-

Solana’s transaction revenue and MEV tips have outpaced Ethereum.

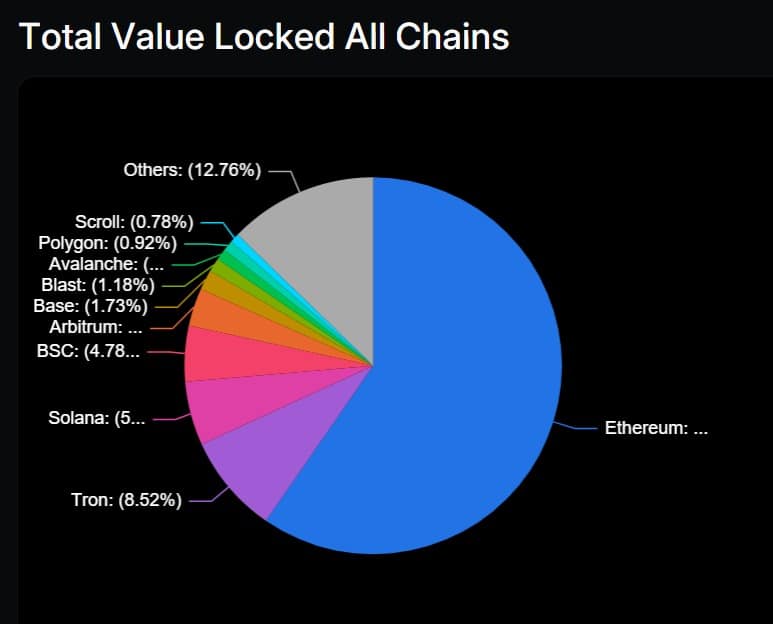

Solana total value locked surged by 25%, but ETH remained dominant.

As a seasoned researcher who has witnessed the crypto market’s ebb and flow for quite some time now, I must admit that Solana (SOL) is certainly making waves. The recent surge in its transaction revenue, MEV tips, and market cap have been nothing short of impressive.

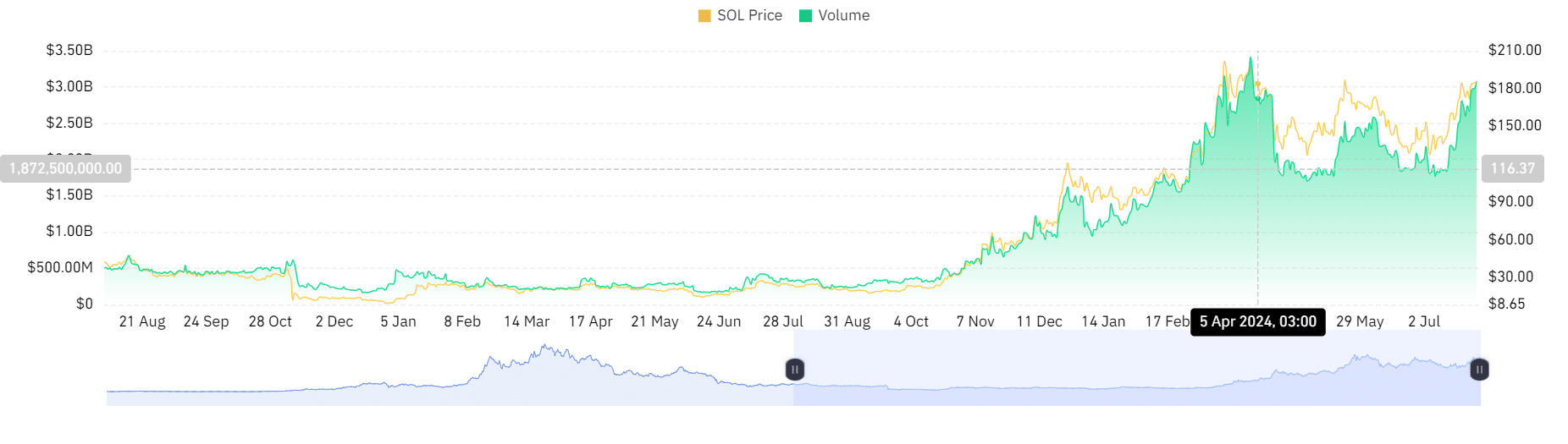

As a researcher delving into the dynamic world of cryptocurrencies, I’ve noticed an uptick in volatility across the board lately. Yet, amidst these market fluctuations, Solana [SOL] has managed to shift its trajectory significantly this month. This transformation is evident not only in its trading volume and market capitalization but also in its growing adoption by meme-coins.

In the past two days, Solana made news by overtaking Binance Coin (BNB) in terms of market capitalization. The value of Solana’s market cap soared to an impressive $85 billion. Simultaneously, the market cap of BNB dipped slightly to $83 billion, as reported by CoinMarketCap.

Solana’s progress persists, marked by increased trading volumes, a boom in Decentralized Exchanges (DEXs), and leading over Ethereum [ETH] in transaction fees and Miner Extractable Value (MEV).

