- Solana retested a key pennant support at press time.

- Metrics and a rising TVL indicated growing ecosystem strength.

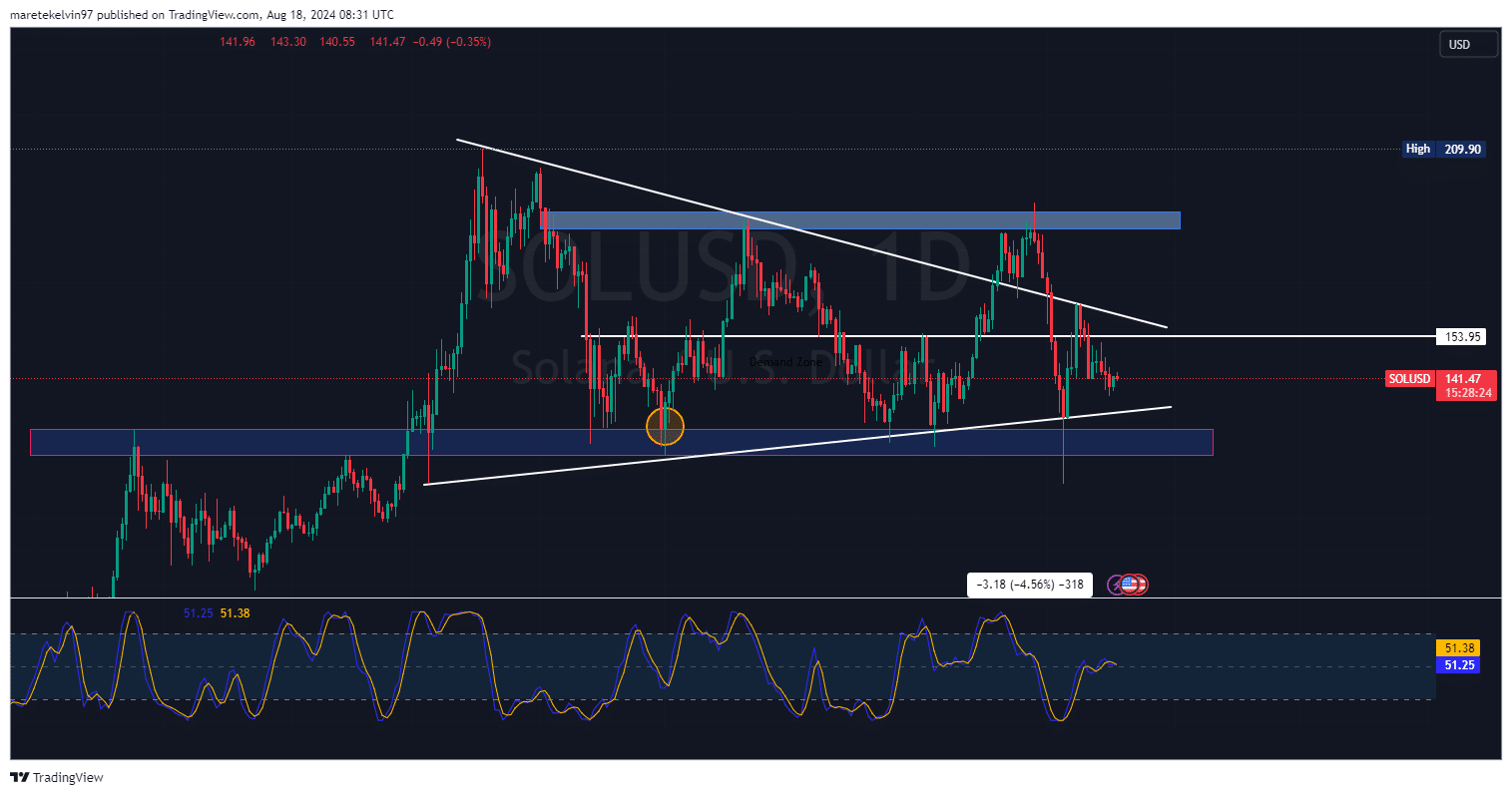

As an analyst with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of bull and bear markets, but Solana [SOL] is certainly showing some promising signs at present. The altcoin has been consolidating within a bullish pennant pattern for five months now, and it seems that we might be on the verge of a bullish breakout.

