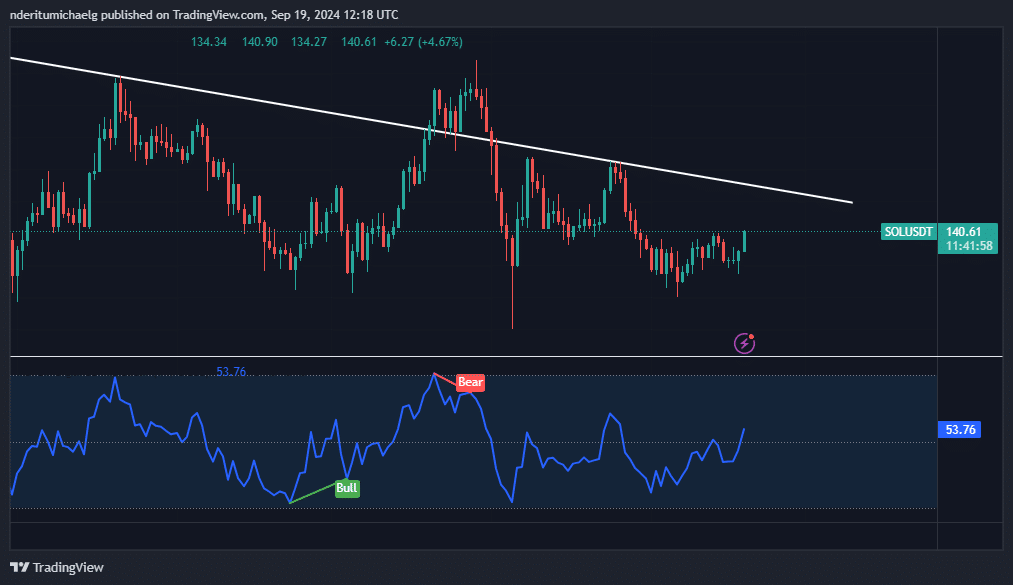

After experiencing a bearish weekend and some uncertainty earlier this week, Solana (SOL) is now exhibiting indications of a bullish trend accumulation.

Its performance suggested that a significant rally may ensue from its latest swing low.

In the second week of September, it became apparent that SOL was on the mend following a period of heavy selling pressure in the last week of August.

Despite a temporary halt due to uncertainties surrounding this week’s FED announcement, the cryptocurrency is back on track for recovery now that the anticipated rate cuts have been verified.

A potential near-term goal for SOL could be approximately $150. This prediction is based on the observation that previous SOL peaks generally follow a downward trending pattern.

This roughly places it around the $150 mark, suggesting a potential 10% increase in value from its current $140 price bracket.

In the past two days, the value of the cryptocurrency surged by 11%. At the moment of viewing, Solana’s Relative Strength Index (RSI) had risen above the 50% mark, indicating a strong upward trend or bullish sentiment.

Due to the recent financial move (the rate cuts announcement), it’s quite likely that the market could see significant increases in available funds.

A potential result might see Solana (SOL) approaching or surpassing the $200 mark in just a few weeks, given a resurgence in robust DeFi (Decentralized Finance) activity for Solana.

Assessing Solana network’s performance

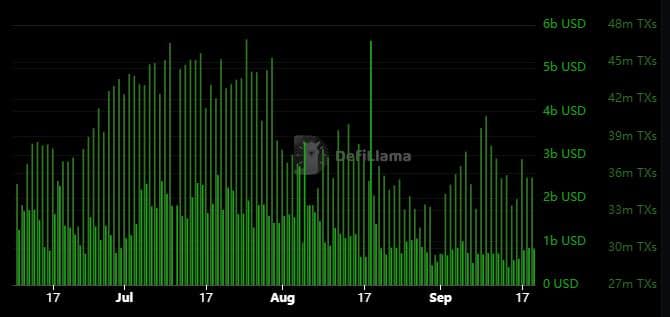

Over the past few weeks, I’ve noticed a significant deceleration in the performance of the Solana network. Interestingly, this slowdown seems to align with the subdued mood that has pervaded the crypto market, particularly during the month of August. This is evident when examining key Solana metrics.

To illustrate, the value tied up in the network’s television reached an apex of $5.48 billion back in August, but has since dipped to as little as $4.66 billion just recently.

Over the past two days, I’ve observed a notable surge in our figures, reaching approximately $4.92 billion. This upward trend suggests a boost in investor confidence, likely as a response to the recent interest rate cut announcement.

The market capitalization of Solana’s stablecoin experienced a more significant decline following the recent slowdown. It reached a high of $4.067 billion on August 23rd, but has since dropped to $3.82 billion as of September 18th.

It’s clear that the Solana network has experienced a drop in activity, as demonstrated by both its transaction and volume data. In July, its daily average volume surpassed $1.5 billion, and it processed over 40 million daily transactions on average.

However, both metrics recorded a notable decline in August.

Read Solana’s [SOL] Price Prediction 2024–2025

At the close of August, on-chain transaction volume dropped below $500 million, and transactions themselves fell below 30 million momentarily. Yet, from early September, we’ve seen a noticeable improvement in these figures.

These findings suggest a potential resurgence of active transactions on the Solana blockchain, as seen before. Such an occurrence logically increases interest and demand for the SOL token.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-20 11:36