Solana DEX trading volume hits $2B

Solana’s exchange trading volume has reached an all-time high of $3.09 billion on its decentralized platform, marking a 50% increase over the past 24 hours from $2.7 billion. This growth surpasses both Ethereum and Binance Smart Chain in terms of trading activity, according to Coinglass data.

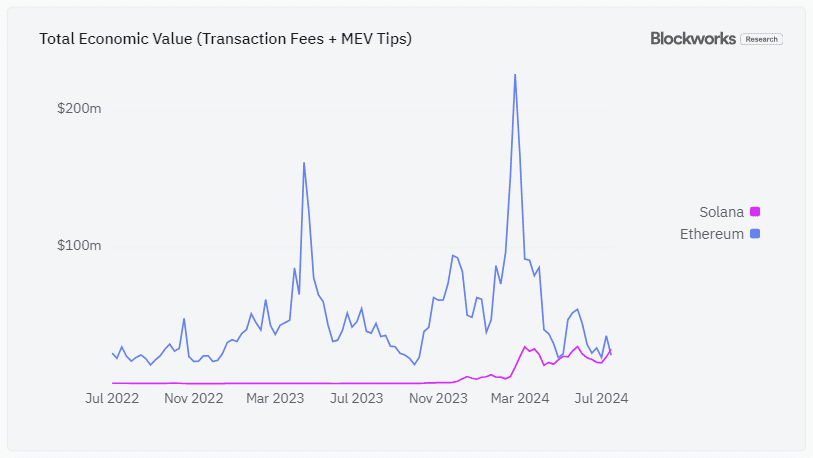

SOL beats ETH in transaction fees

In a bid to outshine Ethereum, Solana has made efforts to lead in significant areas such as overall transaction fees and Maximal Extractable Value (MEV).

In a week’s timeframe, Solana earned approximately $25 million from transaction fees (revenue), whereas Ethereum reported around $21 million during the same duration.

Dan Smith shared the development through his X (formerly Twitter) page, stating that,

“For the first time ever, Solana surpassed Ethereum in total transaction fees and MEV tips on the weekly timeframe ($25M vs $21M). Solana validators and stakers are absolutely eating this cycle.”

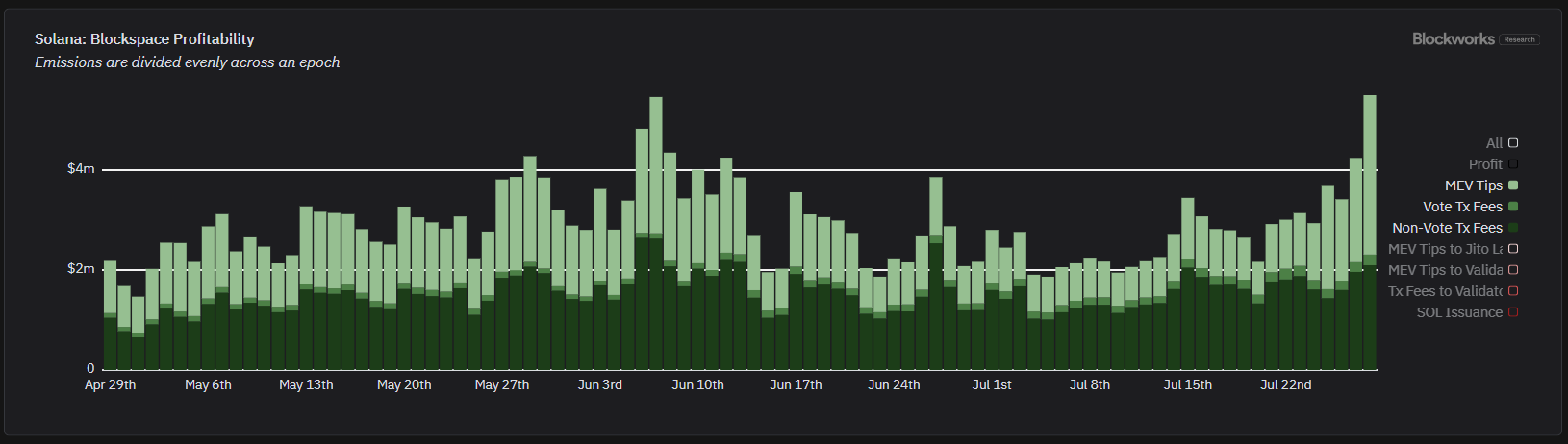

Over the past day, Solana primarily earned its income through transactions on decentralized exchange platforms (DEX). Interestingly, around 58% of this income came from MEV tips and a further 37% was derived from fees. The impressive revenue figure of $5.5M marks the highest earning over the last two months for Solana.