Solana’s price action suggests it might be on the verge of a bullish surge, following a robust hold at crucial support levels. Over the last five months, this cryptocurrency has been building up within an optimistic pennant structure.

In the past day, SOL appeared to rebound from the lower boundary of its pennant formation, suggesting an uptick in demand for this support point.

Based on my extensive experience in trading, this key support level could function as a stepping stone for a potential bullish surge towards the next resistance at approximately $153. Having seen numerous market fluctuations throughout my career, I can confidently say that a strong foundation like this one has often served as a catalyst for significant price increases. However, it’s crucial to remember that past performance does not guarantee future results and always approach trading with caution.

For Solana (SOL) supporters, breaking past the $153 resistance point could trigger increased buying interest and potentially open the path toward revisiting previous highs.

Reduced selling pressure fuels bulls

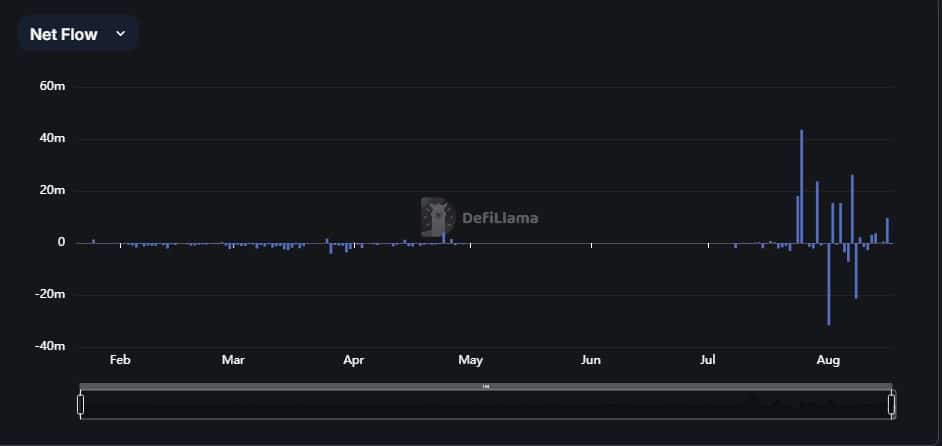

Over the past day, there’s been a noticeable decrease in sellers, as suggested by the net flow data from DeFiLlama, along with the previously mentioned price movement.

At the moment of reporting, Net Flow dropped from 9.58 million to -0.32 million, hinting at decreased selling pressure.

SOL DeFi flexes its muscles

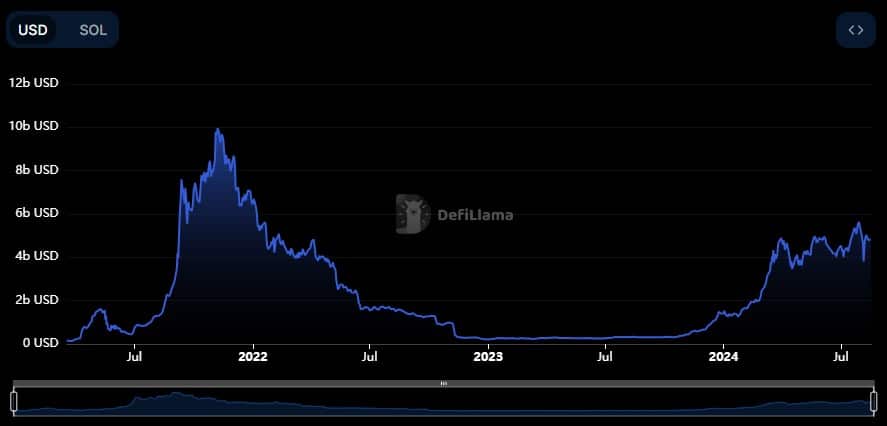

Beyond lessening outgoing funds, it’s worth noting that Solana’s Total Value Locked (TVL) is steadily rising, suggesting a surge of trust in the decentralized finance (DeFi) environment among the network’s users.