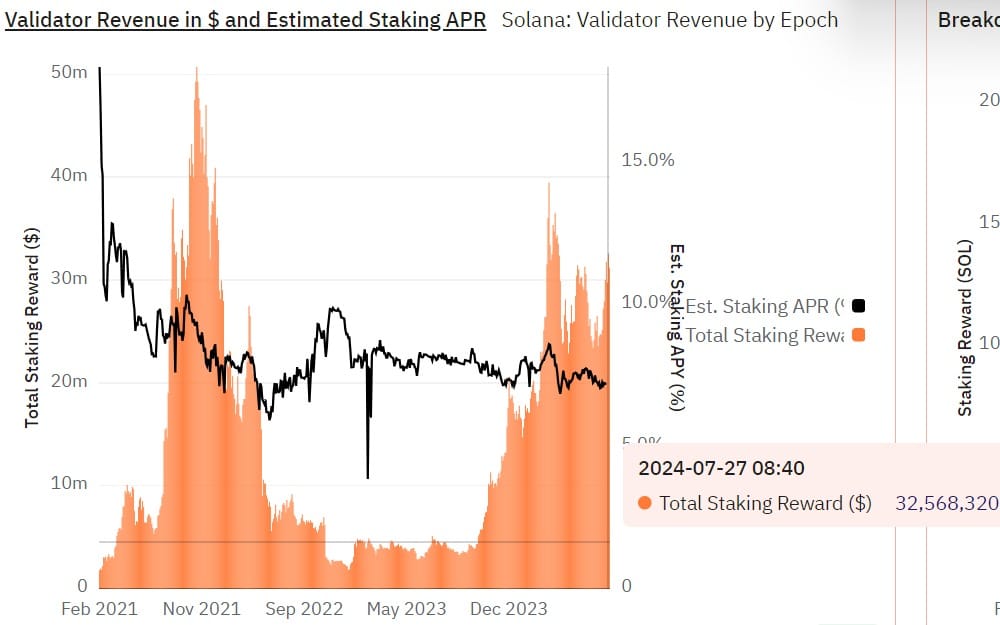

Furthermore, it’s worth noting that the income from Solana staking has seen significant growth, amounting to approximately $32 million previously. In contrast, Ethereum has managed to generate just a 3% return, whereas Solana staking yielded around 7%.

Consequently, an increase in investment returns significantly influences investor attraction, leading to a surge in Solana’s active addresses and trading volume.

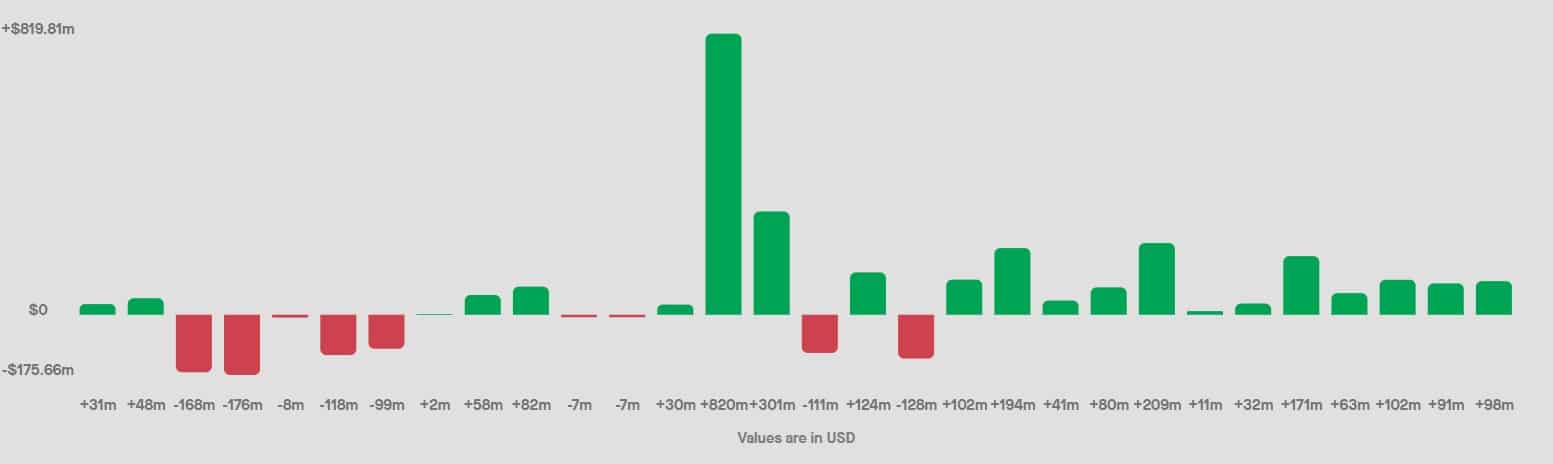

While Solana has seen an increase of 25% in MEV tips and income, reaching approximately $5.5 billion, it remains behind in terms of Total Value Locked compared to other platforms.

Read Ethereum’s [ETH] Price Prediction 2024-25

Regarding this particular category, Ethereum maintains its lead, boasting a total value locked at approximately $58 billion. On the other hand, Solana has outshined Ethereum in Total Economic Value, reporting over $2.2 million compared to Ethereum’s slightly less at around $1.97 million.

These shifts in market trajectories position SOL to become the true ETH killer, as it’s called.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

2024-07-31 01:12