The increase suggests that more money is being put into protocols built on the Solana network, which is a sign of growing network popularity.

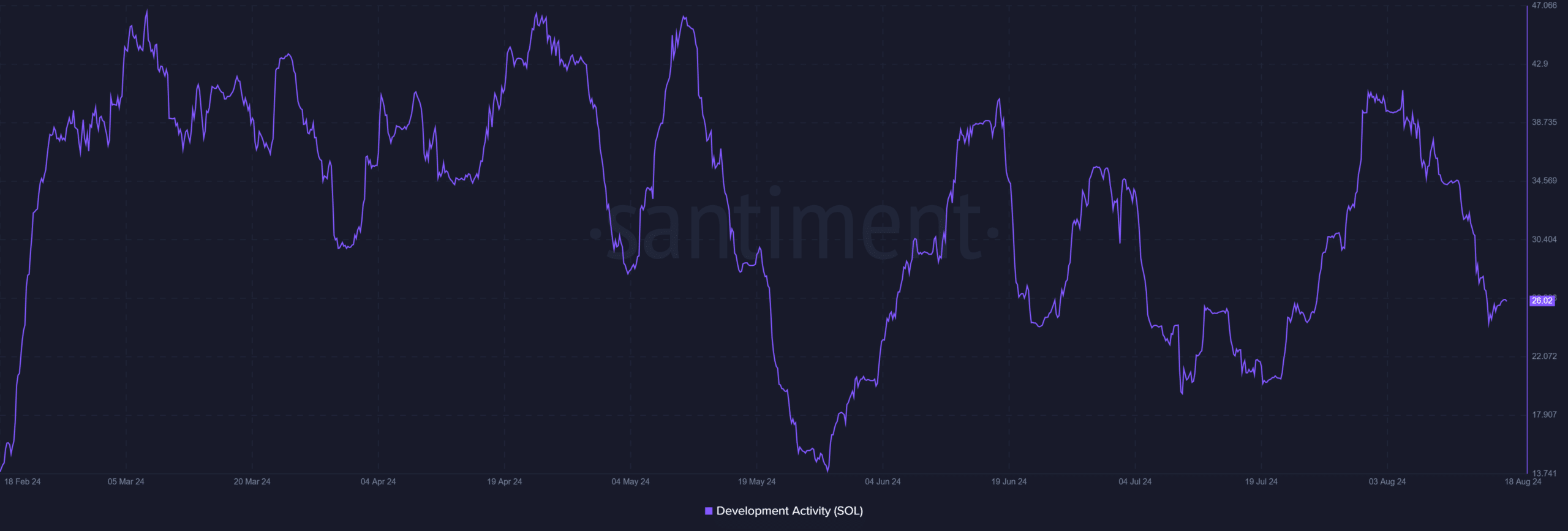

Furthermore, there’s been a significant increase in efforts aimed at enhancing the Solana network as per data from Santiment, over the past few weeks.

Historically, this increase in construction or growth has led to a significant rise in prices. This trend indicates good news for those who believe in Solana’s growth (the Solana bulls).

Read Solana’s [SOL] Price Prediction 2024-25

At the same time, Social Volume showed a general trend of rising steadily. Such heightened social interest usually leads to a surge in trading actions and price fluctuations.

Combining Solana’s technical and blockchain indicators created an optimistic outlook. Should Solana surpass its bullish resistance point, it might lead to additional price increases.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-08-19 05:11